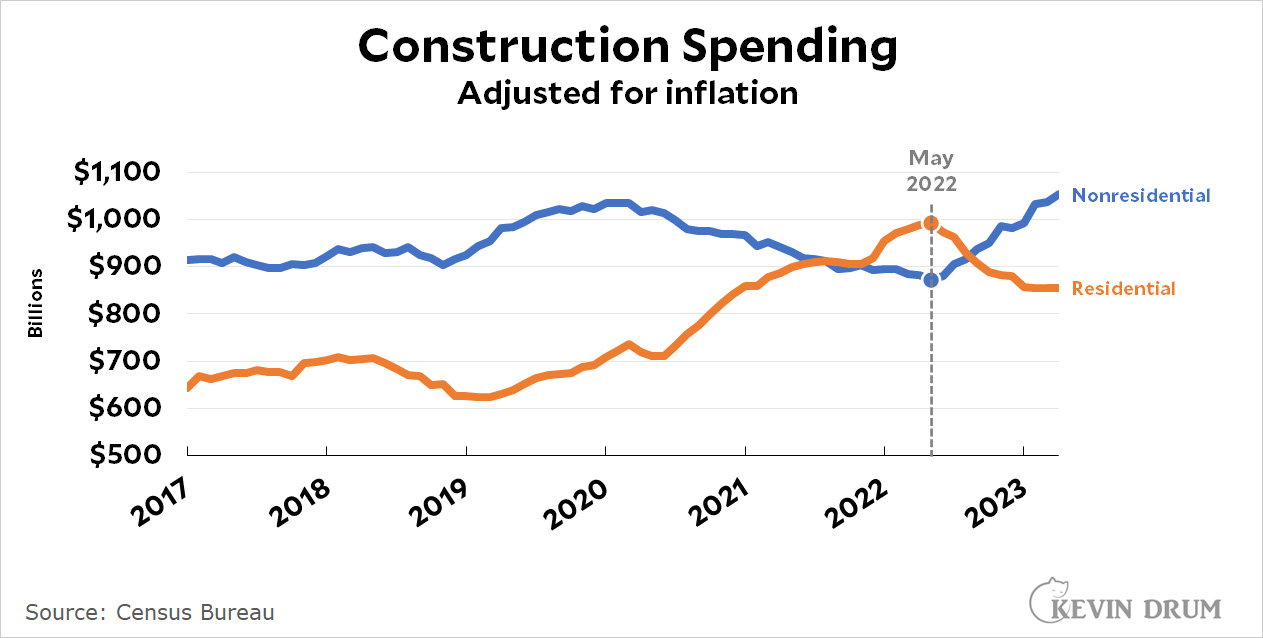

Here's an odd thing:

Residential construction plummeted in May 2022 as mortgage rates went above 5%. That's no surprise.

Residential construction plummeted in May 2022 as mortgage rates went above 5%. That's no surprise.

But nonresidential construction started to rise at exactly the same time and has continued rising ever since. Why? Nonresidential construction is largely financed by public or corporate bonds, and high-quality bond rates rose at the same time as 30-year mortgages, crossing 4% in May 2022. That should have slowed down nonresidential construction too.¹

But it didn't. Why are we in the middle of a nonresidential construction boom?

¹It's worth noting that total construction is not the same as spending on structures. Total construction spending, including roads, utilities, sewage, and so forth, is up 20% over the past year, but investment in actual structures is up only 6%.

UPDATE: David Dayen offers a plausible explanation for the increase in construction since last year:

The manufacturing construction boom is pronounced after IRA and CHIPS. From @soberlook. pic.twitter.com/NZMMmXsYvu

— David Dayen (@ddayen) June 2, 2023

The increase in construction spending started a little before either IRA or the CHIPS Act passed. Based on this timing, I suspect that some of the increase is due to the American Rescue Plan, passed in March 2021 with spending starting a little later. IRA and CHIPS probably kicked in around the time ARP was winding down.

The Infrastructure Investment and Jobs Act passed in fall 2021. I have to imagine that had something to do with. The inflation reduction act also had funds for manufacturing construction as I understand it. Also, there are only so many construction crews, so as the residential jobs dried up there were more resources available for non-residential jobs.

Joey mentions three cogent points. The third point should not be underestimated.

My company subcontracts to general contractors (GCs) in large contracts in both the government and private sectors. In the main, these GCs are not heavy hitters in residential construction, so the parameters of the business decisions are very different. We have found that the bidding is marginally tighter now than it was last year, but the marginal extra cost of commercial borrowing has not proved to be a big factor; rather it represents a few percent cut in the available margins on many of our projects.

So we keep all our workers fully busy, and they still get their raises when they’re due, and the owners accept slightly less profit. But don’t feel sorry for them—they’re still doing well.

Don’t know about a boom… I’m working on a project to build a new manufacturing plant costing more than $1 billion. There are plenty of electricians and mechanical contractors working every day here! More in Europe too.

When mortgage rates went very low in 2020 this made it possible for lots of lower-income people to buy houses, based on mortgage payments related to income. So ownership increased at the lower end (see Dean Baker's piece at Beat the Press). Then this boom was choked off by the Fed.

Non-residential financing is not subject to the same income restrictions - the rules are different. That itself doesn't explain the rise in nonresidential construction. In addition to the effect of the Infrastructure Act, maybe some companies are actually investing their huge profits in expansion.

It appears that this increase in nonresidential construction has resulted in a lot of empty office space in our cities while we suffer from a dearth of residences.

We managed to get in on the low end of mortgage rates in early 2022. The huge drop in the interest part of the payment means even the default payment was more principal than interest. And we put in an extra $1K per month on principal. We've turned a 30 year mortgage into a 15 year mortgage.

I started being a shark on mortgage rates shortly after we bought our first house in MA at a 14% mortgage interest rate (1984). Turned out the tax deduction back then worked well. A year later, the rate dropped to 11%, so I refinanced. My wife was aghast - and the drop in interest paid back the financing charges (I don't ever pay points) in under 6 months.

But the very next year, rates dropped to 8%, so I did it again. By a couple of years later we were down to 5%. Never pay points.

You could have dug down into the data to figure out what's driving the boom in non-residential construction.

You sure you okay?

Construction in the manufacturing sector accounts for about half the spike. But begs the question, what's driving that? Car makers going electric? Chip factories? California's high speed rail? Ok, building out the track is actually under "transportation".

Well, (chip) fabs -- from ingot to lithography -- cost on the scale of a billion dollars depending on their size, so there is that.

Repatriating manufacturing as a response to political de-risking, as they like to call it, is driving a lot of it. So too are the tariffs that have remained in place, post-Trump.

Was the political calculus of allowing inflation to rise in exchange for higher disinflation in the future worth it? IDK, but it seems to me that most politics are driven by short horizons and even shorter memories.

I expect a lot of this has to do with greater "pent up demand" effects from the pandemic. The crisis did not adversely affect demand for housing—quite the opposite, as the work-from-home dynamic if anything boosted demand for residential space. Thus higher interest rates in 2022 arrived during a time of "artificially" stimulated residential construction, and the 2020-2021 trend proved ephemeral.

It was just the opposite with non-residential construction, as demand for office space, hotels and retail flagged in 2020-2021. So, the bounce back in this sector has swamped the effects of higher interest rates. Also, spending from both the Chips Act and the Inflation Reduction Act—as well as increased investment in domestic manufacturing capacity on the part of firms who are understandably nervous about the effects of geopolitics on supply lines—are likewise translating into increased non-residential construction spending in the US.

Kevin's graph bears this out: increased residential construction and decreased non-residential coinciding with the arrival of Covid. And something of a reversion to mean since then...

So? We're going to overbuild office space when increasingly folks are working from home? Then what? We convert the offices to residential over retail? We try to convince folks to buy cracker box "lofts" in office buildings? Home sweet home.

We're building back better, Kevin. Record investments in infrastructure and manufacturing have an impact. A helpful thread:

https://nitter.net/IrvingSwisher/status/1664276605873844228#m

"Total construction spending, including roads, utilities, sewage, and so forth, is up 20% over the past year, but investment in actual structures is up only 6%."

More highway construction means more overpasses for us to live under when no one can afford a home anymore.