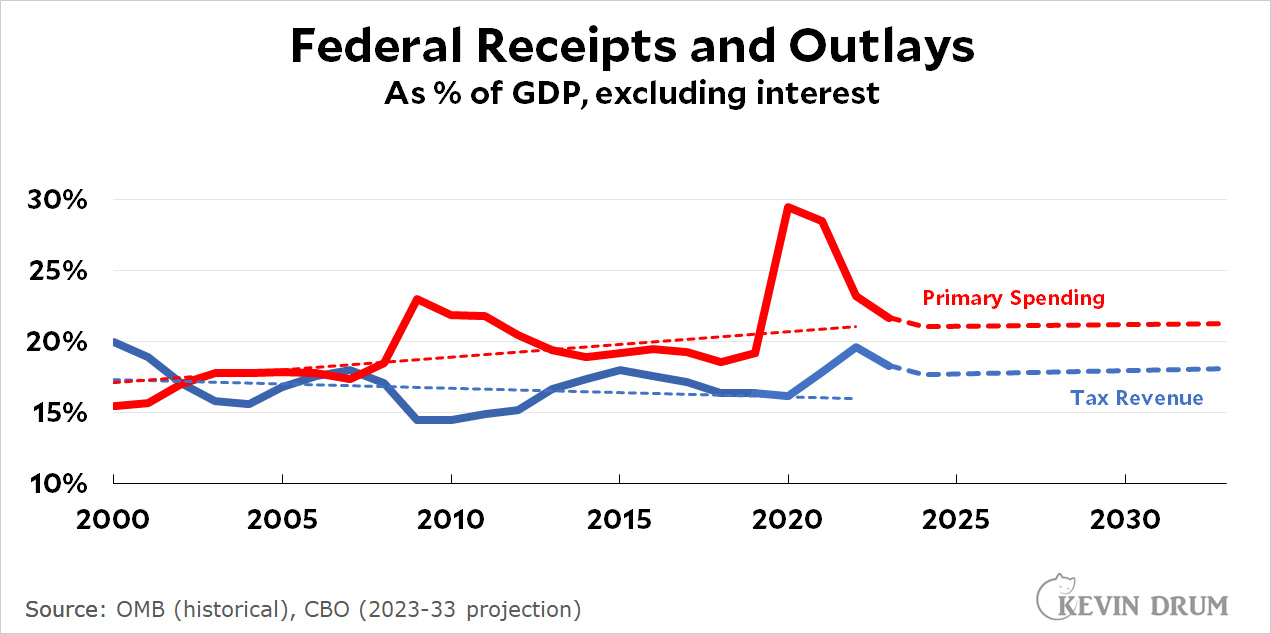

No special reason for posting this. I just felt like it. It shows primary federal spending (i.e., not including interest) and revenue since 2000:

In the early 2000s spending and revenue were in sync. Then, thanks partly to a mild recession and partly to George Bush's tax cuts, revenue fell. The same thing happened again in 2005, and the opposite happened in 2013 (revenue went up partly due to Obama's tax increase and partly due to economic expansion). Revenue has varied since then based on economic conditions, but has generally fallen as a result of further Republican tax cuts—although CBO is optimistic that revenue will stay flat over the next decade.

In the early 2000s spending and revenue were in sync. Then, thanks partly to a mild recession and partly to George Bush's tax cuts, revenue fell. The same thing happened again in 2005, and the opposite happened in 2013 (revenue went up partly due to Obama's tax increase and partly due to economic expansion). Revenue has varied since then based on economic conditions, but has generally fallen as a result of further Republican tax cuts—although CBO is optimistic that revenue will stay flat over the next decade.

Spending, conversely, has gone up, due almost solely to demographically-driven increases in Social Security and Medicare.

The Congressional Budget Office projects that spending and revenue will be out of sync by 3.4% of GDP in 2033. So that leaves us with two choices if we want to close the primary deficit:

- Cut Social Security, Medicare, and Medicaid by a quarter.

- Raise taxes by 18%.

That's it. Either of these would close the primary deficit and automatically take care of rising interest expenses at the same time.

Don't bother talking about welfare or defense spending or any of that. Plausible cuts in those programs would have only a tiny effect. You either raise taxes or you cut Social Security and Medicare. Period.

Raise federal income taxes back to 1972 levels (hell, I'd go back to 1958), raise the maximum payroll tax income level without changing the income level for determining benefits.

Problem solved.

👍👍👍👍👍

Earn as much as possible (Salary depends on the amount of work done. Easy to apply. In this remote work from home position, ww you will be responsible for managing social media platforms, handling requests, providing Feedback and messages to customers responsible),

For use. …. https://possiblework37.blogspot.com

Uncapp FICA, too.

Completely eliminating the deficit is a bad idea. Investors (individual and institutional) want to put some of their assets into extremely secure investments, of which Treasury bonds are the most desired. Government spending on infrastructure, research, education, health, and more pays off over generations, it isn’t inappropriate to borrow for those purposes. (We’re still notionally paying off Hoover Dam and TVA, and they are still making electricity for us. Got a problem with that?). By the way, the growth in productivity resulting from those expenditures leads to increased revenue even at constant rates of taxation.

So 18% is too much, but we should raise corporate rates to OECD-comparable, and increase the progressivity of the personal income tax. And we should restore a proper bargaining position to labor. If wages had kept pace with productivity growth, as in the postwar period up to Reagan, Social Security would be solvent for the foreseeable future.

+1. Nicely explained.

Nitpicking: Hoover dam's bonds were fully paid off in 1987

https://www.latimes.com/archives/la-xpm-1987-05-31-mn-9239-story.html

Still a good example of a debt-supported investment that delivered far more than it cost. KenSchulz's point stands.

Thanks, didn’t know there was a special issue for Hoover Dam. Since the U.S. has carried debt since 1837, general-issue Treasury Bonds are rolled over, and Federal debt is never actually ‘paid off’.

Individual bonds get repaid, but the debt, which is fungible, rolls on. Will the national debt ever be paid off? Highly unlikely. It will be rolled over indefinitely until one day hopefully far in the future it becomes, like the unresolved public debts of the Hittite and Assyrian and many other empires, irrelevant.

Don't fetishize a balanced budget, but it's nonsensical to say that we need to run a deficit so that there are risk free Treasury bonds to invest in. What's relevant there is the cumulative debt, not the current year deficit. We are in no danger of reducing the former to the point that there won't be Treasuries to buy.

There is a secondary market, of course, but there is always a demand for newly-issued Treasuries. Does the latter have distinct value as a price-discovery mechanism?

A balanced budget seems to me like an expression of pessimism.

Yeah, the line in this article that broght me up short was " if we want to close the primary deficit."

Big if. (I know it's popular with the right and the center as a mechanism for cutting social spending but I can see no reason for anyone else to want to do this.)

Mostly fix it by increasing revenues, impose some cuts (cost controls, if that goes down better) on Social Security and Medicare, but you don't need the primary deficit to come down to zero. Get it under 1 percent. If the debt doesn't grow faster than the economy, long term, that's enough.

Yes.

Social Security has *nothing* to do with the deficit. It is funded separately. Anyone who invoke "cuts" to SS in the name of addressing the deficit doesn't understand SS or the deficit.

No, SS income and distributions are included in the "unified" budget which is what the media and policians report for deficits. But until 2021 money was flowing INTO the SS program, building up the Trust Fund, so it was reducing the reported deficits, not contributing to them. From now on SS will be adding to the "unified" deficits, although the amounts are not large in comparison to the military budget, for example.

Yes, the SS budget is technically separate. In a couple of decades the excess in the Trust Fund will be exhausted and the projected income will be insufficient to pay the projected benefits. That is the (future) problem, not any SS contribution to reported deficits. But so what? Why shouldn't the SS program go into the red? If the federal government can be tens of trillions in debt, why should the SS program not also go into debt? Of course the tax base for SS can be expanded by raising the wage/salary cap and/or taxing capital gains, dividends, interest and rent. Congress can change these things at any time.

FICA revenues are dedicated to the programs of OASDI*, and cannot be used for any other purpose. The ‘unified’ budget was a fiction, and did not reduce the deficit, defined as the difference between annual appropriations and revenue authorized by Congress. It merely made the Trust Funds into major lenders to the Treasury, displacing some private purchases of Treasuries. The bonds held in the Trust Funds are a special issue and cannot be transferred; currently, bonds are being redeemed to supplement current revenues and maintain payments to beneficiaries, including the large cohort of baby boomers, as intended.

*Old Age, Survivors’ and Disability Insurance.

Exactly! Thanks!

There;'s so much we could be doing

One thing we cannot do is eliminate the debt over the next decade

Bringing it down gradually is the best way to handle this

Sure, raise taxes on corporations and close loopholes. Expand the SS taxable wage to $500,000 and let population demographics do the rest for SS

Same goes for military spending. We have had to revamp Coast Guard assignments because they are averaging a 2,000 recruit shortfall PER MONTH !!! We are not meeting recruiting goals in the armed forces of in the space farce either. Why? Not enough folks available to drive an M1A2, or crop dust using the new Warthog and NO ONE wants to go hundreds of feet under the surface of the ocean in a nuclear sub so why build as many? Yes, the defense budget can be cut and should be. This along with changing warfare tactics (drones, ICBMs etc) are making battlefield groups obsolete. So yeh, cut the military too.

Apply whatever savings directly to debt reduction payments along with any excess tax revenues. But don't do it all at once.

Disclaimer - "mid" boomer and retired veteran.

Population demographics indicate that WE are dying in increasing numbers but the birthrate is far FAR less than it was back then

As a non-veteran, what's become increasingly clear to me is that we cannot lower military spending. Either we have power and can wield it, or someone else does, be it China or Russia or North Korea or ISIS or Hamas or pick your favorite evil empire. Nature abhors a vacuum, and a power vacuum will be filled by bad actors. The United States is not perfect but we sure as heck are better than the alternatives, and our military keeps their oaths in a way our politicians do not. I thank god for the US Military and this is coming from a peace loving, somewhat crunchy, non-violent liberal. I thank you for your service.

The US military budget dwarfs those of China, Russia and North Korea. There is no evidence that reducing military spending will harm military readiness. Of course, the military and the military-industrial complex (cf Gen. Dwight Eisenhower) would have you believe otherwise.

Joel (and smoofsmith)

Warfare is changing since I got out. What I am seeing now with miniaturization (drones) and America's continued obsession with "bigger is better" I can see the potential for a military disaster in the future. Swarming drones disabling a $4B aircraft carrier and it's planes.

But my point is why build these behemoths when we are struggling to man them properly? The coast guard is running 2K recruits short PER MONTH. Space Farce can't find qualified candidates. This on top of ongoing shortages in the traditional military branches.

Don't abandon them of course but lets be realistic.

As for taxes roll back the Trump Bush tax cuts and raise taxes, Close the loophole carved out for the financial industry. Treasury Bonds can continue to be used to fund new big ticket things like

Nationalizing the power generating industry

Building 5 or 6 new Nuclear plants

Re-build the grid so that it's mostly underground including in Texas

Our priorities should be on computer security and communications security and for both of those you need steady power - first with Nukes then with renewable s backed up by nukes

Add to the University and college systems courses, that help drive students into those fields.

I am NOT in favor of nationalizing "the economy" but the future important industries NEED protection. Communication, data systems and the power grid are all targets of hackers and all need electricity to run them

Part of those funds can come from decreased military spending.

We can no longer provide enough manpower that thees massive ships, thousands of planes and tanks require anyway.

Please don't hold me to any of the details here, because I'm quoting from memory after a couple of decades, but I think the general theme is both accurate and revealing. I believe it was George Will, of all people, from whom I first heard this analysis: The American people -- judging by what issues matter to them, how they vote, who they elect, and who they reelect -- want to be taxed overall at about 23% of GDP, and want government spending overall to be about 27% if GDP.

You can see the problem there.

Exactly.

There is no sort of calculation involved in how Americans vote. A critical fraction of white voters (low-income Trump voters) want social services, but want to preserve White Christian Supremacy, which is what Republicans promise them. Republican pass the tax cuts, but will not cut the services significantly. As Kevin's chart shows, both expenditure and revenues have varied widely.

There should be no talk of cutting Social Security until the trust fund is unable to pay. We Boomers paid more than was needed for then current recipients in order to fund future obligations when our bulge hit retirement. All those dollars that were paid in are legally obligated to pay SS recipients.

Everybody was cool with mingling the funds when it allowed the GOP to cut taxes below spending while obscuring the actual deficit. But now that net flow is reversed and mingling SS funds with other spending makes the deficit look bigger, we're getting the Three Card Monte.

The only moral (and, indeed, legal -- unless Congress passes a new law) option is to raise taxes.

I don't think morality comes into play when deciding to lower or raise taxes. We boomers (although being born in 1960 - I like to fudge and identify as a GenX) may have paid for programs and tax cuts because the money we were putting into SS was not put in Al Gore's lockbox, but we enjoyed the programs and the tax cuts. You could characterize it as stealing from our children.

Your children and grandchildren will produce some number of houses and washing machines and cheeseburgers and blockbuster movies and a bunch of other stuff we haven't thought of, and all of that stuff will be distributed among people who are alive at the time and none of it will be sent into the past to pay our debts. What we must do for our children and grandchildren is give them the education and infrastructure (social as well as physical) they will need to create their own wealth and prosperity. Us leaving them a pile of green paper or a bucket of red ink is completely irrelevant to what they will need to create their own future.

+1

+1, too

The surplus money that we boomers paid into the Trust Fund, above what was needed to pay the smaller cohorts that were retired, purchased special-issue Treasuries. Had the Treasury not had the SSA needing to purchase the bonds, it would have had to sell general-issue bonds in the same amounts to investors. The debt was entirely the consequence of Congress spending more than it taxed. The programs and tax cuts were paid in part with borrowed money. It doesn’t matter who it was borrowed from, debts come due.

'Stealing from our children' is completely inaccurate. Often this phrase is used, misleadingly, as a reason to enact policy changes that will actually make future generations worse off.

Creigh's comment above is correct, but its also worth pointing out that all the public debt has a corresponding and equal asset. We hear cries that we cannot leave debt to our children, but this ignores the fact that the debt is also owed to our children. Obviously Our children are not worse off if they owe each other money.

Building useful things, investing in health, housing, education and technology makes us and our children better off. How much our kids owe to each other doesnt really matter.

+1

Exactly how did we enjoy Social Security? We were promised SS as one part of our overall retirement package and we planned for using it. Revoking the promise and scuttling our plans is immoral.

Forgot to mention, on the subject of Medicare, there is a third option. Reduce payments to providers. This would be tough politically, but so would raising taxes.

For one thing, we have to stop letting Big Pharma charge us 10 times what they charge the rest of the world for patented drugs. We have to make deals to cap prices if the makers want the drugs to be covered by Medicare. As it stands, Medicare Trustees said that fully one half of this year's increase in the Medicare premium is due to approval of one Alzheimer's treatment (of dubious value, I might add.)

I agree. Americans pay too much for our drugs. We do, however, have to realize that innovation will slow. It costs a lot to bring a new drug to market. I am willing to make that tradeoff.

Our hospitals are too fancy. I was in Israel at the beginning of September, and my brother ended up in the hospital (how many people can say they passed out in a bathroom at Ben Gurian International Airport?). They did a lot of tests, and he was in the hospital for two nights. The cost of everything, including the ambulance, was about 1/4 of what he would have paid here in the States. However, private rooms were not the standard, and the hospital didn't have fancy art and long empty hallways of shiny granite-like surfaces with nice couches and chairs. The hospital's common areas were bustling. The emergency care area was a ward, and when he got to the regular part of the hospital, his room had three beds. The care was excellent, but privacy is a curtain, and bathrooms are shared. If we want health care to be cheaper, we may need to give up the luxury,

If we want healthcare to be cheaper we have to take a hard look at healthcare wages. Everything else is just nibbling at the edges. Since we're not going to do that (give doctors, nurses and technicians pay cuts? seriously?) we're not going to get cheaper healthcare.*

We may, however, be able to hold healthcare at about the same percentage of GDP, moving forward (indeed, we've pretty much managed to do just that for most of the past two decades).

But "make it cheaper" in absolute terms? Super unlikely.

*Maybe one day AI will enable us to beat Baumol effects in healthcare. Maybe! That's the one thing I could imagine changing the equation.

I'm not sure that this is accurate. Hard to find good data, but the below link indicates that while nurse and phyisician pay are higher than other countries, they are not responsible for very much of the high cost of US healthcare.

https://www.commonwealthfund.org/publications/issue-briefs/2023/oct/high-us-health-care-spending-where-is-it-all-going#:~:text=Key%20Findings%20and%20Conclusion%3A%20More,%25)%2C%20wages%20for%20physicians%20(~

Thanks for that link. Always good to understand the problem before rushing in with ‘solutions’.

IIRC, there is evidence that we utilize specialists at a higher rate than most others; and since their compensation rates are higher, the total expenditures for specialist care are disproportionately high.

I think that's an exaggeration. First, a lot of the development work IS covered by the government and run at universities.colleges and research institutes. It does cost money to bring a new drug to market - but I've seen studies that a hell of a lot of that is, actually, advertising costs. And big pharma makes a metric shit-ton of money over and above anything I'd consider justifiable costs.

Another phenom that has skyrocketed in recent years is the use of minor and relatively inexpensive changes to justify new drug patents to lock out generics. In many cases, the resulting "new, improved" drug is not actually an improvement to anything but the manufacturers bottom line.

Then we have out and out greedy assholes like Martin Shkreli, the pharma bro who raised the price of Daraprim antiparasitic medicine (I think) by 5000% with no improvements at all - just because he could.

He got released from prison last year - so watch your wallets if he's seen near any pharma outfits.

"innovation will slow": Nice Fox News talking point. Good job.

Obviously, raise taxes. Since Ronald Reagan, those tax cuts have resulted in the massive accumulation of capital in the upper 1%. Bush's tax cuts removed the surplus.

This isn't hard to figure out.

But not on you or me. Only on the rich.

Well no, actually, everyone's taxes, except those below 400% above the poverty line.

So, if my internet calculations on https://povertylevelcalculator.com/ are correct, a family of four earning $130,000 and a single person earning $60,000 would pay more taxes.

Also, your rule results in a tax increase for about 42% of families in the United States.

https://www.kff.org/other/state-indicator/population-up-to-400-fpl/?currentTimeframe=0&selectedDistributions=under-400percent--400percent&selectedRows=%7B%22states%22:%7B%22all%22:%7B%7D%7D,%22wrapups%22:%7B%22united-states%22:%7B%7D%7D%7D&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

Why did you choose people earning 400% above the poverty line as your cutoff point? I assume you didn't pull that number out of thin air.

Yeah, 400% above poverty line was the target of the ACA for subsidies and is roughly equal to what's considered a living wage rate.

The rich have hovered up nearly all of the increase in real income for the last four decades, so I’m fine with that. You want working people to pay more, raise wages and salaries — that’ll put them in higher brackets. Which is where we would be if all the gains from increases in productivity hadn’t been grabbed by the rich.

Precisely. The rich (top 1% and top 0.1%) disproportionately benefitted from tax cuts over the years. Raising taxes on the rich back to levels we had in the past creates a fairer, more equitable, more efficient society.

But I realize you're a troll and can't understand logic.

Raise taxes. And redefine income. Why is income from working people with W-2's taxed at a higher rate than interest, dividends, carried interest and inheritance? Those are all income to the recipients They should all be taxed at the same rates.

(Note, I am not arguing for a flat tax. But income from all sources should count in the tax brackets.).

you ever notice that corporate tax rates are based on profits while personal tax rates are based on income?

so a 20% personal tax rate (on income) is much higher than a 20% corporate tax rate (on inxome minus expenses), but republicans prefer having their voters believe those 20% figures are equivalent

Not so simple. Corporate income goes to pay workers' wages, which are taxed. Then the net corporate income is taxed again as capital gains or dividends, although those rates are mostly lower than "earned" income rates.

Exactly how much of your income are you spending in order to generate that income?

Passive income derived from wealth is different. Wealth is an outward sign of the Lord's election, unbidden and undeserved, and that is an election made by Him from before the beginning of all time.

Wage income, on the other hand, comes from work, which is a punishment for sin (cf. Genesis. 3;19) and as such deserves to be taxed.

Tinker with this at your peril -- it is presumptuous on a good day and blasphemous on a bad day to question how He distributes the good things of this world

A-men!

Investing is more risky than a steady paycheck. Any money you inherit has been taxed at least once already, and further income you make from investing that money, continuing profits from the small business or family farm, will be taxed.

Ever hear of stepped up basis?

Many assets increase in value without being taxed. If I inherit one of those assets, I inherit it at the stepped up basis. When I sell the asset, I only pay taxes on value that has been added after inheritance. The value added during the life of the original owner is never taxed.

You also inherit the losses.

The stepped up basis includes the value added over the life of the original owner.

"Steady" in that first sentence is doing a lot of work . . .

+1!

Any money you inherit has been taxed at least once already,

"Any money" received in wages has likewise been "taxed at least once already." Do you think they owner of the 711 where you work has a printing press? No, he drives revenue via the post tax spending of his customers.

inheritance is different. If a person hadn't died, it wouldn't be income to the people who receive it.

On the other hand, there is a level of accumulated wealth above which the wealth needs to be taxed in order to avoid gross disruptive effects: steadily concentrating wealth and giving recipients a really abnormal world-view.

kevin obviously thinks ai might solve everything

but ai could make a convincing argument that it needs biological and chemical weapons to do a really thorough job

I string along with raising taxes on the rich and very high income people.

With the demise of private pensions and the failure of the IRA scheme to result in savings for most households, we should be looking at increasing SS rather than reducing it. This is especially true for the young. As a mid-boomer, I have a crappy pension that pays about a quarter of what I was promised, but the kids have no damn pensions at all. The median IRA/401K account is around $30k. We need to be increasing the SS benefit for people younger than me rather than reducing it.

Kids who quit school to go to work in construction or some other such job at age 16 may well be physically worn out long before age 67. We should be looking at reducing the early retirement penalty for such people.

From the early 1940s until the early 1980s the bottom 90% of households had around 64% of the total US personal income. Since then it has shrunk to around 49%. If this had not happened, SS might be in fine shape.

It's not like the folks in the 91% to 95% income percentiles have stayed whole either. You have to get to the 98th percentile to get to break even. Since the 1980s the top 1% in income have seen about $3,000 B per year in personal income move to them from the bottom 97% compared to what would have been the case if policies had not changed to favor the rich.

This actually understates things since very high income households put a lot of effort into hiding or deferring taxable income. Perhaps if personal income was distributed among households as it was 50 years ago, the official figure for personal income would be a trillion dollars higher.

Bear in mind that the Venn diagrams of the very rich and very high income may well overlap, but are not congruent. A pro athlete may have a multi-million dollar income for a few years while accumulating little wealth. A very, very rich person may arrange matters so that he realizes relatively little taxable income. It is more important and more just to tax the latter than the former.

So expand SS benefits and kill off the budget deficit, and ultimately the national debt, by taxing high incomes and the rich. Eliminating billionaires should be a goal.

There is nothing to indicate that the current national debt is a crisis. However, there are those who say that eliminating or substantially reducing the national debt is wrong. These people are fools and should be ignored. They are tools of the Banker Class. Remember what Will Rogers said about the relative crimes of bankers and farmers.

Yes, eliminate all 600 to 800 billionaires in the United States. That will solve the problem.

735 at last count. Get rid of them all. That will solve many problems.

I'm sorry if you missed the main point: We can easily pay for everything we need to do by taxing away from the rich and high income households a small fraction of what they have stolen away from the rest of us over the last 4 decades.

Eliminating billionaires would help fix our screwed up politics and should be an intentional policy.

We can easily pay for everything we need to do by taxing away from the rich and high income households

I favor increasing the progressivity of the tax code, but it's not the panacea a lot of liberals seem to think, at least if the focus is on the truly rich (and not also the upper middle class).

Those stupefyingly gigantic wealth and income figures we read about (Jeff Bezos, worth $160 billion! Taylor Swift makes $2 billion from her concert tour!) mostly represent claims on future production—they're not (in the main) being converted into consumption in real time.

If we confiscated every penny from every billionaire in America, we'd have...uh, a lot of mostly useless dollars. Because transferring these dollars (a dollar is just a claim on future resources) to the non-rich wouldn't magically increase production.

There's a reason Denmark and France tax consumption: you can't get the decent society social democrats like me want while simultaneously exempting the middle (especially upper middle) classes from the tax bite. To put it another way, America's billionaire class often live lives of stupendous luxury, true (though that's true of billionaires everywhere). But America is also home to the the world's highest-living upper middle class (big homes, big, powerful SUVs, lots of restaurant meals, fancy professional services, gym memberships, huge wardrobes, frequent upgrades to their already expensive electronics and appliances, ubiquitous air conditioning etc).

I don't have air conditioning, a huge wardrobe, nor professional services. I don't have an SUV, but that's kind of quibbling since my wife does have a really nice convertible BMW... My 2,000 square foot home doesn't seem *that* big.

The point is to increase tax revenues by 3% of GDP or, today, about $700 billion. The CBO estimates we could get around $100 billion of that by increased IRS enforcement.

The total wealth of US billionaires is $4.5 trillion. Billionaires have to have an average return on wealth higher than inflation and gdp growth in order to accumulate that wealth, so the gross income of U.S. billionaires is on the order of $200 billion. While we already tax some of that income stream, I'd be surprised if it didn't make sense to take another $100 billion a year from that stream.

The top 0.1% holds $20 trillion in wealth. Which suggests we might be able to generate close to $400 billion per year in additional taxes from that group.

The top 1% holds $46 trillion in wealth. We are asking to tax 1.3% of that wealth taken from the revenue stream that wealth produces.

Switching from wealth to income, the top 1% of income earners currently pay $2 trillion in taxes. On average, they are taxed 22.2% of adjusted gross income of $2.8 million. We are asking to increase the tax rate on the AGI over $1,000,000 to something like 30%.

And that's to balance the budget. A balanced budget is not clearly economically desirable.

I don't have air conditioning, a huge wardrobe, nor professional services. I don't have an SUV, but that's kind of quibbling since my wife does have a really nice convertible BMW... My 2,000 square foot home doesn't seem *that* big.

Personal anecdotes? Um, ok.

Jasper is right. We need everyone to chip in. That's why I support repealing both the Bush-era and Trump-era cuts entirely. Now that would be pretty rough on the second and third quintiles and should be accompanied by a modest offsetting increase in the EITC. But my and my wife's gross tax rate is just about exactly 10%, year after year. That's too low.

Wild exaggeration doesn’t add to the conversation.

There is a perfect Graphic from the Tax Policy Center....US tax burden vs Europe and other high income countries

Scroll down just a tad...

https://www.taxpolicycenter.org/briefing-book/how-do-us-taxes-compare-internationally

Traveller

...if we want to close the primary deficit. The key words in the post.

What we should want is stable prices and full employment, and whatever condition of Federal deficit or surplus that makes that happen. That is the condition that will maximize wealth and prosperity for us and our descendants. And past experience tells us that a deficit of 3% or so of GDP is most likely to do that.

+1

My problem with cutting SS and Medicare is that they will be "out of sync" for a few years in the 2030s until the bulge of boomers departs, but the cuts are likely to be permanent.

Kevin cherry-picks 2033 as if that would be the ongoing situation, but in fact that is the peak year. After 2033 the problem would diminish.

I'm sure Kevin knows this.

Let's not destroy these programs to solve a temporary problem. Raise taxes (probably by raising the cutoff), then lower it around 2040. That would get us past the boomer bulge while guaranteeing that younger Americans could rely on it.

Let's not destroy these programs to solve a temporary problem.

Though the red ink bears monitoring, it's not even clear it's an actual problem. Real interest rates paid by the federal government are now about what they were before the Great Recession (in other words, normal) and inflation is falling.

This is the battle that's coming. All the talk of trans rights, bathroom bills, etc, is just positioning for the battle. And I fear the Republicans have done the better job of positioning.

However, the politician who points out that when America was Great tax rates on top income were in the 90% range might get a good response. So, go for it, somebody.

I've been reading a lot about how Medicare's finances had supposedly stabilized of late. Is this no longer the case?

Something that has occurred to me lately that might be of some relevance to us all. I think that one of the primary arguments that Republicans and Libertarians make against taxes is, "The private sector can do things more efficiently than government, so taxes reduce the overall efficiency of the economy." Is that a fair and unbiased description of their assertion? I think it's close. The assertion of greater efficiency in the private sector may or may not be "correct", but they believe it with religious fervor and have convinced a lot of otherwise bright people that it's true.

But something that they don't understand is that, because as Ken noted, the Federal debt is mostly just endlessly rolled over, borrowing "new" debt does exactly the same thing. The lender (aka, "the bond purchaser") NO LONGER HAS THE MONEY. Just like if it is taxed from her or him, it's gone. It can't be invested in some new widget that ups GDP by 2%.

Now, there's no doubt that FOR THE LENDER it's a better deal than taxes; he or she gets interest payments along the way and, presumably, will have the principal refunded at the "maturity" of the bond.

So, yeah, it's kind of great for rich people with money to lend, BUT IT DOESN'T "HELP" THE ECONOMY. "Oh!" you say, "but the person gets an income stream from the interest payments and can spend them in the free economy! That's better."

Not so fast. In the current "permanent deficit" economy, roughly one-sixth of INTEREST PAYMENTS ARE BORROWED TOO! Maybe from the same guy or gal.

The point is that as long as the deficit rises by any amount, the money represented by the accumulated debt is just as dead to the "productive private sector" as if it had been taxed away.

So, it's a bullshit argument based on flim-flamming people who have been brainwashed to think that the government can't do anything. Why they continue to think that while living in an environment which has largely been shaped and is supported by governmentally provided infrastructure is a mystery, but there you have it. They do.

A pox on their houses. Raise taxes enough to close the gap in Percent GDP between Revenues and Expenditures, at least pretty closely, and all will be well. The economy will NOT crater.

> it's gone. It can't be invested in some new widget that ups GDP by 2%

That's right, because the federal government does not spend the money it borrows. You are soo smart.

"No special reason for posting this. I just felt like it."

Obviously you posted this because you have no free will and the fundamental laws of physics which have been grinding away for at least the last 14 billion years lead to your inevitable posting of this because they say so.

Sorry for the snarky post, I've been a near daily reader of yours for nearly 20 years, but while we have very similar opinions on a very wide range of issues your free will post still leaves me shaking my head.

Thanks for keeping that bad post from being forgotten. Nicely put.

When you ask "Raise taxes or ....", what specific tax/s do you mean?

- Do you mean a broad based tax, similar to a VAT found most OECD countries?

- Do you mean, raising the cap on Social Security, without changing benefit limits. Note, the concept would be completely redistributive: the increase in this tax would not basically never be returned to the folks paying the increased tax.

- Do you mean some new tax, wealth tax or income tax, on high income people?

- Or is this a completely new tax: carbon tax, land tax, etc....

Yes, I believe it matters for many reasons how one proposes raising additional money.

Certainly a Carbon tax because it helps with decarbonization. For the rest of it, repeal of the entire Bush and Trump tax cuts, from the bottom to the top.

Screw that. Repeal the Reagan tax cuts.

It is not quite true that there are only two options, taxing or cutting. We could also open the border to immigrants (like our national myth suggests). They would create population and economic growth just by working here. this in turn would lead to higher returns from FICA taxes.

Immigration will not close the gap entirely but it would significantly relax the situation. So why not inviting in Ukrainian refugees or Palestinian refugees or refugees from other conflicts rather than burdening Poland or Jordan or other poorer countries with the problem of far too much immigration? We are rich and have a very low population density. Immigration would be good for us.

This is clearly a false choice fallacy. As other commenters have indicated, there are not only 2 options.

Population growth and reducing healthcare spending are the two most obvious other paths. Both are very simple to achieve. Automatically ceding this ground to the healthcare lobby and racists is a bad strategy that has no real benefit.

Infrastructure spending increases is the most obvious other path. 😉

Yes!

Another easy one is to not raise interest rates to create a recession or slowdown in an effort to reduce employment and slow down pay increases.

If we raise taxes by 18% I hope it's spent on things that benefit more people than just the olds.

Free national daycare including high quality preschool and free school meals for kids.

Here's something from the 2023 Social Security Trustee Report

https://www.ssa.gov/OACT/TRSUM/index.html

"Over time, the projected OASDI (old age and survivors insurance) annual cost rate rises from 14.53 percent of taxable payroll in 2023 to 18.50 percent of taxable payroll by 2078. It then decreases to 17.75 percent in 2097."

Taxable payroll is wages and salaries under the current cap. Surely an increase of 4% could be attained by broadening the "payroll" - raising the cap and taxing unearned income. But as Dean Baker often points out, we would certainly expect real productivity to increase by more than 4% by 2078. The problem is that most people who have been paying the SS tax have not gotten their share of the gains in productivity. That is really what needs to be fixed with SS - wages have to go up.

+1!

Revenues were 19% of gdp and are 16.5% of gdp. Increasing taxes by 18% would restore revenues to where they were.

But we have other options. For example, the Republican strategy: in the next pandemic, ensure we don't have lockdowns, let hospitals fill up, and a couple of years later we won't be spending as much on medicare and social security.

Or, the Democratic strategy: prioritize infrastructure spending that has a higher rate of return to increase tax revenues without increasing tax rates.

How often do Republicans have to keep making these kinds of self-revealing typos before we get the idea?

https://twitter.com/nicholaswu12/status/1720479624818278571

Looks to me like the Social Security program will continue to bring in more than it pays out for another 10 years, so there is plenty of time to raise the maximum earnings subject to Social Security tax.

https://www.aarp.org/retirement/social-security/questions-answers/how-much-longer-will-social-security-be-around.html

The Social Security program has been running a surplus for decades and all of that "extra" money goes right into the Federal General Fund, or whatever it's called when the money can be used to buy cluster bombs and whatnot. What this does is artificially suppress the annual deficit. Jerkoff republicans want to reduce SS payouts n.o.w. which would divert even more payroll tax into the general fund to make up for the giant tax breaks the 1 percenters got under the Bush and Trump tax cuts.

Of course, the "fair" thing to do would be to note that TRILLIONS of DOLLARS in payroll tax disappeared into the General Fund over the years and, should the SS program be in danger of running a deficit then money could be removed from the military's portion of the GF and used to make up the difference. Easy peasy.

This is not the case. Revenues exceeded expenditures for several decades while baby boomers were in the workforce, and older cohorts receiving benefits were smaller. During that time, excess income has been held by the Trust Funds as special-issue Treasury bonds (Government Account Series). In plain language, the Treasury has borrowed from the Trust Funds; the borrowed funds are deposited in the General Fund, as are funds borrowed from individual and institutional investors who purchase general-issue Treasury bonds. Borrowing is necessary because, with rare exceptions, Congress most years appropriates more expenditures that it votes to raise in revenue. Cutting benefits would not reduce the federal deficit, because FICA taxes can only be used to pay benefits and administrative expenses of OASDI.

Money is fungible, but saying that Social Security funds disappeared into the General Fund plays into a right-wing narrative that deprecates the bonds issued to the Trust Funds, implying that they need not be honored. In fact, the Trust Funds have been redeeming bonds for years, as boomers retired, and expenditures exceeded FICA tax revenues. I believe that for a year or several, interest on the bonds were sufficient to cover the shortfall, but now the Trust Funds are being drawn down, as expected. Americans need to be firm that the Trust Funds’ bonds must unquestionably be repaid, just as general-issue bonds. The right-wing narrative is pushed because general-issue bonds are mostly paid back to wealthy people, while OASDI benefits flow to ordinary folks.