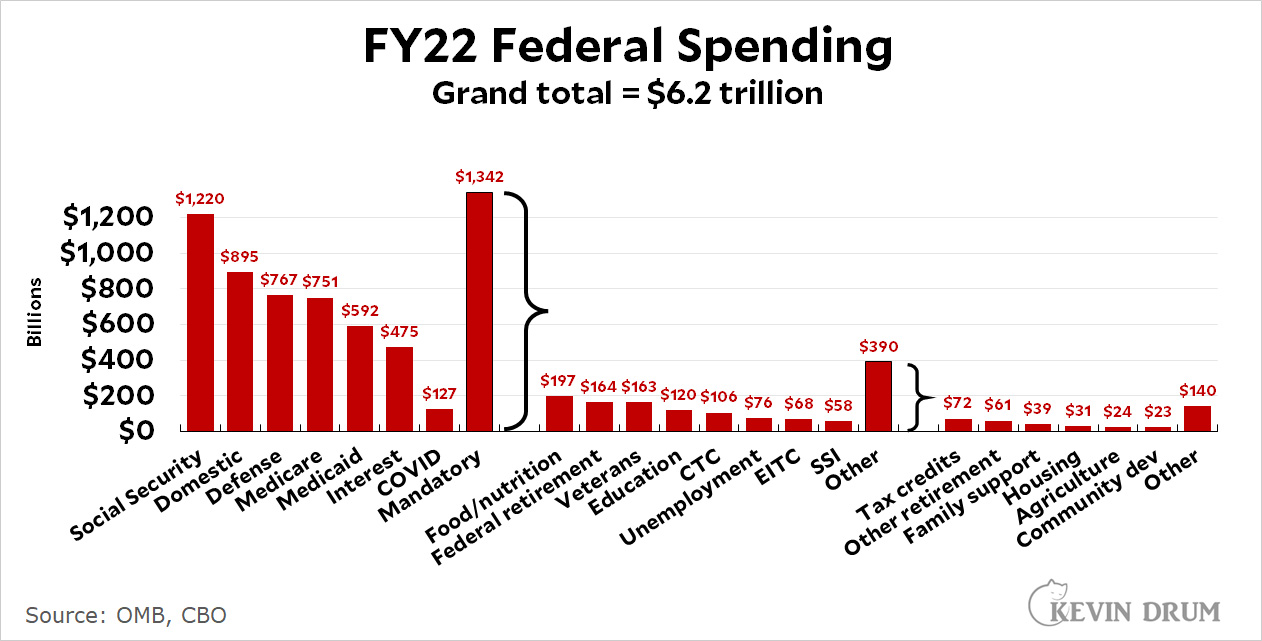

As a bit of stretching before the real workout, here's a 10,000 foot view of federal spending in FY22:

The federal deficit in FY22 was $1.4 trillion and we're supposed to get that down to zero. The rules are that (a) you can't raise taxes, and (b) you can't cut defense. Other than that, swing that axe! Let's find out which of you has the stoniest heart in the land.

Ah yes, the Interest category. I wonder the extent to which Kevin has been so protective of cheap money.

Start making more money weekly. This is valuable part time work for everyone. The best part ,work from the comfort of your house and get paid from $10k-$20k each week . Start today and have your first cash at the end of this week.

Visit this article for more details.. http://incomebyus.blogspot.com/

What does this comment even mean?

Spam

I would start by replacing the medical aspect of workers compensation, VA health, TriCare, with some kind of Medicare-like critical coverage and reap the savings there.

I would not cut defense, but I would cancel a lot of the Air Force and Navy's toys and reinvest in the service members.

You didn't say I couldn't do universal health care.

I reject the premise that "you can't raise taxes." Rather, I suggest we look to history to discover what is a good tax rate schedule.

IMO, the best Republican president of my lifetime (probably by a wide margin) was Ike. At the beginning of his eight years, the top Federal Income Tax rate was 91%. For his entire eight years it never changed. So for starters, one of our guys ought to propose "restore the tax table from the Eisenhower Administration."

After the mandatory fainting spells, another one of our guys could propose "That's too severe. Let's just restore the tax table to when Reagan took office, with a top rate of only 70%."

When that, too, causes a round of fainting, then our next guy could say, "Even that is awfully severe. Let's restore the tax table to AFTER Reagan came in and cut the top rate to ONLY FIFTY PERCENT!" And 202 of our guys could conduct a wildly cheering demonstration like they used to do at the political conventions when the Presidential candidate was nominated.

There are about 214 million registered voters in the U.S. At least 200 million of them think rich people don't pay enough taxes. Let the Republicans chew on that for a while.

Like +53.

Here are your GOP priorities.

The "Stop Tying to Obsessively Vilify Energy" Act.

https://twitter.com/daveweigel/status/1613973994990096384

Week 1 of the new Congress. It's going to be a long 2 years.

Yep

At least 200 million of them think rich people don't pay enough taxes. Let the Republicans chew on that for a while.

Republicans don't give a shit about those voters because they're not their donor base. Really rich people and corporations who write the checks to put them in office are. So no tax hikes.

The important point: The plan is to balance the budget in 10 years! No one needs to do it all right now.

So this being a political matter, not an economic one, my recommendations on what Washington should do:

1. Announce they have balanced the budget!

2. Pass the FY23 budget doing business as usual.

3. Pass the next 8 annual budgets same as #2.

4. In the 10th year, let the president and Congress at the time figure it out. If they don't balance the budget, that'll be their problem. Today's pols will be long gone.

And...

5. Never fail to remind the American people about #1. It will be their lasting legacy. "Remember back in '23 when our country's leaders put aside their petty differences to balance the budget once and for all."

Makes sense. After all, much of the Republican playbook has long been smoke& mirrors. Apropos of nothing, some time back I served as treasurer for a local nonprofit.

There was a goal of drawing down the excess savings, for various reasons. But certain members howled that they wanted to see "a balanced budget." That is, income and expenditures EXACTLY equal.

So we added in a "Withdrawal from Savings" item and lo and behold! Expenses and income "balanced." (sigh)

Honestly, that's how it should be done anyway. Putting something away as savings should be accounted for on the budget where that happens. Then, when you pull from it, it's income.

Just easier that way. Also it's easier to stay honest in budgeting when doing it that way.

Done it the other way for years. Only recently discovered that I need to account for savings as an "expense" and withdrawals from savings as "income."

I do not enjoy this game.

I do, however, enjoy the prospect of Republicans trying to play it. Luckily they, not us, are the ones committed to it.

And if they were a serious party that would actually be good for us.

But they're not. Their plan is to demand a balanced budget and refuse to vote for appropriations or raising the debt ceiling otherwise. If you think they'll feel the need to pair that demand with an actual plan to achieve that you haven't been paying attention.

Unfortunately, spot on.

Do not believe the BS Laugher curve. It’s never delivered. To start, raise taxes to pre-Trump levels. Then raise taxes on those earning over a billion/year to between 60 and 90%. Audit DOD. Look at medical expenses and reconfigure the system to reward service and value, not stockholders—doubt that this is possible.

DOD is already under several audits So that's already done. Good luck on reconfiguring healthcare.

Simplifying the tax code (I know; stop laughing) could make it easier to catch cheats, if they have fewer crannies and nooks to hide their money in. The current forms have gotten more surreal and incomprehensible to me every year. I just hope the accountant knows what he's doing, because I sure don't.

Well, the tax package the GOP just passed in the House abolishes the IRS and replaces the income tax with a straightforward consumption tax. Much simpler! Of course that would also mean a massive tax hike for the average American since most people spend all, or nearly all, of their income on day-to-day necessities, while millionaires can live very comfortably spending only a small fraction of what they make. But that's who the Republicans are working for, not Joe Sixpack.

Although it is not progressive, I have come to think that the flat tax, applied to all income over some set amount, is the only way to get the wealthy to pay their share. I really would like to go back to the tax rates of Ike, but that won't happen either.

Why? Progressive taxation makes a lot more sense. A shift to a single rate would do just the opposite of making the rich "pay their fair share."

Investment (so called "unearned") income is treated too lately by our tax code, and that should be remedied. But that doesn't require that there be a single rate.

I'd suggest that, but it shouldn't be an income tax. It should be a revenue tax. That gets rid of a lot of accounting hacks for hiding income.

I suggest you retake your math courses. Flat taxes are a means for the Wealthy to escape paying their fair share and to drown the poor/middle class in taxes.

I like piecharts better.

https://www.usgovernmentspending.com/us_fed_spending_pie_chart

FWIW: cost of borrowing money may double over the next ten years.

Explain. Include in your explanation how each of 1) the real vs. nominal interest rate distinction, and 2) tax-bracket ‘creep’ due to inflation affects the burden of debt service.

AI will soon know, and I'm guessing it will be "who needs old people". I wonder that too, sometimes, and I'm near retirement. Okay I paid for old people all my working life, but young people didn't get that money and don't owe me anything.

To Balance the Budget, all you need are the tax policies in place the last time the budget was balanced, under Clinton. Problem solved.

What? That's not what you want? You want to unbalance the budget with tax cuts for the rich, and then cut services for those in need?