Last night I posted a chart showing that housing prices had moved up and down a lot in the past 50 years and had often been higher than they are now. But you have to adjust for both inflation and mortgage rates to see this.

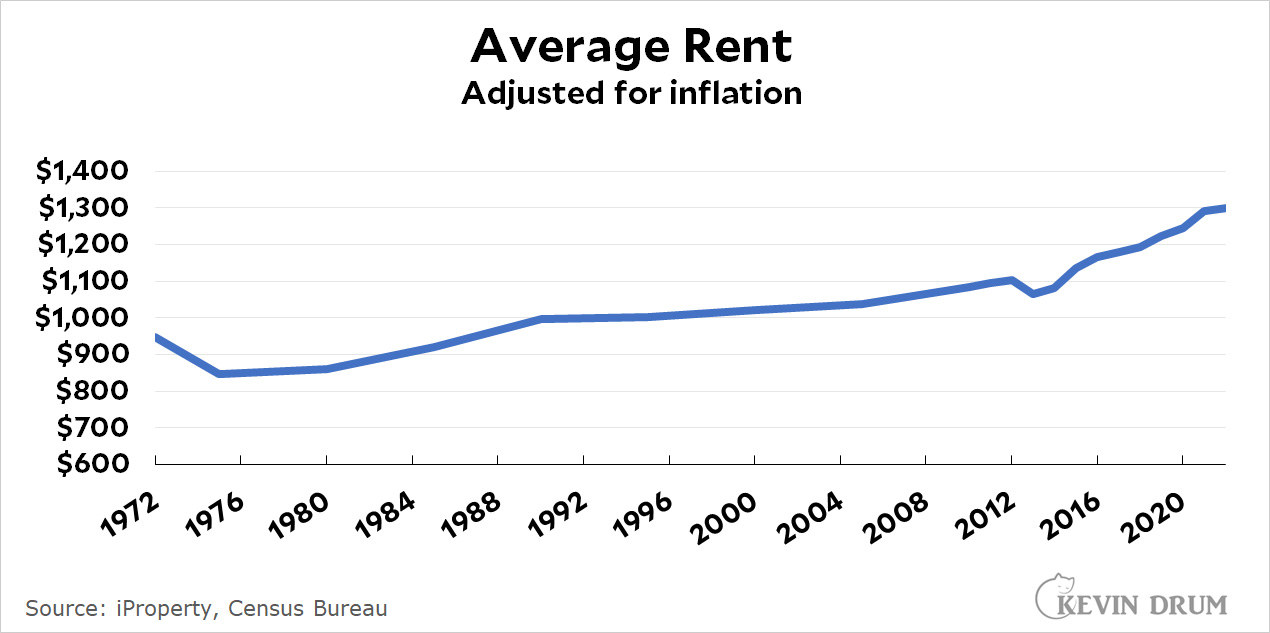

But what about rent? That data is a little harder to come by, but here's a decent estimate:

In real terms, average rent has gone up from around $900 in the early '80s, when my segment of boomers was graduating from college, to $1,300 today. (Then again, the annual earnings of 25-34 year-olds have increased too, which makes up a lot of the difference. Basically, rents have gone up 45% and earnings have gone up about 30%.)

In real terms, average rent has gone up from around $900 in the early '80s, when my segment of boomers was graduating from college, to $1,300 today. (Then again, the annual earnings of 25-34 year-olds have increased too, which makes up a lot of the difference. Basically, rents have gone up 45% and earnings have gone up about 30%.)

This, of course, is a national average. Rents are quite a bit higher than this in Southern California, where I live, and I assume they're lower in states like Montana or Alabama. According to the Census Bureau, rents in the West right now are about 60% higher than they are in the Midwest. According to these guys, California rents are 80% higher than in the lowest-rent state, North Dakota. But that's if you use Census data (which you should). If you use Zillow data, the difference is 260%.

By the way, this is where some of the most fantastical numbers come from. Outfits like Zillow and CoreLogic deliver numbers that are monthly and up to date. This is great for the news industry, which wants to know what's happening right now. The Census, by contrast, delivers fewer numbers and they do it less frequently, so they get relegated to a blurb in the back of the business pages. But it's really the Census numbers that are more accurate, based on good survey design and not cherry picked from limited data.

So if you can find a well-paying job in MT, AL, or ND, you're OK. But if you have to seek work in, well, the states that produce the most jobs overall as well as the lion's share of well-paying jobs... you're screwed on rent.

Not really sure where you're going with this, Kevin, but you need to just let it go.

The rent could be $1/month in North Dakota, and yet since there are exactly zero jobs there in my professional field and zero non-stop flights from there to the places where I can find a job in my field... it's completely irrelevant to me that such "great rent deals" exist there. You might as well tell me that rents are cheap in Mexico, Croatia or Zimbabwe for all I care. It's possibly true! And yet entirely unhelpful to workers who must work in specific locations in the US!

There are a lot of good posts and comments on this blog. But this is one of the most succinct and the best.

The people who are constantly grieving about the US going to hell in a handbasket are usually misinformed and wrong, but no one is wrong about everything.

The US had the weird situation, for much of its existence, where if you were willing to work in some form, there was a job for you almost everywhere. You could throw a dart at a map.

The industrial revolution changed this. I heard a USC professor point out in 2017 that the computer/internet/tech revolution of the 1990s onward changed this on steroids, to use a metaphor .

He said "at least in the industrial revolution, you could move from your farm into the city and get a job." Now, well, see Austin's post above. The Trump conned are worried, correctly, about Austin's post in reverse. Once a job or type of job leaves their area, they have two choices, neither of which they like - move to the city or stay and wither on the vine.

My brother - who actually is a Millennial vs. me a Gen Xer - is doing the latter, staying and withering on the vine. He put down roots in our hometown and has spent the last decade-plus trying to find a job nearby that will put his degree in computer science to use. He's never found a permanent job. Instead he goes through temporary job after temporary job, and earns way less than I did at his age, because there is nowhere in North Carolina that needs lots of employees with computer science degrees outside of Raleigh-Durham or Charlotte... and he refuses to move to either one (or to any of the other 12-13 metro areas in the country where computer science jobs are plentiful). It's sad to watch his skills go to use as a temp for an IT help line at some shitty community college or shittier local business. But... increasingly in America, you have to move to where the jobs are (and take on the debt in doing so - moving to and living in Chicago during my first 2 professional jobs wasn't easy or cheap!)... or resign yourself to the lower middle class as living costs rise faster than your income.

Point of clarification: It's also not "move to (any) city or stay and wither on the vine." Back in the 20th Century, you could just move to pretty much any city and have better job prospects than "staying on the farm." Few cities were in total collapse until the 1970s and even then usually their suburbs still had growth and thus job opportunities until about the 2000s. Nowadays though, you have to move to *specific* metro areas for *specific* kinds of jobs, especially the jobs that have a future ahead of them (e.g. a reasonable likelihood of landing you into a stable middle class existence)... and none of those metro areas may be anywhere near the metaphorical or literal farm that you're fleeing.

North Dakota has one of the lowest unemployment rates in the US.

https://en.wikipedia.org/wiki/List_of_U.S._states_and_territories_by_unemployment_rate

This extends to major cities like Fargo.

Meaning the issue is less that you *can't* find a job there than that you *choose* not to work there...

Which is a rather different sort of complaint.

Clearly rent has gone up, however the level of amenities has also meaningfully risen.

For example, the appliances, cabinets and flooring in a modern apartment are much better than the 1970's. Similarly, the shared amenities (depends on the apartment) can now include onsite gym, dog parks even EV chargers. Also, the life safety features (sprinklers, ventilation etc) are superior.

Similar to say a 1970's car, apartments today are better but more expensive than the past....

Sure, that might be true, but the reason why basic housing isn't getting built isn't because we can no longer build basic housing. It's because there is so much unmet demand in the housing market that builders choose to focus only on the high end because (1) that's where they can make more money and (2) why bother making less profitable housing units when you have to jump through shittons of red tape? May as well make it worth your while.

cmayo - you are mostly correct. 'Affordable' housing in high cost areas are mostly built by charities or non profits. Why, you ask....because they have different business models (tax funding, no need for profit/can lose money etc).

Why, for example near a California city, can't a for profit developer construction affordable housing?

- the cost of the land is not really changed by the use.

- the building codes are basically the same

- the municipal fees, in some areas these exceed $50,000 per each new apartment unit, apply to lower cost apartments

- the cash flow and sale valuation from higher end apartments are often (clearly not always) superior with higher end apartments

Basically, the real estate developers are responding rationally to the market structure.

I work in nonprofit housing, I'm well aware of this. The scale of development at the not-big-developer level is basically irrelevant when it comes to the housing market. It's a rounding error in the total number of units. Funding is insufficient.

It is my observation (San Francisco Bay Area) that apartments that are newer and have those amenities tend to be smaller than older apartments that don’t have those modern amenities.

Similar to the design of many newer hotels, smaller rooms but more generous common areas are in vague.

That's brutal. A 35% inflation-adjusted increase in average rent - 23% just in the last decade! Not even declining rents in cities hit by economic dislocation and major shifts in industrialization was enough to offset that.

To me, that indicates that there's some serious problem in apartment construction capability in places where people either want or need to live. Anecdotally, that fits with trends making it more difficult to build apartments in many cities.

I fail to see how Zillow's extensive time series (as well as market research/data) is cherry-picked. Academic researchers use Zillow as a source at times, FFS. I trust the Zillow data far more than the Census data, and the monthly data points are a gigantic point in Zillow's favor as well.

https://www.zillow.com/research/methodology-zori-repeat-rent-27092/

Beyond that, rents shown on Zillow are going to reflect the market rates in the area for units with similar properties. The landlords putting prices on Zillow are not doing so in a vacuum - they are setting their prices based on the market in their area, not "what can I get for this on Zillow only?" Why don't you mosey on over and take a look? There are tons of rentals posted in even small cities like Des Moines.

Some time back I did some research on the average hourly wage versus the average annual mortgage, and there was a big shift around 1980. Before then, it took 600 hours of work to pay the mortgage. After then it went up to over 1,000 hours, then fell to around 800 hours, but it has not yet gone down towards 600. There are about 2,000 work hours in a year and the goal is to pay about 1/3 of one's wages for a place to live. It was quite possible to pay for a mortgage on a single income before 1980, but it has not been anywhere nearly as easy since.

Of course, every generation has its housing stories. During the Great Depression, the problem was affording housing. Jobs were scarce. My grandfather worked as a janitor / apartment manager and my mother said it was great that she and her friends could always "borrow" an empty apartment as a playhouse. During World War II, housing was a problem because of the boom in defense and military industries. After World War II, the situation was dire with all the returning veterans.

I also liked how Kevin just flatly states that his own research shows that "Basically, rents have gone up 45% and earnings have gone up about 30%." As if rents rising one-and-half times as fast as earnings over a multidecade period with no end or plateauing in sight is not a cause for concern?

I don't think he said that. He said that relative to income, the rent increase is much smaller than it seems, and it is. He presented what the data is and how he came by it. He made no comments on what it means. But he has said plenty about that elsewhere.

I guess every day is a new day.

Vacancy rates on a map: https://bityl.co/DdOX

I've been to Alabama. I have family in Alabama. If rent was negative, I still wouldn't move there.