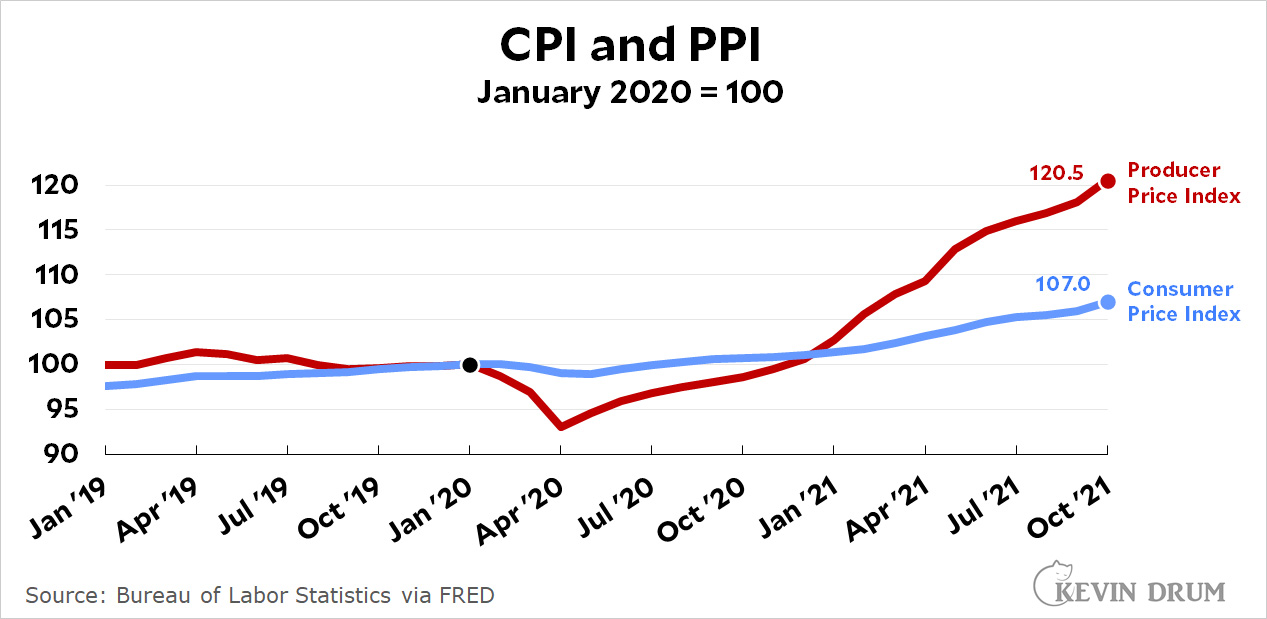

Are big corporations using COVID-19 as an excuse to screw consumers? Here are two data points. First up is inflation:

Since the beginning of 2020, the producer price index has gone up far more than the consumer price index. This suggests that corporations are trying hard to keep prices down even though the price of their inputs is going up.

Since the beginning of 2020, the producer price index has gone up far more than the consumer price index. This suggests that corporations are trying hard to keep prices down even though the price of their inputs is going up.

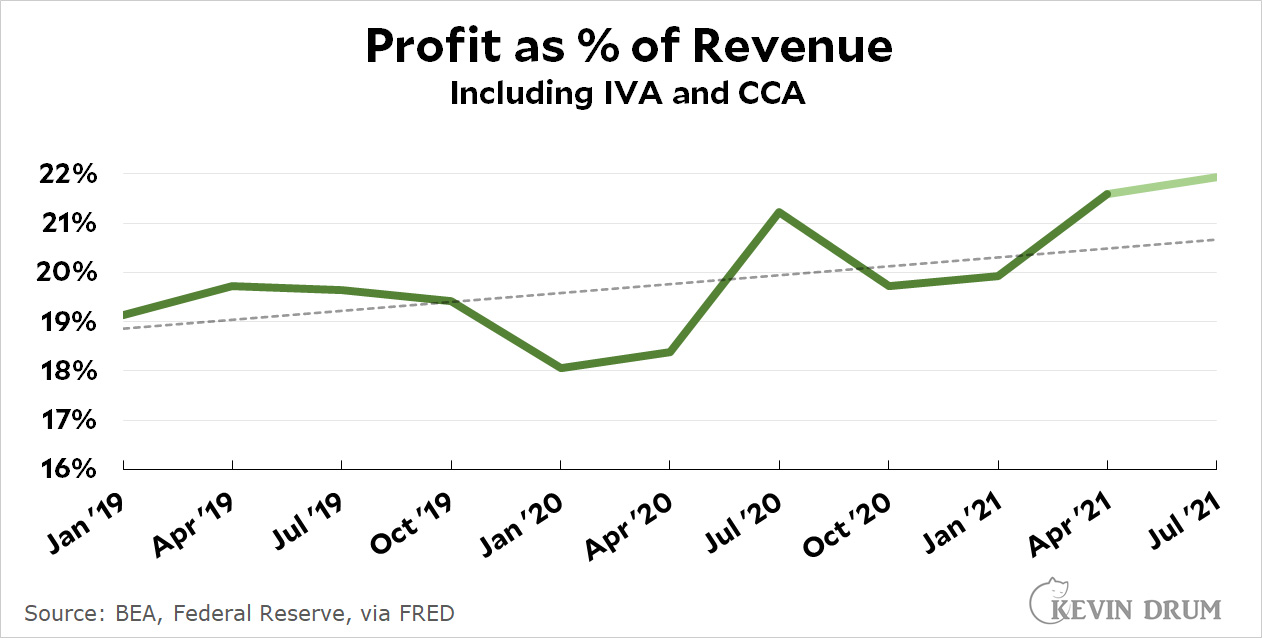

But there's also this:

Corporate profits are up, up up. One way or another, corporations are doing pretty well and could obviously afford to pay workers more and hold down prices more.

Corporate profits are up, up up. One way or another, corporations are doing pretty well and could obviously afford to pay workers more and hold down prices more.

I'm too lazy today to draw any firm conclusions from this. For now, it's just raw data to ponder over.

What's happening with total wages? How many places are perfectly fine with the great resignation? They can put off hiring replacements and pocket the money as profit.

PPI measures the selling price of domesticly produced goods and services. It does not measure the cost of inputs for items measured in the CPI.

Many items are in the CPI, but not the PPI and vice versa.

I dont think you can draw the conclusion that companies are trying hard to keep prices down by eyeballing PPI vs CPI. These two data sets do not provide the information needed to attempt this conclusion.

Prior to the little hiccup presented by the discovery of omicron, the stock market was on a rocket ride to the moon, so it didn't look like investors were too worried about "inflation" eating away at corporate profits.