As you know, I keep asking what it is, precisely, that's causing our current round of inflation. What are the underlying economic pressures that are permanent enough that they won't go away unless the Fed drives us into a recessionary ditch?

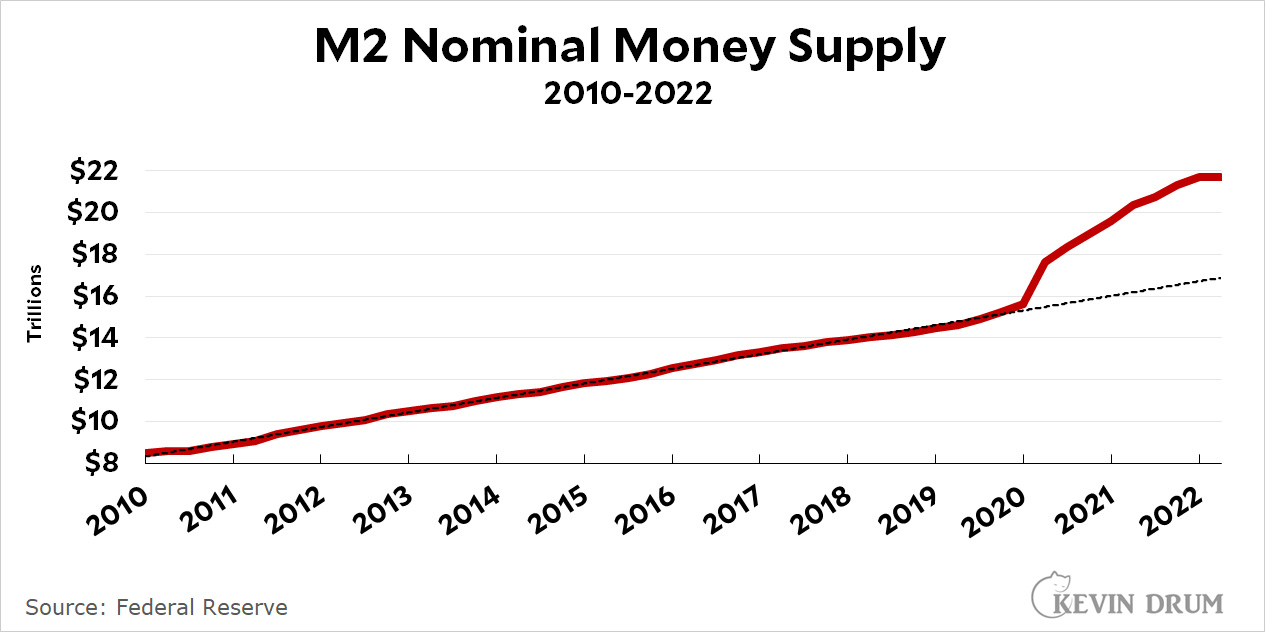

A couple of days ago I was looking at the money supply, and today Tyler Cowen mentioned it too. So here it is:

Unsurprisingly, there was a big surge in M2 at the beginning of the pandemic as we spent money to avoid a recession. But this doesn't tell us very much. As Tyler mentioned, you also have to adjust for the velocity of money. If you have more money, but it's changing hands more slowly, then effectively the money supply might be stable.

Unsurprisingly, there was a big surge in M2 at the beginning of the pandemic as we spent money to avoid a recession. But this doesn't tell us very much. As Tyler mentioned, you also have to adjust for the velocity of money. If you have more money, but it's changing hands more slowly, then effectively the money supply might be stable.

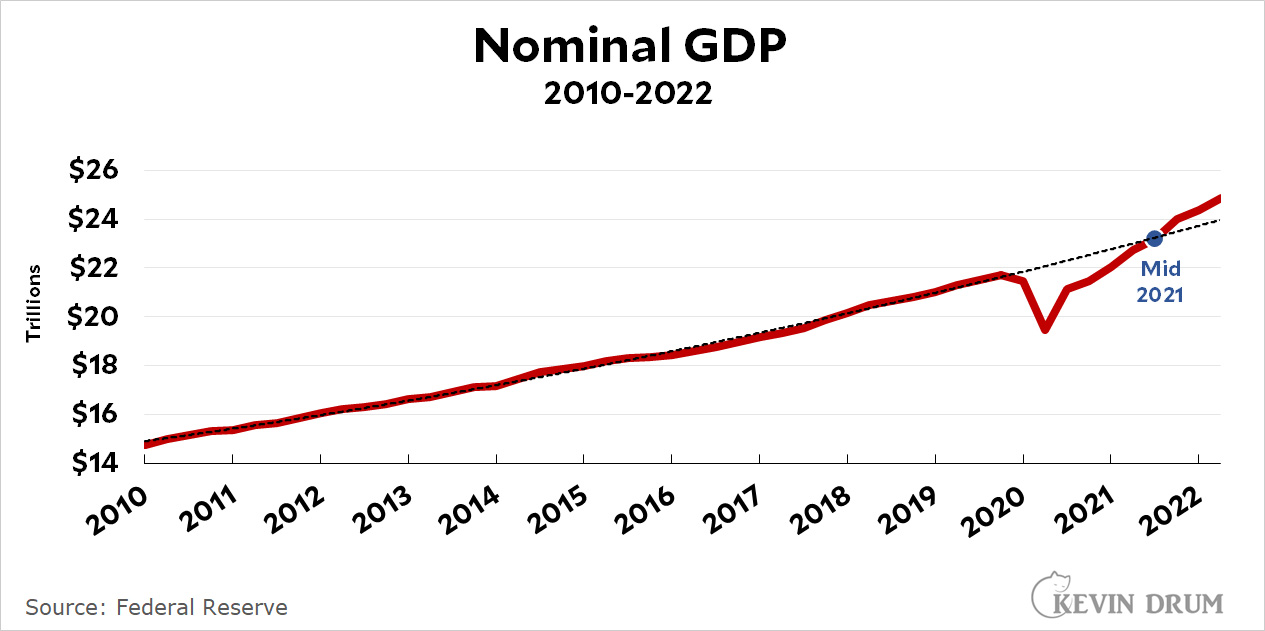

So let's take a look at M2 adjusted for velocity:

That's right: if you multiply M2 by velocity, you get GDP. So now we're in the territory of the NGDP-level-targeting folks. If you take them seriously, we're now a bit above our target level so the Fed is doing the right thing by reining things in.

That's right: if you multiply M2 by velocity, you get GDP. So now we're in the territory of the NGDP-level-targeting folks. If you take them seriously, we're now a bit above our target level so the Fed is doing the right thing by reining things in.

But despite lots of PR, the idea of using NGDP level targeting to control the economy has never gotten anywhere. Fine. Then what combination of M2 and velocity should we keep an eye on? I don't know, and that's why I didn't write about this earlier. It seemed like a dead end.

Still, despite all this you might wonder what we see if we look at plain old M2 by itself. Answer: M2 began to surge in March of 2020 while inflation started to surge in February of 2021. That's about a one-year lag.

M2 stopped surging in January of 2022, well before the Fed began raising interest rates. If it's still working on a one-year lag, inflation will respond in January of 2023 without the Fed having to do much of anything.

Speaking for myself, I have no idea whether or not to take this seriously. Even the inflation hawks never talk about money supply these days. But these are the figures. You can decide for yourself if they're meaningful in any way.

Once Capital and its mouthpieces/apparatus feel comfortable again will the rest of us go back to normal anxiety.

Just gotta turn your head and squint the right way and you can justify more cheap money…

I'm definitely not an econ guy, so most of this blog entry... zzzzz.

This part caught my attention though "Even the inflation hawks never talk about money supply these days." What is he referring to? Isn't that all anyone's saying? That we dumped too much money into the economy?

Clearly, being a conservative makes me a "troll" for many on this site, but this is a real question and I'd love a reasonable discussion on it...

Of course, I've come to expect an occasional FOAD by now. haha.

If you were around during Volker and Greenspan you’d understand what he is saying. Back in those whenever M2 was announced the markets would move. Too high and tightening was on the way. Way down and an ease was forthcoming. Today no one gives two shites about it- traders, the general public and most importantly the Fed.

Didn’t at one time have the ability to edit and or delete a post?

Sorry for the mostly duplicate post. Barely worth one and certainly not worth two!

If you were around during Volker and Greenspan you’d understand what he is saying. Back in those days whenever M2 was announced the markets would move. Too high and tightening was on the way. Way down and an ease was forthcoming. Today no one gives two shites about it- traders, the general public and most importantly the Fed.

People do say that the pandemic ‘rescue plan’ or ‘stimulus’ put too much money into the economy, though I have never seen any reportage that nets out the lost wages, salaries and business revenues the government money was intended to replace. But economists, who once paid a lot of attention to the particular measure designated M2, don’t anymore, because it turned out not to be a very good predictor. As I understand it, M2 measures privately held cash and demand deposits. I don’t believe any of the usual measures (M2, as the numeric suggests, is just one of several) take credit lines into account. Consumer debt is rising faster than trend - https://jabberwocking.com/recession-is-coming/ - when a credit card is used, or a HELOC is tapped, the money actually spent is counted, but the difference between the account balance and the credit limit is not, even though it can be spent as readily as money in a checking account. If I understand this all correctly, this would certainly tend to wash out some of the predictive power of M2.

@KinersKorner

@KenSchulz

Definitely appreciate the response and you're definitely much better economists than I am! haha.

Literally, here's my simple analysis:

-People get "free" money. They go spend it. (Crypto, comics, baseball cards, used vehicles, etc. went nuts)

-Also, in regards to housing/rent, rates were super low (had to be artificially low - for years- no? You'd know better than I). Anyway, "I can borrow money at low fixed rates, so I'll go buy. Oh, other people are buying like crazy too..." Prices and demand go up, but not enough supply. Then, "Hey, I need to charge $1800/mo on this to make any money... time to raise rents".

And, sorry for the book, but what are your thoughts on this somewhat related topic?:

- I really feel like rent control completely screws over young people. It removes so much inventory that owners have to charge over the odds for new, open rental properties. I mean, people are buying properties with the expectation of having to either lose money every month or pay people large sums of money to move so they can bring the units to market rent all in the hopes of someday making money through appreciation.

I get that the current tenants are making out like bandits, but it's such a killer to the young that want to stay in the area. Also, it's gotta cause owners to neglect their properties, I'd think. They have every incentive to be slumlords to get their tenants out...

Just curious for a well-reasoned response (assuming you disagree).

Thanks again!

Well, ask me a well-reasoned question, and I’ll give you a well-reasoned answer. Ask a loaded question, get scolded.

People don’t collect used cars as a frivolous hobby, people bought used cars because the supply of new cars was disrupted by the pandemic; and our built environment leaves many people needing cars to get to work, shop for groceries, etc.

“current tenants are making out like bandits” - Rent control is too far OT, but citation needed …

The problem with the money supply=inflation argument that nations that are not tied to the Fed or to the dollar also experiencing high inflation, which means the Fed learned absolutely nothing from the 1970s commodity driven inflation which seems to be what's happening worldwide now. Of course the other unspoken part of this is a failure/feature of capitalism. The news reports rising prices, so even sectors that don't have rising costs, increase their prices because it's already baked into the consumer psyche that things will cost more. The inflation spiral continues until the Fed crashes the economy and then we repeat the whole thing in a couple of decades.

I totally get what you're saying, but wouldn't they be forced to follow our inflation in the sense that they're probably forced to buy many of our products and services?

If US exports were more than less than 1% of the global economy I think it might, but they're not and therefore it's hard to imagine they're driving worldwide inflation.

Ho hum. Friday can’t get here soon enough. What have Charlie and Hilbert been up to?

The formula:

V = PQ/M

Where:

V = Velocity of Money

PQ = Nominal Gross Domestic Product

M = Money Supply

That is, velocity is a fudge factor that relates the money supply to GDP. Theoretically velocity is determined by how often money changes hands, but that is not something that can be measured accurately.

The Fed tried mightily to control the money supply by fooling around with interest rates in the 60's through 80's but the result was a fiasco. Look at the growth rate of M2 at FRED. To talk about this might be embarrassing. Also look at the growth rate of the CPI (inflation) - that was not controlled either, yet economists still believe that the Fed controls inflation with interest rates. Economist have their own alternate reality on some subjects.

A stronger dollar produces cheaper credit.....which can push money velocity higher as interest rates push business to seek long term profit over short term profit aka less stock buybacks, more investment.

As always, it would be interesting to hear the explanation for how surging M2 in the U.S. causes inflation in Europe and Asia.