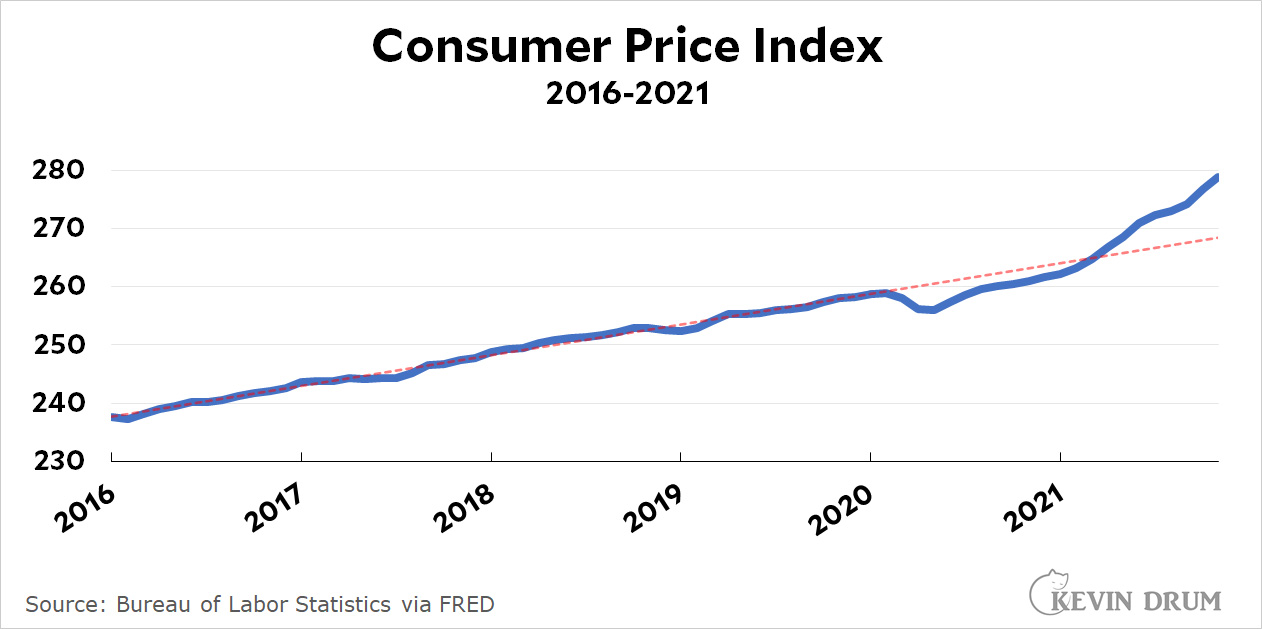

Inflation remained high in November, clocking in at 6.8%. Here's what this looks like over a longer term:

The price level is now about 4% higher than it would be if inflation had remained on its pre-pandemic trendline.

The price level is now about 4% higher than it would be if inflation had remained on its pre-pandemic trendline.

Outside of food and fuel, the biggest gainers were airfare and used cars. The best performance was turned in by car insurance and hospital services, which were both down from last month.

The Democrats would do well to abandon inflation nay-saying now.

While the paranoid hyper-inflation scaremongers have cried wolf many time over the past 2 or 3 decades, there the data say the wolf actually has arrived this time.

Best to deal with it rather than let acceleration retar them with the old tar of inflation incompetence of the 1970s Left.

I agree. People are not interested in "it's only because of" excuses (supply chain, COVID, rebound from 2020).

And there will be anecdotes galore. Dollar Tree raised all its prices this week. It's now $1.25 Tree.

When the late night shows have jokes involving inflation - and it will happen - whoever is in power will be blamed, fairly or not.

sure, most people are not going to care about the underlying cause of inflation and will blame dems because they are in power. but what do you expect dems to do about that that they aren't doing already?

Drop TFG's tariffs. The tax on softwood lumbar from Canada is bad. Dropping all the rest would help, too.

You mean the ones that were popular with the Trumpistas?

You mean the ones that were popular with the Trumpistas?

Caring what "Trumpistas" think is pointless for Democrats. Their votes aren't gettable.

Yep. Dropping tariffs is a no brainer. And not just on Canadian goods.

I don't know that any prominent democrats are inflation naysayers, some just believe it is transitory based on covid related supply chain problems and global oil/gas supply and demand issues, and it is not driven by government spending, fed policy or biden admin actions. And I think the transitory explanation still makes the most sense.

Ah this fatigued Trope, variant on the No True Scotsmen gambit. "I know of no prominent X"....

Tired and threadbare the trope.

Of course you then go on to rattle off the very litany of inflation naysaying - all transitory. (even more amusing the strange disconnect in statements "demand issues" as if demand is somehow existing as a platonic effect, and not as any proper Keynesian economics will tell you, very much supported/driven/effected by government spending and monetary actions (Fed, central bank).

The transitory case is very dead right now, and massive injections of liquidity - government spending, Central Bank stimuluses are of course the explanation (such actions in response to Covid were well merited and well justified to have been taken, however the after effects are here).

Of course the Lefties of your sort are going to be hell bent on recreating a 21st century version of the same denialism that helped produce the 1970s.

Hopefully the wiser faction shall win out, or the Orange Cretin may yet return.

Aaagh, no! If “massive injections of liquidity - government spending, Central Bank stimuluses are of course the explanation” - well, those are themselves transitory. Unless some other mechanism kicks in, price increases will slacken as the spending and stimulus are exhausted. Can you identify such a mechanism?

Yeah, I have been thinking the same way.

I agree that government and Federal Reserve interventions are part of the inflation story, though they aren't expected to continue on their preset course indefinitely.

However, "no prominent Democrats" is not quite "no true Scotsman". "Prominent" can be rated objectively. So who are the Democrats who still say inflation is not happening?

"It's transitory" is still a tenable claim, if we can agree it covers a period of several months. I give it until March.

The "transitory" explanation is just that: an explanation. And a highly plausible one, at that. It's far from a "trope." Are you perhaps under the misapprehension that something that is transitory isn't real?*

All that matters for Democrats, politically, is whether inflation comes down, or doesn't, and by when. The actual technical reasons or explanations for why it's occurring don't matter.

*A classic example of transitory inflation was the situation in the United States after WW2, after rationing ended. And yes, that episode of transitory inflation lasted nearly two years. Democrats had better hope this one isn't so lengthy.

Frankly, we could have used this level of inflation 12 years ago. It would have made our recovery from the Great Recession a lot easier, by giving all creditors a bit of a haircut. Of course they don't like it, and they generally have the microphone, as opposed to debtors.

Also, people have jobs, and job prospects. This is good, and a policy success. What has happened is pretty much exactly what the covid relief package was intended to do.

Yeah, it may be time for the Fed to be a bit less accommodative, though. Debt is far less of an issue now than it was then.

I will note though that the events of the last year validate a fairly Keynesian view of macroeconomics.

I agree and I will also note the rate went up a mere 0.6 percent from 6,2 to 6.8 so the rate of increase is slowing as the markets rebalance themselves after pent-up demand chasing too few supply.

Vs two years ago cpi annualized inflation for the last three months: 3.3% 3.1% 4.0%.

2020's vs one year ago last three months all very close to 0.5%.

Gotta at least do a little digging to find out if you have just stumbled upon another way of saying "gosh, 2020 was weird". Recent years have mostly been around 2%, but around 3.5% in 2000, 2008 and 2011. 2009 was -0.4 because it's baseline year was 2008 at 3.8%. Seems like it is very normal for this number to jump around a bit when dramatic things are happening.

During the late 70's inflation was bouncing around 5% to 13% and vs two years ago would still have been returning values in that range. Even vs 3 or 4 years would have been giving a 7-10% range.

String enough "one time events" together and you get a trend.

I was thinking earlier today that it is possible to have a ‘stochastic transient inflation’; prices fluctuate, some categories are more volatile than others. Over time, there will be occasions when a number of categories peak at once, purely by chance. Think about bad harvests for one crop due to drought, for another, a too-wet spring, for yet another, late frost. So even in an economy in which price categories were uncorrelated with each other, there would be bouts of ‘inflation’ from time to time.

Of course, real economies do have correlations, so more prices will tend to move together, and more intervals of broad price rises will occur. But it takes one or more positive feedback mechanisms to produce inflationary spirals; otherwise, these inflationary periods will spontaneously end.

It’s awful. When you give poor people money they spend it. Imagine that. We should have starved them instead. That way gas would be cheaper for people like me. I had to pay an extra $20 this month for gas! I will make $140,000 this year so you can understand why I’m so upset. At least I don’t own an SUV. My sporty Audi is fuel efficient but hey… I feel the pain of the low class F150 drivers.

This is silly. Oh well. Now that my Christmas shopping is done, I promise to stop spending money on junk from China.

The USA isn’t worth the effort. Please, Santa, for Christmas please send an few asteroids to destroy NYC, DC, and south Florida.

The market reaction? Long-term inflation expectations went down. The market expects inflation over the next 5 years to be about 2.75%.

https://twitter.com/TheStalwart/status/1469308714419109895?s=20

The S&P meanwhile is up 0.7%.

The market reaction? Long-term inflation expectations went down. The market expects inflation over the next 5 years to be about 2.75%

No doubt because the market now suspects (probably rightly) the transitory inflation we're experiencing will undo Democratic efforts to boost the long term vigor of the economy.

According to BLS data, average real weekly wages actually increased for a while and are still above the long-term trend:

https://fred.stlouisfed.org/graph/?g=JJuw

So on average those wage-earners who are employed really have nothing to complain about yet - they are doing about as well as before the pandemic. To the extent that inflation is driven by excess spending people still have excess money, so maybe they shouldn't be complaining - yet. When people run out of excess money then that pressure for inflation will be gone. Real wages have been going sharply down lately, but for various reasons that Kevin has mentioned inflation will not last forever.

But there are still a lot of people who are not employed and these have tended to be among the lowest income, so some people are getting pinched more than others.

“But there are still a lot of people who are not employed…”

Really? I don’t think that’s true. If folks are unemployed today it is by choice, in my opinion. It’s high time we acknowledge that the recovery is complete.

The labor force participation rate hasn't matched the pre-pandemic level, and that level, in turn, was fairly unimpressive compared to the late 90s/early aughts. And there's always some degree of voluntariness when it comes to unemployment, in that most people most of the time belong to the species Homo economicus and so won't voluntarily take jobs that don't pay enough.

I reckon the US now has a relatively robust and healthy labor market. But it's not yet as vigorous as during the Clinton years, much less the 1960s.

Transient, broadly-occurring price increases are annoying, but get sorted out within a reasonable time frame, through substitution, wage adjustment, or falling prices as kinks in supply get worked out. Inflationary spirals are the bad ones, but they only occur when there is a positive feedback mechanism, for example an increase in price in an ‘ubiquitous’ factor of production like labor or energy, which lead to increases in the prices of ‘everything’, which lead energy producers to raise their prices to cover their increased costs, or workers to demand raises to cope with the higher cost of living, and so on around the loop. I think the risks of inflationary spirals are much reduced, because 1) fewer workers are unionized, so have little bargaining power for wage increases; 2) labor and energy share of production costs is lower due to automation, outsourcing, and energy-efficiency programs. So I think the burden is on the inflationistas to point out the positive-feedback mechanism that is going to sustain these price increases beyond another few months.

The 10 year US treasury yield is 1.45%. The last time we had an inflation scare, a month ago, it was about 1.6%.

This is what financial people think the average 10 year inflation in the US will be.

We're still comparing Covid pandemic prices with today's prices. This will keep bouncing around, especially since people seem to be looking at regular CPI instead of core CPI, so we're including volatile food and fuel prices.

Covid stuff. 1.45% is a distortion. I have the real price up around 1.80% when the trade unwinds

Note all the angst about inflation when discussing rising real estate prices, or 401K's hit record highs.

Then when it benefits, inflation doesn't really count.

In a nicely cynical mood today...

Once again, half of this is used cars. Production finally started normalizing in November but it distorted the report.

Economic growth of 10% annualized will create inflation.