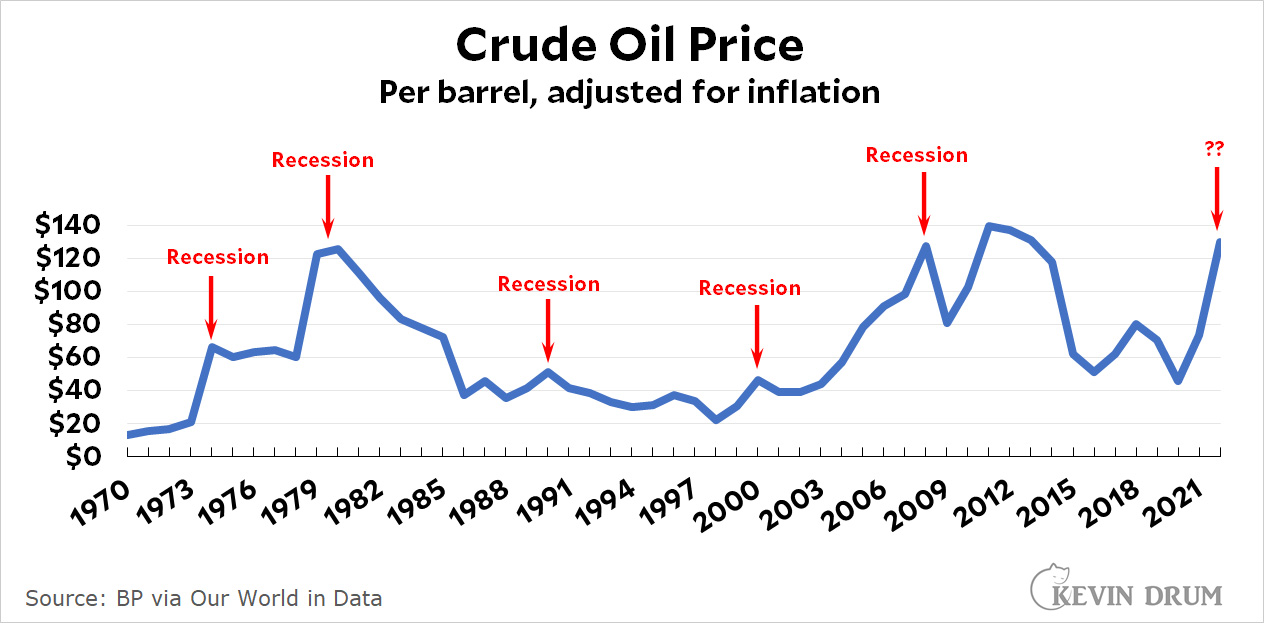

For the past 50 years, spikes in the price of crude oil have been associated with economic recessions. Big spikes are followed by big recessions and small spikes are followed by small recessions:

We are now approaching a very large spike in oil prices thanks to the Ukraine war. If this is merely a short-term response that settles down in a few weeks, it will probably have little effect. But if prices stay high for a while, we should probably brace ourselves for an economic downturn.

We are now approaching a very large spike in oil prices thanks to the Ukraine war. If this is merely a short-term response that settles down in a few weeks, it will probably have little effect. But if prices stay high for a while, we should probably brace ourselves for an economic downturn.

The Fed has signaled that it plans to raise interest rates at its next meeting in order to fight inflation. It's possible they might want to rethink that in light of current events.

It seems like a perfect time for Saudi Arabia to take revenge on America for voting their stooge out of office. Squeeze off a little supply and watch Biden squirm. Jarred Kushner is probably already making the deal with MBS to cut production.

Meanwhile... this is interesting. Maybe we should kill globalization.

https://www.reuters.com/markets/asia/russias-reverse-globalisation-will-test-putin-2022-03-07/

https://www.nytimes.com/2022/03/07/business/cars-russia-china-trade.html

Globalization... Oops. I should go find that famous speech by Bill Clinton from 2000 when he told us letting China into WTO would be great for America. Jackass.

Mr. Drum must be reading Forbes.

https://www.forbes.com/sites/bill_stone/2022/03/06/is-the-us-descending-into-recession/?sh=592cef7f243d

The closest model is the associated stagflation of the OPEC oil embargoes. The Fed will have to pick one or the other: inflation or employment.

Your forgetting increased oil extraction employment. This isn't 1980 anymore. More likely what kind of employment.

Apparently, this oil production flexibility is a right-wing talking point, perhaps because there's an assumption that if OPEC can flex production, so can US. Doesn't work that way. US oil production is done by a shit-ton of rigs producing significantly less oil per rig than elsewhere in the world. Once a well's pump production gets below that of operating cost, it is abandoned and new spots are drilled.

US might be able to expand oil production if it opened up new leases and paused permitting review for new drilling. That's still not going to result in an immediate increase in oil production -- months off.

Cry me a river: Conservatives wanting a muscular response to Russia but without sacrifice. The Modern Conservative is a melting snowflake.

Gee, I wonder why Republicans were falling over themselves to push for a Russian oil ban? The thought of America in recession before the midterms I'm sure has them high-fiving.

And anyone saying boycotting Russian oil is causing prices to go up is just politicizing the war in Ukraine..

How about raising rates and going all in on QE?

Yeah, bizarre--but why not?

------

Here's The Atlantic take on gasoline prices...and number of things come into play. One of the immediate issues is, are people hoarding oil now for fear of shortfalls later?

https://www.theatlantic.com/science/archive/2022/02/why-gas-got-so-expensive/622887/

There would seem to be two, non-trivial spikes for which there are no recession indicated. What is the story there?

thank Obama

Only one of them was during the Obama administration.

They don't fit the hypothesis, so were ignored.

...to be fair, I don't mean to imply that KD's saying oil price spikes always mean recession. He's said only that they appear correlated, and obviously that correlation isn't perfect.

He still needed to/should have explained why those two were contrary to the hypothesis.

Pretty sure that spike in 2008 didn't really have a lot to do with the financial crisis either.

It did have a correlation to the crash, tho. Bubbles begin to rub against each other and something has to give.

High oil prices and inflation, related topics, are politically tricky for Biden. Over the medium term, Biden clearly wants the US (Europe etc) to rapidly move away from petroleum-based energy. The challenge, if one wants to be honest, there are no cost effective, robust (at say the scale of a city) storage solutions currently available. No matter how many green energy (note I am not counting nuclear as green but some will contest this definition) solutions one installs, there are period of time (often measured in weeks or months) that today’s green solutions (wind, solar, hydro, geo thermal) are not sufficient for 24/7 and 365 energy. I have seen no creditable analysis that shows TODAY’S technology able to fully be sufficient for the east coast or mid west during winter.

My point is twofold. NOTHING, can rapidly completely replace petroleum energy if oil prices continue to spike, or say the Russian turn off the gas to Europe. Solutions, measured in the two-to-three-year horizon, are more petroleum (or coal) energy. Clearly, Biden does not want to support non green energy. However, for example, without Russian gas what options does Europe have in the near term?

Venezuela is sitting on an ocean of oil, if you want oil.

Bad oil. Much like US oil.

Your point is irrelevant. Yes, Russia oil can absolutely be replaced. It only makes up 15% of US oil imports.

Yes, the US can replace Russian oil. Now how about Europe?

Sorry mean Europe will struggle to replace Russian gas (oil is much easier to replace).

Yes, they can. Russian oil isn't that much.

Don’t feed the troll.

"Biden clearly wants the US (Europe etc) to rapidly move away from petroleum-based energy. The challenge, if one wants to be honest, there are no cost effective, robust (at say the scale of a city) storage solutions currently available."

I really wish people would stop conflating this. Oil is a transportation fuel; it has almost NOTHING to do with electricity/energy storage. Almost no electricity is generated in the US from burning oil; and while a small (but growing!) proportion of transportation is electric, that's more of a solution to the problem of oil than a linkage between oil and electricity markets (and vehicle electrification tends to drive *down* electricity prices, anyway, since vehicle charging can be done in off hours or during solar peaks to absorb energy off the grid without requiring additional capex investment in transmission and generation).

Russia produces ~11% of global oil supply. That's a lot, but Russia isn't about to stop selling oil. And even if the West embargoed Russian oil, that would just mean that China and India would buy more Russian oil, and less oil from everywhere else, meaning there's more oil from everywhere else to be bought by the West etc.--oil is a global market. Which isn't to say that idiotic and criminal Russian military adventuring isn't going to push oil prices up, but that it's not going to push them up all that much. And, to the extent that they do, that's probably fine: GDP growth has been significantly decoupling from oil consumption since the 1970s (by nearly 60%!), and higher oil prices are just going to accelerate vehicle electrification, which is a very good thing.

And, before you say something about methane supplies: yes, methane is used for electricity. But, methane is very, very different from oil, in that there is not a global methane marketplace, because there are relatively few LNG terminals, and LNG represents a relatively small amount of global methane consumption. So, a cutoff of Russian gas to Europe would bring some pain to Europe (but then again, not that much, since Europe is rich and resourceful), but it's not going to impact the North American gas market: no trans-Atlantic pipelines.

aldoushickman - I agree, in the US, oil is not a major source of our electrify generation. However, when you look globally, combustion turbines (oil fired) are more common.

Further, oil fired turbines have advantages as they can be turned on and off reasonably quickly. Also, without a pipeline LNG (natural gas) is difficult to transport when compared to oil.

Note, I am not saying that oil or natural gas are 'good.' More, at least in the near term oil and natural gas are necessary....

I think with combustion turbines, you are again conflating oil and gas. Only about 3% of global electricity comes from oil (and I'd bet that much if not most of that is backup generators, emergency peakers, and things like military bases or remote grids). CTs mostly burn gas, and are mostly used for fast peaking, as the best CT is half as efficient/twice as pricey as a combined cycle plant.

I agree that oil and gas are not good. But I don't think that they are "necessary" in the short term, unless we're talking about the short term it takes to build something better, given that we already have a lot of fossil fueled infrastructure in place. In the US, total electricity spend is less than 6% of GDP. Very, very roughly, you could increase our spend on the electric sector by a ~fifth every year and build out a decarbonized grid without it impacting economic growth. We're pretty colossally rich, and, unlike decades past, it's not primarily because we use cheap fossil power . . .

aldoushickman - respectfully, assuming you don't count nuclear in the category of green energy, explain how we can get 24/7 and 365 energy with just green power and current technology?

There are times, especially during winter months, that green energy does not produce at high levels. Further, there is no robust storage technology that is sufficient to supply a city for a couple of days.

To be clear, I WISH I believed that we could move to all green right now.....

I was pretty clear to say "decarbonize,"--I'm not for ripping out the nukes (or the hydro--together, nearly 40% of US electricity!) while we replace the fossil.

I'm also not too worried about what are effectively last-mile issues. Half of our current electricity is fossil; replacing that with renewables on just a utility-industry depreciation schedule means that it'll be another two decades before non-dispatchable power hits levels where we need to worry too much about storage.

Which is plenty of time to build more responsive grids, blend solar and wind and offshore wind (all of which have different peaks), scale up battery storage, integrate off-peak vehicle charging and V2G solutions, build some more pumped storage, add in some geothermal, green hydrogen fuel cells, etc. Especially if we as a society decide that it's fine to spend a little more on energy to get the good stuff/avoid catastrophic climate change.

Also: I am not sure why you think you'd need a form of storage that could store enough to supply a city for days--if there comes an event big enough that the wind doesn't blow, the sun doesn't shine, the rivers don't flow, and uranium doesn't fiss for multiple days, electricity is going to be the last of our worries!

At end, I don't think that energy storage is that tough of a nut to crack (after all, living things have been doing it for billions of years!) from an engineering standpoint that we need to be investing in more fossil infrastructure now that we know we're just going to have to rip up in a decade.

Actually, pumped-hydro is cost-effective and robust - Candlewood Lake in western Connecticut was filled in the 1920s. The downside is that there are a very limited number of suitable sites.

People complaining about gas prices, why did you buy a stupidly expensive car that gets 5 miles to the gallon?

Why did you buy an internal combustion car at all?

This is simply obvious, hard, physical evidence that we need to replace petroleum in every application.

omg! screams the pretend to be panicked, That would be hard!

Well it is not as hard as Putin's dick, is it?

I'm rather enjoying all the suffering of owners of F-150s

Schadenfreude is enjoyable.

The modern F-150 is still much more energy efficient than the old ones. THANKS OBAMA.

Some of us have legitimate use-cases for our trucks that aren't just point A to point B.

I'd also wager that people with legit use-cases for trucks probably aren't going to complain about the cost of gas for their trucks.

Then they can pay a pollution tax.

Meanwhile, here's Ford's electric pickup,

https://www.ford.com/trucks/f150/f150-lightning/2022/

It has a gizmo that automatically maps out your route to always be within range of a charging station.

Re: Why did you buy an internal combustion car at all?

Electric vehicles are hellishly expensive, and are impractical on longer trips.

"Electric vehicles are hellishly expensive, and are impractical on longer trips."

Not so pricey when comparing new EVs to new gas-powered, and they are actually cheaper overall when you think lifecycle (electricity is way cheaper than gas, and EVs require much less maintenance than ICE counterparts, because they have far fewer moving parts). Fair point--to a point--if you are just looking at the used market, though.

W/r/t long trips: the number of people who routinely have to drive for 5+ hours without stopping represents a pretty niche use case.

The point is: don't buy new.

I have the distinct impression Kevin's commentariat average six digits for their incomes. Electric vehicles are out of the price range of a huge fraction of the US population. Heck, they're out of my price range and I;m doing quite well. (And I just paid off my 2015 Jeep and I hope not to have to buy another car for many years. Oh ,and I bike as much as is practical.)

No they aren't,

Cheapest electric vehicles,

https://www.edmunds.com/electric-car/articles/cheapest-electric-cars/

Charging station map, and there are more being installed every day,

https://chargehub.com/en/charging-stations-map.html

Ownership costs over lifetime of the vehicle substantially cheaper,

https://www.consumerreports.org/hybrids-evs/evs-offer-big-savings-over-traditional-gas-powered-cars/

and there's more all the time.

Cheapest EV is an ebike.

Those sneakers with flashing lights.

edit: remove last line.

Long trips... I see we are still in denial. You can't have both. That world is fading away. Please begin coming to grips with this future.

I'm not being flip here. I think we are all trying to imagine what modern life looks like when fossil fuels are not cheap and readily available. So... what would it mean to you if "long trips" for things other than freight were prohibitively expensive or impractical?

Electric vehicles are hellishly expensive, and are impractical on longer trips.

I'm no expert. But I think this is due to the lack of maturity and competition of the EV sector in the US. Here in China, a simple EV can be bought for less than a gas-powered vehicle. Which makes sense, I think: all the high grade metal required to handle the explosive force of internal combustion has to be pricey. By contrast cheap electronics are, well, cheap!

Not in 2010+. Part of the reason is online shopping. Let Bezos eat some of that cost for example.

This spike is toast anyway. Once oil is rerouted, the traders will be forced to reduce prices.

Another reason is higher oil prices increase nonresidential investment and push jobs into flyover country. Boosting growth. We see this in 2010-14.

Why would higher prices push jobs into areas where there's less public transportation and often enough more sprawl necessitating even more driving?

Don’t feed the troll.

You need a finger snapped. Higher prices translate into more mining/drilling which feeds into higher Midwestern factory orders. You are retarded

...and you're a bigot.

Oil extraction but mostly - it doesn't. Recession does. Recessions push people to seek cheaper housing if they're no longer attached to work.

He's right. The metal bashers of the Great Lakes did well out of the fracking boom (all that drilling machinery), but a dip in oil prices led to semi-recessionary conditions by late 2015. This was the difference maker in enabling Trump to flips Michigan, Pennsylvania, etc in 2016.

An increase in food and energy prices (ironically) might actually help Democrats in the the interior.

Kind of simplifying on my part but when conservatives complain about inflation I suggest increasing taxes to pay the debt down. That never really takes, however.

Crazy high oil prices will do the same thing in a less good way.

The other thing is, I don't doubt for a second that Putin gamed this out in his invasion plans. A few billion for him is a lot easier to stomach than $5/GAL is for the average American.

Even if that had taken, it wouldn't do anything as the debt doesn't really have anything to do with inflation.

Reducing the amount of money by raising taxes would tamp down on inflation, though. We could spend that on other stuff besides just running smaller deficits, too...

I honestly think it's more likely that Putin's inscrutability are rooted more in linguistic/cultural barriers and his age, isolation, and temperment than him being some sort of supergenius supervillain thinking five moves ahead with a keen insight into the American mind.

Indeed, on balance, he seems to be making a lot of stupid and poorly-informed decisions, which is more in keeping with him being a run-of-the-mill autocrat. Sure, autocracies can do things quickly and unpredictably, but that's not because they are strategically brilliant--it's just that there's nobody to say "no" to the foolhardy things El Supremo comes up with.

Absent firsthand knowledge, you have to go with base rates. And there is a lot less 11-dimensional chess played in the world than there is stupid.

That's sort of how I look at it, too.

Think of how difficult the job of being the U.S. president is. Now, treble the scope of responsibility, cut in half the quality of information received, reduce by 80-100% the dissenting voices and feedback you hear, and amp up tenfold the paranoia (about being assassinated, or overthrown, etc.)--that's basically the situation for an autocrat of a mid-sized country like Russia. How many senior citizens do you know that could do that job for years on end, not just passably (or more realistically white-knuckling it), but skillfully and masterfully enough to be playing 11th-dimensional geopolitical chess?

Stupid is easy; smart is hard. It may appear to most of us that predicting and planning for the future is difficult, but that's because we more-or-less automatically take dumbass moves off the table. A person in a dead end job might congratulate themselves for upending the future by torching their own house, but it's plain to see that was a foolhardy move; Putin is more likely a self-arsonist than a visionary.

In a sane world, political leaders would bill this as a clarion call to phase out petroleum fuels. You still drive that big SUV? Do you get a kick out of paying the big bucks every week just to keep your vehicle going? How do you like supporting an autocrat who invades neighboring countries? Do you care nothing for the environment that your children and grandchildren will inherit? Be patriotic! Go to electric, renewable energy sources!

These particular arguments will, of course, fall upon deaf Deplorable ears. Another spin will need to be devised for the trumpy folks.

I think just the opposite, with the disaster in Europe appeals for general electrification and the elimination of internal combustion engines as expressions of patriotism and independence, personal sovereignty and integrity, will find a wide audience.

Non oil related, but halting goods into Russia will create a inventory build up. A we bit of deflation.

Very wee. Russian imports are on the scale of $250 billion per year, or about 0.3% of global GDP.

It's hard to overstate just how economically insignificant Russia is.

But inflation was 4.7% in 2021 so 0.3 is over 6% of the total.

Even if Russia stopped all imports (which it won't--imports are likely take a hit, but nowhere near cease entirely for a whole year or more), that's still a tiny amount of global commerce. You'd have to look carefully for it at the macro level, and even then, you might not notice it among all the noise.

But, more to the point: firms making the machinery, chemicals, and food that was destined for Russia were doing so because that was the lowest cost thing for them to do; retooling, rerouting, repackaging, recontracting, and remarketing those goods will cost more money, not less.

The Fed, not oil price or inflation itself, was responsible for the recessions of the 70's and 80's. If the Fed raises federal funds to the insane levels of the 70's and 80's we can expect recessions, but otherwise the economy will probably depend more on other factors than oil price. Oil price went high in 2008, but the following recession was a result of the collapse of the housing bubble which was caused by banks running wild. The US economy is actually less dependent on oil price than it was 50 years ago.

Not that there is no danger of financial collapse and recession, as stock and other speculative prices are still at very bubbly levels. Who knows what specific overextension by big banks and finance will collapse, perhaps because of bad international news?

The Fed failed to prevent inflation in the 70's and 80's, despite setting interest rates very high for years on end. Why is it assumed that it could conquer inflation now? This is an aspect of conventional economics which is just fantasy.

Oil price went high in 2008, but the following recession was a result of the collapse of the housing bubble which was caused by banks running wild.

Oil was spiking in 2006-2007 IIRC.

It's certainly the case that this spike wasn't the main cause of the Great Recession. But I think it did accelerate its arrival (or help precipitate the crisis) in the US. And that's because the most financially vulnerable, highly leveraged households—the ones whose mortgage defaults were beginning to multiply as the crisis approached—in many cases were the same households who were buying in the furthest-out, most "affordable" suburbs. Most affordable, that is, until their commuting bills skyrocketed. For many such households, I suspect gas prices were the straw that broke the camel's back in terms of their already strained finances.

Then the foreclosures started. And we were off to the races.

Vladimir Putin and the Fourth Reich,

https://www.rawstory.com/aleksandr-gelyevich-dugin/

It's good that you adjust the prices for inflation but think you should also have included a graph showing the ups and downs of energy costs as percentage of GNP. I believe over time they've decreased from around 8 percent to less than half that.

I'd suggest including as similar graph whenever you graph food prices.

"If there is one overriding emotion gripping Ukraine right now, it is hate.

It is a deep, seething bitterness for President Vladimir V. Putin, his military and his government. But Ukrainians are not giving a pass to ordinary Russians, either, calling them complicit through years of political passivity. The hatred is vented by mothers in bomb shelters, by volunteers preparing to fight on the front lines, by intellectuals and by artists.

The emotion is so powerful it could not be assuaged even by an Orthodox religious holiday on Sunday intended to foster forgiveness before Lent. Called Forgiveness Sunday, the holiday is recognized in both the Russian and Ukrainian Orthodox churches.

And this hatred has overwhelmed the close personal ties between two Slavic nations, where many people have family living in both countries."

I feel it with them.

https://www.nytimes.com/2022/03/07/world/europe/ukraine-putin-hate.html

I'm confused about the direction of causation here.

Some of those "spikes" aren't particularly high. So does the chart show that run-ups in oil prices lead to recessions, as Kevin seems to be arguing?

Or is it that recessions lead to drops in oil prices, so that a spike becomes apparent (because of the downslope) after the recession is underway?

Hearing whispers of Putin removal soon. My guess back channels are already starting.

Raising interest rates gives them space to lower them. They should have raised them once it was clear inflation lived into the first quarter.

Should be obvious that 1) rising fuel prices will constrain spending on other goods and services, since historically Americans reduce miles driven very little, and turn down thermostats little, in reaction to higher fuel prices; and 2) raising interest rates can’t reduce the pseudo-inflation caused by exogenous supply constraints.

3) as Americans and Europeans spend more on fuel and less on other stuff, price-index rises ex energy will decelerate.