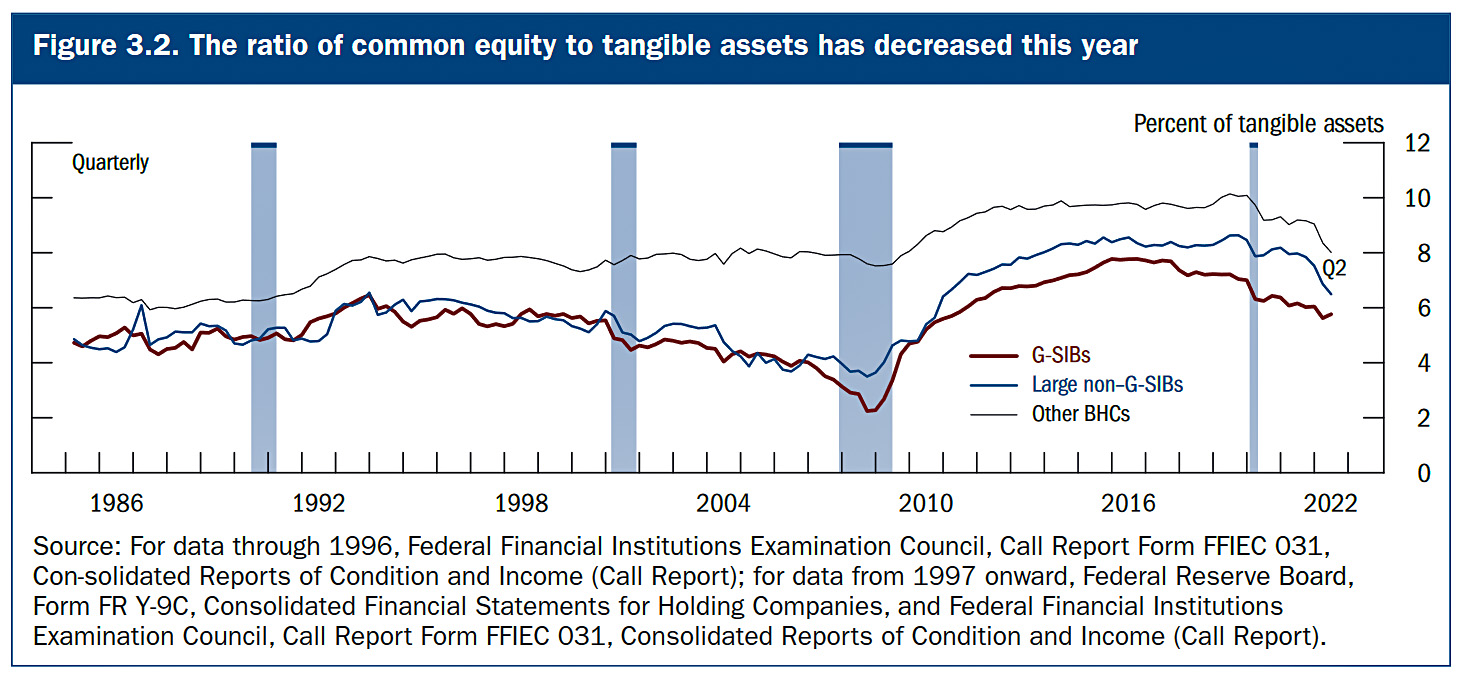

Remember a decade ago when we were all obsessed with leverage? Whatever happened to that, anyway? According to the Fed's latest report, our nation's big banks are doing fine if you look at the usual measure of leverage that uses risk-weighted capital. On the other hand, if you use a plain-Jane measure of tangible assets, things are looking a little dicey:

None of this is in disaster territory. Capital ratios are still well above their 2008 levels, and there are no financial disasters on the horizon. Still, if we move into recession and there's another couple of years of this, things could get a little precarious. Let's all hope the Fed is keeping a close eye on it.

None of this is in disaster territory. Capital ratios are still well above their 2008 levels, and there are no financial disasters on the horizon. Still, if we move into recession and there's another couple of years of this, things could get a little precarious. Let's all hope the Fed is keeping a close eye on it.

Am I missing something here? Why do we view a reduction in tangible assets at banks as risky?

At a bank, tangible assets are things like office towers, branches, data centers, etc. So a reduction in tangible assets as a percent of all assets should be a sign of increased efficiency: fewer branches are needed as more customers bank via mobile apps, fewer office towers are needed as more employees work remotely, etc.

(Speaking as an employee of a Very Large Bank, but not in any finance capacity)

Asset inflation.

Trump's tax gift to the wealthy meant a lot of money was sitting around--and inflated assets, e.g. stock, housing, etc. The pandemic hit, and the quantitative easing helped keep those assets afloat. Now the easing is ending and Fed rates went up--and prices for assets are falling. For some, say crypto, the fall was pretty big and needed. For others, the drop has been, and will be, less drastic--and also needed.

For the voter--the "wealth effect" has dropped--which also has them nervous. Their 401K's dropped by what, 20% this year!!! granted, the average yearly gain over the past 5 years is still ca.3 to 5%--but stocks fell!!!! Some for housing prices. They may not be selling, but still feel insulted if their home price drops.

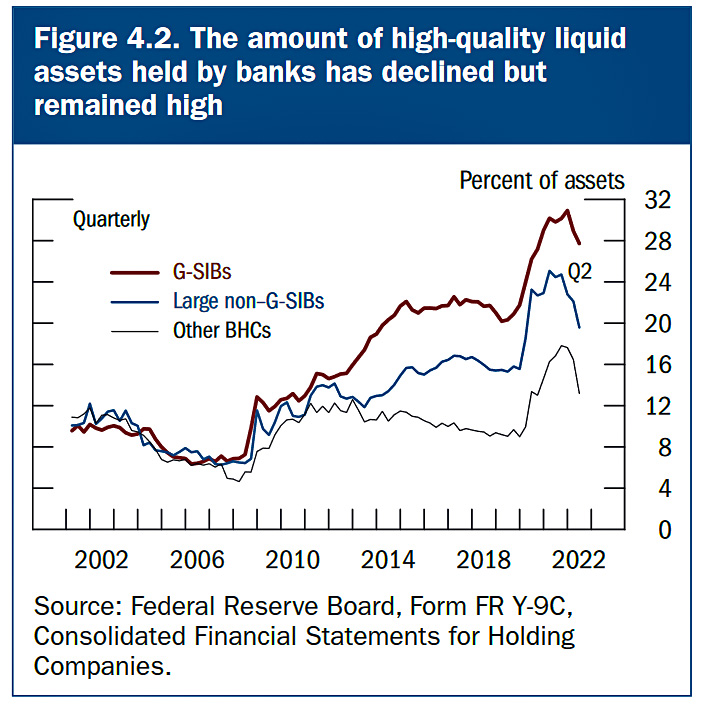

For banks--maybe their high quality assets are not as high quality anymore....

Don't expect 2008 collapse, but it may be a little messy....

fyi: G-SIB's = global systemically important banks

I wonder how these calculations would have looked in say, 2006. A lot of MBS's had essentially fake high ratings and credit default swaps were wrongly thought to provide security. While some people realized that there was a housing bubble nobody really appreciated the way that credit default swaps put the whole system at risk. In other words the degree of risk was vastly underrated. Speculators are constantly working to get around regulations and invent "financial innovations" to extend their leverage, which is the way to make the most money. Those who caused the 2008 collapse were bailed out by the Fed and suffered no other consequences so they will see no reason not to inflate another bubble. I doubt if evaluating real risk is as simple as Kevin seems to think.

The more money you have the thinner your skin gets.

It's like magic.

Doctors should study this.

The Fed report also stated that the bank's commercial and industrial customers (C&I loans) have been reducing their leverage, so that the bank's core loan portfolios are in good financial condition. My recollection is that the C&I leveraged loan portfolio's did reasonably well during the 2008-2009 great recession, with much greater losses in the commercial RE portfolio. Banks almost never lose money of loans secured with receivables and inventory.

FYI, tangible assets are any asset that is not an intangible, such as good will, trademarks, patents, copywrites, etc. For a money center bank, a vast majority of it's tangible assets are it's investment portfolios, such as loans.