Politico reports that young people are pissed off:

While these voters are frustrated by Washington’s slow action on climate change and student debt, there’s another, often overlooked reason for their growing pessimism: The surging cost of housing has hit them harder than anyone else.

The combination of record-high home prices and escalating mortgage costs — rates have nearly doubled in the last seven months — threatens to price a generation of would-be buyers out of the market, cratering home sales.

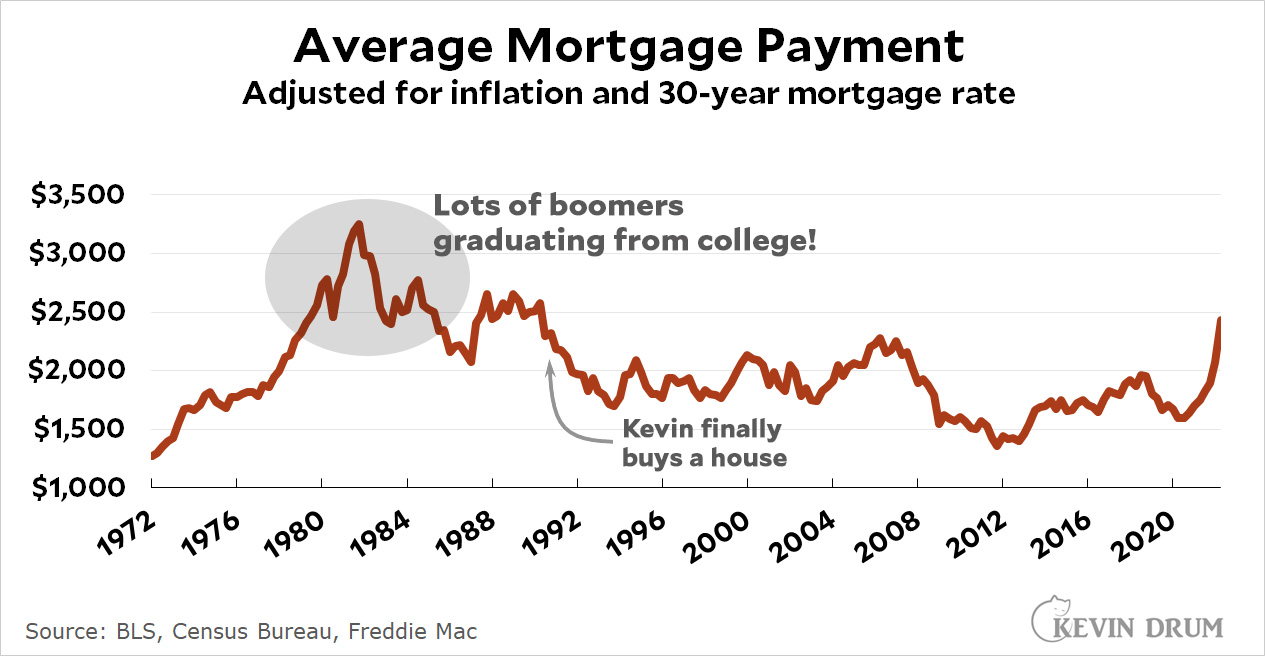

I know everyone is tired of this particular chart of mine, but I was alive in 1981. In fact, I graduated from college that year. Here's what the housing market looked like back then:

It's true that the average house costs twice as much today as it did back then (adjusted for inflation). But 1981 was part of the big Volcker war on inflation and mortgage interest rates peaked at 17%. This means that the average mortgage payment back then was over $3,000 (again, adjusted for inflation). That's a lot more than it is today.

It's true that the average house costs twice as much today as it did back then (adjusted for inflation). But 1981 was part of the big Volcker war on inflation and mortgage interest rates peaked at 17%. This means that the average mortgage payment back then was over $3,000 (again, adjusted for inflation). That's a lot more than it is today.

Those were bad times, but we made it through and bought plenty of houses. Our entire generation wasn't priced out of the market, and neither is this one. Interest rates will fall and the effective price of homes will likely return to its average of the past few decades.

This is also a chart for all the Millennials who think that boomers snapped up cheap housing back in the day and now want to pull up the ladder on younger buyers. But it ain't so. It was our parents who got cheap houses in the '50s and '60s, along with some of the older boomers. But most us faced mortgage payments over—sometimes well over—$2,000 a month. That lasted 14 years. For today's grads, it's lasted less than a year so far.

Kevin: just stop. Boomers, even late ones, got much more generous pension plans, health plans, raises and cost of living adjustments than anything available today. And Boomers could live decent lifestyles in any 1 of hundreds of metro areas across the nation. Nowadays, most people can’t get a decent job unless they live in 1 of about 12-15 metro areas. So the average nationwide cost of housing matters little - it’s the average cost of housing in those 12-15 metro areas that have the only pathways to a secure middle class existence that matter, and those 12-15 metro areas have housing costs much higher than nationwide averages.

For example, somehow my dad earned upper middle class wages living in Erie, PA and then Somersworth, NH and finally Wilmington, NC. Wages higher than what I earn today (when adjusted for inflation) with the same master’s level education in a science field. Retired with full pension and health benefits. I can’t find a single job that offers a pension or retiree healthcare anymore… and I had to move to Chicago then Washington, DC (and submit to the higher housing costs in both) to earn anything close to his wages. My job doesn’t even exist anymore in any of those 3 small to medium sized metro areas. No wonder he bought his first house at 23 and I didn’t buy mine until 44.

Oh and Boomers also got to attend college when it cost as much as what you could earn over a summer of working full time.

Gen X and Millennials got to attend college when it cost upwards of $20,000 or more per year for a state school. Try earning $20,000 in a single summer to “pay as you go” and not accrue any debt.

Gen Xer here, I got cheap college actually. Four years at excellent state school for less than the tuition of my private prep school beforehand. Only a few years after I graduated the early 1990s recession happened and state funding was slashed. Then tuition skyrocketed.

OTOH -- I delayed purchasing a home because DC housing market was unaffordable back then and suddenly with the S&L scandals there were a ton of cheapo condos you couldn't pay folks to buy so I was very hesitant to buy anything but a SFH so I sat out the 1990s didn't buy until the Oughts.

How MANY of those Boomers attended college?

We've switched from a model where few (but mostly the best) attended college to one where everyone has the option to attend college (and plenty do and drop out, while many of the rest learn nothing of value).

We've also switched to a model (contrary to what is generally claimed) of offering many more subjects, to substantially smaller classes.

It's not at all clear that this change is to the benefit of society as a whole. The changes have been made on political, not economic grounds, and the high costs of college (along with increasing dropout rates) are the inevitable consequences (as was predicted at the time by people who were, of course, excoriated for these predictions).

We can roll back the clock any time to the boomer world where

- college was cheap AND

- went mainly to people whose resultant increased productivity generated enough taxes to cover the costs BUT

- any sort of genuine aptitude tests and rationing of college will result in not enough of certain groups getting in, and the collapse of interest in certain subjects, and right now the US is not willing to go down that path...

Will it be one day? Who knows?

Rationing college? Do you read what you write?

Yeah, this.

I'm also still extremely skeptical of charts like that, because it ignores a whole bunch of context like geographic/economic/labor history. And then there is the problem with the types of jobs you mention in your other reply.

I feel like we lose something when we go from “back in my day” to “back in your day”

I see what you’re saying, but I disagree. We went from wages in line with much of the developed world to wages far in excess. Move to Europe in a highly skilled profession (obviously doctors because of their state medical system, but I mean more like tech and engineering) you will take a 40-50% pay cut

Sure there are lots of professions that did not have their wages grow. College graduates which don't work in technical fields. And they live like Europeans basically. But if you work in an “in-demand” profession or a somewhere out in the country it’s not difficult. Even if you have a blue collar job you can have a house, just not in a metro area

The idea that nobody can buy a house anymore is largely a product of the urbanization of the American public. There are more college graduates than ever before. College graduates tend to find jobs in densely populated areas where land is expensive. Hence the high demand in your 10-12 metros when they could have a house in rural Texas for cheap

Not digging at you or going for a cheap gotcha, just think pound-for-pound the housing supply is sort of the same, just the demand is different

Kevin: just stop. Boomers, even late ones, got much more generous pension plans, health plans, raises and cost of living adjustments than anything available today.

Early boomers, maybe. I don't know about "late" boomers. Someone graduating college in 1985 was entering a working world where private sector unions had already been declining for years—and were largely unknown for white collar workers (by then a rapidly growing part of workforce), so COLAs and defined benefit pension plans were already largely a thing of the past, at least for younger workers (which boomers then were). HMOs were beginning to proliferate because of healthcare costs. Etc.

I do think the "housing" piece hides (as usual) some regional disparities. I'm younger than Kevin, but I remember (around that time) I had a part time job in high school, and my boss was complaining about the struggle he had to undergo to buy a house. Now, IIRC this was in a fairly nice, leafy Boston suburb, and, although I don't remember the particulars in terms of numbers, he and his wife may have been putting 50% of their net to make the mortgage (largely because they had secured a mortgage in, like, 1980. Ouch!). But the difference between now and then is: 40 odd years ago, people like them strained to get onto the housing ladder. In 2022, they simply wouldn't be able to do so with such jobs, certainly not in that particular town.

Uh lol to 50% of net income going towards housing being an "ouch"; generally 30% of income towards housing is seen as a benchmark for affordability and losing 20% to taxes isn't out of the question.

"most people can’t get a decent job"

Define "decent job"...

That's at least part of what is going on here, a dramatic rise in expectations by young adults. The college graduate population has grown dramatically, but neither jobs that *really* need the degree, nor the quality of the graduates has risen in the same way. So, unlike earlier times, we have a substantial population who believe (because they were told this their entire lives) that the fact that they have an associates degree from Mediocre Community College means they're a shoe-in for a managerial career starting at $80K.

I'm not interested in blame here; I think it's more important simply to get the causality correct. It's not that life is any more difficult for the median young adult than in 1950 or 1970 or 1990; but it is true that, unlike those earlier times, many many more young adults think they're Lake Wobegon above average in skills and social/commercial value...

If only Kevin’s comment field allowed emoji I could’ve left a TL; DR middle finger to Kevin’s “actually Boomers had it tougher than anyone else” argument here instead.

I snapped up a cheap house in San Jose in 1971. A real fixer. 34.6K. Sold this year. 2,25M. The Silent Generation takes revenge!!!!

Are those Weimaraners in your profile picture? There was a Sesame Street bit that had those, my sister was terrified of it but I loved it

https://youtu.be/wgQNx_aRZgk

Congrats on the 2 (and a quarter) mil

Stole the image from somewhere. It fit my handle. dd was stolen from my #2 son.

Yes, but now where are you going to live???

Sold the Palo Alto house in 2008. PA prices dip but never crash. Was gonna live in the cabin till 2010 or so when prices bottomed. HaHaHa!!! Spring time with 37 degrees and raining for weeks drove the wife mad. Bought a foreclosed property near Auburn. Above the valley fog and below the snow and closer to the cabin.

When I was young I thought the arc of my life was to spend my declining years living on the street in a cardboard box.

This is as it should be when you have a country so insane that it supports policies that lead to massive population growth. E.g California from 20 million to 40 million in 50 years.

Without those policies, California would have about 25 million today and housing would not be a problem.

Florida has grown considerably faster than California in that time period, and features far less costly houses. Massachusetts has expanded by something like 18% in that time, but yet housing's very much a problem. NY has grow even slower, but housing's still a problem there, too! Scandinavia has low rates of population growth and some of the toughest affordability issues on earth. Hawaii has seen mostly sluggish population growth over the last half century but also crushing housing costs. And so on.

Clearly providing enough supply doesn't violate the laws of nature. We just choose to make doing so illegal.

No it hasn't. California has grown faster than Florida. Leading to double the population.

No it hasn't. California has grown faster than Florida. Leading to double the population.

You're wrong. Since WW2 California's population has roughly quadrupled. (Just under 10 million to just under 40 million)., Florida's population has grown about NINE fold (2.5 million to 22 million). The growth figures are stacked even more heavily in favor of Florida since 1980, given the dramatic slow down since then in the Golden State.

This piece is fair but misses an important aspect of buying a home: that pesky down payment. While high interest rates make housing monthly payments higher, they do not make down payments higher. A mortgage interest rate of 2.5% doesn’t do a 25-year-old much good if you have to work 15 years before you can save up enough for the down payment.

What's the % of "average" income relative to "average" mortgage?

Worth noting that new privately-owned housing starts hit bottom in late 1981, at peak of mortgage rates.

Politico are idiots. Housing is only a large issue with overpopulated urban centers. In Ohio, housing isn't even a big issue in terms of buying one.

Heck, rental markets are loosening as well. Lagging stories vs real time issues. By this time next year long forgotten.

Slightly OT, here's a FRED map of vacancy rates: https://fred.stlouisfed.org/graph/?m=SpYo

Too bad it's by state, and therefore just flat out worthless unless you're looking only at Rhode Island.

Pingback: So how about Boomer rents vs. Millennials? – Kevin Drum

Intergenerational sniping is pretty pointless. And the real estate market varies from place to place. I'm not sure I see why this post is all that relevant.

Millennials have problems boomers didn't (high student loan balances, for instance)and boomers had problems millennials don't (no computers! No Internet!).

The main problems confront all of us: Climate change and terrible economic inequality. Reactionaries controlling one of our major political parties and the SCOTUS.

Interesting....

I tried posting a link to student loan data--and those posts are not showing up. Yes, student loans have shot up, though it would be good to have student loan payment per person data. Parents also have to take out loans to help their kids with college--so are less able to help with a down payment later.

And Slate had a fun article on financial aid...apparently it's a bit of a racket.

Let's try posting a link again:

https://slate.com/business/2022/07/college-financial-aid-sham.html

It's hard to do comparisons, since so many costs have changed, and the programs available to help first-time home purchasers have expanded.

I've been watching old game shows, and it's shocking how much cheaper things like furniture and appliances are now. You can buy a decent sofa today for the exact same amount of money as you could in 1984. Smaller electronics, like microwaves and electric skillets are a fraction of their earlier cost.

There are also differences in wages and ability to work. Men made more back in the 80s, but women were paid little and often fired for things FMLA would protect them for now.

The thing is, everyone feels really stretched in their 20s. There are a lot of big expenses that all come in a short period of time. You are trying to build an independent life from scratch. And the people who are older than you are already settled, making you think they had only smooth sailing.

This is just a moment in time. Older millennials who bought homes in 2012 are doing great. By 2030 we could see Boomers ditching their homes, making housing purchases cheap for younger Millennials.

Kevin, Kevin, Kevin!

For a guy who loves charts, I would think by now you'd be posting your own version of something even better than Case-Schiller.

Housing is so unique, size of house, location of house, etc, that you would think that all you have to do, like your regular commentators regularly do, is compare house prices per sq foot of house per sq foot of land adjusted for distance from public transport or job center and mixed in by rank of urban center with, not just average cost, but by job growth in said area where said houses are.

You're from SoCal I mean come on? You lived through most of the development of Orange County for goodness sakes.

KD really wants those kids off his lawn, huh?