Karen Petrou explains why so many people are unhappy with Joe Biden's economy:

The mortal enemy of Bidenomics isn’t Donald Trump; it’s a reliance on aggregate and average numbers.... For most Americans, a sense of financial well-being doesn’t come from capital returns in the stock market or even from house price appreciation. It comes in each paycheck and benefit payment and is challenged by each bill and receipt from the supermarket. Paychecks are falling shorter and shorter for more and more households, no matter the seemingly record high employment data the White House also likes to trumpet.

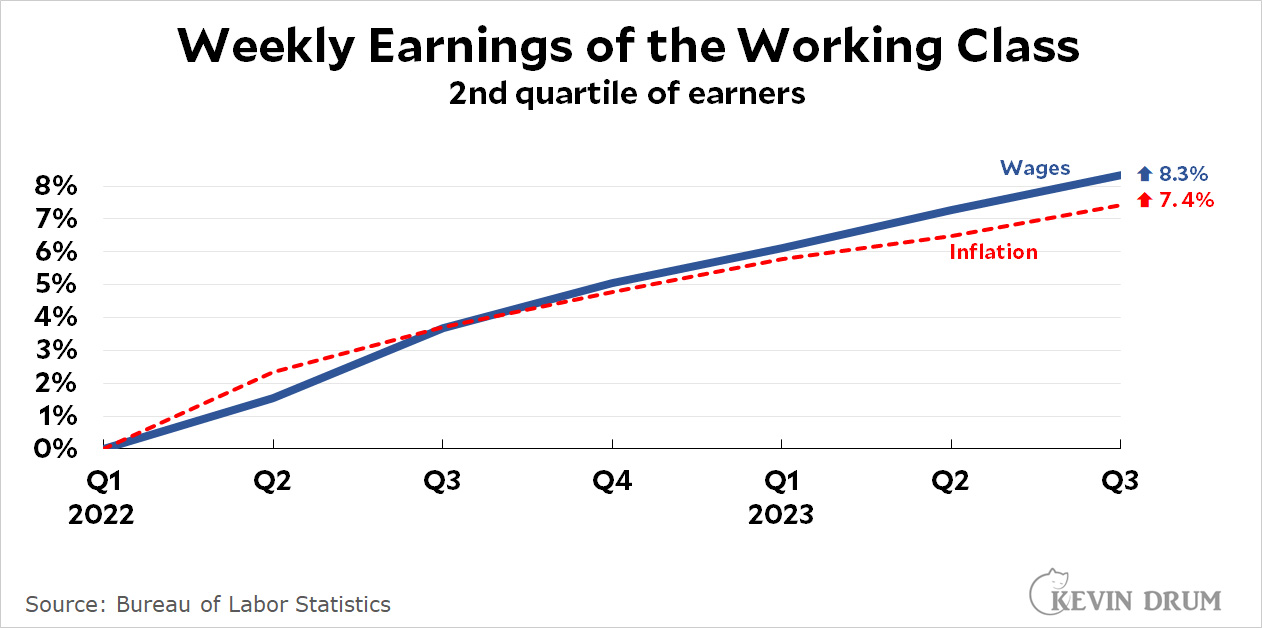

We don't have to rely on averages. Income data is broken down all sorts of ways by the boffins at the BLS. Here, for example, is income over the past two years for the second quartile—that is, people whose income ranges from 25% to 50% of average:

Look: I know that charts like this aren't going to influence public opinion. But if you're a managing partner of Federal Financial Analytics writing in the New York Times, shouldn't you at least briefly check the data before you start typing?

Look: I know that charts like this aren't going to influence public opinion. But if you're a managing partner of Federal Financial Analytics writing in the New York Times, shouldn't you at least briefly check the data before you start typing?

The rest of the piece is about entrenched income inequality, and that's certainly a problem. But it's been a problem for decades and hasn't gotten any worse lately. In fact, after rising for years, income inequality has dropped recently and is now lower than it's been in the past 20 years:

Whatever the reason for recent economic dissatisfaction, it has to be something that happened recently. So it's not because paychecks aren't going as far. It's not because of rising inequality. It's not because inflation is currently high or because people don't have jobs. It's something else. But what? It's a mystery.

Whatever the reason for recent economic dissatisfaction, it has to be something that happened recently. So it's not because paychecks aren't going as far. It's not because of rising inequality. It's not because inflation is currently high or because people don't have jobs. It's something else. But what? It's a mystery.

Everything costs too damn much. Even if someone has more money to pay for it they are still being ripped off constantly.

The steaks at the local Costco that used to be 7.99 lb are now 9.99 lb.

12 packs of Coke at the local supermarket were 3 for 9.99 every other week and holidays. Now 3 for 14.98 is a "sale" where you are told you are saving $12.

This is like telling me it's raining while you pee on my leg....

And I've been buying boneless skinless chicken when it's on sale (which is a lot of the time, almost always at one supermarket chain or another) for $1.99 a pound for 25 years, and I've lived in small towns and the biggest cities on both coasts and in between.

Anecdotes aren't data, but most people think they are. They also think that Biden is responsible for gas and egg prices.

So… wages should rise but prices should be frozen forever?

Don't be disingenuously stupid. We are light years from needing to raise prices because wages are too high. Remember the massive price gouging companies went in for? The rise was about half supply chains/inflation and half rampant greed.

Oh my god, profits are only modest! What a fucking tragedy!

The 'Biden economy' is a scapegoat because it's easy to complain about prices, but it's not so easy to complain about your nice and pleasant neighbor who votes for Republicans.

Prices are easy to understand, but if you try to understand your neighbors you quickly realize they would be just as happy to see you dead and when they vote for Republicans it's just a way of murdering others from a comfortable vicarious distance.

Rather than talk about that people complain about prices.

Social conservatives are people who've never won an argument on its merits, who don't care, and are deeply frustrated that you think any of that was ever the real argument.

The argument is they think you should die.

They think that because they're going to die and nothing else matters to them, but they want you to do it first.

That's why they don't care about anything, and that's why they will hate anything because they can see it's going to survive them, and that motivates them to make it all worse because when it's all worse that makes it easier to hate so that way they're not missing anything.

i don't think my republican neighbors want me to die, but they might be happy thinking that some abstract liberal might die

similar to how drivers see annoying traffic primarily as intentionally malicious human operators and not as, you know, someone's doddering grandmother just doing the best she can behind the wheel

They may not actively want you to die but they also may not give too many fucks if you just cease to exist in their worldview. Most republicans I know are like this: everyone they don’t personally know and like are just non-player characters. Doesn’t really matter what happens to the NPCs, if it doesn’t affect them personally.

Again, WordPress needs at least upvotes if not downvotes too. Or Kevin needs to get on a different system. At least it has replies with a few seconds of editing time available.

OK now do rent vs. wages.

The 2nd quartile spends far more on housing than anything else (half of renters pay more than 30% of their gross income on rent, which is 50% or more of their take home). Housing is only 1/3 of the inflation calculation, but it's 1/2 or more of these people's actual after-tax expenses.

Housing/rent has increased by more than the inflation figure, so of course it makes sense that regular people think their paycheck isn't going as far as it used to. At best, they're treading water - but doing so in the midst of rapid price increases, which makes for lots of anxiety and stress (which have their own negative impacts) even if their earnings manage to keep up. It feels like a scramble.

When you're in a position of such privilege, it would behoove you to remember things like that.

i agree that housing is top of the list for most people, but my favorite touchstone is broccoli

at my grocery store pre-pandemic broccoli was $1.20/lb

now it's $2.00/lb, so that's a 67% increase in price, and hasn't budged for over 2 years

otoh, pre-pandemic cabbage was 70 cents/lb, now it's 90 cents/lb, so that's a 28% increase

these plants are both brassicas with very similar growing requirements

yet the price of one went up twice as fast as the other

to me it looks like nothing more than opportunistic price gouging, but i'd be happy to revisit my conclusion if someone could give me a rational reason for the discrepancy

That's a great point about similar plants.

and the price of capital letters has gone up to unaffordable levels.

Housing costs are too high for lower income households....

but the math here is wrong.

The tax burden (gross income to net income) of roughly 40% isnt close to accurate.

The CPI does pick up sales taxes which is probably much of the tax burden for this group. CPI doesnt pick up income and SS/Medicare taxes, but this will be something around 10% for this group, not 40%.

Only 40+% of this group are renters, so roughly 20% of people in this group pay more than 30% of gross income in rent....so the CPI isnt far-off for this group.

Averages obviously dont work for everybody, some people face higher costs than the CPI, others face lower costs.

This link is 2 years out of date, but should provide a useful frame for this issue.

https://www.bls.gov/spotlight/2022/inflation-experiences-for-lower-and-higher-income-households/home.htm

Admittedly, I based this on my own personal experience of being in the 2nd quartile and I was rounding. My take-home was between 63%-67% of my gross (it's now 63% and I'm somewhere around the median, and living in a a state with a couple percentage points lower income tax rate). It's not just taxes, it's also health insurance. I did not contribute to any retirement fund because I couldn't afford to.

Note also that it's not a clean "spending 30% of their gross income on housing", it's "spending 30% OR MORE." Given that we're working with 60-something percent, or perhaps even somewhere around 70 or 75%, for some folks, and that those who are housing cost burdened are spending 30%+ (which could be 35%, 37%, even 40%) of their gross income... Yep, that's about half. And those with lower incomes are more likely to have both a higher percentage of their gross be take-home AND spend a higher percentage on rent because there's a high price floor to housing. At the very bottom, it can be around 2/3 of your take-home pay. Ask me how I know (:.

So yeah, I stand by my "people are spending 50% of their take-home pay on housing" noodling.

I'll also note that the BLS link you cited hints at my point but admit (as I do) that there isn't really data on it: they highlight that lower income households spend more on household essentials, with housing cost being the single biggest item (by a country mile). A few slides later, they show their work on total inflation and show that lower income households experience a higher rate of inflation.

Given that we know about the inflation calculation and its housing component, it is really not a far leap here. Regardless of the actual math, which AFAIK nobody has real data on (which is a great disservice to us all), the point stands that Kevin's post is wrong (and/or lensed through economic privilege) about paychecks going as far as they used to.

Thanks for the BLS link though, good citation-able nuggets in there.

There's people with untold billions they'll never use, want, or even notice. But you are being ripped off every day, and are struggling to keep it even. And losing.

Ergo:

I don't think you will actually find anything in traditional economic measures to explain it.

People are just angry.

I think it is emotional hangover from the pandemic. People wanted to buy stuff, but supply shocks stopped them. The lack of socializing hurt happiness, but it's hard to get back out there. Partisanship lowered social trust. Post pandemic life is full of change, and people hate change.

Some things are also more visible. Estimates of homelessness are down from 2007, but the homeless are more likely to live clustered in obvious camps now. Tipping has spread, either increasing costs or making people feel bad for not paying.

Everything is something to complain about when you are angry. People are even complaining about how their 3% mortgage makes leaving their starter home for a fancier home seem unwise. Or grumbling about the paperwork needed to get tens of thousands in student loan debt written off. Stuff that would make people cheer a decade ago just makes them even more angry now.

My psychic wage for being a straight, white, suburban Christan male cratered in 2009 and has never recovered.

Good.

So much wrong here.

Overall wages may have gone up, but for people who did not change jobs, their annual raises do not match inflation. Additionally, those raises only happen once a year and then price increases eat into it a little more each month.

For the second quartile workers, weekly wages going up usually means an increase in hours which comes with a corresponding increase in expenses (primarily transportation).

This is misleading. Youre right that job changers always see bigger pay increases than those who stay in their same role, but this is always the case, lots of people change jobs and job stayers have also seen large increases.

https://www.atlantafed.org/chcs/wage-growth-tracker

Its a bit of a silly counterargument to say 'sure, the averages and medians have gone up, and sure thats even true within the lower income groupings, but some people are still below that average or median!'

I mean...thats always true, but it turns any discussion of 300+ million people into a waste of time. Things can never be good if we only look at the person who is doing the worst. Averages and medians are useful when discussing large groups.

People feel like they earn the raises they get, even though those raises would probably have been smaller absent the high inflation we've seen recently.

Normal people don't think "my 5% raise this year is mostly due to inflation", they think "wow, even though I earned a 5% raise this year, I'm barely able to afford the same things I could a year ago because of all this inflation."

Your complaint about the author of the NYTimes piece is absolutely valid (it's simply not true that paychecks are falling shorter and shorter for more and more households), but to say that people are angry solely because of Fox News or whatever point you were making at the end of the piece is to ignore human nature.

People hate inflation! People hate inflation even after it has mostly gone back to normal, because they still remember prices being much lower 18 months ago. And they don't credit inflation for their larger nominal paychecks, even though economists and you and I know they are related.

Fox News is also bad. But you ignore human nature at your peril.

I am not an economist, so excuse me if this is totally irrelevant, but it seems to me that high inequality has a large lag effect culturally. What I mean by that is that the new apartments you see for rent now, the Bentleys on the street... production of those was all planned at least a few years back when inequality was higher. And these things (apartments and Bentleys you see around, for instance), I believe, have a pretty big effect on the culture and on whether you (or I) think things are out of balance.

When I was growing up in the 70s the rich guy whose kids were in public school with you had a newish car and a house in the newer subdivision, but these days the rich guy has a helicopter and a 10,000 sq ft house in a gated community. And you are definitely not in the same school with his kids. And that affects your perception of whether the rich simply have too much stuff. If inequality is down, it will take a few years for businesses to realize the people with money are now of a different class.

I grew up in a small town in an area where most of the inhabitants were probably in the third income quartile (average to above average but not rich). The lots were spacious, mostly because there was no sewer system and septic fields take up room; a half-acre was a small lot. My next door neighbor was one of the exceptions to the "mostly third quartile income"; he used to wake us up on Saturday mornings in the early '70s landing his helicopter in his front yard. Neither the house nor the yard were remarkable; the helicopter was the only sign of the fellow's wealth.

The latest installment of "That thing you're worried about? It's not a big deal to me, Kevin Drum" with the added flavoring of "I already figured it out, you're welcome".

OK, here I go. Probably someone with a better handle on economics will weigh right in and show that I am missing something.

Not that any politician on either side will say this, but the problem is not just the percentage increase in theoretical costs vs. theoretical income (wages).

Housing, for example, just goes something like this.

In 2020, your income produces 10K a month net. Based on that, you can just barely figure out how to wedge yourself into a house at around $1M where you end up with a mortgage of $4,300.

By 2023, your income has grown to, say, 11,000 per month. Problem is that due to the interest rate hikes the same house you were looking at is now $1.3M and the payment would be like $6K a month.

All the percentages track but you are left behind. Same thing with the price of college, and also health care.

The price of, say, food, can easily track wages on a percentage basis.

But what I think I see is (1) the increase among "things" is not constant, (2) some "things" are really more of a measuring item of how one is doing than others, say, cost of houses v. cost of broccoli, and (3) when something, like a house, increases over the fraction of your income which is comfortably allocated to "housing" then you feel it, and no amount of charting would convince you otherwise.

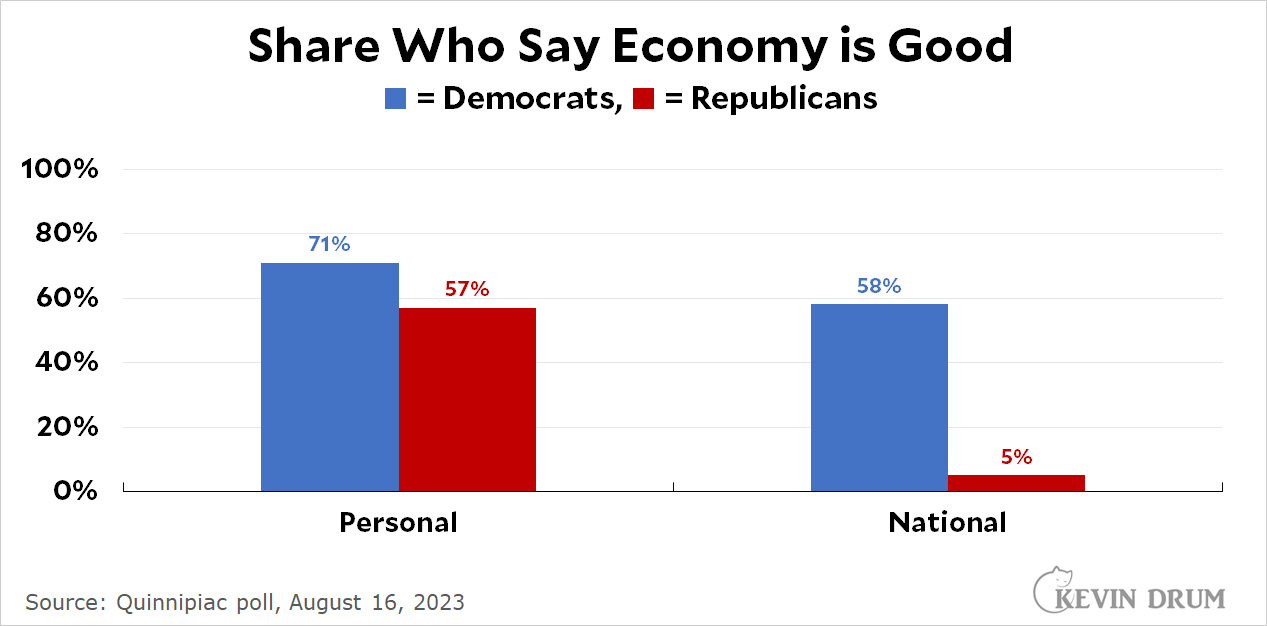

The problem is that people's average perception of the economy is totally out of whack with reality. Current attitudes are as pessimistic as they were at the worst of the Great Recession in 2009, when there appeared to be danger of another Depression. Unemployment had risen to over 10% then and now it is less than 4%. But Trump says unemployment is high and people believe him.

So what has changed since the times when polls about the economy gave more realistic answers? Partisanship has increased hugely and almost half the population now believes in an alternate reality where Biden is causing high inflation, high unemployment, increasing crime, etc. Pointing to aspects of the real economic situation just does not explain what is happening. The current average attitude is not based on reality, and neither is Petrous's piece.

Pre-pandemic the yogurt I buy for breakfast cost me $1, and it now costs me $1.49. My salary didn't go up 50% over that time.

However, I do know that in the 5 years I've been at my current job, my salary is about even with inflation, including the higher rates of the past couple of years. But I'd be hard pressed to tell you exactly how that works out. Gas has bounced up and down a lot. Likewise eggs. Some things like bread and lunch meat not too bad in terms of inflation.

But the yogurt up 50%, that definitely sticks in my mind. I know intellectually that's not the only thing I spend on, but "yogurt up 50%; salary not up 50%" is easy to grasp and is very sticky in mind. I imagine that is just how human nature works.

i think you're right about the the noise level in prices; gas goes up and down so i don't use that as a reference.

but housing prices tend to be sticky, and apparently food prices are somewhat similar.

p&g had an earnings call and said they raised prices by 30% and sales dropped 2%. so there's no incentive for them to ever lower prices; maybe they'll do stuff like issue coupons or limited time offers but that's it.

otoh housing/rent prices can change, but they tend to be very sticky and are set by the most recent sales data which of course represent marginal buyers/sellers.

i think a lot of the most recent sales are driven by cash sales (boomers) that are less influenced by mortgage rates; at some point you would expect cash sales to start falling and then you're left with organic sales driven by younger people who take on mortgages, and prices will have to fall to attract them back into the market. (or sales will be limited to those who change jobs and get big raises so they can afford the higher prices)

we've seen a bit of that over the last 20 years where people don't move to take jobs in another state nearly as much as they use to. (eg., more people are moving to texas than california since housing is cheaper in texas)

but back to your point... you may use yogurt as your touchstone, i may use broccoli, others may use kid's shoes, gasoline, rent, etc

so there are a lot of prices in the marketplace that trigger this feeling that "i'm getting screwed" and since there's a lot of those inflationary prices/gouging in the current environment there's a lot of people feeling disgruntled even though in the aggregate prices and wages may look pretty even

and since kevin focuses on aggregates, he's mystified by the apparent unhappiness which to me seems to be a result of the stratification in the 'lived experiences' of a lot of the citizenry

Try Aldi.

This is yet another post by KD about “so many people unhappy with Joe Biden's economy.” He already answered it two weeks ago. Republicans are gaming the polling. https://jabberwocking.com/economic-gloom-is-all-about-republicans/

Everything else is clickbait and wasting one’s time.

My take is opportunism and greed. I am not a coffee drinker. My dear neighbour gave me a Starbucks card, worth a fortune, for some care I gave her. So, I go by, occasionally and get two shots of decaf and a splash of cream. $2. 01. This week, not 7 days, I was shopping and got the same. It is now $3.00! Hello... Manager tried to explain that is was that they were behind on salaries and the salaries are going up. Choke.... I didn't believe a word but honestly, prices are crazy.

My usual decaf use to ge $8. and now it has jumped to $13. Then this week is was back down. What gives?

Obviously electing more Republicans would solve the inflation problem. We could just crash the economy again and that’ll fix both low unemployment and wages increasing… nothing like a recession to put workers back in their places and crater demand so that the profiteers decide to stop raising prices and settle for slightly lower profits.

America will never be able to have nice things. Anything nice will have downsides for someone, and if there are any downsides at all to anything, the voters jump onto the Republican bandwagon until the Republicans crash it into a ditch and need Democrats to clean everything up again. Rinse and repeat over and over again until Republicans finally abolish elections.

Crash the economy until we have to start over again from scratch, trading rocks for flint knapping. That's the real conservative goal.

Minimum and median wage earners are more aware of the gaping rate of economic inequality in the US, where the top 1% owns 31% of US wealth and the bottom 50% owns 2.5%, than affluent Democratic liberals.

Pingback: Animal Spirits: You Can't Quantify Happiness - The Irrelevant Investor