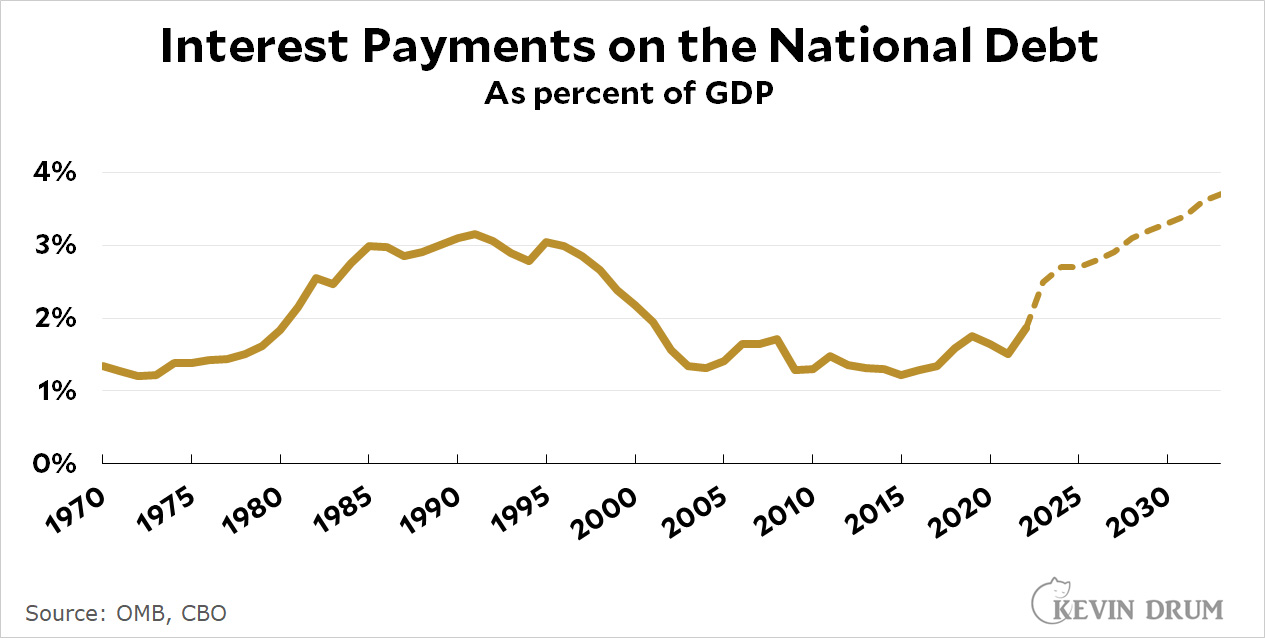

According to the CBO, interest payments are going to hit a postwar high within ten years:

The previous postwar record was set during the Reagan era and peaked at 3.1% of GDP. CBO estimates that interest payments will attain that level again in 2028 and then keep climbing until they reach 3.7% by 2033.

The previous postwar record was set during the Reagan era and peaked at 3.1% of GDP. CBO estimates that interest payments will attain that level again in 2028 and then keep climbing until they reach 3.7% by 2033.

It is likely based on their interest rate assumptions for the future, since we may be entering an era of relatively higher interest rates (or we may be leaving an era of relatively low interest rates). Of course it will really skyrocket if the GOP MAGA schmucks continually threaten a default and the rating agencies actually downgrade the credit rating of the good old US of A.

Good time for another tax cut for the wealthy and the corporations. The last tax cut cost me over $2K per year. At least George W's tax cut saved me money.

Cheap money doesn’t stay that way.

Interest payments do not disappear into a black hole. Most of them get back into the US economy. If rates were held at a moderate level (not extremely low like they were during most of 2020) many people would benefit - retirees and others who are relying on bonds rather than stocks. Of course when the Fed jacks rates up and down there are losses and gains in both stock and bond markets to make things interesting and unpredictable. The Fed is now holding a considerable fraction of Treasury bonds which complicates things still further.

Currently a large fraction of the interest payments do go to China and other countries, primarily because of trade deficits. There is supposed to be a counterbalancing benefit to trade deficits in the influx of foreign capital, but the limitation to growth in the US is not lack of capital - corporations have so much capital that they buy back their own stock rather than invest in expansion.

This looks like a perfectly fine outcome. Its only worrying if you are desparate for an excuse to slash public investment.....but as the last few years have shown, the actual amount and cost of debt doesnt impact anyones thinking about public policy.

I'm firmly in the camp of "debt matters very little."

As such, I am constantly perplexed as to those who simultaneously assert that the US should not cut programs and should not increase taxes, but what the hell is going on with our out of control debt and oh my gawd look at how much interest we're paying on our debt!

You can't be serious about policy if you're in that camp.

And if folks can't or won't talk about fiscal multipliers and acknowledge that a cut in federal spending is a cut in GDP, then we're in an econ fantasyland and policy is just nonsense bullshit.

Public debt doesn't matter. Private debt, through the magic of compound interest, eventually destroys an economy.

I believe during most of my life (82 yrs) the federal government has had taxes yielding about 20 percent of GDP. Up some years, down some years. That seems to be all we Americans are willing to pay for the government. Over the same time span while spending on defense has declined, mandatory spending has increased and discretionary spending has decreased (from abt 9 to abt 6 percent of GDP). If the debt ceiling bill is an indicator, every billion more of interest payments will mean a reduction in discretionary programs by the same amount.

Historically, the purpose of selling government bonds was to protect the Treasury's gold supply (by taking the convertible money used to buy the bonds out of circulation temporarily and foreclosing on the possibility that those dollars would be presented to the Treasury for conversion to gold.) The Treasury paid interest on its bonds to compensate bondholders for the risk that the government would default on its promise to redeem money for gold when the bonds matured, and to motivate people to take that risk. Today, that risk does not exist, and there is no public purpose for paying interest on government liabilities, unless you believe that higher interest rates will cure inflation. No doubt Jerome Powell believes that, because his salary depends on people believing that, but the evidence, frankly, is slim at best.

I will continue beating this drum (sorry, Kevin):

WHO gets most of that interest on the debt?

Answer: we do, at least about 67% of it. The largest debt holders of U.S. federal debt are institutions like the Fed, the SS trust fund, the military health fund, and a whole slew of private pension funds, mutual funds, and banks.

So most of the money does NOT LEAVE THE COUNTRY. And of the 33% that does, most (88%) of it goes to banks in Japan, the UK, and a bunch of countries that are NOT CHINA.

So the age-old proclamation that we are "leaving our grandchildren saddled with debt" is a falsehood. We are not "running up the credit card," as the right-wingers love to say, because "we" -- meaning our country -- owns most of the debt!

Yes, China does own SOME of our debt -- about 4% of it. But it would be nice if some media would put the lie to the BS obsession over the federal debt and how terrible it is. The only purpose this serves is to shift public capital to the private sector, the oligarchs at the very top of the wealth heap.

Source: https://www.pgpf.org/blog/2023/05/the-federal-government-has-borrowed-trillions-but-who-owns-all-that-debt#:~:text=Domestic%20Holders%20of%20Federal%20Debt&text=The%20Federal%20Reserve%2C%20which%20purchases,largest%20holder%20of%20such%20debt.