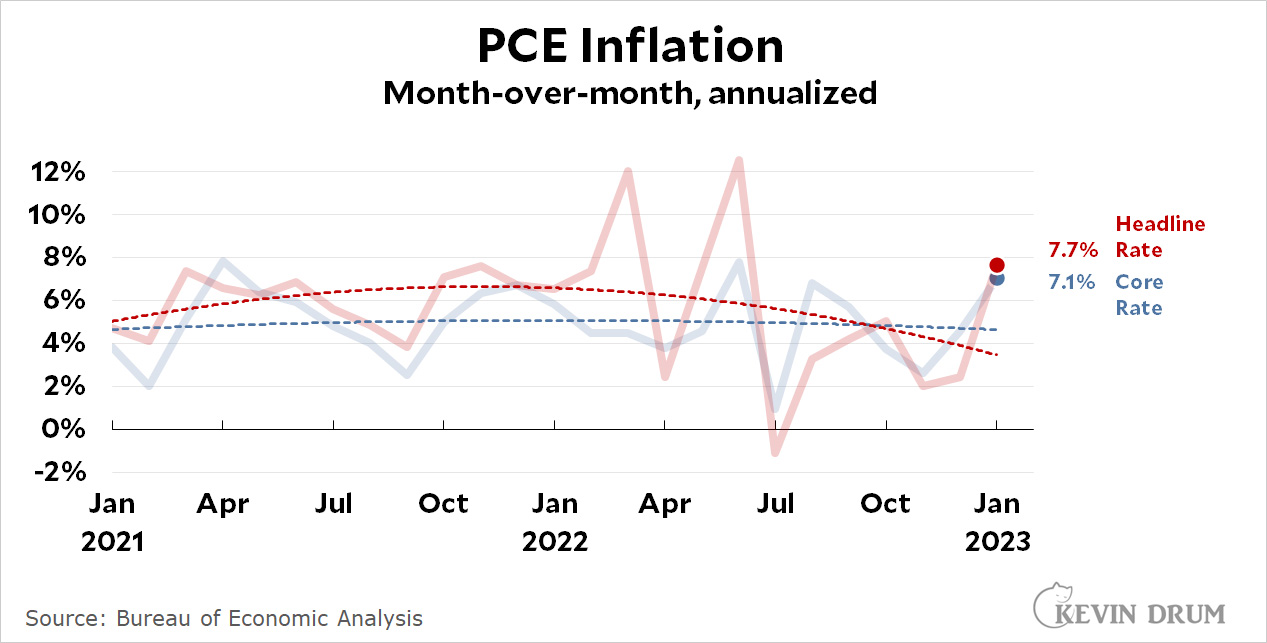

There's no good news on inflation this month:

As usual, don't pay too much attention to noisy monthly changes. That said, this was a mighty big monthly change, just like the one we saw a few days ago in the CPI numbers. It's so big, in fact, that it makes the trendline for core PCE inflation look nearly flat at around 4.5%.

As usual, don't pay too much attention to noisy monthly changes. That said, this was a mighty big monthly change, just like the one we saw a few days ago in the CPI numbers. It's so big, in fact, that it makes the trendline for core PCE inflation look nearly flat at around 4.5%.

The year-over-year figures came in at 5.4% for headline PCE inflation and 4.7% for core PCE inflation.

I expect to see a reversion to the mean next month, but who knows?

OT: "We recognise the importance of keeping Dahl’s classic texts in print. By making both Puffin and Penguin versions available, we are offering readers the choice to decide how they experience Roald Dahl’s magical, marvellous stories." -- Penguin

Smart marketing move.

Pen-goo-ins is prac-ih-tally chicken…

Coke and Classic Coke. And look at all the free media Dahl's works have gotten over the last week and a half!

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details

visit this article... https://createmaxwealth.blogspot.com

At this rate Kevin may have to revert to a linear trendline.

Or come up with more elaborate excuses to not admit he was and is wrong and his casting aspersion on the Fed (and by extension all the other development country Central Banks ex BoJ) has been ill-founded.

Yeah, more and more I think this is the case.

His pitch was:

-o- Inflation is destined to head down fast and not be a problem by end of 2022.

-o- The Fed's action's won't cool the economy until 2023, by which time we'll be back to 2.5% (or thereabouts), so the Fed's moves are unnecessary and will be economically harmful.

Yes, that is my broad recollection of his position since 2021 (without going to archives and re-reading).

And quite clearly outright wrong, for which sadly no admission. Krugman (a good and proper economist) at least has had the intellectual candor to say so, while providing useful critical reflection on the current trade offs between tight policy and not - while also admiting that the picture is far from clear cut either way. That's useful reflection.

Drum's 'unskewed' inflation commentary is not useful reflection, it's embarrassing...

It must be repeated that Drum's assertions about central banks impact timing as in "doesn't take effect for one year" arise it would seem from a radical misunderstanding of a general rule-of-thumb that it takes about a year for the effects of a reference rate rise to fully feed through (rule of thumb depending on a specific economy's lending rate structures, prevalance of fixed rates over adjustable etc - which can vary quite a lot: more fixed rates in private-to-private lending the slower full feed through).

Drum reified and misunderstood this as "takes effect in one year" - that is evident but that is a full out misunderstanding.

The channels of course are both immediate: variable rates that benchmark by contract directly or indirectly on Fed rates immediately go up. Bond market rates respond (as everyone has seen) in similar fashion, which also begin . Fixed rates take longer of course but typically there are roll-overs falling within the fiscal year - and regardless of the direct impact, in medium plus size business world CFOs see rate rises and start to adjust.

Drum writing ridiculoulsy in past months posts that Fed rates had not even taken effect yet showed a fundamental ignorance of financial architecture - which is certainly pardonable except his unreasonably nasty casting of aspersion on Fed et al. while not owning his own clear analytical errors. Quite disappointing compared to his usual.

Of course one has some central banks like Turkey which have in fact done as Drum has argued the US Fed do, that is nothing on rate front, and Turkey has seen significant inflation acceleration double digits approaching triple annualised (topped 88 back to 55 of late on Russian contraband trade) - of course the Turkish approach has been made worse by stimuluses and other economy boosting mesures, as well as attempts at price controls.

Oh, we could go beyond a linear trendline to a constant of 4.9%. That seems to be as good a fit as any since January 2021, and it's the simplest model around.

Companies across the board are looking for ways to raise prices. Stores are pushing back a bit, but I recall reading that Nabisco was going to push through more price hikes. Netflix is going to try to end password sharing, and streaming services in general are raising prices. As are most "online" services.

But...consumers have run out of money and are running up debt--so spending spree will end. Bird flu still causing problems, and it may not be until summer until the industry moves to vaccinations--which raising the cost a little, but still better then culling millions of chickens a year. As for the rest of food prices, depends on the weather out west. We might end up with a reprieve from drought conditions for this year if we're very lucky--and that will help. Of course Russia's war with Ukraine has screwed up both the energy and food markets--though may have hastened shift to renewables.

Consumer debt adjusted for inflation and population is still below where it was prepandemic. It doesnt appear to be true that people are running out of money, wracking up debt and the spending will soon have to stop.

Given wage increases, capital gains and reduced mortgage/debt payments for anyone who refinanced in 2020-2022 and record unemployment....this might have quite a ways to run.

A few months back, Ezra Klein had a very interesting interview with Mohamed El Erian (former chair of President Obama's Global Development Council and CEO of PIMCO, the world's largest bond fund): much of the discussion around inflation assumes regression to the mean.

Basically, you remove atypical issues (Covid supply issues, Covid stimulus, war in Ukraine etc) and inflation goes back to a stable and low number/2% (yes I am over simplifying his statements here on purpose).

The challenge, per El Erian is changes such as near sourcing (buy local versus source from China), green energy, more inventory etc are ALL inflationary. Thus, El Erian is far from certain inflation is transitory....

https://www.cnn.com/2023/02/17/business/sticky-inflation/index.html

El Erian - or anybody - would have some credibility if he had predicted inflation in the past, but nobody has consistently done this. The only type of prediction worse than that is predictions about the effects of Fed action on inflation. In fact economists don't even get the past effects of Fed action right. If they did they wouldn't assume that the Fed can control inflation, since it hasn't done so in the past.

Green energy is inflationary??? Explanation, please.

KenSchulz - you are free to listen to the interview as I am paraphrasing El Erian.

My GUESS, often clean energy has up front costs (for example purchasing and installing solar) that are hopefully recouped over a period of time: thus, in the example I provide, solar would be inflationary at the point of install.

Without listing to El Erian, green energy will certainly be inflationary in price pressure near term due to up-front expenditure needs on

(1) direct installation

(2) infra upgrades, particular very significant expansion/reinforcement of both long-distance transmission and local distribution networks.

In the near term there is due to the structure of the Biden bill and due to market transition, inflationary pressure on new skill sets (near term constraints on skilled labour, construction workers availability) and production of of parts.

So yes, green energy transition in near term on an accelerated basis is likely to be inflationary.

On longer term it should be the inverse, but near term it is a source of price pressure.

See this: https://www.statista.com/statistics/194327/estimated-levelized-capital-cost-of-energy-generation-in-the-us/

Capital costs of renewable energy are less than fossil.

that is.... a non-sequitor.

listen mate, my literal job is investment in green energy. Primary, not stock market.

Primo: the link is the levelised capital cost new power plants (USA) - and the comment was not about "new power plants" but overall transition. And as anyone clicking through will see some RE is significantly less, some is significantly more. -But capital cost is not the key relevance to the comments.

Secundo: the comparison is at *generation* whereas as I noted the overall need in green energy for significant wider infrastructure (grid) upgrading, which is ex-levelised cost of power plant, genreation source. Grid upgrading is not in there, however it is significant. Grid upgrading is not a reason not to transition to green energy, rather it is a long-run positive bet. HOWEVER it does have consequences, of which clearly potential inflationary pressure due to pressures on narrow skill bases / HR bases, significant potential bottlenecks in materials for grid upgrades, etc.

Tierce: green energy transition is requiring NEW investment NOW whereas most fossil fuel is not new, and relatively limited new current investment is needed, ergo ex fuel costs (which of course is not a trivial source of instability)

The innumeracy of the Party Political posturing on various sides, Left in naïve innumeracy and ignorance - the above all American but also some English Right from a malignant idiocy and corruption of interest, and ignorance.

Quoting Levelised cost is simpleton town.

>green energy transition is requiring NEW investment NOW whereas most fossil fuel is not new

True, but the US is maintaining most existing plants to end-of-life. Some of the oldest coal plants are being decommissioned early due to the expense of retrofitting emission controls; only that fraction are adding to new-plant outlays above expected levels.

Yes, green energy will require grid upgrades beyond what would be needed if the current power mix were continued.

Still, arguing that the transition to sustainable energy must be inflationary strikes me as a version of Bastiat's 'broken windows' fallacy.

Lounsbury's usual insults ignored ...

So what's the expiration date on "transitory"?

When the Phillips Curve and Beveridge Curve are no longer vertical?

This is not news - it's essentially the same number as the CPI which came out 10 days ago. The two indexes have been in close parallel for some time.

In the meantime, the delayed transmission effects of price pressures that have accumulated in lower ends of value chains / production chains and "side slip" mini-inflation movements is evident. As the pattern of the 69-83 rough period as show in Martin Wolf's Financial Times article last week.

That's the current challenge to bleed out pricing pressures (demand) so that a major inflationary earthquake pressure and see sustained acceleration.

The good thing is all the major central banks of developed markets have recovered their memory of dealing with the 1970s so we can avoid a re-run of the 1970s (which one will achieve if one followed Drum) - we should avoid 1970s and it appears there is enough economic resilience that maybe recessions can be avoided.

Great

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details visit this article..