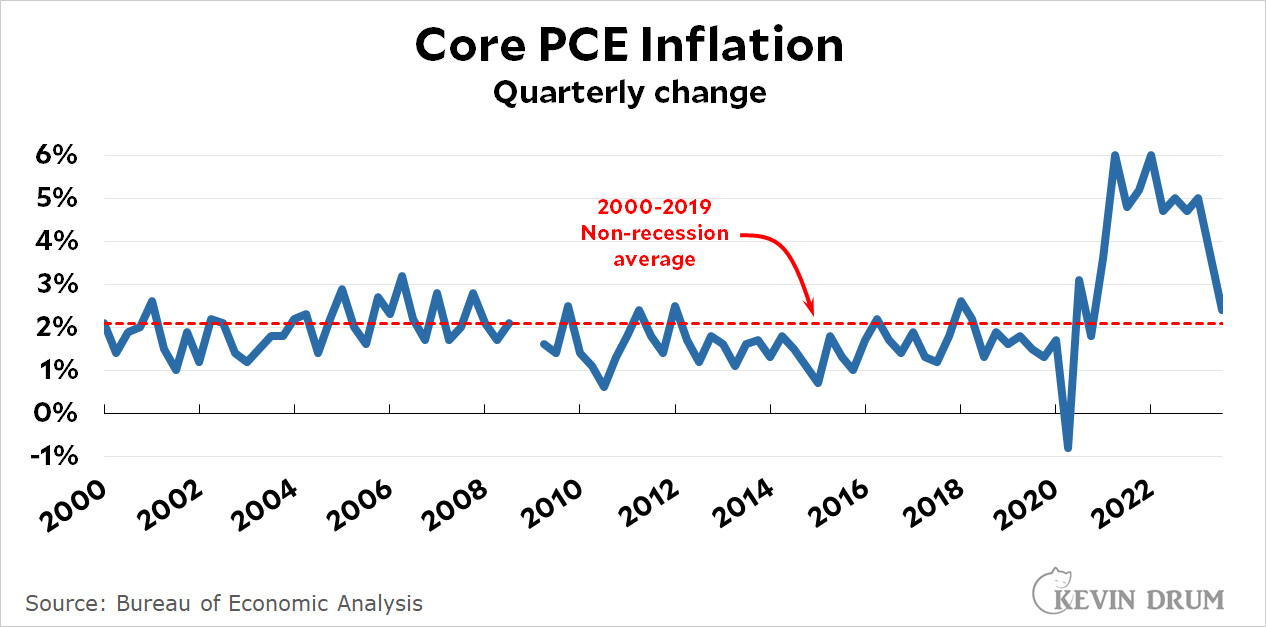

Here is the quarterly rate of core PCE inflation over the past couple of decades:

Excluding the unusual deflation during the start of the Great Recession, average core PCE inflation averaged 2.1% through 2019. In the third quarter of this year it was at 2.4%.

Excluding the unusual deflation during the start of the Great Recession, average core PCE inflation averaged 2.1% through 2019. In the third quarter of this year it was at 2.4%.

I lived through the 80s but was young enough that I didn't notice the change in prices. I think people are still shocked at how much more things cost now, especially food, even if it isn't going up as much any more. IMHO.

Most people also think that the higher you set the thermostat, the sooner the house will warm up (and in summer, the lower you set it, the quicker the air conditioning will work). Lately, I see evidence that they also think that speeding to the next red light will get them to their destination sooner.

But most people still believe inflation is increasing. Out of control. Like never before.

And the Fed is listening to them.

No, the Fed is tracking economic data and ongoing pricing pressure feed-through.

the same for European Central Bank (ECB)

Why both have said they are pausing rate rises but not saying they anticipate cuts.

But the price of eggs!

So it was temporary....

😉

If you look at a chart of core inflation, over say the last ten years (or longer), one will likely come to a different perspective on inflation being back to 'normal.' Core inflation is still about double the desired 2%.

https://tradingeconomics.com/united-states/core-inflation-rate

I think you are correct that people's expectations have been set by the past 10 years and until a couple years ago inflation was not only unusually low but also did not fluctuate much. Expectations is what this is about. All through Reagan's Presidency inflation was as high or higher than it is righjt now and most people showed little or no concern about it because it had been so much higher for most of the 70's.

But expectations are also set by the media and the politics of the moment. If you listened to the WSJ or much of the business media you've heard near hysteria about inflation for over 18 months and that seeps through to the average voter.

Your link directly states that housing is doing nearly all the work. I suspect that you know that housing costs are delayed by about 18 months in the current YTD CPI and that your core CPI chart is not representative of current or even recent inflation. Quarterly or monthly values are also much lower as inflation has continued to decrease over the last year.

So why post something that you know is misleading?

jdubs - I provided valid, third party, data.

I might agree with your perspective, IF folks didn't have to pay rent or their mortgage....

Lol, that doesnt make any sense at all.

I have linked to data but I dont want to understand the data because people have MORTGAGES!! I have a narrative to sell, understanding is not necessary!

lol, you win!

It’s pretty clear that Kevin was right. It was transitory!

A key thing is going to be how long it takes for higher price levels to be acceded to as "normal" even as most inflation gets down to more usual levels, and I have no idea how long that is.

One of the hardest new levels to get used to, my guess, is the monthly car payment, and I've been surprised it doesn't get much attention. I'm not saying these are exactly the numbers he uses, but my cousin who sells cars for a living has been having to tell customers that the days of paying 350 are over and they have to expect more like 500 (and according to several sources the average new-car payment now is 729 so I'm probably remembering wrong, but you get the idea-- quantum jump).

Whatever the actual numbers, they've been much higher since covid than people were used to or than they likely paid last time around, and outside of a few major metro areas cars are really a necessity for most households so the hit is inescapable and felt every month. Gas, as a lot of people point out, has gone down a bit and that's the current trend, but those car payments won't go down.

Food costs would be my second nominee for a new price level that people have a hard time getting used to.

I sure hope the time it takes for that to happen is no longer than a year.

“ Excluding the unusual deflation during the start of the Great Recession”

Foul! Why would you do this? Cherry picking is cherry picking!

I agree that we’re almost done beating inflation, but when you pull nonsense like this it makes it hard to take you seriously.

I think it's fair enough to exclude the short disinflationary period of 2008, as long as you say you're doing it. What I would add to Kevin's observations is (1) inflation from 2008 through 2019 averaged under 2%, in contrast with the 2004–2008 period where it was hanging around 2.5% a lot of the time; and (2) there's reason to believe that 2% inflation is too low, and we should hope it stays close to 2.5% in the future. This would make it easier for the Federal Reserve to respond to recessions by setting interest rates to a level below the rate of inflation.

In technical circles it is widely agreed although impossible to say politically that the 2% target (which developed ad hoc oddly enough out New Zealand) in inflation targetting is too low - after the 2008 crisis and the contortions that were needed to address the Zero Bound problem (QE etc).

For at least 10 years there has been quiet technical support for the idea of 3% as safer.

It's all the pandemic. 100%. The disruption it caused is something that had never happened before in the modern global economy. Economic activity ground to a halt, supply chains crashed and burned, and then the vaccines started to come about, creating a rebound. And efforts by governments to thwart a depression and save lives via government stimulus were successful. There was an inflationary overshoot that was rather mild (up to about 10%, which is NOTHING compared to hyperinflation that has erupted from time to time in history) and has now subsided.

But the western media jumped on it as a rich, endless source of emotion-triggering stories to generate eyeballs, clicks, and outrage. And now Americans may actually re-elect one of the worst human beings of the century because they believe Joe Biden single-handedly raised the price of their gasoline and burgers.