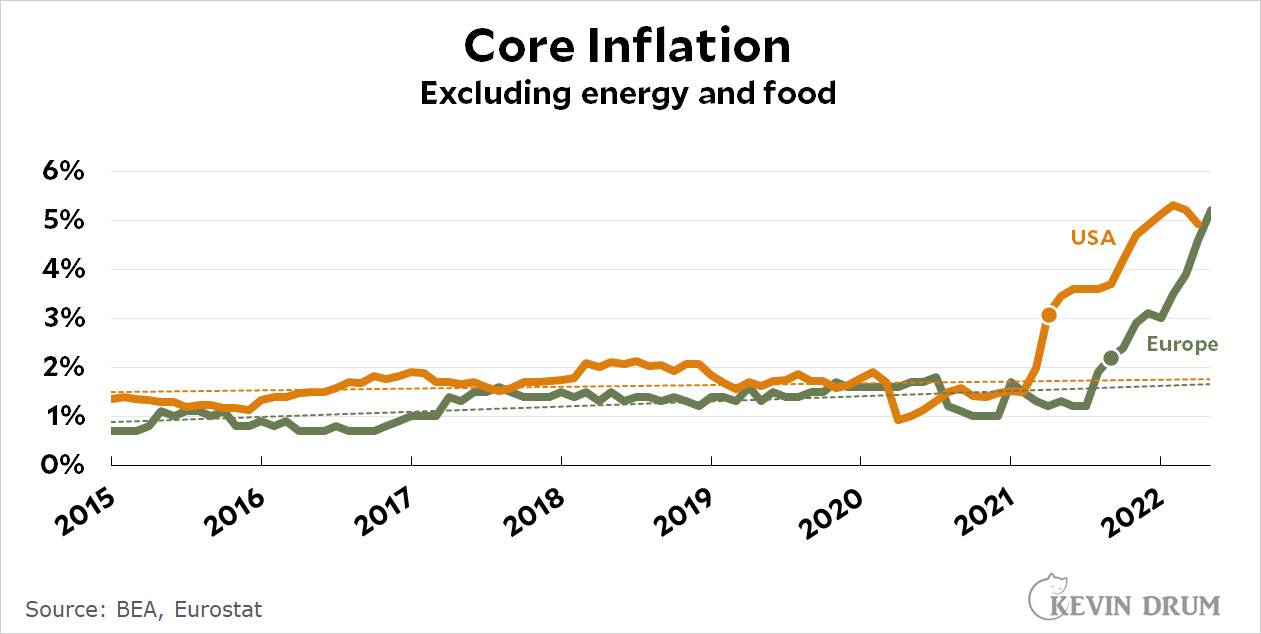

The chart below shows core inflation for both the US and Europe:

For the US I used the PCE price index excluding energy and food. For Europe I used Eurostat's HICP index excluding energy and unprocessed food. Since these are core inflation rates, they are unaffected by differences in oil spikes, Ukrainian food blockades, and so forth. This is just plain, underlying inflation.

The two markers show when core inflation first jumped more than half a point above its trendline. For the US that happened in April 2021. For Europe it happened in September 2021.

Given the timing, it seems likely that the initial surge in the US was prompted by the $1.9 trillion American Rescue Plan, which produced higher consumer spending for a few months before the flow of money stabilized. Then, in September, inflation surged again in both the US and Europe even though consumer spending was pretty flat. Given this, I would apportion the causes of core US inflation like this:

- Underlying inflation: 1.5%

- ARP: 2%

- Supply chains etc.: 1.5%

In Europe, it's more like:

- Underlying inflation: 1.4%

- Supply chains etc.: 3.8%

I've done this calculation a few times before using different data, but it always comes out about the same.

So here is my surprising conclusion: ARP has run its course, which is why core inflation has softened over the past couple of months. That will eventually leave us with core inflation of about 3.5%, which will decline as consumer spending eases and supply chains open back up.

Europe is a different story. They apparently handled supply chain issues considerably worse than we did, and that's pretty much the sole source of their surge in core inflation. It will not start to decline until they fix this.

In addition, both the US and Europe are suffering from an additional 3.6% inflation thanks to soaring food and energy prices. This is likely temporary, and in any case there's very little that policymakers can do about it.

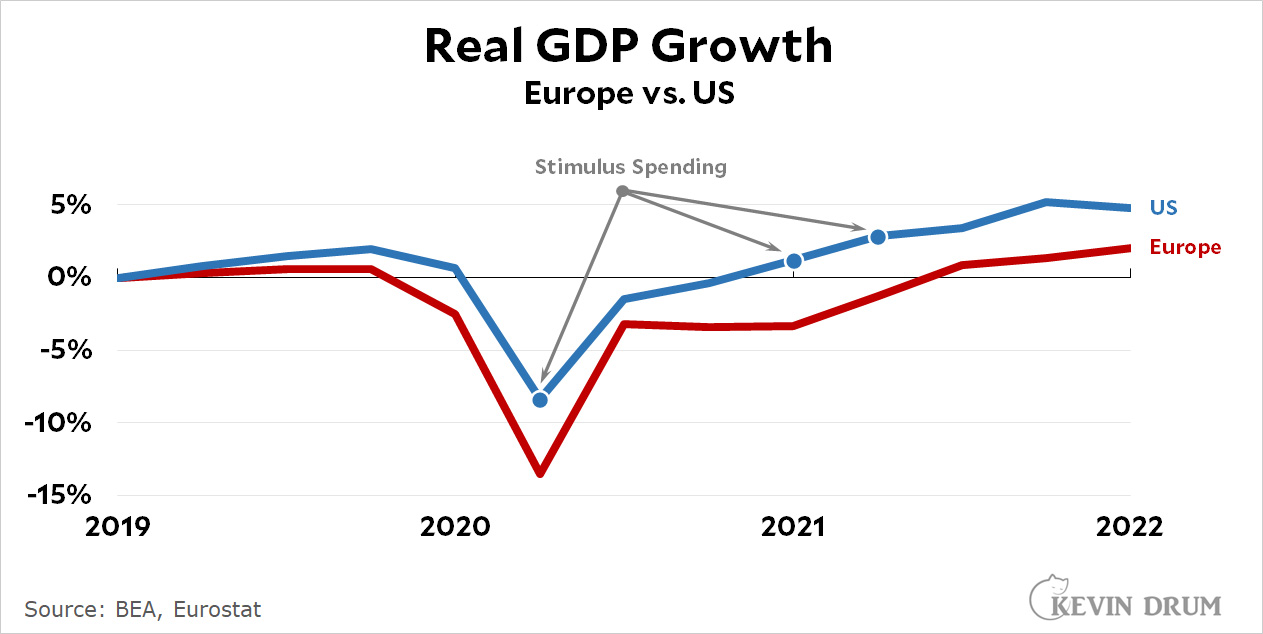

Bottom line: Despite our endless whining about it, the US handled its supply chain issues pretty well. And while Joe Biden's spending package may have created some additional inflation, it was temporary and it gave the economy (i.e., actual American people) a boost when things looked bleak.

Europe, by contrast, appears to be suffering much worse from its handling of supply chains, and their economy is more sluggish than ours because we were more generous with stimulus spending (in March 2020, December 2020, and March 2021).¹ We might not have been perfect, but which place would you rather live in?

¹Europe didn't need as much stimulus thanks to its relatively strong safety net. Even so, they were too stingy with stimulus spending. In the end, this stinginess hurt their economic growth and didn't help them with inflation, which is currently higher than ours.

Supply chains are global, so inflation somewhere will increase inflation everywhere unless their are swings in exchange rates.

And the blockage of the Suez Canal hit Europe more than the US--curious if that increase in inflation in 2021 months afterwards was a delayed response...

This is a good explanation by Kevin, showing how Biden is not really killing the US by doing something or other or by not doing something else about inflation.

Now it will be up to Kevin to explain this to the media and the American public - or at least set out a detailed plan for how Democratic politicians can get the message across.

Russia is the biggest threat to world stability right now. Let's fix the energy picture by cutting a new nuclear deal with Iran which will allow them to start shipping oil again. The Israeli's won't like it, but they've got plenty of means for protecting themselves. Ditto the Saudis. And screw both of them anyway.

Opec will go back to normal. Oil is already down due to increased shipments. I suspect another run down in early July creating disinflation over the top for the rest of the year.

Iran is toast. They are making the bomb.

Eyeballing the chart....it certainly like the majority of the 'ARP inflation' occurred before any ARP money was distributed. Thats.....hard to understand.

Assigning inflation to individual causes is an exercise in assuming the conclusion.

The inflation in the US and Europe looks pretty close to identical except for Europe being a few months behind.

For a while, when US inflation outpaced that in Europe, Europeans claimed that their policy of paying employers to maintain jobs worked better than the US universal covid relief payments. All that seems moot now because, apparently, neither strategy was the main reason for the rise in inflation.

Oops! Please disregard comment above.

Follow change in M2 money supply in terms of 2020-22 percentage of growth. Due to the 3 covid packages, it surged peaking in the summer of 2021. Now it has fallen down below the early 2010's post financial crisis bump.

We might not have been perfect, but which place would you rather live in?

Do I get to choose which European country?

Since food and fuel are necessary discounting them is a terrible idea. I'm not saying you shouldn't look at core inflation but it's not going to make things less hard for people.

Though it does look like the fed has noted this and plans to cool down on rate hikes.