Is the Fed planning to taper support for the economy too soon? After all, Delta had a bigger effect than they had predicted, and the jobs market is still pretty sluggish. Maybe they should hold off?

Maybe. But much of this concern is based on slow employment growth and the "missing millions" of jobs. Anecdotally, though, workers say no one will hire them and employers say they can't find workers—and no one seems to know what's really going on here. Meanwhile, the headline unemployment rate is a very respectable 4.8%.

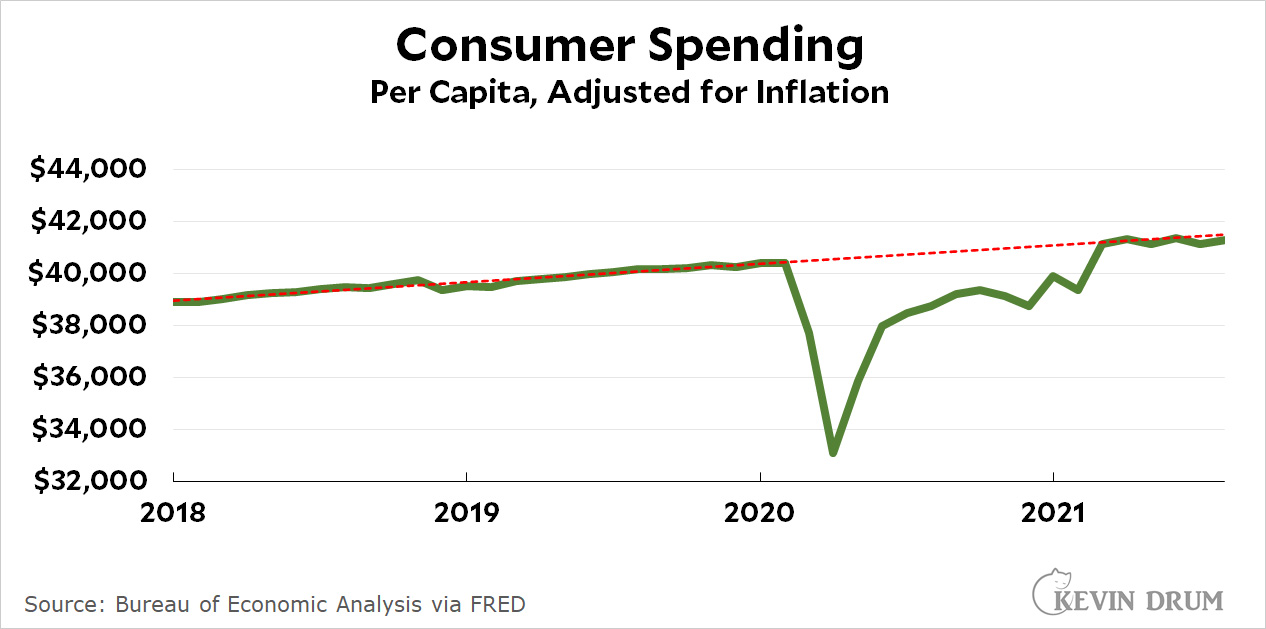

As for me, I keep coming back to simple stuff like this:

As you can see, consumer spending caught up to its old trendline in March and has been precisely where it should be ever since. You'd need a microscope to suss out any kind of weakness relative to trend.

As long as consumer spending keeps rising, it's hard for me to think there's anything badly wrong with the economy. But I could be wrong about this. Maybe spending is being propped up by households that are drawing down their savings, and it will collapse when savings are used up. And there's still the job market weirdness to figure out. And GDP still hasn't quite caught up to potential.

Still, it looks to me like our recovery is close to complete. Not totally, but pretty close.

Anecdotally, though, workers say no one will hire them and employers say they can't find workers—and no one seems to know what's really going on here.

It's because there's this entire mini-industry now devoted to telling employers they should expect to hire only the exact perfect fit for any possible position and accept no others.

What they're looking for is a robot.

Partially agree. I keep hearing how if you don't have _exactly_ the right keywords in your resume you're automatically spam filtered. And while I get filtering out by not enough keywords, what's this about have too many? Or the right ones in a mix of otherwise irrelevant qualifications?

Anybody able to shed some light on this?

Anectdotes are not the plural of data.

Of course as typical there is a confusion between the potential practices of a small set of large corporations and the idea of businesses in general.

Sigh. No, anecdotes are not the plural of data. As you have heard me say several dozens over the course of several years ... and more than once to you. I'm putting this one down to the fact that you know nowhere near as much math/stat as I do (again, established many times over several years.)

I the light of that, I need hardly point out your innumeracy in this latest comment of yours. Poor spiteful thing, you probably don't even see it, even now.

4.8% is still a bit high. We should get it down to 4%.

I wonder if this is a regional thing. The national rate is 4.8%, but here in Utah it is 2.6%.

Pingback: Some good news | Later On

The economy is much weaker than it appears. There was a brief sense of recovery in late spring, but by early summer it was obvious that not enough people were getting vaccinated and that delta was a much more contagious strain. I know we cut back on our travel plans, and I know several other families that have done so. The service businesses have recovered somewhat, but most restaurants are many shifts down from their peak.

Naturally, the Fed will to make sure that the nails are properly hammered into the coffin.

They're down because they won't pay for more service. That's not the same as the economy being down.

Partially agree. I keep hearing how if you don't have _exactly_ the right keywords in your resume you're automatically spam filtered. And while I get filtering out by not enough keywords, what's this about have too many? Or the right ones in a mix of otherwise irrelevant qualifications?

Anybody able to shed some light on this?

Scent-

One of the things that I have learned was that many employers now want resumes submitted either online and/or as a PDF.

It is then scanned through a computer for initial screening which uses and algorithm that seeks out certain key words.

The example I have seen is that 3 matching key words is OK but anything MORE than that throws the resume into a kinda "Call only if desperate type file".

If there are no keywords the resume is shit canned.

About 50% of larger corporations use this method. As for medium and smaller companies they may be contracting out the screening to subcontractors. The key seems to be to get only those resumes from people who are MOST qualified into the hands of the hiring person.

Its like just-in-time for human resources folks

Add 'for the salary offered' to most qualified and that matches my suspicions. As I understand it, a fair amount of these non-core but essential functions are contracted out, everything from housekeeping to payroll.

And yes, to forestall the L's smug gotcha, this is purely anecdotal and seems to apply to mostly younger businesses. That goes for preferred languages too:; Python as opposed to SAS, for example. The bean-counter JIT philosophy will have a lot to answer for some day.

You would expect some catch up spending to make up the spending postponed during the pandemic. An expected full recovery should show consumer spending going well above trendline for a time before settling back down to the trendline. And we have not seen that yet and maybe never will ?

I would think there is some catch up spending going on , but offset by the fact that covid is not yet over and that caution, and continued covid restrictions holding back spending . Plus I would think there was some long term damage too.

So , if covid really does come down now, and restrictions come off, I think we might finally see spending going above the trendline for a while before settling down to below the trendline. Why people think it is expected for the economy to fully rebound from such an economic shock is beyond me.

And would also wonder whether spending is being held back by supply constraints. Many seem to have the belief that consumer spending magically will create the supply simply be existing which is never true but especially not now when the economy has real constraints on how much it can produce to satisfy whatever consumer demand .

Not all spending can be made up later. I saved $$$ during this by not commuting to work, putting on more formal clothes and wearing makeup. I won't be buying more gas,makeup or clothes to make up for what I did not buy in the past year.

But that said I was contemplating buying a new car and some deck furniture. I put off buying the car as I'm not driving much as I'm working from home, my car is in good shape though ten years old and manual transmission, eventually I want an automatic with modern safety features. I never bought the deck furniture because so much of it was on back order or horribly overpriced.

Put it off until you can get electric. Then you can shift your electricity to time of use and charge it cheaply.

It does depend on how long the interventions take to affect the economy.... but starting the tapering now is not ending support now. Announcing tapering of support will cause the stock market to gyrate a bit--until it hits the next pearl clutching moment.

The Fed's support of the economy should end around an un-employment level around 3%, and it would continue to drift down a bit before. It used to be said that 4% unemployment was the value with the normal churn and reflected "full employment", but then we into the 2% level without an issue.

Note, some of the jumps in inflation will stick. Spot shortages will end (ok, the many, many spots), and those price jumps will climb back down. But the increase in ordering online and food and grocery deliveries means they all get a cut of the income of the local businesses, so prices will have to go up.

ONe of the problems facing the FED is that they are trying to fight too many battles simultaneously.

***************THIS IS FROM JANUARY***********

https://www.cnbc.com/2021/02/08/january-jobs-report-covid-19-pushes-millions-from-the-work-force.html

{snip}

Around 406,000 people left the labor force last month, according to the January jobs report issued Friday by the Bureau of Labor Statistics. ********More than 4 million have left since the pandemic started.***********

{snip}

This was PRE - Delta. Even more have left since then How many will have died come January 2022? Will we hit the million mark? That is not just old folks or young folks but consumers, each and every one of them

I do not want to see UI drift below 4% again. With 20 million boomers gone already. With millions leaving the work force earlier than they anticipated and with the potential for an infrastructure plan being passed I am beginning to think that low unemployment will be more harmful than helpful to our economy, And this will put a lot of pressure on wages = but once wages go up, they very seldom come down

And Covid will be hanging around a bit longer....

Looks like the heavily vaccinated Northeast and upper MidWest have cases bumping back up a bit, or at least, a hiccup in the drop in cases. MN, WI, MI and PA seem to be going in the wrong direction now, and VT and NH still have high levels

.

The really hard hit states in this latest wave have seen cases dropping pretty consistently. CA is, for the most part, doing ok now too--though spots are still bad.

Looks like going indoors, summer for the South, winter for the North, helps the virus. And it's still mainly a disease of the un-vaccinated.

Some of the states that are doing better now still have very high hospitalization rates, e.g. AL and TX are at 90-91% ICU usage, a little down from the highs--but still not good.

A little?? They will be down to 75% usage by November. Amazing you don't get lags.

I do understand lags, which is why the crisis is not over when caseloads drop. And even when hospitalizations drop, we need to take care of the hospital workers.

And for those hospitalized? They can be on the hook for $100K if they are in the ICU--even with insurance.

https://www.fox13news.com/news/financial-burden-of-getting-covid-19

I HOPE Kevin is wrong. I noted Justin Wolfers (generally considered a liberal economist)

"Oh dear.

Non-farm payrolls in September rose by only +194k, after +366k last month.

The recovery has stalled.

We're missing about 8 million jobs, and at this rate, we're not bringing them back any time soon."

https://twitter.com/JustinWolfers/status/1446453154975977489?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Etweet

No, your not missing 8 million jobs. That is your error.

Respectfully, my post is a direct quote from Justin Wolfers: he is a U of Michigan professor.

I think consumer spending is being supported by people drawing down their savings -- which is mostly the three rounds of recovery checks.

https://www.statista.com/statistics/246268/personal-savings-rate-in-the-united-states-by-month/

Don't count your chickens before they hatch.

A new wave is coming. Zero-infection policy within net-export countries is going to continue to drag supply. Temporary inflation will remain volatile for the near-future.

If you plan and prep for ongoing/new disruptions, there won't be nearly as much chaos and frustration if they come true. If they do not happen, you're fine.

If you do not plan and prep for ongoing/new disruptions and they occur, Biden and Ds will see catastrophic 2022 midterms.

You need to tamp down your enthusiasm and optimism. Do the cheering *after* the fact, not before.

A new wave is coming, why??? Post with reason and not gibberish.

Endemic respiratory viruses -- Influenza, RSV, other Coronaviruses, etc. -- typically become seasonal, which are essentially long (annualized) waves. SARS-CoV-2 is making its way toward becoming an endemic respiratory virus. The multiple short waves we've experienced from SARS-CoV-2 come from both responsive mitigation (implementation and removal of) and seasonality.

By experience, we already know that SARS-CoV-2 is substantially more easily spread than Influenza. With more jurisdictions removing mask mandates and other mitigation measures, we're set up to experience a seasonal wave of COVID-19 infections and hospitalizations.

Like Influenza, you can get re-infected in the same season. People who carry on as though their infection earlier this year means they're completely protected will be in for a surprise. The people around them who aren't vaccinated will be caught totally off-guard.

In the case of influenza there are very different viruses which cause the malady. Every year's 'flu shots' are a guess as to which will be prevalent. I've twice gotten the flu even after having the shot.

With Covid there's also an issue with the vaccinations not offering 100% protection, but as time goes on the immunity data on people who survived an actual bout of the illness (and do not have weakened immune systems) is looking better and better.

If you do not plan and prep for ongoing/new disruptions and they occur, Biden and Ds will see catastrophic 2022 midterms.

Considering how little the havoc of 2020 affected the success of the Republicans on every level save presidential, I wouldn't be too sure about how the Democrats will do.

And, the not mentioned much wild-card so far might the overturning of Roe v/ Wade; creating a Dred Scott moment.

Besides, elections are irrelevant in the off year in a uninterested public.

The Republicans didn't suffer much because Democrats were interested in helping people, so pushed for throwing money at the problem--even if Donny insisted on signing the checks himself (ok, he ended up sending out a letter instead).

A quick check on the workforce seems to show 4-5 million people not in the workforce as compared with the prepandemic number. That means checks not spent, goods not bought, etc. One needs to look at various charts to come to a reasonable conclusion on the state of the economy so I will not venture to guess whether the recovery is “complete”. I will say that I still see significant disruptions in the current state of affairs.

Your point is dead as basic numbers you whine about, don't tell us about structure or capability.

Consumer spending is the wrong thing to be looking at to really judge recovery. There are strong signs that people still have savings from the stimulus payments, as Kevin says himself. If employment does not recover to the previous trend, then consumer spending will almost certainly fall back. There are still many millions of jobs missing from the 2020 level, let alone the trend before that. That itself tells us that consumer spending may be temporarily inflated.

Of course when savings run out more people will presumably be forced to go back to the old lousy jobs, which would probably put an end to the rise in wages. And if both bills pass with major spending that should also put money into the economy although that would take effect for some time. Things are complicated and it's way too soon to be declaring full recovery.

Will people please stop saying a lot of people aren't working because they received $3,000 from the government over the past year! I can't believe I have to say this, but no one is living off $3,000.

I'll bet a lot of EMPLOYED people saved the money, but normally stimulus checks are spent within a month or two.

I don't know why so many did not go back to work. If I had to guess I'd say it was because many are afraid of covid and a huge number can't get childcare. But it is not because they got $2,000 over 6 months ago. It is not the 1950s!

The government data on savings, which Kevin has shown more than once, prove that not everybody spent the money instantly. People spend an enormous amount on restaurants and entertainment outside the home and that was cut off, although partly made up with on-line buying. But certainly covid is a factor, especially when workers are exposed to non-vaccinated people. And another wave is not impossible.

Also many unemployed people were actually getting more than they made when employed.

I'm aware of all that, and it doesn't hurt to say it, but I'd still say it is no longer relevant. If you compare the number of people currently working to the group that people think should be working, we are talking about 30:1 or so. So if you look at Kevin's savings charts, it is safe to say that most of the increase in savings is among people that are employed.

Among the middle class and up, $2,000 6 months ago isn't a big factor in their finances. And among the working class they probably used up the $2,000 by now. I could be wrong, but it has just been too long since the payments to matter to almost everyone today.

Again, an appropriate past tense: "were getting". That's no longer true.

"Was cut off" is the operative phrase: The lockdowns are long over with and people are going out again. Well, no, not everyone: some people are still staying home in dread of Covid-- but not because nothing is open. we're way past that.

Yes all Aislewalkers, let the money flow through you and soon the recovery will be complete …

Congrats! Perfect timing: You come up with the message that "the economy is fully recovered" at the exact point in time when supply chain problems get visible in every grocery store as well as gas prices.

Great work!