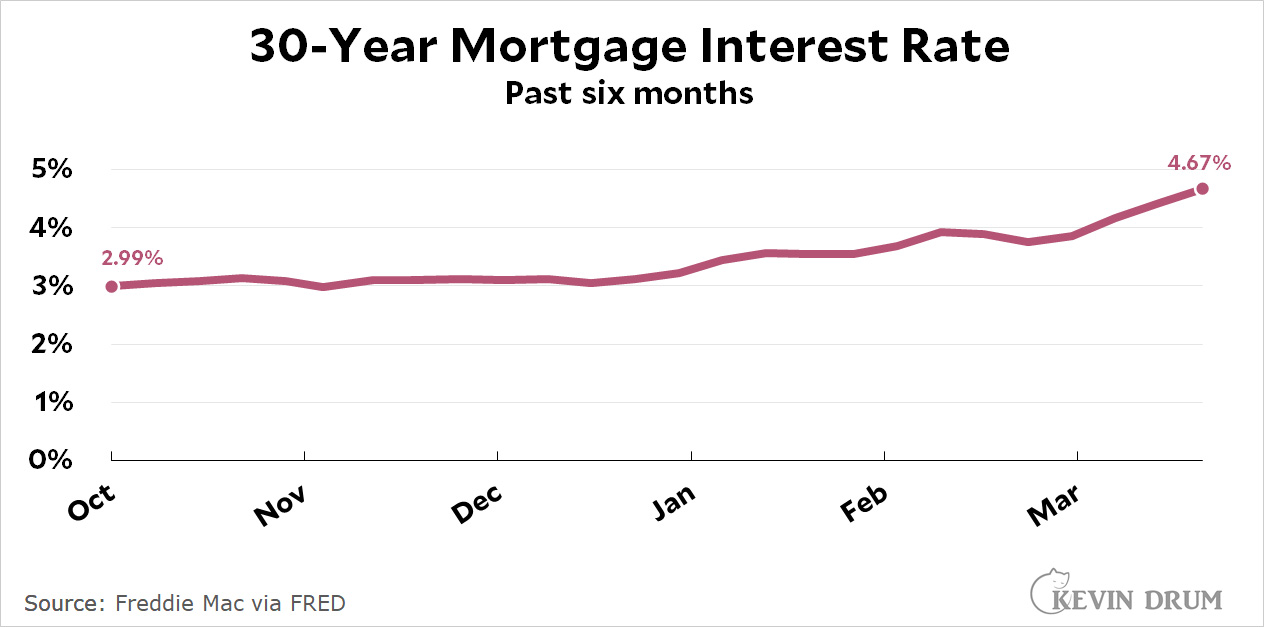

Mortgage interest rates are up again this week:

When you account for both home prices and interest rates, monthly payments are up nearly 30% over the past half year. Unsurprisingly, sales of both new and existing homes have dropped over the past few months and average sales prices have been flat. I expect this trend to continue, perhaps even with declines in home prices. There's only so much money you can squeeze out of households that have seen their incomes drop about 2% over the past year.

When you account for both home prices and interest rates, monthly payments are up nearly 30% over the past half year. Unsurprisingly, sales of both new and existing homes have dropped over the past few months and average sales prices have been flat. I expect this trend to continue, perhaps even with declines in home prices. There's only so much money you can squeeze out of households that have seen their incomes drop about 2% over the past year.

Hmmmm....Fed rates haven't jumped that much....

Mortgage back securities not that much fun now?

Given the declining purchasing power of the dollar in recent months, it would be surprising if lenders didn't demand more interest for letting you borrow theirs.

But the upper middle class has plenty of cash so… who pays interest?

Refinancing is highly sensitive to mortgage rate, but home-purchase mortgaging is not:

https://www.mortgagenewsdaily.com/data/mortgage-applications

Can Kevin or anybody else show a historical correlation of home building and buying with mortgage rate? Why do people, including economists and not just Kevin, express opinions about things like this which have no correspondence to reality?

If they raise rates, it slows the economy and housing almost always follows suit. Duration of slowdown and how high rates get will decide how large an effect.

Kiners-

Correct but in the sense that refinancing is hit harder by the FED raising interest Skept is correct.

Yes re-fi's suffer first and foremost but what is the reason for the re-fi? For most it's home renovation which means new flooring, roofs, kitchen upgrades etc. THAT slows the demand for the materials which means those industries are hit hard. This is followed by another hit when applications for new home building permits declines. That too affects all those suppliers. But there are a LOAD of programs in place to help first time home buyers get into that home

My question is this - is the housing market now addicted to helping first time home buyers? Can they wean themselves off that hand out? It would be an interesting thing to see because without the help, how many young couples could afford a new home?

We are incentivizing certain industries - fossil fuels for decades, the movie industry etc. These incentives take the form of tax breaks primarily or out right government grants. As such our numbers are skewed.

It seems that the Fed will likely raise rates several times over the next year plus: mortgage rates are going to continue to rise....

The Fed doesn't control that.

Don’t feed the troll.

The Fed does not DIRECTLY control mortgage rates. However, indirectly, the Fed influences a bank (or other financial institution) cost of capital: so when the Fed raises rates often mortgage rates will also rise.

Since you added home prices, I have to point out that you are making a huge assumption that a hypothetical buyer would actually pay 30% more, or 20% more, or whatever.

My personal experience and the same with clients is that people have a certain down payment and a certain monthly payment they can afford.

Its not that they "pay more" its that they settle for less house than they might have bought before the run up.

Part of the "settling for less" aspect is that it falls heavily on first time buyers. It does affect the market but the main thing in many markets is the crazy low inventory.

Since you added home prices, I have to point out that you are making a huge assumption that a hypothetical buyer would actually pay 30% more, or 20% more, or whatever.

My reading of this post is that such an assumption ("a buyer would actually pay 30% more") is not made by Kevin here. Rather, the assumption is that some homebuyers will be priced out of the market. At least for a while. Some. Not all.

About where they were in the 2010's. Yawn.

Don’t feed the troll.

Bought my house in 1976 with 8 percent rate, which was part of the sales pitch.