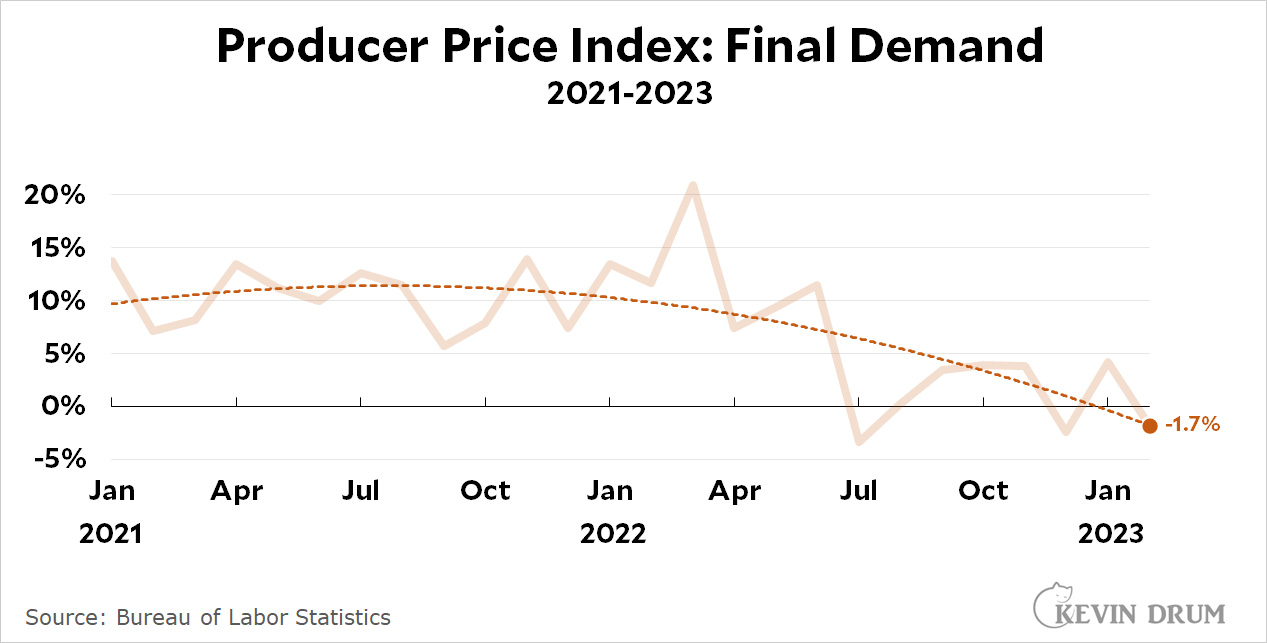

We have good news and bad news today. The good news is that producer-level inflation was negative in February:

This doesn't tell us anything about inflation in services, so it's limited good news. Still, good is good.

This doesn't tell us anything about inflation in services, so it's limited good news. Still, good is good.

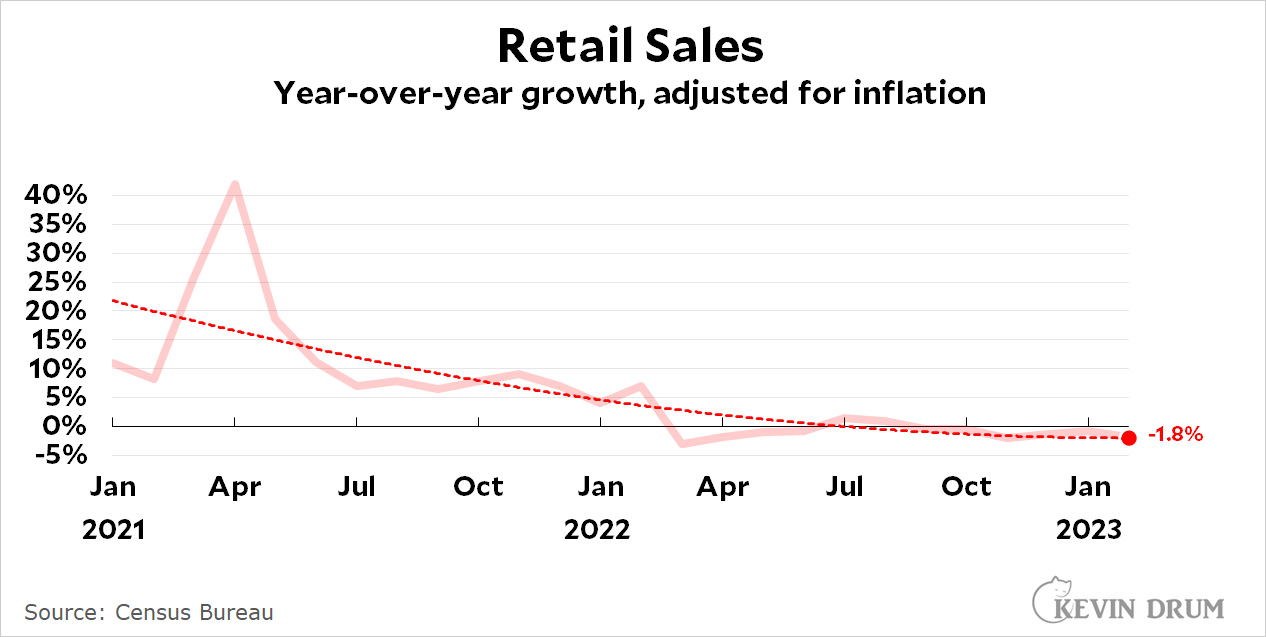

The bad news is that retail sales fell for the sixth straight month:

Of course, this is good news insofar as it suggests the economy is slowing and the Fed doesn't need to raise interest rates to slow it even more. Take your pick.

Of course, this is good news insofar as it suggests the economy is slowing and the Fed doesn't need to raise interest rates to slow it even more. Take your pick.

I've never quite understood, (maybe someone here knows) why its always the Fed "dealing with inflation."

I mean, two questions. One wouldn't inflation effectively end up "dealing with" itself - prices get so high demand craters?

Second, is that really what this is about? The Fed want's to "crater" the economy in a small way before the culmination of an inflationary cycle craters it in a big way?

I had a third theory, that the Fed raises rates so later it can just lower them when they see things are going to cycle in a bad way. But that just sounds to naive or too simple.

Gotta destroy the village in order for your friends to buy it cheap.

One wouldn't inflation effectively end up "dealing with" itself - prices get so high demand craters?

Yes, that's what happened during the Great Depression, and all other recessions/bank failures prior to it. Eventually, prices stabilized on their own, usually after lots of people lost their savings, livelihoods and sometimes even lives. See, unfortunately for millions of humans, sometimes inflation goes on so long that the prices of things like "food" and "housing" and "heat" and "water" go up so high that they can't afford them anymore... and then millions of other humans feel bad for their fellow humans all but dying in the streets and vote en masse for things like "politicians willing to do something about it" including creating entities like the Federal Reserve expressly ordered to do something about inflation.

Disclaimer: I'm fully aware also that "politicians willing to do something about it" may not actually be effective or benevolent. Like, politicians can also respond to high inflation by, say, waging war and executing millions of scapegoats (Nazi Germany) or putting in place price and wage controls that decimate the economy further (present day Zimbabwe and North Korea). But the Federal Reserve didn't come out of nowhere... it came out of people getting so frustrated with the length of time and pain it takes to wait for inflation to "eventually" stabilize the supply/demand curves that they voted for politicians to do something about it (and luckily we ended up with the Fed instead of work-to-death camps or whatever in the 20th Century).

I can't believe The Powers That Be haven't come up with a way to tank the economy that doesn't involve Deserving Billionaires, Farmers and Corporations from losing money too. Like can't the Fed simply raise interest rates on Those People until they stop getting so uppity with their employers about "living wages" and "decent work schedules" and such?

The growth rate of real production-worker wages in both retail and private-service provision continues to be negative, as does that of wages overall. Retail salesperson is the most common job. So the uppity workers are showing no signs of causing higher inflation in services.

Judging by these headlines, you'd think the sky is falling:

WaPo: "Stocks tumble as Credit Suisse woes add to banking sector jitters"

NYT: "Markets Tumble as Bank Fears Go Global"

As of 1:45PM Eastern, DJIA is down about 1.8% and the S&P 500 is down about 1.7%.

I dont believe it is true that retail sales have fallen for 6 consecutive months. The source Census data indicates that sales were up in January and appears to paint a very different picture of the past 12 months than Kevins graph portrays.

I assume the discrepancy comes from Kevin applying an inflation adjustment to nominal retail sales? Its not clear that using the economy wide PCE or CPI inflation figure to adjust retail sales will lead to a useful statistic.

In this case it might be telling us that actual growth in recent retail sales should instead be considered shrink because the prices of homes and services increased. Even ignoring the much discussed timing problems with housing in the inflation calculations, this is questionable because neither home costs nor services are included in retail sales.

Imagine getting news that recent sales of Product A have increased. Then being told that actually we should view that as a decrease because the cost of Product B increased dramatically 6 months ago. Makes you go....hmmmmmm.....

"The Fed doesn't need to raise interest rates to slow [the economy] even more." This is overdetermined at this point. The fallout from SVB's failure put the kibosh on any more rate hikes, and the forecasting now is about how much they'll cut rates this year.