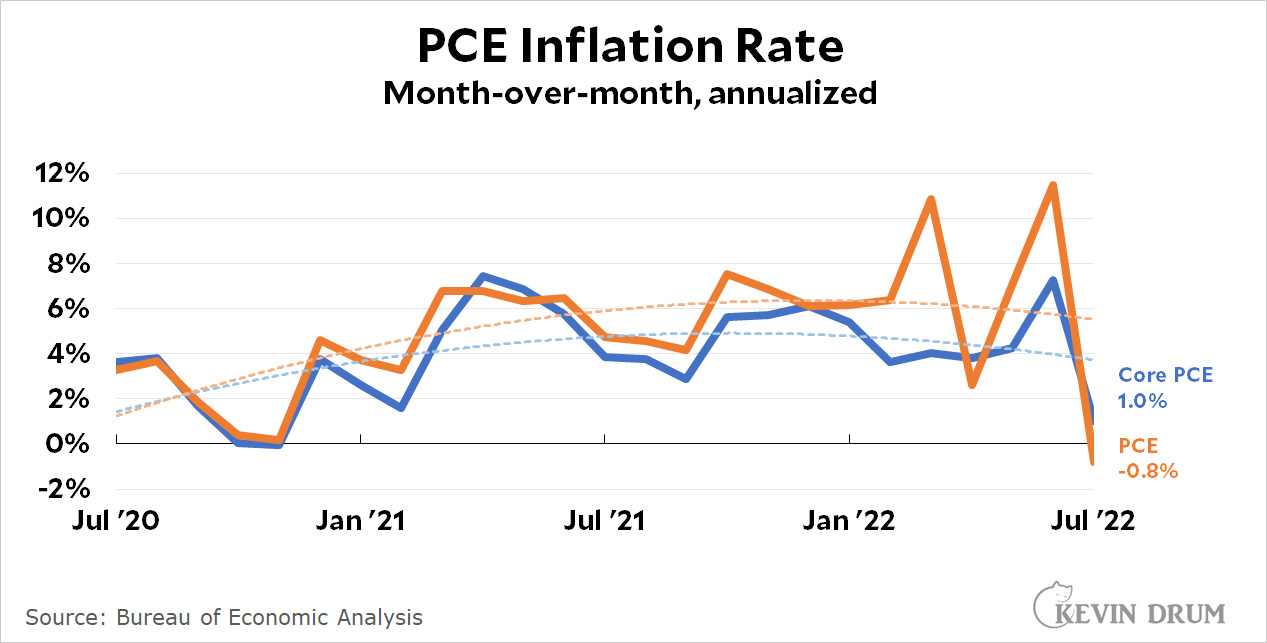

The PCE inflation rate for July was released today and it showed that inflation has slowed almost to zero:

The change from June was -0.8% at an annualized rate. The change in core PCE was +1.0%. As usual, since these are volatile numbers, the trendline gives the best indication of what's really going on.

The change from June was -0.8% at an annualized rate. The change in core PCE was +1.0%. As usual, since these are volatile numbers, the trendline gives the best indication of what's really going on.

On a year-over-year basis, the PCE inflation rate was 6.3% and the core PCE inflation rate was 4.6%.

Consumer spending remained pretty flat last month. Adjusted for inflation, consumer spending has increased only about 0.6% over the past six months.

Powell still seemingly wants to force a recession though. Probably be a few interest rate hikes even before we know of any possible inflationary impact of the student debt forgiveness.

It will be interesting to see what happens when credit card rates go up enough to blunt the debt forgiveness. And how most Americans without student loans, but hight credit card debt, do come election day.

Student loan repayments will be starting back up in Jan. Since payments have been paused since early in the pandemic, the debt relief won't mean more purchasing--at least directly.

Credit cards are already higher than the fed funds rate. Another moron. Stop posting.

Yes, this has been obvious since he opened his pie hole. Powell will not be happy until he's tanked the economy.

If anything, inflation not giving him an excuse seems to be making him more hawkish, I guess on the theory that he needs some real-world excuse, and there won't be any soon.

Dude's a saboteur. It has been obvious for some time.

So inflation is pretty much licked?

And along comes Powell:

"Restoring price stability will likely require maintaining a restrictive policy stance for some time," Powell said in his remarks at the gathering in Wyoming. "The historical record cautions strongly against prematurely loosening policy.”

Market down 1.9%.

This tweet did not age well (<1 hour):

Dylan Matthews: "If Jay Powell got unemployment from 14.7 percent to 3.6 percent in two years flat, and also got the ensuing inflation under control in less than a year, we're talking GOAT Fed chair"

https://twitter.com/dylanmatt/status/1563159357738856448

The Fed helped...but this time the White House threw money at the problem which did most of the heavy lifting.

Now the Fed seems to be more interested in looking strong against inflation instead of acting more logically. Hence the people are going feel the pain comment.

Food and energy inflation is beyond their ability to control--people need to eat and get to their jobs, so this is a pain point, but demand is a bit inelastic. Housing prices are starting to drop, but only because interest rates have gone up and made payments out of reach for many.

We'll have to see how the monopsony lawsuit progresses...

Not how it works. Housing prices are going down well before mythical interest hikes. Lazy post.

Powell should never have been put up again.

this statement from powell really baffles me in light of the data from the last couple months.

GOAT Fed Chair is still Alan Grenspan for being able to get his dick hard for Andrea Mitchell & her crater face.

(Seriously, she's got more acne scarring than Brad Pitt!)

We should still throw a bunch of people out of work and throttle the supply of new housing just be sure.

The inflation boogeyman must be appeased with sacrifices.

SEVERELY OFF TOPIC

Seems as though our old friend Donald Trump is used to getting snookered by suspected foreign agents. First it was a Chinese agent. Now a possible Russian using a fake name like Ana deRothschild?

https://newsinteractive.post-gazette.com/anna-de-rothschild-trump-mar-a-lago-security-fbi-investigation/

And she is pictured with Dump and Miss Lindsey on the Golf Course at Barge of Lardo

Wonder is she found any good reading material while there? You know, like nuke strategies and so on...........

Well, I'll blame Powell for that too. He's in charge of the Fed and the Feds should be doing a better job keeping Mar-a-lago secure.

😉

"Consumer spending remained pretty flat last month. Adjusted for inflation, consumer spending has increased only about 0.6% over the past six months."

Well, hang on.

When we're using consumer spending to understand inflation, does it make sense to adjust it for inflation?

If someone asked you if summer was warmer than winter, you could answer that, adjusted for seasonal variation, it's about the same.

Plus he is adjusting poorly.

An argument for looking at inflation-adjusted spending is that, in principle, it gets you close to the actual physical quantities of ‘stuff’ (both goods and services) purchased in the time period. In turn, that tells you something about the likelihood that inflation is being expectations-driven. That is, if the actual quantities aren’t increasing sharply, it indicates that people aren’t rushing out to buy, say, appliances “before the price goes up again”. And as I have said multiple times, price increases that are not being continuously driven higher by some positive-feedback mechanism will level off when the transient causes play out — the ‘inflation’ will self-limit.

Jay Powell seems to be setting himself up to take a big victory lap over this.

"Inflation was terrible and I fixed it" etc etc

For the last 5 months core inflation is at 4.1% annualized according to the BEA (their site show the increments up to five months ago)- in the recent past the Fed has been articulating an inflation rate target above 2%, probably 2.5%, so I would expect another rate increase. However, it seems we are getting awfully close to the target so one we need to question the degree of aggressiveness, the economy has slowed down plenty and it is unclear what further rates increases would have on inflationary pressures. So as long as the inflation trend continues as it is I would expect to see the last large Fed rate.

Good stuff.

Next, you should track the Beveridge Curve. https://bityl.co/E2gB

You can see we have a significant deviation from the past. This is where the fear of a wage-driven inflation spiral comes from. Trigger a soft landing and the current curve makes its way back towards the norm -- or so Powell and the Feds believe.

Kevin keeps fixating on trend lines, but predicting trend lines is hard, especially for the future. Things in economics seldom follow straight lines, or even simple curved ones. There is an obvious tendency for peaks and valleys, as in the standard business cycle, but the future path is not predictable. If you are trying to predict based on the upward trend, that does not tell you when things will start downward, or how fast. There is a tendency to overcompensate - when things are in short supply there is a tendency to overproduce or overstock, leading to surpluses. We are seeing some of this in excess inventories of some retailers.

So when inflationary factors ease off, there could be a fairly sudden downturn in inflation, possibly even leading to some deflation. Of course everything is still dependent on oil price.

Right. I think faith in a simple geometric fit for extrapolating the inflation rate is not supported by theory or past data. I'm predicting inflation will slow down, not because of any trendline, but because of what the Federal Reserve has been saying and doing.

That makes no sense. Inflation is already falling. Idiot.

Fitting a linear or quadratic to economic data is less stupid than annualizing monthly data, which is done routinely. At least curve-fitting combines information from a number of observations, which attenuates random error. Annualizing extrapolates from a single, embarrassingly noisy data point to an entire year.

Annualizing the monthly change just puts the number on a scale that is easy to relate to annual rates. It isn't an supposed to be interpreted as an extrapolation. Just like I don't expect the credit card company to list my interest rate as a monthly or daily rate, even though they charge interest every month based on a day-by-day calculation.

1) How it is supposed to be interpreted, and how the general population understands it, are likely to be two quite different things:

2) credit card rates are a lot less volatile than month-over-month changes in the CPI or other price indices.

It seems to me that Jay Powell is trying to make up for being slow in raising rates last year by over steering, i.e. by threatening higher rates for some time to come. It will be interesting to see this month's inflation numbers and what the Fed actually does next month.

Can you imagine if the egomaniac turd were still President ? He'd be screaming for Powell's head on a pike.

Biden administration could intervene. Especially considering the huge rise of subprime banking since 2008. The Federal Reserve system is irrelevant to those banks with a strong dollar keeping capital plenty.

But what sort of trend line. Until recently the trend line of choice was linear. Now it is something else. Seems like: the answer is inflation is easing, now what trend line choice supports that desire?