Big companies just can't help themselves:

Some of the largest consumer brands in the country have continued to raise prices aggressively this year while raking in large profits, posing a tough problem for the Federal Reserve as it aims to tame inflation.

Coca-Cola, PepsiCo and Unilever have each reported raising prices significantly in the second quarter, from about 8 percent at Unilever to 15 percent at Pepsi.

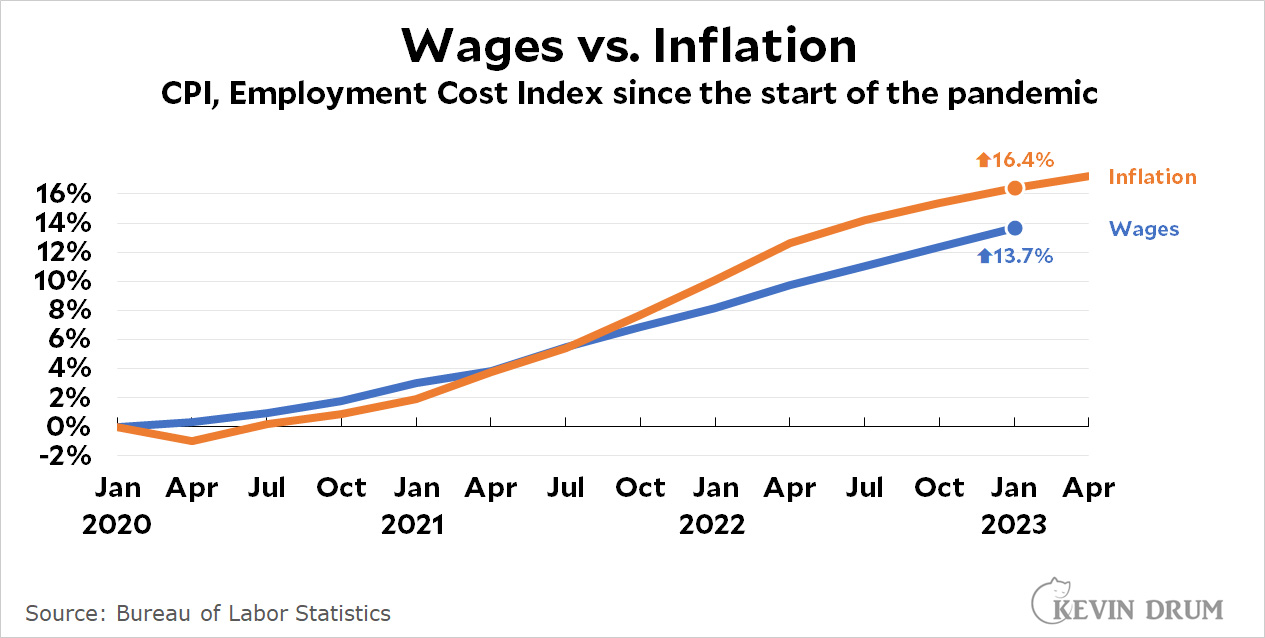

Meanwhile, wages continue to grow at a slower pace than inflation.

Am I missing it or is there a way to contribute $$ to Mr Drums efforts? I don't see a pay option.

Real on the web home based work to make more than $14k. Last month I made $15738 from this home job. Very simple and easy to do and procuring from this are just awesome. For more detail visit the given interface.. http://incomebyus.blogspot.com

By how much did those companies raise prices the several years before? Without knowing that, we don't know if they were "saving-up" price increases.

Have their profit margins increased?

Yes, they've skyrocketed: https://fred.stlouisfed.org/series/A466RD3Q052SBEA

I’ve been hearing about this for a few months. I wonder if the Fed knows this? My guess they do know this but they have just one tool to fight inflation so they intend to keep pushing the rate increase button until a recession eventually causes prices to come down. Workers wages are just collateral damage, but they can’t publicly say that.

Since February wages have gone up faster than inflation. That should be in your chart.

As a matter of fact if the Fed succeeds in its objective of causing a recession (and it has almost always succeeded in the past) it is likely to affect profits more than wages. Wages are sticky downward. They are also sticky upward in most cases of inflation, a fact which the Fed - and most economists - basically ignore.

This might be true, but only because we stop counting when someones wages fall to zero? Thats a pretty important distinction.

“wages continue to grow at a slower pace than inflation.”

False.

What this chart shows is “cumulative wage growth since January 2020 continues to be lower than cumulative price increases over the same period,” and that’s true and important. But recently, wages have been growing faster than prices. This is a good development! We should celebrate this instead of misleading our audiences about it. There is more work to be done, but we’re headed in the right direction!

Can we please just stop calling it inflation already? Or at least stop adjusting everything for inflation when we're talking about time series that don't go back more than 10+ years?

Because it's pretty damn clear that "inflation" isn't really inflation so much as just price increases.

https://fred.stlouisfed.org/series/A466RD3Q052SBEA

https://fred.stlouisfed.org/series/CP