The Wall Street Journal reports that consumers are fed up with rising food prices:

Now, some consumers are hitting their limits. Restaurant chains and some food manufacturers are reporting sliding sales or slowing growth that they attribute to consumers’ inability—or refusal—to pay prices that are in some cases a third higher than prepandemic times.

....U.S. fast-food traffic declined 3.5% in the first three months of this year compared with the same period in 2023, according to market-research firm Revenue Management Solutions. U.S. grocery sales of food and beverages fell 2% by volume for the 52 weeks ended April 20 compared with the year-ago period, according to NielsenIQ.

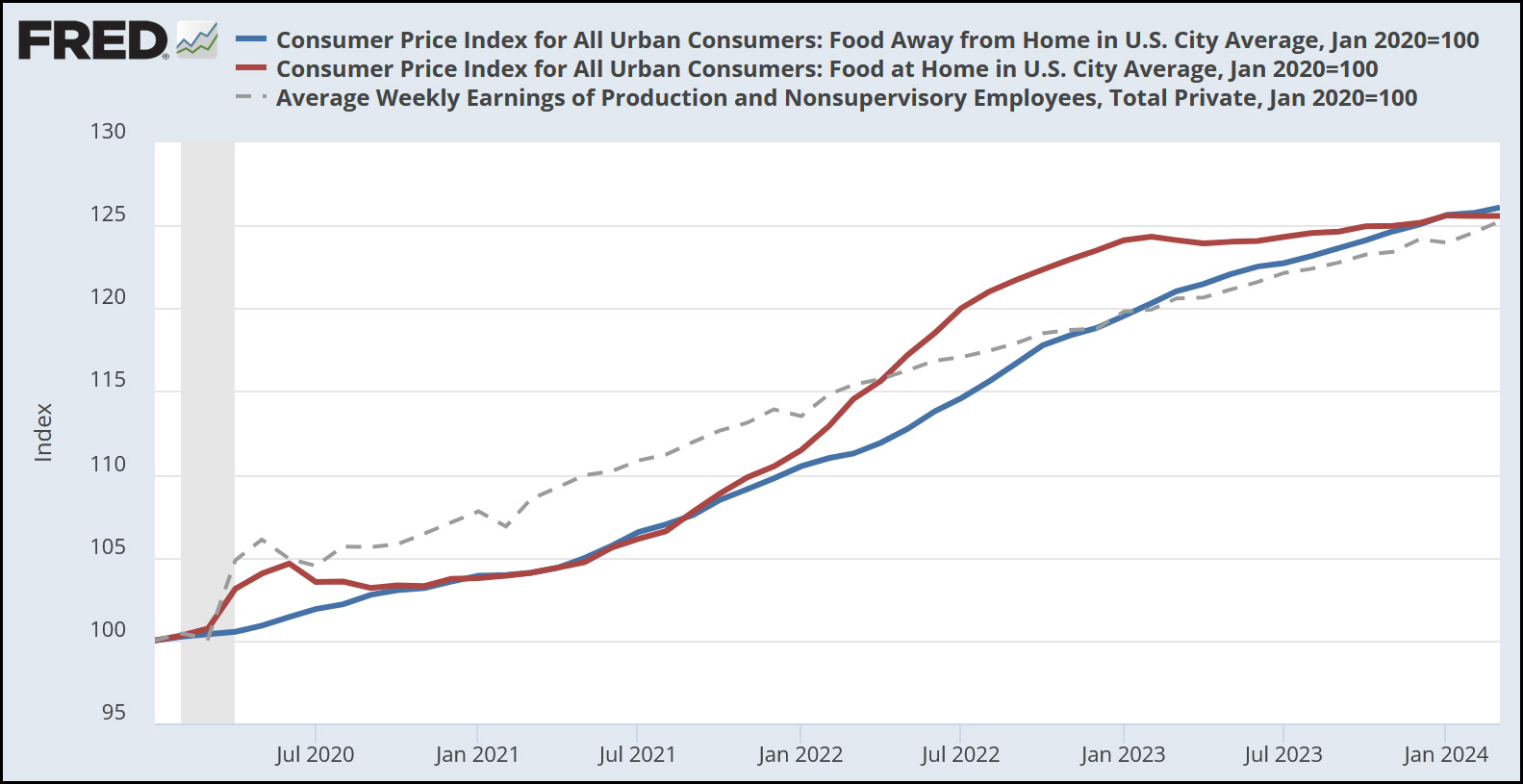

This might be true—but only for food suppliers who greedily pushed prices up well beyond the pace of inflation. Here's the overall story:

Since the start of the pandemic, food prices have kept pace with blue-collar wage growth almost perfectly. Both groceries and restaurant food have grown about half a percent more than wages.

Since the start of the pandemic, food prices have kept pace with blue-collar wage growth almost perfectly. Both groceries and restaurant food have grown about half a percent more than wages.

So there's nothing special to be ticked off about except in the case of multinational chains and food companies that decided to test the limits of consumer patience by raising prices until they finally got pushback. Well guess what? If that's your strategy, then eventually you're going to get pushback. Duh. That was the whole point.

In any case, the food giants who followed this strategy apparently have no plans to do the obvious thing and just lower prices a bit. Instead they intend to continue trying to trick customers into paying more for less:

McDonald’s and Starbucks plan to launch more promotions and communicate them more clearly to consumers.... Van de Put said Mondelez will introduce new, smaller multipacks for Clif Bar, for example, with 10 energy bars instead of 12 inside, to offer the bars at a lower price. Kellanova CEO Steve Cahillane said the company is offering more deals and adjusting their timing throughout the month, promoting large pack sizes at the beginning of the month, when consumers have the most cash on hand, and smaller ones toward the end of the month.

Good luck with that.

It's remarkable how grouchy people can be when the price of their Oreos, Big Mac, and Grande Latte shoot up. It's like they can't inherently figure out the whole price substitution thing.

I guess the free market libertarian economist is right: people are rational consumers. /s

With consolidation, all those choices are controlled by a few companies. Options are further limited with the larger companies buying up store shelf space.

Not sure when I last saw Hyrdox cookies available....ahh via Wikipedia, it was stopped being made in 1999, then revived in 2015 by Leaf Brands. Leaf Brands made candies, e.g. Whoppers, but sold that off to Hershey in 1996. It was revived in 2011 and makes other candies and Hydrox cookies....

Isn't that just plain capitalism?

Sounds to me like a dog-barks-at-a-potsman kind of news.

If "screw thy customer" is just plain capitalism, then "hate thy neighbor" is just plain Christianity, and "I'm right, you're wrong, and this conversation is over" is just plain science.

Real capitalism works because it's based on Adam Smith's Theory of Moral Sentiments. Absent morality, what would otherwise be capitalism colipases like a house of cards.

Question: What is morality?

Answer: Love your neighbor as yourself, aka do unto others as you would have others do unto you, aka be as skeptical and openminded about your conclusion as you are about your neighbor's conflicting conclusion, aka stop thinking some people are more worthy and other people are less worthy.

I'm repeating myself while counting how many times a person can turn their head and pretend that they just didn't see.

my personal version of hedonic adjustment involves nutritious home-made food like rice, beans, chicken, vegetables, etc and applying the savings to top-shelf alcohol

i'll take springbank or whistlepig over a clif bar any day

oh yeh

Buffalo Trace or for higher octane maybe Makers Mark 46 for me...........

maybe 15 years ago i picked up a bottle of pappy van winkle 20 for $120; still have half left since i know i'll never buy another

apparently you can sell the empty pappy's bottle for 120 bucks; unscrupulous bars will buy the empties and screw their customers by refilling it with cheaper booze (not selling mine because of that)

sadly finished my william larue weller cask strength; that's also selling for ridiculous prices so i'll never see that one again either

OMG, I looked up pappy van winkle 20 - $3299.00. Crazy.

I can remember way back when, when Springbank was the stealth Laphroaig for people who didn't want to pay Laphroaig prices. Somebody caught on to it and it's premium now, alas.

Everything is being optimized at this point for the customers with the most money and willingness to spend it. I think we'll see this progress much, much further as AI gets smarter and bean counters can narrow down exactly how many customers they need, paying XX price, to hit the profit margins they expect.

If you can't afford it, they don't want you as a customer. It's pretty simple and you can extrapolate it out across nearly everything from housing to Big Macs.

People have gotten use to being able to consume at levels their grandparents would have boggled at and now we all expect it. But profit is where it's at and the modern tools available to business will result in a lot of people having to cut consumption as business optimizes, which is not necessarily a bad thing but they'll just keep blaming on on Biden, Newsom, and liberal policies in general.

In many cases a cheaper provider will step in to serve the need with massively downgraded products. Fast food is a luxury for the time constrained and is being priced accordingly.

Everything is being optimized at this point for the customers with the most money and willingness to spend it

yup; the automotive c-suite is laser-focused on the top third while everyone else drives over-priced hand-me-down beaters

same with the drug industry; the median income american isn't the target demographic for all those expensive biologics you see during sports broadcasts

the mirror image to this is the voting public where the top .0001% desperately needs a good chunk of the bottom 50% while refusing to spend any money on them

kulturkampf and xenophobia allow them to square that circle

Pricing is an art, essential to the continuing operations of the firm.

Price too low and you will be out-grown by your competition. Your company will vanish, as most companies do.

Price too high and you will lose market share, although you might make up for it in overall profits, through the higher individual rates.

The best approach, if you have a large number of customers who are repeat-buying over a long period of time, is to maintain stable prices in most markets, but to test the price point by raising prices in limited markets. You may then decide that the market will support your operations at the higher price, or you might decide to temporarily revert to the former price structure. But if you are able to do this in a time- or geography-limited market, you won't alienate most of your customers, and most of the customers who get pissed off by higher prices have short memories.

Of course, if you are selling the Brooklyn Bridge, none of this applies.

(I'm an ENTJ, if that isn't obvious.)

It depends on what your success metrics are - market share might be outdated in our era of private equity dominance. If you can make the same profit selling 750,000 hamburgers at $8.50 as you can from a million hamburgers at $7.00 then market share is irrelevant because you're making the same profit and can cut staff, along with reducing supply chain pressure.

Your best customers are probably going to keep buying your product because they know it vs the cheapo burger joint that might be gone tomorrow and not there when you're running late and need a quick meal. Fast food joints aren't in the restaurant business, they're in the convenience business and they know it.

"It depends on what your success metrics are - market share might be outdated in our era of private equity dominance."

Ultimately, you have to make a profit.

ENTJs have only one metric for success: that is, that their companies be profitable next year. Exactly how that happens is mostly irrelevant to them, which is why so many ENTJs are considered to be dangerous (to society) assholes.

"If you can make the same profit selling 750,000 hamburgers at $8.50 as you can from a million hamburgers at $7.00 then market share is irrelevant because you're making the same profit and can cut staff, along with reducing supply chain pressure. "

There may be good reasons for going with "a larger sales volume at a lower price" than the easier approach of "high prices and low sales volume", even if both approaches yield the same profits.

Generally, all other things being equal, having more customers is safer in the long run because it smooths out the statistical variations in cash flow. In small operations, even very profitable ones, those normal variations can cause your little airplane to hit the tree tops.

"Ultimately, you have to make a profit."

Ultimately, you have to serve the economic system profitably, which is how everyone wins, and not profit by serving yourself at the system's expense, which is how everyone, including you, ultimately loses.

The ability to raise prices and make them stick is a strong function of market consolidation. The more competitors in a given market, the harder it is to raise prices and not lose so much market share that your overall profit decreases. I'd bet that if you look at which companies have raised prices the most, you'll find that those are the least competitive markets.

i've always been kinda curious about what keeps a lid on isp pricing

is there some level where people start agitating with the local franchise board if it goes too high?

or is it just pushback from the board itself if prices get out of control?

I believe that the ISPs collude with each other to set prices, and if there is a local board which governs their pricing, that board is in collusion with the ISPs.

Nothing else explains the price levels that we see, in my opinion.

Everyone and their brother wants to get $70/month from everyone else, every month, forever.

+1

Time to start breaking up companies to force competition...

Fogey/Foodie Rant: I continue to be surprised at how much people are willing to pay for substandard fast food and lousy convenience food, but I chalk it up to a lack of knowledge. If people knew how to cook some simple stuff well, perhaps they would find it more rewarding than eating crappy take out and fast food in chains 3-4 times a week. It is so damned easy now to cook a decent meal in 30 minutes and clean it up in 20: microwaves, toaster-oven/air fryer combos, instant pots, dishwashers. Yet very often we don't.

We live in a time compressed world today and it's because of the excessive amount of time we invest in the digital world. Checking social feeds, responding to blog posts, gaming, checking email.... All that attention is what we use to have free for cooking, hobbies, relationships. Food has entered the realm of convenience for most people, how fast can I grab something and get back to whatever. Covid made many of us cooks and bakers again, but that fad passed once everything opened up and we all had stuff to do.

Microwaves at least became very popular well before the digital world. “TV” dinners even earlier. In other words, the rush started some time ago.

Most people are making rational decisions about their meals.

When I was worse than broke, at impossible debt levels with no prospects for earning money, I shopped for food bargains and I never, ever ate out.

When I was earning more per hour than it cost me to buy and prepare food for myself, I started eating all my meals out.

Plus, I'm a lousy cook.

The consumer sentiment in 2021 they were willing to pay any price for whatever goods or services they desired allowed corporations to raise prices. The excess profits earned became a standard CEO's have to meet or exceed to meet investors expectations, making price elasticity relative to demand a quaint ideological concept.

One side effect of rising prices and general enshittification at the big stores is that I spend more at local stores and farmers markets. I used to get fruit at Whole Foods, for instance, because the better quality was worth the price. After Bezos bought WF, the quality dropped to where it's no longer worth it. And now the supermarket prices have risen to the point that, in season, I get fruit for only a little more at the farmers market.

These folks must think we just crawled out from under a rock. I have made a point to stop purchasing the products that have been downsized for the high price. We aren't fools yet....