Check this out:

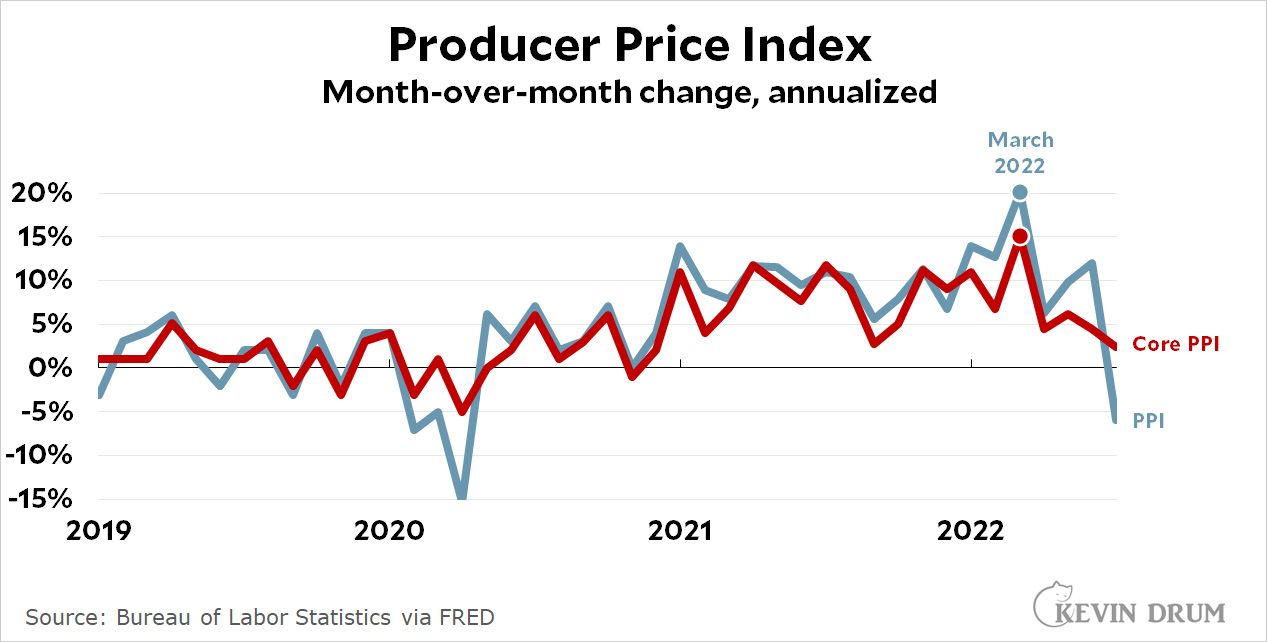

The Producer Price Index clocked in at -6% from June to July on an annualized basis. Core PPI remained positive, but declined to 2.3%. As with other inflation indexes, they both peaked in March and have been easing off ever since.

The Producer Price Index clocked in at -6% from June to July on an annualized basis. Core PPI remained positive, but declined to 2.3%. As with other inflation indexes, they both peaked in March and have been easing off ever since.

The biggest price increases were in eggs, beef, and construction. The biggest declines were in energy and grains. More generally, the decline in PPI was nearly all for goods, with PPI for services flat for the month.

PPI is generally considered a leading indicator for CPI. If this remains the case—and who really knows these days?—it's yet more evidence that inflation peaked in the first quarter of the year and has been slowly subsiding ever since.

If we are supposed to focus on the core for consumer, ignoring the volatiles just as energy, does the same not hold for producer?

s/just/such …

Yes.

Fine but note that 1) it’s on a three-month downward trend, and 2) it’s a stupid annualized figure, which assumes against evidence that we somehow know that all of the possible causes of changes in price indices, change more slowly than annually.

Looks like the business-industrial complex miscalculated their attempt to bloody joebiden going into the midterm.

& then Scammin' Sam Alito stepped up to the plate to ensure strong Democrat base turnout to pair with weakened opposition vote (wrong track mind types).

Will be funny when Dems hold House with 220 or 221 seats, & get 52 Senators (all incumbents hold, pick up FL & NC). (I want Mandela to win, but knowing what Ronny J did twice to ( ( ( Feingold ) ) ), I am not hopeful. Am more prepared to say Tony Evers gets reelected Gov, though. With a Lt. Gov. named Rodriguez. (First, a Mandela, then, a Messican. Wisconsin is changing, hard as it is to believe (especially considering it was only thirty years ago that Brad Debraska, truly a creature of the swamps, got Milwaukee's Messican police chief defenestrated for having the gall to fire the two cops who turned over a 14 year old Lao boy to Jeff Dahmer, then laughed in the face of the Black woman who called the police to report the suspicious incident described by her niece & niece's friend).)

You’ve got it wrong. The ever-vigilante… commentariat’s discovery and outing of that plot is wot did it in…

Florida???? Not a chance.

Barring another stroke (or worse), Fetterman is close to a lock to flip an R Senate seat in Pennsylvania to D.

BUT HIS MEDICAL CHARTS!!!

(The reprise if her emails, from the team that very much understands HIPPO Law.)

I’m hoping Mandela Barnes takes Charlie Pierce’s advice here: https://www.esquire.com/news-politics/politics/a22063027/republican-senators-russia-4th-of-july/

Russia is not well-regarded these days. Even the Cult of TFG must be having doubts.

Well based upon recent polling the most likely Dem pick ups are in Penn and Ohio.

Wisconsin, Florida, and NC. all seem possible. Kelly is looking increasingly safe in Arizona. Nevada is always close but the Dems should hold it. So 2-5 pickups seem possible. I'll go with 3.

Dems have a very strong chance of increasing their Senate margins by a point or two. The math looks remorselessly grim when it comes to the Senate, though (I'm hearing an eight point popular vote House margin is needed, so brazen and effective is GOP gerrymandering; and such a number looks frankly unattainable).

Still, here's to hoping!

um, by a "seat" or two..

Yep. Team Transitory was proved fucking right.

Now, I can't say for certain the Fed saw this overshoot and went for it anyway knowing it would probably cause a recession. And I definitely can't prove it was to damage (D) prospects.

But I did just win a $100 bet by predicting exactly this back in April. If you've watched the reruns, you know how the show ends.

My favorite economist is Paul Krugman, for several reasons:

(1) He is very smart.

(2) In spite of number 1, he (as all economists do) makes mistakes in judgment and/or analysis from time to time.

(3) In spite of number 2, he (unlike most economists) is unafraid to recalibrate and/or recalculate in the face of new evidence and is unafraid to quickly make that known in public.

It looks to me like this time his misjudgment was minimal. It looks like he underestimated how long it would take to correct, but the miss was measured in months, not years.

I don't have any issue with Krugman. I agree with you about all his listed virtues.

My irritation is focused on the "moderates" who squeal whenever incomes start rising, Larry Summers, and whatever brainiac convinced people that keeping Powell in place was a good idea.

But I’m sure they “viewed with concern” for forty long years while real incomes of working people mostly stagnated even as productivity rose. Thoughts and prayers ….

The Fed means less than in The past. Out sourcing mortgage lending to nonbanks is a story that the media is missing.

Time will tell, but my read on the data does not lead me to believe that inflation will be less than 4% annually (double the Fed goal) a year from today. As an aside, the Fed seems to agree with the aforementioned.

Cleveland Fed 1-year inflation expectation: 3.3% (https://fred.stlouisfed.org/graph/?g=SI3b)

If the broader Fed believes our one year inflation is likely 3.3% then they will have no need to raise rates again. My money is on higher Fed Funds rate...

Well that's not true.

If the market's expectation is elevated above the Fed target, it will still feel inclined to raise rates. As you can see in their expected inflation term structure -- https://bityl.co/DmJn -- the long term projection is still above 2%.

So long as the economy can accommodate higher central rates, the more likely the Fed will raise them until the long term projection is at 2%.

Point is, one year from now inflation will still be elevated but the market is signaling something closer to 3%, not 4% you're pointing to.

D_Ohrk_E1 - fair point/agreed "If the market's expectation is elevated above the Fed target, it will still feel inclined to raise rates."

Let me rephrase - even IF the Fed continues to raise rates, I would be surprised in annual inflation is 3.3% twelve months from today. We will see...

they will have no need to raise rates again. My money is on higher Fed Funds rate...

Zero question they're not finished raising rates. And rightly so. A single month does not a trend make. Nor are they likely to be quick on the trigger in terms of cutting rates when the eventual slowdown materializes (for similar reasons). I do think there's reason to hope, though, they may largely be done tightening by year's end, or very early in 2023.

Hmm, still need a deep recession just to be sure.

No. They don't need a "deep recession." But by all accounts they do need rising unumployment or (at minimum) a sustained period of time when the job openings/job seekers ratio is lower than it is now. Employers won't be able to hold the line of price increases when they're doling out big(gish) wage increases.

The Fed is not abandoning its restrictive stance absent 5-6 months of verifiable data indicating the economy has definitiveley cooled.

That was what is colloquially called a "joke" using the scientific principal of sarcasm.

It's a good thing that the Fed acted quickly to raise rates and prevent those uppity chickens from getting wage raises.

Raise rates to what??? Normal???

Mortgage rates have been dropping for 2 months: https://fred.stlouisfed.org/graph/?g=SI4A

I would expect a leading indicator to lead or indicate more than this one does.

Higher prices are sticky....

CNN has an article about how streaming wars have ended. Companies are/have been losing money and are now raising prices. Investors want returns now, not more subscribers.

As for groceries, some prices may fall a little--but the grocer has to deal with paying for "free" or nominal cost deliveries now and higher processing fees for credit cards. Those step up in baseline costs aren't going anywhere.

In other words, prices will fall slowly and settle at a higher level than before (even accounting for trends).

People will be relieved it's not getting worse, yet still upset that prices are higher than last year....

Eh, nope.

Some are, some aren’t. Egg prices that rise sharply with the spread of bird flu drop again when the disease is brought under control. Lumber prices have doubled (or more) three times in the last three years, then fallen by half or more. Look at the 5-year chart: https://tradingeconomics.com/commodity/lumber

Prices are dropping off their highs, and it looks like they're landing well above pre pandemic levels.

Prices are made by the basket of goods people. They don't reflect reality. They never have. Trying to say "prices are sticky" is misleading .

In Sydney eggs produced by your chickens in your backyard can have up to 40x as much lead in them as eggs from the store,

https://theconversation.com/backyard-hens-eggs-contain-40-times-more-lead-on-average-than-shop-eggs-research-finds-187442

This is clearly the result of the 2018 Trumpblicans tax cut.

By jvoe that must be correct.