I have a big pile of charts to show you. Don't worry, though, they'll go pretty quickly.

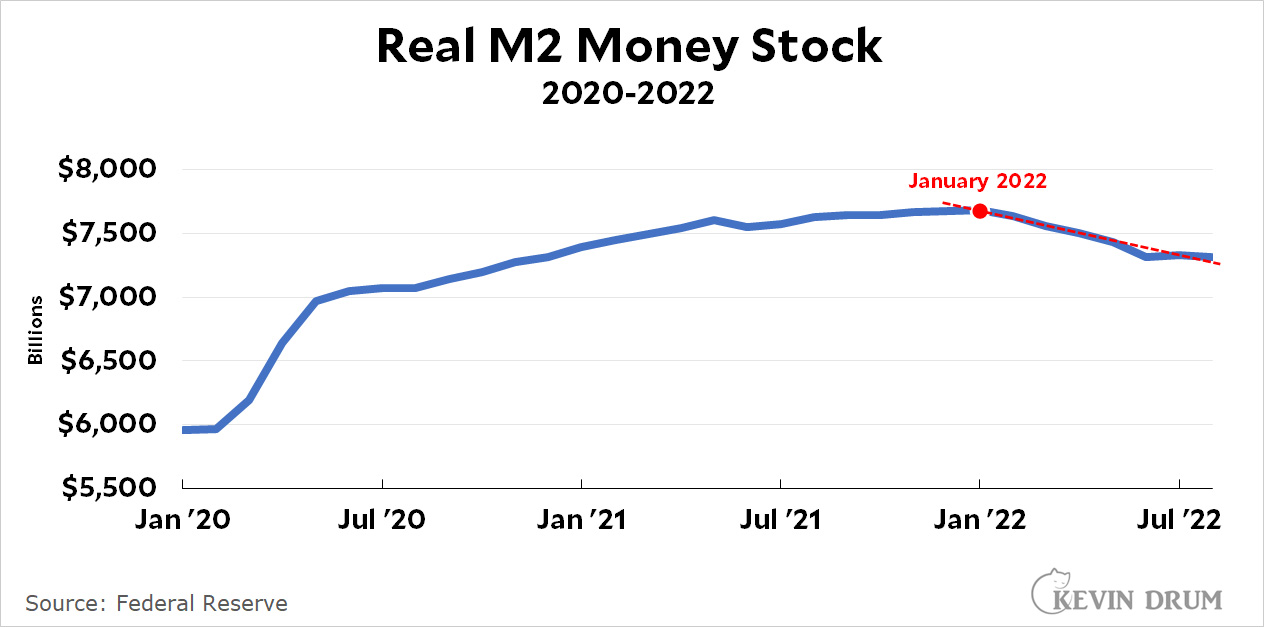

The first is the M2 money supply. It spiked upward after the $3.2 trillion COVID rescue bill was passed in March 2020, and then continued growing. But in January it peaked and has been falling ever since:

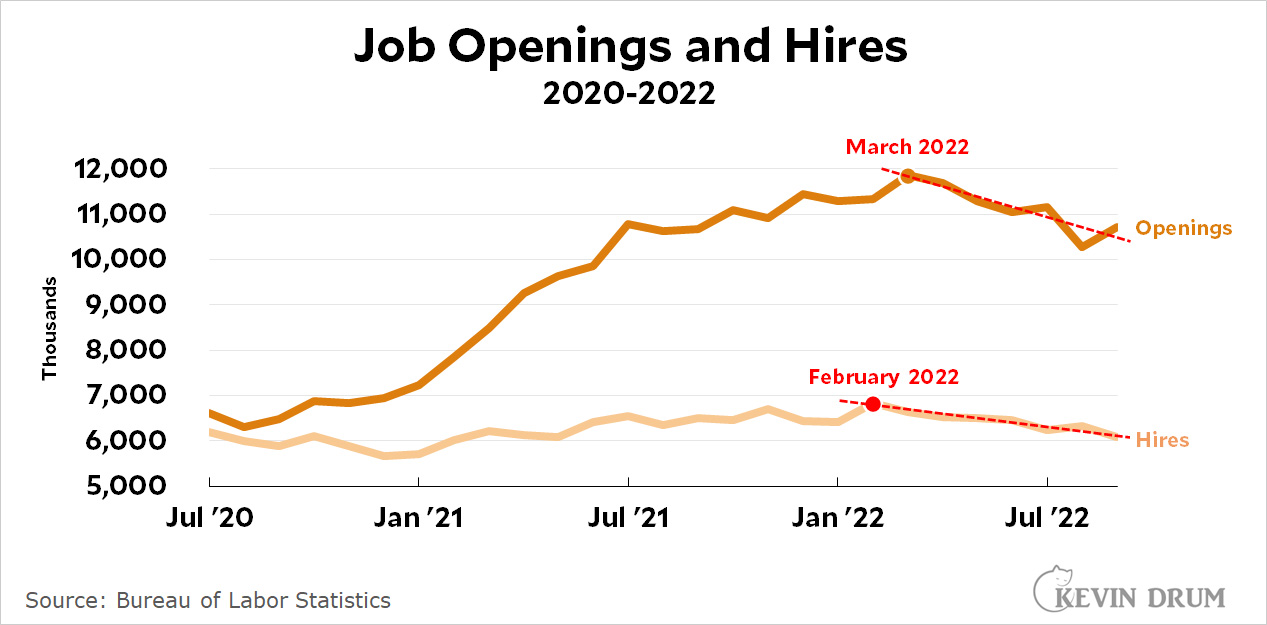

Next is both the number of job openings and the actual number of new hires. These metrics were rising until early this year. Then they peaked and they've been declining ever since:

Next is both the number of job openings and the actual number of new hires. These metrics were rising until early this year. Then they peaked and they've been declining ever since:

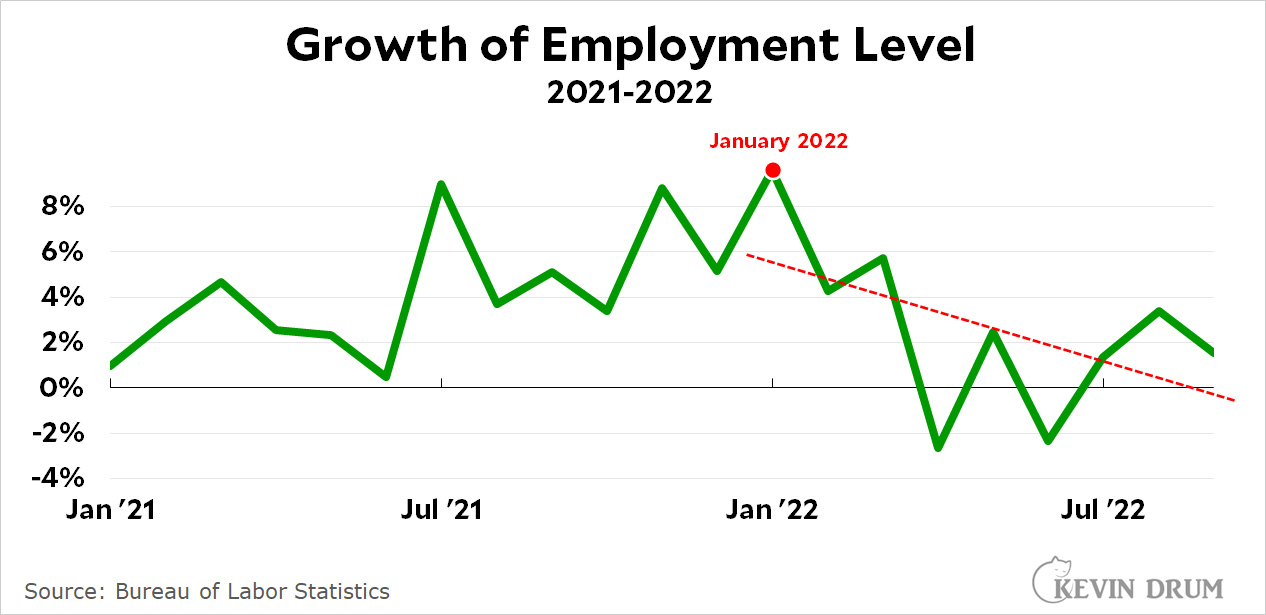

You are probably sensing a trend. Next up is a related measure, the growth of the employment level. It too was growing until January, at which point it started to drop at a fairly dramatic rate:

You are probably sensing a trend. Next up is a related measure, the growth of the employment level. It too was growing until January, at which point it started to drop at a fairly dramatic rate:

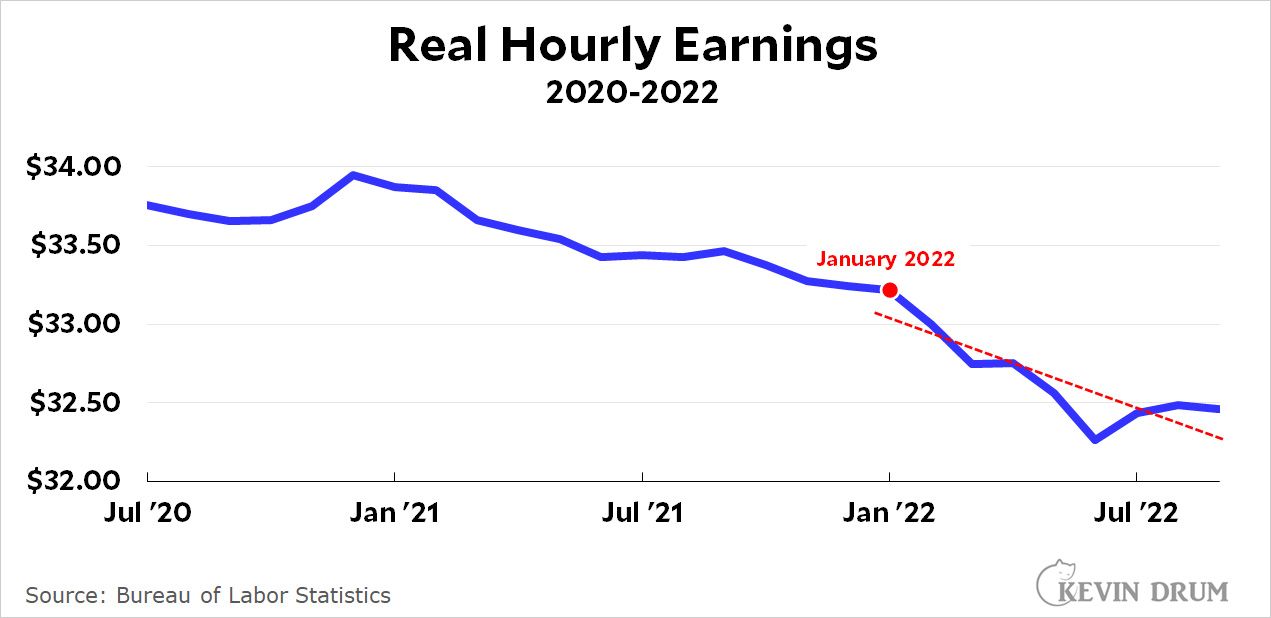

Next let's look at hourly earnings. They've been dropping ever since early 2021, but in January of this year they started to really drop:

Next let's look at hourly earnings. They've been dropping ever since early 2021, but in January of this year they started to really drop:

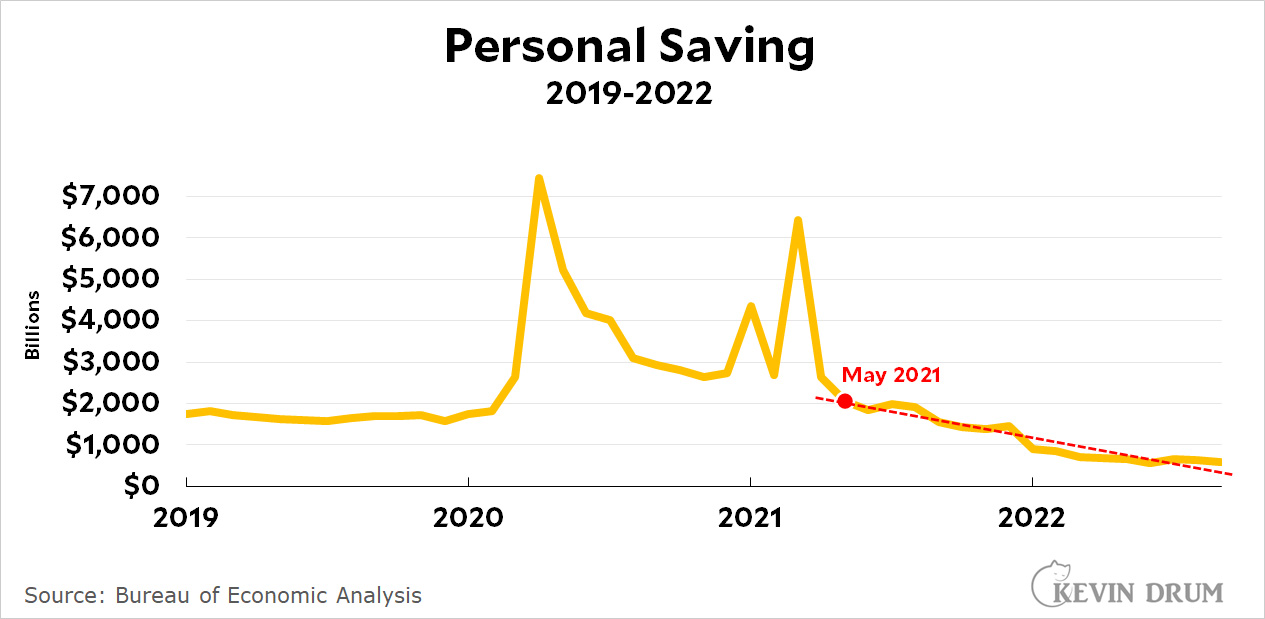

Next is personal savings. Savings spiked after each stimulus bill, the last of which was passed in March of 2021. Savings were back down to normal by May and have been declining ever since:

Next is personal savings. Savings spiked after each stimulus bill, the last of which was passed in March of 2021. Savings were back down to normal by May and have been declining ever since:

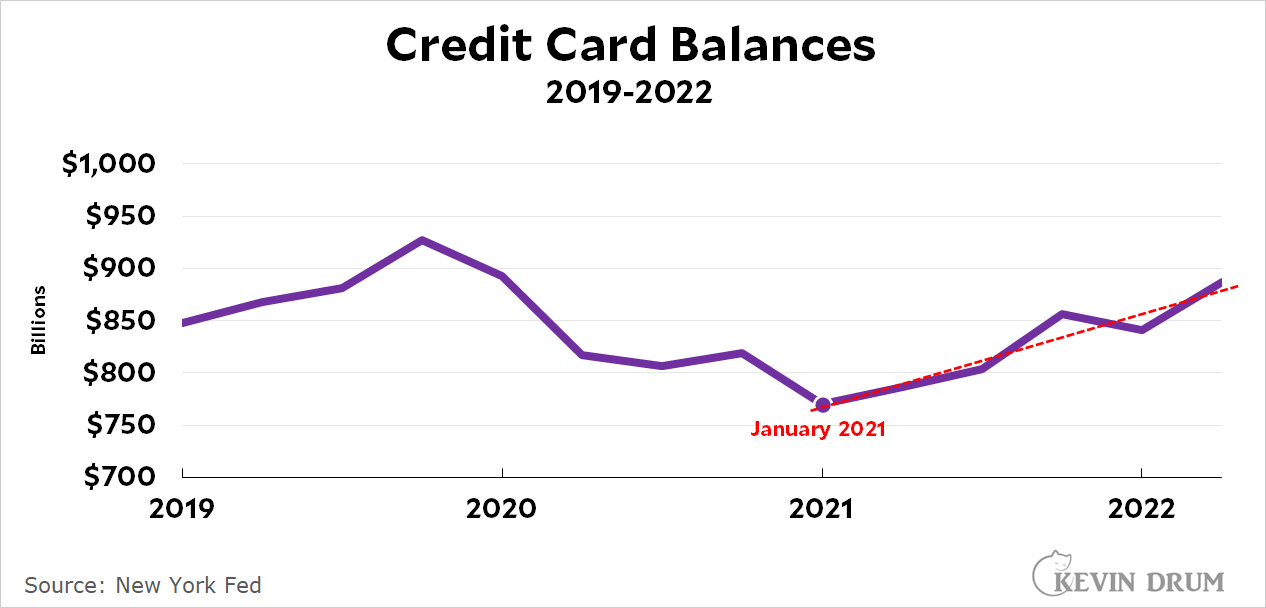

Next is credit card balances. In January 2021 they suddenly started to go up, a signal that people are making ends meet only by putting purchases on plastic as wages begin to dry up:

Next is credit card balances. In January 2021 they suddenly started to go up, a signal that people are making ends meet only by putting purchases on plastic as wages begin to dry up:

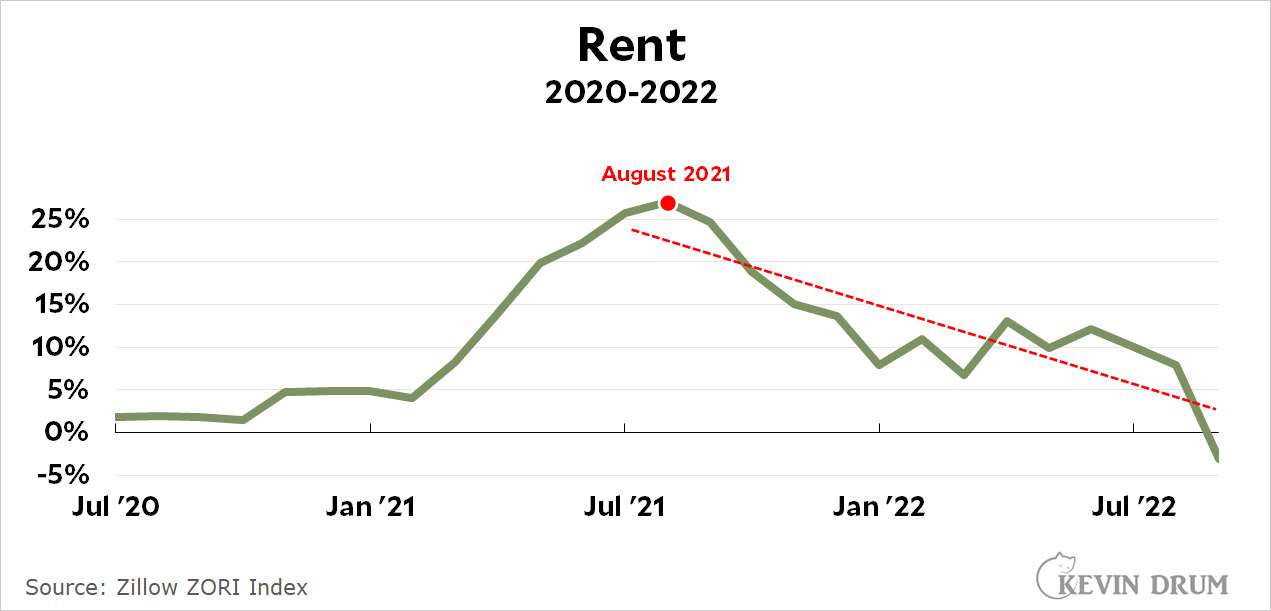

Finally we have average rents, which rose considerably in the first half of 2021. However, the growth rate of rents has been dropping ever since August 2021, and last month the growth rate was negative:

Finally we have average rents, which rose considerably in the first half of 2021. However, the growth rate of rents has been dropping ever since August 2021, and last month the growth rate was negative:

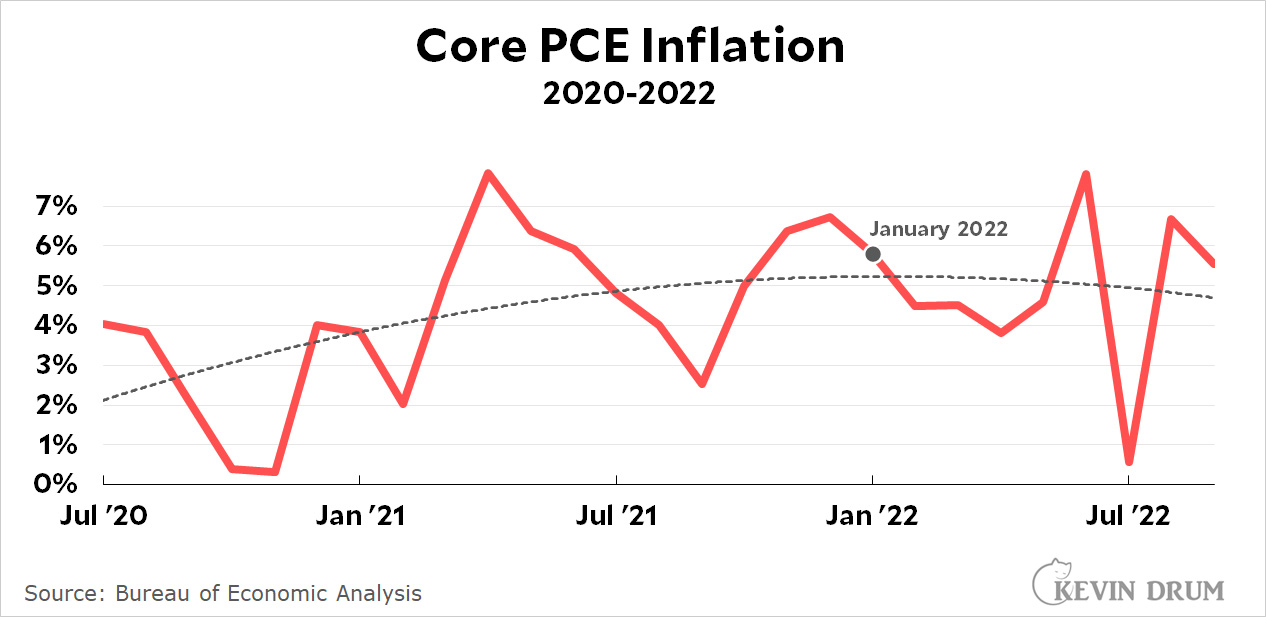

All of these things are either inflation precursors (M2 money, employment) or actual elements of inflation (wages, rent). All of them have been falling since the start of the year, and some of have been falling even longer.

All of these things are either inflation precursors (M2 money, employment) or actual elements of inflation (wages, rent). All of them have been falling since the start of the year, and some of have been falling even longer.

None of them affect the inflation rate immediately. They all have lags. The M2 money supply takes about a year to affect inflation, while others have an impact in less time. This is why inflation peaked in January and is already dropping:

By the end of the year pretty much everything related to the inflation rate will finally be having an impact. But all of them started long before the Fed began raising interest rates.

By the end of the year pretty much everything related to the inflation rate will finally be having an impact. But all of them started long before the Fed began raising interest rates.

This pisses me off. Inflation will be under control by the start of 2023 and will continue to drop throughout the year. This will happen after four or five big interest rate jumps, and people will therefore hail the Fed for conquering inflation. Like this from NPR today:

The Federal Reserve ordered another big boost in interest rates on Wednesday....The rate, which was near zero in March, has jumped 3.75 percentage points in the last eight months. That's the most aggressive string of rate hikes in decades, but so far it's done little to curb inflation.

"Interest rates have risen at a whiplash-inducing speed, and we're not done yet," said Greg McBride, chief financial analyst at Bankrate. "It's going to take some time for inflation to come down from these lofty levels, even once we do start to see some improvement."

The implication here is that we need more and more rate increases, but it's not true. Like everything else, increases in the fed funds rate have a lag—probably of at least six months and maybe as much as a year. It's true that the Fed's recent increases haven't had an effect, but that's not because the Fed hasn't done enough of them. It's because they simply haven't had time to have any effect.

In other words, whatever happens in January of 2023 will have nothing to do with the Fed and everything to do with other things that started dropping in 2021 and early 2022.

By the middle of 2023 I suspect we'll be firmly into a recession thanks to those interest rate increases. And that recession will come at the worst possible time, just as inflation is reined in and the economy has cooled of its own accord. We won't want that recession by then, but we'll get it anyway thanks to Jerome Powell.

instead of fuming, lock .... the rates....

2 year treasuries at 4.6%... no 4.70%. 10Y 4.15%.

When, not if, the economy slows down , these rates will halve.

From one of the dozens of posts Kevin made in 2021:

July 12, 2021

The endless preoccupation of the US news industry with inflation is truly spectacular. They will simply take any opportunity, no matter how trivial, to hoist the red flag of high inflation right around the corner.

Until he explains why his analysis was incorrect in this instance, and others throughout the year, I don't think we should pay any attention to this latest post denouncing Jerome Powell.

Well, there isn’t any analysis in the quotation; the only arguable point is whether or not the media devote a lot of coverage to the potential of sustained inflation. I don’t think that Kevin’s opinion on that is disqualifying.

The Fed's charter is to create a labor surplus, full stop. Nothing else matters to them.

Which is a pure fabrication of populists right and left...

"By the middle of 2023 I suspect we'll be firmly into a recession..." - very likely

"Inflation will be under control by the start of 2023 and will continue to drop throughout the year." - one hopes but that is far from certain

I have previously registered significant complaints about your insistence that the Fed is Wrong Wrong Wrong. But I want to highlight something specific about this post that really makes me concerned about you.

You have repeatedly made the point that any post-pandemic time series you look at needs to be compared to the pre-pandemic trend. You need to project out how things were going before the pandemic and then see where we are now.

But you started your credit card loan chart in April 2020. Interesting! I wonder what happened prior to that? Let me go check the Fed database and...

Holy moly! Credit card debit decline MAJORLY from February 2020 to April 2020. It's almost like the economic circumstances changed dramatically in those two months.

Let me just calculate a pre-pandemic trendline and...yep! We still haven't recovered to the pre-pandemic trend.

I mean, seriously, Kevin, that's just dishonest. What is UP with you? This just really embarassing.

Almost as embarrassing as misspelling the word embarrassing. ::smh::

It is really disappointing.... particularly as his "analyses" and predication on inflation going have been wrong repeatedly for running on almost 2 yrs.

It looks to me like Kevin started his credit card chart at the beginning of 2019, not April of 2020. BTW, I don't know if Kevin is right about inflation but the constant drumbeat in the media about inflation surely deserves some push back or at least critical analyses. I think those , like Lounsbury, who thinks we are in for a rerun of the 1970's, need to show their work. There is an awful lot that is unique about the current situation and even inflation worried economists like Larry Summers admit that they don't understand inflation all that well. And for those who point out that team transitory has thus far been wrong it should be repeated that there's another team that pretty much screams about inflation constantly and they were dead wrong for over a decade.

Show my work? Good fucking lord that's preciously Lefty pretension.

Primo, what I have said is not that the world is in for a rerun of the 1970s. That is a prediction. I have not made any prediction (and certainly not that "we are in for a rerun of the 1970s"). That's at best an ignorant distortion if not a deliberate a strawman distortion.

What I have noted is the Policy Errors promoted by the inflation denialist Left (which is certainly not all Left nor Centre Left, but is rather well represented among innumerate ideological knee-jerkers here) who are attacking the Central Banks global responses to sustained are more or less identical to the policy errors of the Left in the 1970s.

In fact, thanks to broad central bank response to inflation being sustained - despite notably the denialist minimisation and multiple Friedman Units prediction of ending à la Drum - we will not see a rerun of the 1970s globally. One would see such a rerun if Drum's asserted non-action was taken, but it will not be, and in the end it is actually in the best interest of Democrats / Centre Left to see inflation tamed now to benefit from a rebound on next cycle than be idiots.

The Drumbeat about fucking inflation is because bloody prices are going up and it causes daily pain, and idiotically minimizing because Your Team is in power and you have to deny it because Your Team side is idicoy.

As for this

"it should be repeated that there's another team that pretty much screams about inflation constantly and they were dead wrong for over a decade."

This is the perfect example of the ideological knee-jerking and conflation of technical specialists seeing inflation and the idiotic ideological Party-Political fools - right or left - understanding everything via the party-political agenda (my team/tribe versus opposition...). It is fucking irrelevant to being wrong about inflation now.

The ideological teams are not my fucking concern (and if one were to look in comments back over a decade here one could find me dismissing those inflation scare mongering idiots), the fact that the US right notably the Republican Party has been pants wetting and making idiotic inflation predictions for the past two decades is utterly irrelevant - other than demosntrating that Economic Analysis Via My Political Tribe/Team is an utterly shite way to have an understanding and jugement of policy responses. It's not a fucking goddamn football game.

I was not surprised to get the usual Lounsbury treatment of haughty dismissiveness. Pretension is not a word you should be tossing around. casually btw. I will engage with your points anyway.

1) Yes, what a bunch of ideologically driven folks said about inflation for a decade is not fair to those who were not on that bandwagon (like you I suppose - sorry I haven't been tracking your comments for that long) and who are concerned about inflation now. Fair point. That said is there unanimity of opinion among the "technical specialists" ?

2) Agreed that it is clearly in the best interests of Democrats, actually everyone, to see inflation tamed, as you put it, and soon.

3) All that being said, other than insulting people who disagree with you - technical specialist are you ? you've never actually presented an argument for what is driving inflation right now. My best guess is that you would argue (though you haven't deigned to do it) that inflation is real (true) and so it doesn't matter exactly what caused it ; you have to treat it with the tools you have, notably the Fed raising rates. But who knows, other than carping at Kevin I don't know what you think.

Blog comments are not the place to successfully or fruitfully examine

I have in other comments over the months (to literally no use) noted multi-variate feeders of inflation - and Drum's monocausal simplistic "analysis" (a disappointment from him) - is the route to failure to understanding. Multiple feeder effects of price pressure via multiple channels on different parts of particularly goods values chains - not mere supply chai analysis - with sustained pricing pressure at multiple goods input points dissolving price stickiness are classic examples of high risk for sustained inflation- and it is this analysis basis that technical specialists with various central banks and related observers discarded "transitory". Ongoing price pressure aftershocks as well from supply constraints in energy keep up this pressure.

In the end trying to ID a "Cause" in the singular is an excercise in myopic futility and besides the point.

Further the various and sundry Left side inflation denialist-minimisation discourse - driven by foolish political lensed tribalism are not only idiotic political own-goals but also replications of more or less identical (let us say allowing for change, highly similar) reaction and policy error of the early 1970s - including the early declaration of comig victory over inflation based on asserting a trend or plateauing - if one looks at the 1970s data (multi-country, developed countries) one can see the similar repeats of acceleration plateau, re-accaleration...

For political sucess (as well as economic) repeating 1970s errors should not be done.

>Multiple feeder effects of price pressure via multiple channels on different parts of particularly goods values chains - not mere supply chai analysis - with sustained pricing pressure at multiple goods input points dissolving price stickiness are classic examples of high risk for sustained inflation- and it is this analysis basis that technical specialists with various central banks and related observers discarded "transitory".

Ungrammatical word salad.

I particularly liked ‘supply chai analysis’, which I guess is tea-leaf reading …. which is about as likely to be correct as economic forecasting.

He has updated the chart; I did not screen shot it, so you'll have to believe me, but I swear on my grandmother's lasagna recipe that it started at April 2020 before.

Good on Kevin for updating the misleading chart. Bad on Kevin for updating it without any note.

Regarding the rest of your point, I agree with you 100%. In fact, I was on Team Transitory for all of 2021, exactly because I had heard the "raise rates now!" chorus so many times and had never seen the dreaded inflation come to fruition.

But by the time we got to 2022, I changed my mind. 9% inflation is too high! Kevin talks a lot about how real wages are going down, but doesn't seem to focus on the fact that they are going down BECAUSE OF INFLATION! People hate this much inflation, and they are right to do so.

Those of us who can afford to keeping buying everything we normally do should not be so quick to dismiss the real pain that inflation causes most people. Kevin seems supremely confident that inflation would have go down on its own, and I just don't think that confidence is warranted.

Archive.org early.

Archive.org often.

Kevin once again looks for The One Guy Wot Did It (take away cheap money in this instance) and decides Jerome Powell makes Fed decisions single-handedly.

Your right, it's not just one person, but Powell has been the one banging the pots the loudest on this issue.

Trump's tax cut for the wealthy led to an asset bubble--and the Fed's cheap money to keep liquidity in the market during Covid kept it going. It was a good thing they unwound the quantitative easing and raised rates a bit. However, they're just putting on a show now--and it's a show that will have real consequences down the line. Just as raising rates takes time to filter through the economy, lowering them will take time too.

If I recall correctly, Powell gave an interview where he admitted the Fed Funds rate won't affect the main drivers of inflation, bottlenecks, lockdowns in China, war in Ukraine, etc., but we had to do it anyway.

Of course Powell is the one we hear from most. Who is a reporter/repeater going to want to quote more? The Fed Chair or some “lowly” Fed Governor?

If you want to explain how the Fed's decisions differ from attempting to thumb the scales for political purposes, you really need to do better than silly straw-men like this.

"Hey, did you know you the Fed sometimes speaks in code?"

Ok, how about this? Powell is in place today because Biden reappointed him to the position. Or is that a second presumed deal on which Biden got suckered like the one where he thought the Saudis were going to increase oil production?

Furthermore, are these rate decisions split or unanimous? There are seven members on the Fed board. Four of them are, ostensibly, Democrats. https://en.m.wikipedia.org/wiki/Federal_Reserve_Board_of_Governors

They saw the JOLTS report that V/U had jumped despite their actions, which freaked them out. Otherwise, it makes less sense why they would boost rates another 75 basis points. They previously anticipated tapering until they hit 4.0% at the end of the year. That they decided to maintain robust increases suggests something spooked them and V/U is the only thing that appears to fit.

And so, I was listening to Danny Blanchflower this morning -- https://youtu.be/dayJZNLHbBg -- which then pointed me to this paper earlier this year -- https://www.nber.org/papers/w30322 -- which I think really speaks to the issue of V/U and the misplaced fear of wage-price spiral.

Labor must be disciplined, Capital coddled...

Letting the days go by, let the water hold me down

Letting the days go by, water flowing underground

Into the blue again, into the silent water

Under the rocks and stones, there is water underground

Letting the days go by, let the water hold me down

Letting the days go by, water flowing underground

Into the blue again after the money's gone

Once in a lifetime, water flowing underground

for you simple minded idiots

Capital does not suffer in elevated inflation, Labour however does.

Getting inflation down is a benefit to wage earners.

And what the Fed is doing will not lower inflation, but 𝘸𝘪𝘭𝘭 likely throw many wage earners out of jobs.

For you simple minded idiots: this is not helpful to Labour

The 1970s Left makes it's return.

Of course the assertions are at once unfounded empirically and with today's USA jobs report, ridiculous.

No one is or was predicting a recession or hiring slowdown right before the holidays.

Leave the 1970s with your bell bottoms; that scenario has nothing to teach us, presently.

>Capital does not suffer in elevated inflation

Oh, good then, I must have just dreamed that my IRA lost a quarter of its value.

I would like Kevin to clarify what under control means in the following sentence: "Inflation will be under control by the start of 2023 and will continue to drop throughout the year."

Does this mean inflation will be falling. Does it mean inflation will be below a certain threshold.

It would be nice if Kevin took account that he has gotten these predictions wrong at least a year now. How has getting the predictions wrong changed his analysis?

He of the “transitory” tribe….

You don't understand. We have a Democratic President and there is a Presidential Election in two years. It's critical that we have a recession the GOP can blame on the Democrats in time for the Election. So the Fed has to raise rates enough to cause a recession.

Four of the seven fed board members are Democrats.

(reposting b/c system error put content in a reply upthread) (Where's the DELETE POST option?)

From one of the dozens of posts Kevin made in 2021:

July 12, 2021

The endless preoccupation of the US news industry with inflation is truly spectacular. They will simply take any opportunity, no matter how trivial, to hoist the red flag of high inflation right around the corner.

Until he explains why his analysis was incorrect in this instance, and others throughout the year, I don't think we should pay any attention to this latest post denouncing Jerome Powell.

Couple of points:

1) Kevin should stop displaying second order polynomial trend lines, which he does all the time because they align with his preconceived notion that inflation is headed down.

2) RE:

"By the end of the year pretty much everything related to the inflation rate will finally be having an impact. But all of them started long before the Fed began raising interest rates."

That doesn't mean the Fed raising interest rates had no effect on inflation. It likely did.

I dropped two pounds in weight and then went on a diet afterwards, so my 30 pound weight loss has nothing to do with what I was eating. Anybody buy that?

Package it in party-political tribal colours and then yes.

Partisan party political lensing and motivated conclusions around "For my Tribe"/ "Against my Tribe" are astonishgly power distortion fields (as evident in this very thread).

The motivated resoning and concluions one sees with the MAGA fools one can see in this topic are in no way limited to them. Beni Adam Beni Adam.... humans are human.

Core is around 5-6% currently, trending lower and never was much higher than that. This despite an economic environment that includes a European land war, oil shocks, leftover Covid effects, substantial logistics disruptions and corporate malfeasance. How so many people lost their collective minds over relative low higher inflation rate is befuddling. All the things that caused the modest inflation hike are ebbing or will soon ebb, yet the overreaction is still there. I think we need a new term to describe this ludicrous overcompensation: inflation hysteria. A rate increase was definitely needed but almost 4 points in a few months? That’s panicky and does not infuse confidence. Again, core going from 2 to 5% is what we call a very easy manageable problem but the reaction one sees is if as core was 15%- I cannot imagine what the reaction would be if that was the case.

For about 35 years, ie since the end of the Great Volcker Strangulation of the early 1980s, 10-year Treasury rates have been on a bumpy path of decline (Fred, market yield on 10-year constant maturity treasuries). 10-year rates went from just under 10% in 1987 down to well under 1% in early 2020.

When Powell and most of the current Fed governors were cutting their teeth around 25 years ago, these rates were in the range of 5.5 to 8, so these are the rates that feel subliminally normal to them. For centuries before central banking, the "natural" rate for long-term lending was 5 or 6%. This is deep backdrop for the current Fed board-- they don't feel right unless rates are around 5% or so. They're fidgety.

There are other reasons why rates above, say, 3% might be a good idea. Most credible in my view is that you have to have a starting point when you need to cut rates, one that makes a cut meaningful. As I understand it, that's been a worry of central bankers and economists throughout this low-rate period and first really surfaced in early 2009 when the housing crash prompted big rate cuts. I think Yellen talked about that when she was chair, and iirc Powell has been a particular bug on this (and on unwinding other Fed emergency measures too).

Now at last along comes inflation, so what's a Fed to do? The textbook response of hiking rates also happens to be what they've been hankering to do for over a decade, to make things feel right again, so up we go. And in big chunks, so they're not letting a good crisis go to waste.

What I have a hard time accounting for is Powell's bloodthirsty language. Yesterday, commenters first saw the committee statement and were convinced it signaled a dialing back of the pressure to raise rates in big chunks, maybe even to hold off altogether if the data looked promising-- the Pivot (tm). Stocks rose, rates at all maturities slid.

But then came Powell's press conference, after which stocks tanked and bond rates trended back up. Everybody understood him to be saying in so many words "we're bound and determined to strangle inflation in its crib and drive a stake through its heart and stomp on the body and drive a gun carriage over it and salt its grave and we don't care what that might to to anybody who lives in the USA or anybody who uses the dollar, or to the Almighty himself or herself. That's what we gon' do." Rate hikes as far as the eye can see, iow, and big ones.

All I can make of it goes back to what Krugman said at the start of the pandemic about how central banks had to be credible about being irresponsible, or something like that. In this case, maybe jawboning corporate honchos into expecting a recession so they'll pull in their horns and avoid borrowing and spending. If that's the game, well, a lot of these firms are sitting on so much cash now they don't know what to do with it, and haven't for many years. Maybe convincing them that there won't be any productive way to invest new money for a long, long time will get the effect he wants.

And then the press can give us stories about how the committee managed to talk him down when the Fed does in fact pull off the Pivot (tm). It would turn out better for it to be this kind of good-cop/bad-cop expectations management, I think.

A week or two ago I commented on the local gas prices around Florence, SC. I posted a picture of a gas station that went out of business when it was isolated by road construction. When my tank was low and I was in that area, I bought gas there a few times as it cheaper by a few pennies than most other stations. The price was $3.199 and that was about 6 or 7 years ago.

Today, driving a short distance, I saw a Shell station with a price of $3.159/gal.

The other thing I should have mentioned is that SC had not raised its motor fuel taxes in a long, long time. The legislature finally bit the bullet and phased in a tax increase starting a year or two after the $3.199 station closed. That gas tax increase is now complete and adds 12 cents to the cost of a gallon. Considering that, and ignoring general inflation, what the gas stations are asking for gasoline here is 16 cents/gal less than 7 years ago. People still complain. I guess they want the good old Covid days back when there was nowhere to go, everyone was paranoid, and people were dying all over then place. That sure kept the price of gas low.