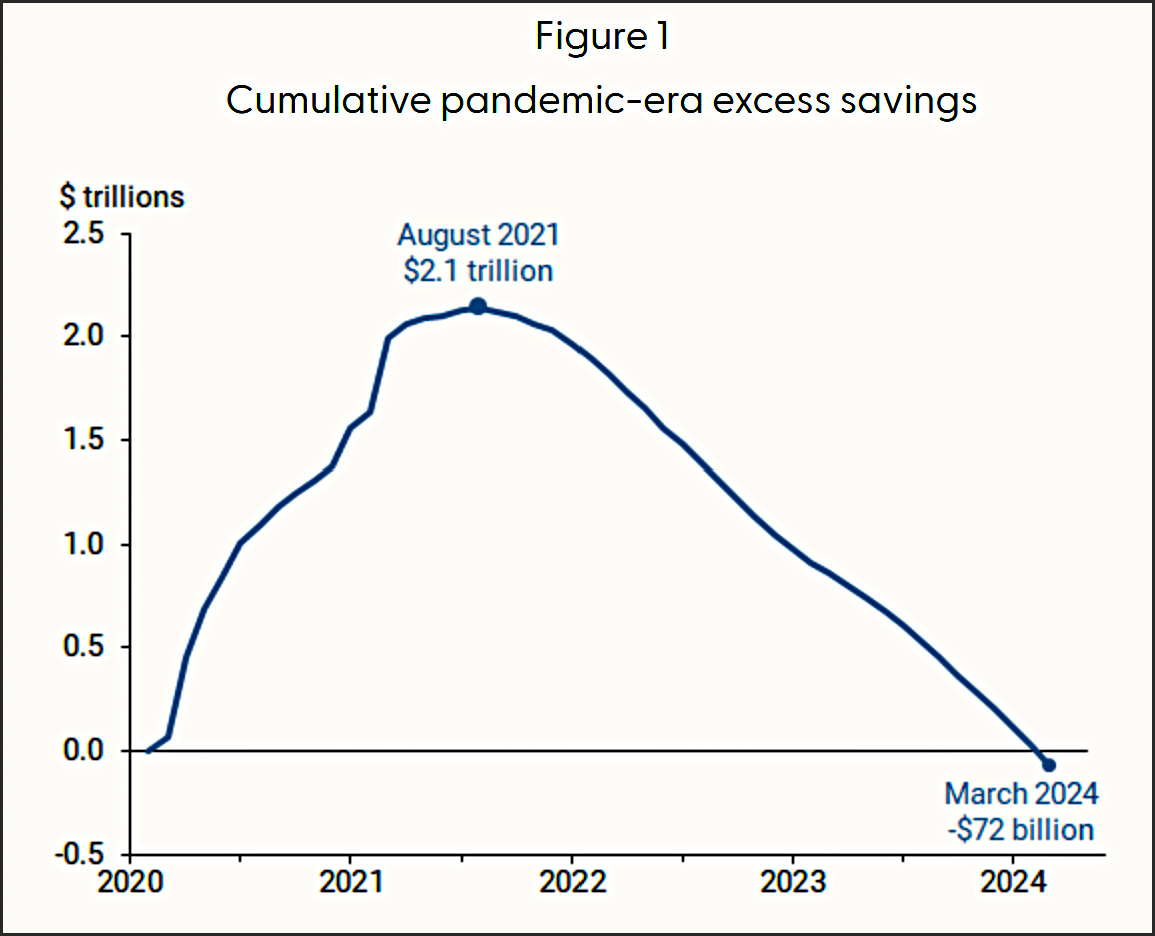

Hamza Abdelrahman and Luiz Edgard Oliveira, the gurus of savings levels, report that excess pandemic savings are finally gone:

I'm not sure how much real-world difference this makes, since excess savings have been nearly zero for awhile outside of the affluent, but it's still a milestone. From this point on, the economy is on its own.

I'm not sure how much real-world difference this makes, since excess savings have been nearly zero for awhile outside of the affluent, but it's still a milestone. From this point on, the economy is on its own.

don't worry, we can all get rich buying and selling djt stock to each other

On margin…

Hopefully we avoid a recession/fascist dictatorship.

It's important to point out that spending down these subsidies did not mean pushing out aggregate demand. That's what Republicans have been claiming this whole time: that millions of Americans pissing away their pandemic checks on hookers and blow is what gave us all the inflation, and that's simply not the case. It was basically keeping things even at most given the massive contraction of esp. the services sector.

Also, I'm not sure if "aggregeate savings" = pandemic $$ in any case. People could have also been saving money other ways, e.g. by working remote and not having to pay for gas and childcare for several years. I suspect most (non-affluent) people used up their pandemic checks a long time ago just paying rent and basic expenses.

Considering that every single country in the OECD has also experienced similar or higher levels of inflation, but never received any pandemic checks from the US Treasury, it seems highly likely that inflation is being caused by other factors, e.g. global supply chain snafus.

However, that explanation is boring and unsexy, and lacks any blame for Democrats. So obviously it cannot be true, and even if it is true, it will not get any media traction. Look over there, another shiny object/squirrel/Hunter Biden's penis.

Also as a sidebar: checks were sent out by Trump and Republicans too. I love how they skate by though, unblemished by their own role in (supposedly) creating all this inflation by mailing out multiple rounds of checks to the lazy people who spent it all on hookers and blow.

You make it sound like the US were the only country providing stimulus: https://www.investopedia.com/government-stimulus-and-relief-efforts-to-fight-the-covid-19-crisis-5113980 …

We need a scatter plot of net* stimulus as a percentage of GDP vs. inflation to date for OECD countries.

*net after lost income due to business closures and lost/reduced working hours due to pandemic amelioration measures. ‘Stimulus’ that merely replaces lost business or personal income is a wash.

"...excess pandemic savings are finally gone:"

I think this is misleading. The original recipient of COVID stimulus and or the other forms of excess savings, are gone. However, where did that money go? It went to merchants, service providers, for the purchase of equities etc.

Based on the concept of velocity of money, those excess funds will be spent MANY times over....

https://www.investopedia.com/terms/v/velocity.asp#:~:text=Key%20Takeaways-,Velocity%20of%20money%20is%20a%20measurement%20of%20the%20rate%20at,and%20services%20in%20an%20economy.

Republicans prove yet again how many people they're willing to vicariously kill because they hate their neighbors,

Congress voted against funding a cure for cancer just to block a win for Biden,

https://www.usatoday.com/story/opinion/voices/2024/05/05/biden-cancer-moonshot-initiative-congress-funding/73525016007/

Goddamn godless liberals. If they just placed all their faith in God when they get sick, they wouldn't need to blow all my tax dollars on curing cancer.

Aggregate savings calculations/ estimates are very difficult to put much faith in. The authors of the linked analysis highlight the potential inaccuracy of the data.

For the official calculations of disposible income and savings rates, capital gains are not treated as income while capital gain taxes are treated as a reduction in income....so any time we see large increases in capital gains without a cap gains tax increase (like 2021 and 2022), income and savings are severely undercalculated.

The authors may have corrected for this, but most analyses do not attempt to correct for this.

The savings rate isnt always a very useful statistic as it doesnt always give a good picture of what we typically think of as savings. I sold two houses over the last few years and while I ended up with a bunch of money that I would think of as savings, these calculations would show that my savings rate declined dramatically.