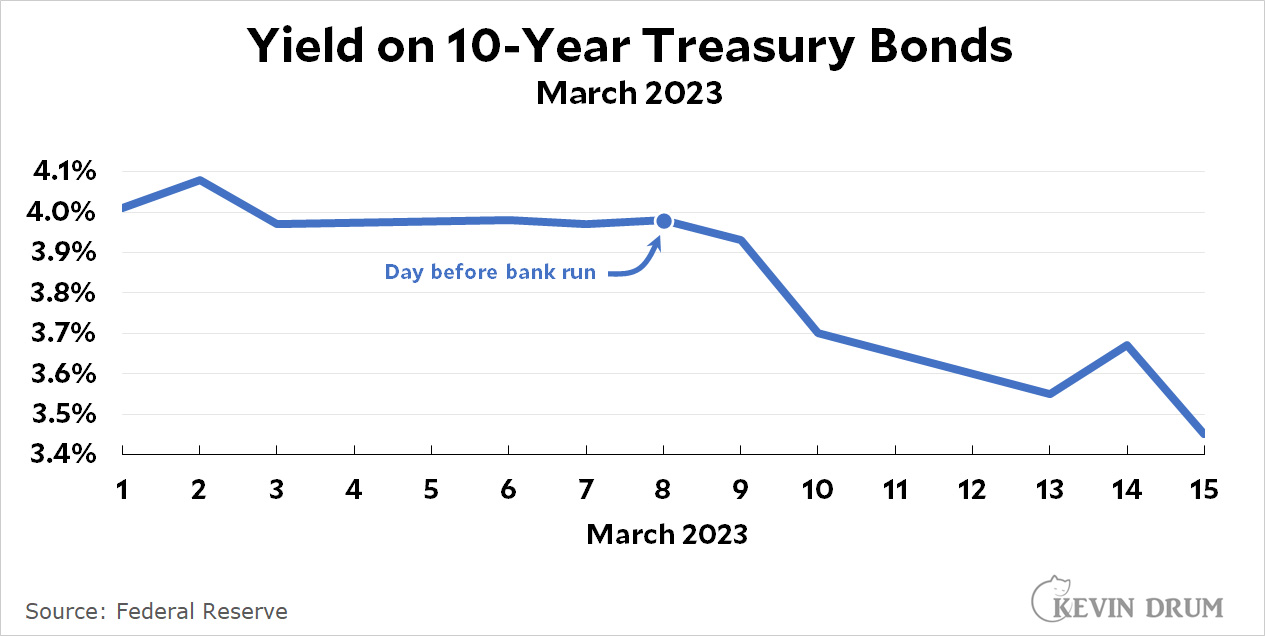

Here's a chart that must be driving all the ex-managers of Silicon Valley Bank nuts:

One of SVB's problems was a portfolio of long-dated Treasury bonds that was $15 billion underwater. But 10-year Treasurys have fallen by more than 50 basis points since Peter Thiel's run on deposits put SVB into receivership. Their portfolio has probably recouped a couple of billion dollars just in the last week.

One of SVB's problems was a portfolio of long-dated Treasury bonds that was $15 billion underwater. But 10-year Treasurys have fallen by more than 50 basis points since Peter Thiel's run on deposits put SVB into receivership. Their portfolio has probably recouped a couple of billion dollars just in the last week.

Of course, SVB's collapse is part of the reason that yields on 10-year Treasurys have gone down. In other words, destroying the bank put in motion events that made it unnecessary to destroy the bank.

Whatever. On the bright side, this is all good for the FDIC and SVB's creditors. On the downside, now that Peter Thiel realizes that torpedoing the global banking system requires no more than inducing an absurd panic among the snowflakes in Silicon Valley and Wall Street, who knows what he'll do next?

Great. Up next: meme bank runs. Every idiot with an internet connection and a small reddit following will be trying to trigger the next panic. The rest of us will be trying to find that precise combination of regulations that would prevent it.

The internet needs to not be anonymous. If it weren’t, it’d be a lot less likely that people would be able to destroy real life stuff through it.

Also taxes need to be higher on the Masters of the Universe class. They’ve got way too much money doing nothing sitting in banks apparently.

It would help to explain for average folks that when bond yields go down their resale price goes up. The decline in Treasury yields shown on the graph makes those bonds worth a more.

"...worth more."

There's too much capital floating around, and too few people managing it.

Capital gains tax rate is far too low, and too many ways to avoid it--that needs to be reformed. ...

Now what's that saying....if you owe the bank $1,000, the bank owns you. If you owe the bank $100,000,000, you own the bank....

Agreed on the snowflake characterization. All for teh munie.

This Wikipedia page doesn't have much on bank runs in the US during the past century. The list includes this month, 2007-08, the Great Depression, and that's it. Lucky for us, we live in interesting times.

In the more distant past, bank runs were more frequent during what they used to call "panics." That's a good name because it explains people's behavior in a bank run. People lose faith in an institution and panic. At an individual level, it's rational. You want to get your money out today because tomorrow it might be gone. But at a collective level, it's irrational. The solution (withdrawing money) only makes the problem worse.

There comes a point when whether a bank has a good balance sheet or not is immaterial. What matters is confidence, and once confidence is lost, it's hard to regain. That goes for the entire financial system, and the wider economy, for that matter.

Things are fluid, but my take on the market reaction so far is that's not too bad. A lot depends on what happens next. SVB, Signature, Credit Suisse. Are there bigger worries to come?

If not, there could be a silver lining, but it's too early to know about that.

Time for “inciting panic” to go with “inciting riot?”

Depositors should withdraw their money to earn a fairer market return elsewhere. Chasing returns is not just for Wall St. investors in a market society. The market should be allowed to eliminate the selfish banks which made soaring profits on the rates they charged borrowers while keeping interest low for depositors. Market discipline is advocated by the bankers themselves when foreclosing on delinquent loans and they and their investors, including depositors exceeding FDIC limit guarantees, should not receive public assistance except the food stamps and and unemployment insurance provided for wage earners.

I think we’ll need some time and good investigating to understand what Peter Thiel was trying to do when he started the bank run. Was he short SVB? Did he simply panic? Or was there a more political motive at play?

You forgot one. He is a stupid. rich sob who thinks he is a lot smarter than he really is.

It's easy to guess what Thiel will do next. He will do it AGAIN and STRATEGICALLY. Expect some similar move in October 2024, to say the economy is going South and we must put T***p back in the White House...

Whatever Thiel does next will reflect his ego.