As you know, there are two basic types of Medicare: traditional fee-for-service (FFS) plans, where doctors get paid for services rendered; and Medicare Advantage plans (MA), where doctors are paid a set annual amount for each patient.

In theory, MA plans should be cheaper. In reality, they game the system in two ways. First, they subtly tune their services to attract healthier patients (gym memberships, acupuncture, etc.). Second, they increase their coding intensity.

Wuzzat? Well, the annual payment for each patient is risk-adjusted: the sicker the patient, the bigger the payment. So MA plans benefit by making their patients look sicker than they really are. They do this by coding lots of ailments, even those that don't require treatment. More codes means the appearance of more sickness, which in turn means a higher risk-adjusted payment.

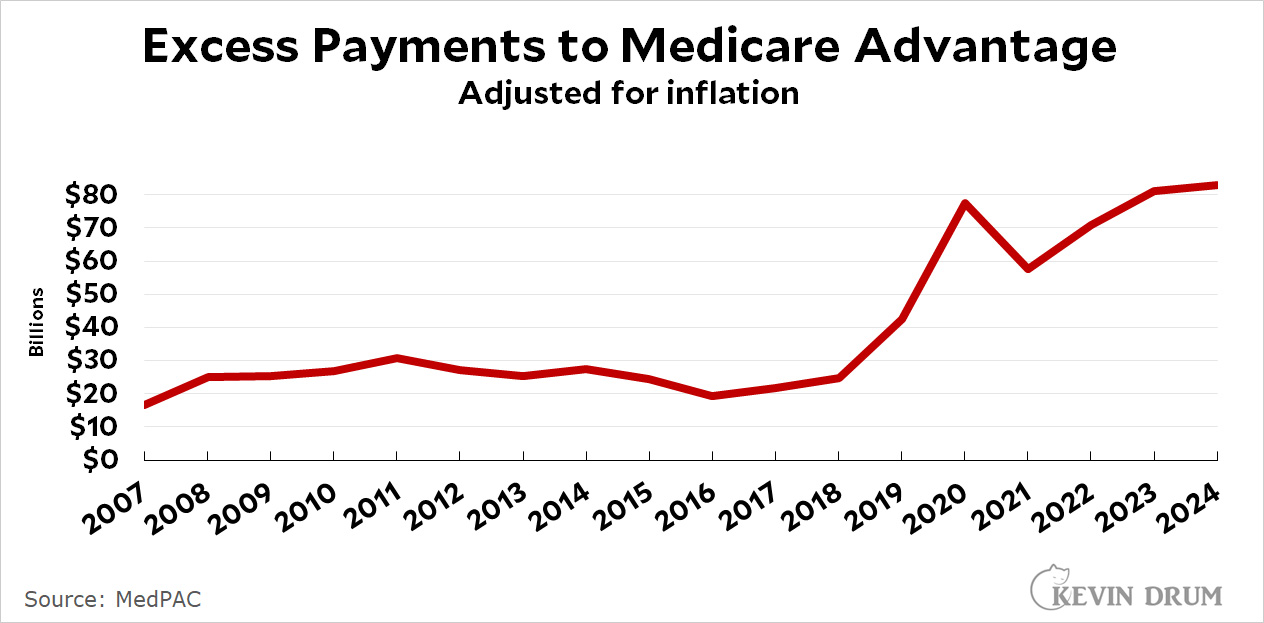

How does this net out? Here's a chart from MedPAC showing how much the government pays MA plans compared to how much they'd pay if the same patients were in traditional FFS plans:

That extra $83 billion for the current year is just shy of 10% of all Medicare spending. It's a lot.

That extra $83 billion for the current year is just shy of 10% of all Medicare spending. It's a lot.

I myself am in a Medicare Advantage plan because it's a great deal. That is, it's a great deal for me personally because my plan can afford to give me extra bennies thanks to the extra money they get from the feds. Needless to say, a great deal for me doesn't mean it's a great deal for the rest of you, whose taxes are paying for this.

So thanks!

How much does Joe Namath get?

Of course, you can always afford to go out of network and pay full price, so there's that.

Since Medicare Advantage is provided by a private insurer, can they decide not to pay for a treatment that traditional Medicare would cover without question? Do Medicare Advantage companies deny claims more often than Medicare.gov, and then force patients to work through the appeals process more often?

Asking since I am not sure of the answer.

No and generally no to your 2 questions. They definitely cannot deny payment for something that Medicare would’ve unquestionably paid for. They can however make you jump through more bureaucratic hoops than Medicare would’ve made you jump through (which is to say basically none as long as a doctor signed off on it). But in practice they don’t put anywhere near as many roadblocks to care as pure private insurance does, because (1) seniors bitch more readily to their congress critters about every actual or perceived injustice they face and (2) Medicare pays MA plans for almost everything they could hope for anyway so there’s no real financial incentive to cut corners by denying care.

Original Medicare is actually really nice if you can afford a supplemental coverage plan to cover the roughly 20% they don’t pay for. They pay their 80% promptly for anything reasonable that a doctor orders done. My mom had about a years worth of Medicare cancer bills before she died, and every time she remarked about how easy it was to get them paid compared to her workplace plan. No pre authorization. No in network penalties

Hundreds of thousands of dollars were billed and then paid out days later by Medicare and her supplemental plan, usually before we even got the bills ourselves. I wish I had access to Medicare! The only things comparable to Medicare in my experience are single payer coverage in Canada and Kaiser Permanente in America, both because you almost never are billed for anything. I’ve spent 13 years now covered by one or the other and have only gotten 1 bill ever, for an ambulance ride to an ER.

According to the Medicare website, Medicare Advantage plans "must cover all medically necessary services that Original Medicare covers." How many hoops they will make you jump through in order to get that service is anybody's guess, of course. (In my case, it has been not many at all, but as you can see by other comments here, that hasn't been everyone's experience.)

MA is basically a scam. It’s only purpose is to enrich insurance companies and for individuals who have a problem with “socialized” medicine. It is true than in some instances MA is superior to regular Medicare but that depends on geography and network use. Right now, MA is probably better for LTC like Alzheimer’s but again it does depend on the region. The problem with MA is that as soon as underwriter’s change the coverage due to circumstances (usually high net cost) everybody on it is left holding the bag. Unless one has a limited life expectancy living in an extensive affluent urban area with good medical options (e.g., NY, LA, DC, SF, CH, HOU, etc.) and do not intend to move (to be with children for example), I would not recommend leaving Medicare.

A conclusion I have come to recently, by reading discussions in comments sections like this one, is that Medicare Advantage plans must vary wildly depending on where you are. I regularly see comments like the one from Raoul here -- often enough that, to be clear, I am not disputing them -- but it doesn't match my experience at all.

I live in a rural part of NY state, and have a MA plan. It costs $30 a month (down from $35 last year). In return, it fills in all the gaps that would be covered by a Medigap plan, and includes an excellent prescription drug plan that I would otherwise have to purchase separately under Part D. I have never encountered a doctor or hospital around here that is "out of network". (Hospitals here are few and far between, and the region has a serious problem attracting and keeping doctors, but that's not the insurance company's fault.) It even has an over-the-counter option that basically amounts to a refund of a third of my premiums if I use it. So I'm just delighted with my Medicare Advantage plan.

Just because you haven’t run up against the prison walls yet doesn’t mean they aren’t there. Most people like their MA plan until they get really sick, then they aren’t able to switch back into traditional Medicare.

Umm, OK, I concede your general point, for sure. But in what sense are there people who "aren’t able to switch back into traditional Medicare"? The Medicare website says very plainly that during the Open Enrollment period every year, you can drop your MA plan and return to "Original Medicare".

P.S. I am not a shill for the health insurance industry. In my ideal world, we have a single payer system, and no one has to mess around with Medigap, MA, Part D, ACA exchanges, etc., etc. But in the particular circumstances that I find myself in, this public/private thing is working, and that was my only point in the original post.

It is my understanding that one move back to Medicare but a higher cost determined by a series of factors and that cost can indeed be substantial.

You can switch back into traditional Medicare during two periods each year. There are some complications regarding supplemental policies.

Of course people shouldn't have to deal with all the complications. Everything that MA offers - and there are many things for most plans - should be in standard Medicare. It would save money and give better care overall.

This is my understanding based on anecdotes from acquaintances:

You can switch back into Medicare Advantage, but if you have been out of the system too long (sorry, I don't know the actual number here) you will be subject to what the industry euphemistically calls "underwriting," which means you have to meet their wellness standards and you might have to pay more for your plan, plus you will probably have to foot the bill yourself for the extensive medical checkup required before they'll let you back in.

That's the problem. If you do not cost them much, they'll take good care of you--but load up your medical profile with all sorts of diagnoses. You see your cheap co-pay, not the government's portion which probably went up a lot. That can affect you if you do end up with something that's hard to diagnose. The physician treating you will see all these issues due to over coding problems to get better payments--which can then lead to a real mis-diagnosis.

This needs to change, both corruption and bureaucratic capture are unacceptable. The American Dream is not grift if you can get it, though there's a remarkable lack of concern for all this tapping which is actually not favorable in just about any economic theory I've heard.

The amount of money that can be harvested by collecting the money upfront then delaying and denying care is mind-boggling. And Liz Fuller says she wants ALL Medicare beneficiaries in either MA or the backdoor privatization scheme called ACO REACH in the near future. Note that one of the "selling points" always used to tout MA and ACO REACH is they are widely used in disadvantaged communities. But this is only because MA is allowed to waive the cost-sharing that traditional Medicare is not allowed to waive. And, from an insurer standpoint, low-income communities are the place to be if you want to find lots of people who risk adjust to a high level but don't actually use many services because there is poor access to doctors and hospitals. It's a criminal enterprise pure and simple. Imagine what $85 billion a year could do if put to some better use than this!

Who's Liz Fuller?

My wife was on a MA plan until recently when the medical group she used dumped all of the MA plans. The plan she was on was actually developed for that medical group. They were going to move her to doctors 2 towns over so that was a nonstarter. I was able to switch her to a plan G because a CA insurance company allowed people to switch to that plan who were in the MA group without being underwritten . Now she still has her same doctors and can go to any doctor who accepts medicare without having to get permission and no copays. A much better deal.

Medicare Advantage smells like a scam to me. It's not Medicare, it's private insurance pretending to be Medicare. The "advantage" goes to the private insurance companies who are running the grift. The Heritage Foundation's "Project 2025" includes a provision to make MA the default choice for all new Medicare recipients. There's more, but that all I need to know.

Medicare Advantage is more accurately described as Medicare plus an expanded Medigap plan (drugs, dental, vision, gym and Silver Sneakers).

I was in original Medicare with an employers "medigap" coverage costing about $1500 a year for 12 years. I switched to first Aetna and then Humana MA, both with no monthly payments, copays ($35 Aetna, $30 Humana) for specialists, none for primary care. Same doctors as in original Medicare (you have to make sure before enrolling).

So far my statins and blood pressure meds are free, and my out of pocket expenses have been almost nil (tooth extraction about $100).

I figure MA has saved me about $1500/year. Like Kevin, I thank you young folks.

a periodic reminder that taxes don't pay for medicare, or pretty much anything else at the federal level.

#LEARNMMT

Carry on.