I'm not an economist with a sophisticated macro model or anything like that, but even before this week I thought that a recession was almost inevitable. Here are the basic reasons why:

- The economy has been propped up by COVID-19 spending for a while, which is a good thing. But the last stimulus bill passed 15 months ago and is now fading out.

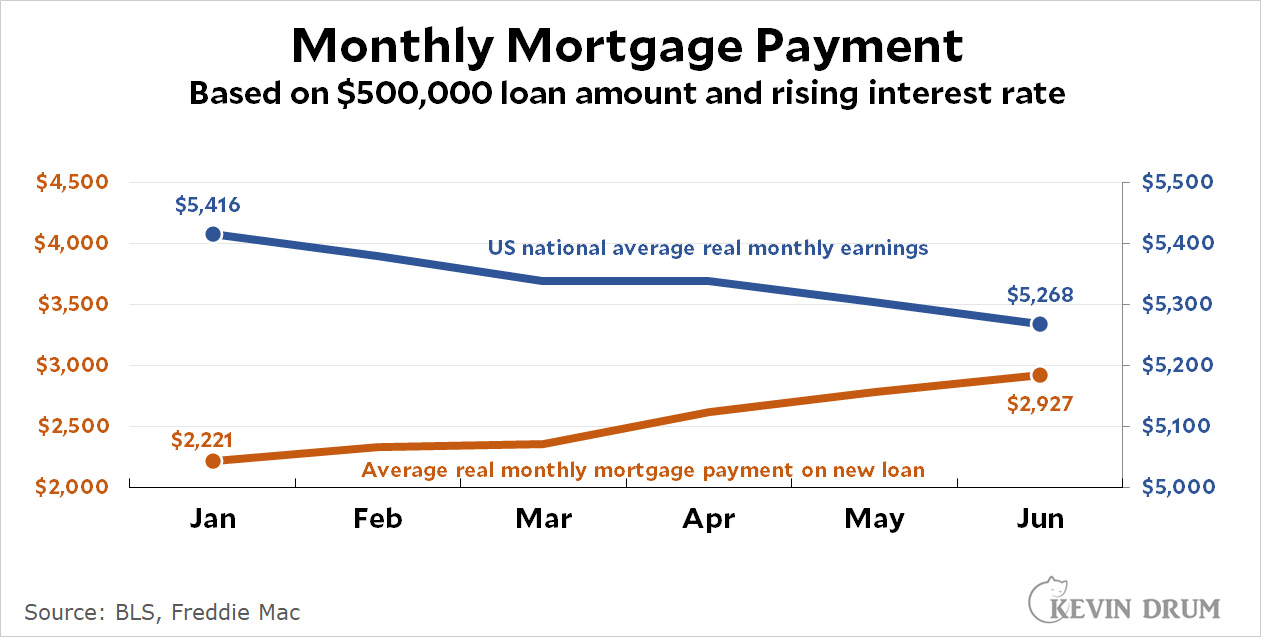

- Skyrocketing mortgage rates are going to squelch the housing market. This has a big effect on consumer spending (via the wealth effect) and on the residential construction industry—and it's happening at the same time that average earnings have been falling.

.

- Consumer spending has slowed down in 2022 and is now nearly flat.

- Companies that expanded recklessly during the pandemic are now finding that they have to cut back. Amazon is Exhibit A here.

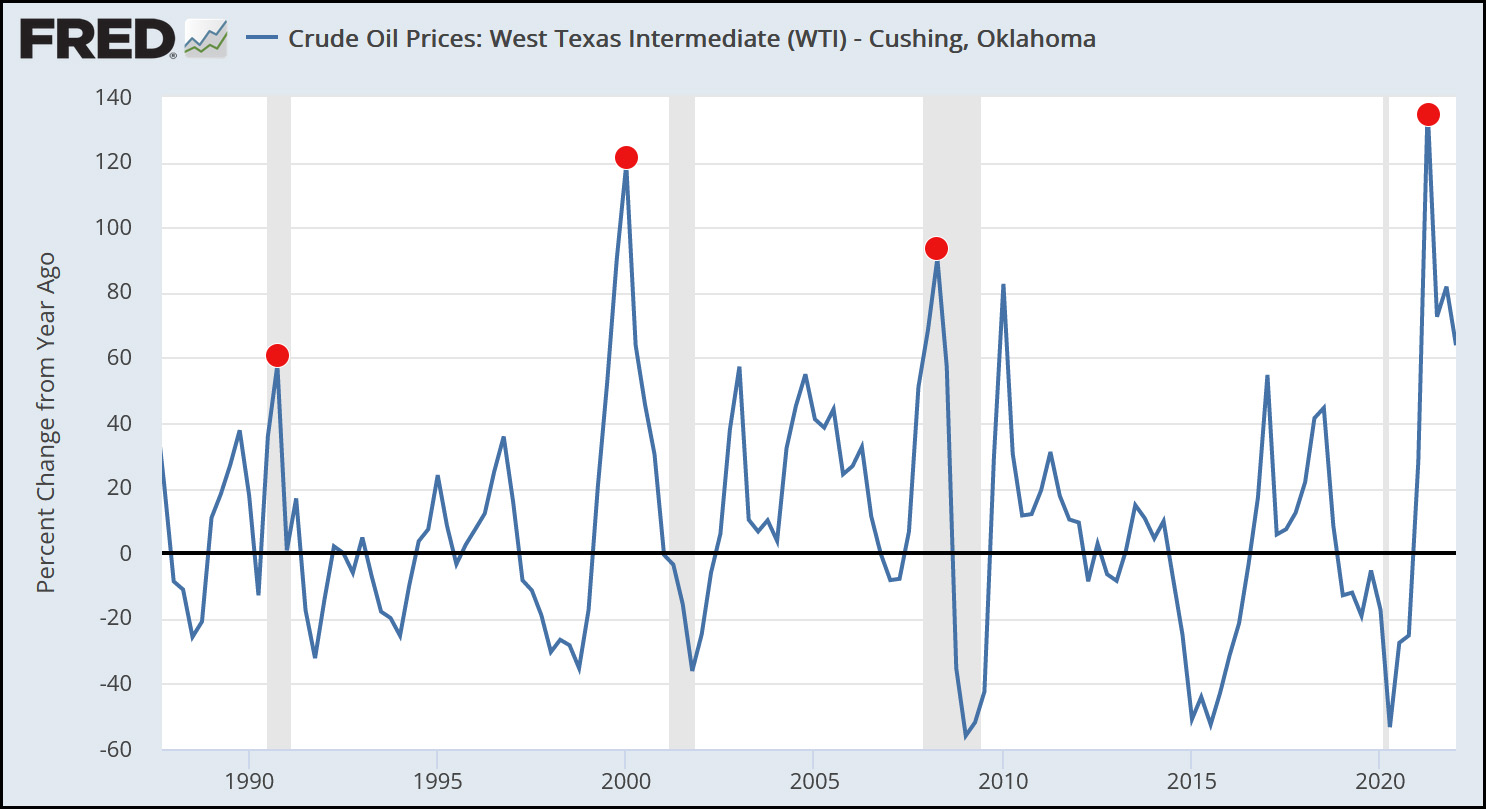

- In 2021 we had a huge spike in the price of oil. This is usually enough, all on its own, to produce a recession within a year or so.

.

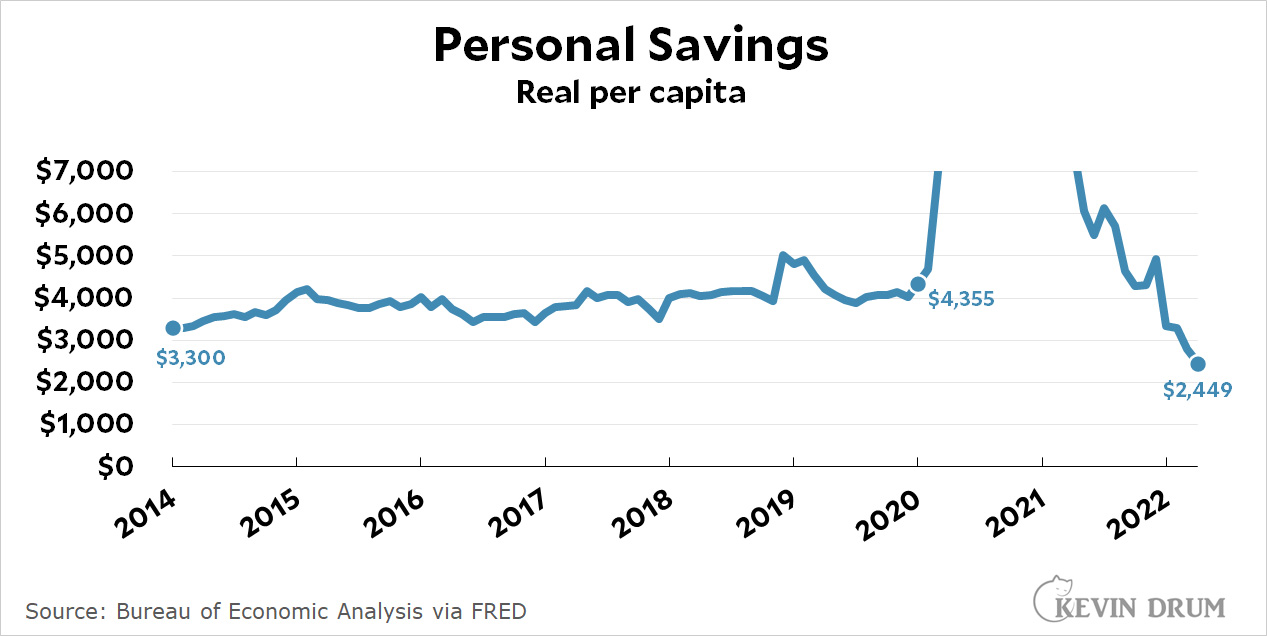

- Personal saving has dropped below its normal pre-pandemic level and consumer debt has risen above its normal level. Neither one offers any kind of buffer anymore.

.

All this was enough to push us into a downturn already, but then the Fed decided on some "shock therapy" that will almost certainly be enough to finish the job. Both the stock and bond markets have delivered their verdicts on this, and it's hard to see what can stop an oncoming recession now.

I'm not sure if I'm the last holdout on this or not, but I continue to think that inflation would have subsided on its own as the economy slowed, oil prices dropped back to normal, and supply chains eased. The Fed just needed to stay the course. Instead they panicked and decided a recession was the only way to attack high prices. And all because the May print of an inflation index they don't care about was 0.04% higher than March and therefore a "record."

The only good news here is that, to my eyes anyway, the economy is still in decent shape and we can probably count on a mild recession. Assuming, that is, that we don't panic even further.

Service people demanding raises? Workers changing jobs? The whole fabric of society was in danger!

Why would oil go back down?

It won't - not until one side or the other blinks over Ukraine and its related sanctions.

It already has. As builds increase, more pressure on price. A July intervention to destroy oil revenues to Russia may be coming as well.

Also, Saudi Arabia is purposely reducing output to keep prices high and stick it to the Biden administration. Things were so much more fun in the KSA with their Trumpy buddies in the WH. No uncomfortable questions about proxy wars, political assassinations, etc...

That is doa as well.

Thank you Fed. May I have another?

So you can be certain to ask each of them: https://en.wikipedia.org/wiki/Federal_Reserve_Board_of_Governors#Current_members

The Fed was going to crash the economy no matter what. That's what they do. Ever since the late 1970s, Fed policy has been to keep economic growth from raising living standards, and they've succeeded. As soon as the benefits of an expansion start reaching into the bottom 20% of households, the Fed crashes the economy and does a reset.

Are you trying to say that living standards (quality of life) haven't improved since the late 1970s? That's absurd.

Living standards have improved, but it's largely because consumer goods are a lot cheaper than they were 40-50 years ago thanks to offshoring to Asia, not so much because workers are earning a lot more in real terms.

But the stock market already priced in the last increase, so they had to follow through....

Yes, inflation would have subsided on it's own eventually. I didn't mind some raises--punctured some bubbles that needed puncturing (crypto anyone?). Last rate hike was a bit too steep--the Fed should stand pat for a while, if not drop rate a little bit. And of course there's all that quantitative easing that's being unwound too....

"This is usually enough, all on its own, to produce a recession within a year or so."

Please. The oil price spikes in 1992, 2000 and 2008 had very little to do with the recessions that occurred around those times. Two of them happened after the recession started!

Drum you are profoundaly and utterly wrong on the inflation issue, as broad international data has reflected not cooling but accelerating (and your and other "oh it is calming now" readings are eery reruns of the same errors the Left made in the early 1970s). Of course there is no convincing you or the readership here, so ... well just baffling how you lot are repeating the intellectual errors of the 1970s Left

The political side in any case, it is far better for you to have a mild recession circa 2022-23 and cool down inflation than allow accelerationg via the 1970s reminiscent 'it is just passing' stories you're telling yourselves. Then your Democrats can be in line for a cooler 24 rebound.

Whereas your preferred transitory story inflation-minimising to denialism will see ongoing acceleration with expectations coming unmoored and you end up in more a Jimmy Carter 1979 position for 2024.

Come back when you actually have an argument.

Note: shouting "Jimmy Carter" is not an argument.

+1

Real argument, very amusing, regretttably the audience here is too innumerate and economically iliterate to know what a real argument is.

Of course observing parenthetically that having a political position like Mr Cartin in 78-79-80 is not desireable and being in a rebound situation is better, is not "shouting" Jimmy Carter. Although the histronic exaggeration is a fine illustration of the strawmanning response that boils down to Left-Left Lefties are upset their punch bowl is being taken away and are so deeply bought into denialism that they are blinded to the political penalty in real world. A sort of queer inversion of the Right-reactionaries making the inverse error for the past 20 years and seeing inflation when it was not there.

Political ideology and motivated reasoning over econometric data.

Otherwise one can review completely not Rightty side discussion in re Inflation such as chez Brookings (https://www.brookings.edu/blog/up-front/2022/06/10/5-key-takeaways-on-inflation-from-the-may-cpi-report/). This should be simplfied enough for this readership, although overcoming motivated reasoning and ideological blinders....

Otherwise it is sad to see Drum falling into this, and talking about Fed or CBs panicking, when the move was well signalled and came in-cycle. One sees CB panic when they take out-of-decision cycle rate increases (or decreases). That's panic. It could be 750 basis points is too much, but that's correctible if data begin to show that. With sustained global inflation acceleration, however, spending another 9 months waiting for Temporary is a foolish replication of the 1970s policy errors that led to stagflation.

Pity Drum normally quite good with data, but here the combination of political hurt, as well as superficial and too limited understanding / focus of the econometrics in inflation analysis leads him to foolish error.

'I know plenty math' is drunk-posting again I see.

Thanks for the link; it perfectly illustrates what I’ve been saying here: No one has put forward a mechanism that would drive continued inflation, let alone accelerating inflation. No one in that Brookings post. Not you. Not our inflation-hawk fellow commenter Dana Decker. Not Justin Wolfers (an economist I actually have a degree of respect for), who notes that this current period of inflation is not driven by wage pressure. But, he offers helpfully, “one day, somehow, the experience is that your wages are going to catch up.” Somehow. That’s not simplified, it’s vacuous.

If you're so sure that the current inflation is part of a longer-term, structural economic problem and not a direct result of the pandemic (and rapid recovery) disrupting supply chains and labor markets, please explain. I'm willing to entertain the idea that all this really started with Trump and McConnell ramming through a huge, deficit-busting, tax-cut package for the wealthy (on top of a bunch of tarrifs on Chinese goods) while the economy was still at full employment. The issues caused by the pandemic merely added fuel to an inflationary bubble engineered by Trump.

For what seems like the hundredth time, I am asking for one of you inflation hawks to identify the mechanism (positive feedback) which is acting to sustain inflation. Because if there is no such mechanism, and price increases over the last year-plus are the effect of the pandemic, limited-time stimulus payments (partly offset by wage losses during pandemic shutdowns), and the war in Europe, as many commenters here have argued, then prices will stabilize as these time-limited factors plateau or decrease.

KenSchulz - there are several items that that are core expenses (both goods and services) that are rising rapidly: I limit my comment to things that are broadly used and the inflation is more about triple the inflation target of 2%.

- apartment rent

- transportation and heating fuel

- dairy

- beef and chicken

- fresh fruit

The list would be much larger if you just looked at items rising twice as fast as target inflation.

Observing is a good thing, but it isn’t yet understanding. Lumber prices started shooting up late last year. Wow, I guess they’ll just keep rising until 2x4’s are valued like bars of gold. Oops: https://tradingeconomics.com/commodity/lumber

Give me one reason to think that any of the prices you cite must continue rising. Because even if they just plateau, they are no longer driving inflation.

"Give me one reason to think that any of the prices you cite must continue rising."

The key word if your question is must. Certainty about the future is rare. Rather, my point is, many of the items I mention have secondary impacts that result in price increases. For example, as the price of transportation oil (gas and diesel) increases shipping costs rise, employees demand higher waves. Similarly, as apartment rents rise the tenants feel the impact (note, yes I am aware rants can also fall) for an extended period.

Stated differently, I can cite a robust list of 'experts' who support the aforementioned point of view. In contrast, I believe your perspective is a minority position. Then again, the future is uncertain so we will see...

Energy prices tend to propagate through to downstream goods rather quickly; we may have seen much of the effect already. Rent: remember, inflation is not a level, it’s a rate of change.

You can stack up as many experts as you wish; if they don’t have models validated on multiple out-of-sample predictions, their opinions are as good as the next drunk’s at the bar.

Ken Schulz -

I am humble enough to accept that my perspective, or any 'expert', is no more than an educated guess.

I am confident enough to say, we will see who is right...

Actually, we won’t, because the Fed is now planning another 75-basis-point hike, so we’ll never know if inflation might have abated if they had stayed with a more gradual schedule. If inflation does decrease, the Fed action will be credited; if it doesn’t, the hawks will say rates should have been raised sooner and more. There can’t be disconfirmation without highly specific, hard prediction.

Nope.

Correct the Fed has raised rates. Rather, its my point, even with the rate increase, you will continue to see high inflation. I believe the Fed will continue to raise rates several times until the Fed's Funds Rate is in the 4% range....

Nope.

The political side in any case, it is far better for you to have a mild recession circa 2022-23 and cool down inflation than allow accelerationg via the 1970s

Bingo.

Recessions are markers of the end of the business cycle. They are always inevitable, but impossible to predict accurately, as many different inputs can delay or accelerate the cycle.

What makes it worse is the news media embraces granting of prescience to anything that appears to be lucky enough to guess the start of a recession. They would grant an octopus celebrity status for accidentally correctly guessing 3 of the last 4 Super Bowl winners, after all.

Nassim Taleb showed us the original-ish concept of the Black Swan event, then the world turned him into an economic Nostradamus.

But if we hit a recession because the central rate benchmark is set between 1.5 and 1.75%, what does that tell you about the ZLB and where our economy actually is?

I know it kinda feels like the Fed did shock therapy but are 3% interest rates really that awful? Seems like the whole country is addicted to the nonsensical 0 interest rate. Sorry but that stuff doesn’t last. We are starting to get to a normal growth trend line in the stock market and housing prices should moderate but not stop selling or buying. Pulling the punch bowl away should not crash economy.

The Fed's ongoing panicky behavior depends on what the midterms look like.

The point is to punish Democrats for daring to do things that helped the nonrich in a crisis. If it looks like Democrats might actually hold on to legislative control, they'll raise rates again. Otherwise the message wouldn't be delivered.

There is no "panicky" behaviour except on the part of the Left ideologues.

An in-cycle decision that was well-signalled to the markets and in keeping with both standard timing for rate decisions and discussions is not "panicky" - it certainly is in disagreement with a large swath of the Left but not being in agreement with you is not panick.

The FOMCs guidance was for a 50-basis-points increase. Powell gave an argument for staying with its own forward guidance to maintain the trust of the markets, then they went ahead and departed from guidance anyway.

Wrong on retail sales. They are still above the base trendline. So they are flat, big deal.

"The Fed just needed to stay the course. Instead they panicked and decided a recession was the only way to attack high prices."

Perceptions are as important as actual action in curbing inflationary spiral. Staying the course wouldn't have threatened enough pain to modify behavior.

No, the Fed is sorta useless there. Crypto bubble bursting has led to capital raising venture to cover debt. It's probably about over. Inflation is already toast going forward. A point that has been made several times. But normalization no matter how fast was going to make elitists like Musk mad. But it's impact on the real economy and credit markets is little.

Bro, why are you looking at $500,000 average mortgage amount? Is that pulled from anywhere, or is it just pulled out of thin air? Because Motley Fool says that it's $411,400. Big difference. https://www.fool.com/the-ascent/mortgages/articles/the-average-new-mortgage-amount-is-411400-can-you-swing-it/

Not sure their source, but I'm more likely to believe that since it's far closer to the median house price (yes yes, average vs. median, but the median home price is about $375K).

And a mortgage of 411K vs. 500K is a huge difference in monthly payment.

Nope, your wrong.

Lets note that banks and homebuilders will just start offering incentives......you know, in a normal market.

I did some sums a while ago, which I can't be bothered doing again. But the gist was that while Australian GDP per capita is considerably lower than America's, average monthly earnings for full-time employees are about $US2,000 higher than they are in the USA. I suspect that relative depression of workers' incomes in America accounts for a lot of the chronic discontent that keeps being reported in polls, especially when American workers' non-wage benefits also tend to be lower than in other developed nations.

I've seen zero evidence of this, and I've just spent time online trying to come up with a reasonable explanation for your claim. It's possible, depending on how one is doing the calculations, to derive a figure showing Australian median monthly disposable wages at market exchange rate are higher than the US equivalent. But not average. And definitely not PPP.

/Users/mikeharper/Desktop/sahmrule_may22.png

Interesting graph.

https://econbrowser.com/wp-content/uploads/2022/06/sahmrule_may22.png

Normally this would be bad news. But now that Kevin is predicting it, it means a recession probably won' t happen. I base this solely on Kevin's strong record of failed predictions, from inflation to political candidates to Joe Manchin coming around.

Don't leave out mass unemployment of truck drivers!

I'm not sure if I'm the last holdout on this or not, but I continue to think that inflation would have subsided on its own as the economy slowed

I'm with you Kevin, but what does that "eventually" translate into? The sharp transitory inflation when WW2 ended lasted a full two years. We could easily be looking at another year of uncomfortably high inflation without some added help from the Fed. Or maybe longer.

I know Jerome Powell doesn't work for Joe Biden, but I think he's done the President and Democrats a favor. We're likely to see improving conditions (stronger growth, etc) by early 2024. That would've been less likely had the Fed "let" inflation run its natural course. Sure, it's possible I'm wrong—and absent Fed action the economy would've gradually seen progressively lower inflation and continued economic growth. But I doubt it.

Mortgage applications are down 28% YoY here in New Hanover County NC. Prices are up.

That being said I have to understand that I live in a desirable area near the beaches.

OK

Now we are faced with a dilemma. In order to keep the construction trades, Bankers, developers, and Real Estate businesses happy we need to face some facts.

First aside from where I live the population growth is diminishing if not going negative already. Now these new born babies aren't buying homes but where was our birth curve say 30 years ago? It was declining but still in the positive territory. Now we are close to having more people dying than there are births.

What this means is that in the near future supply will out strip demand for housing. Boomers will represent close to 27% of the population within the next decade. They, for the most part have paid off their homes.

Bankers will see declining numbers of loans

RE Agents will see declining numbers of sales

Construction will slow in MOST areas of the country

Because of all of this home "valuations" will start to decline over a LONG period of time. The decline will be gradual.

Boomes learned a LOT from their recession remembering parents. My Dad bought US Savings bonds for years. For him they were a great investment because at the time they had no index funds, no CDs, no stock options etc etc etc, He saved money by doing this. When he cashed his bonds out he had his nest egg.

I still save 25% of my income each month. THAT was DRILLED into me for years. I am not rich but I have no debt, and have been following his advice for a very long time. My home has been paid for for years. I pay cash for any cars I buy, new or used

But I make them last. I don't believe in getting the newest and greatest "thing" on the market. I personally don't care to "keep up with the Joneses". Never have.

I look at boomers and I see a generation that is sitting on a HUGE amount of wealth. The transfer of that wealth to their offspring will be an enormous shift.

That wealth the boomers have is "paid for" it's "free and clear" for the most part..

I took economics in college as an elective but that was when they chiseled your diploma on to a stove tablet so my economic knowledge is severely dated.

Just remember this. I owe NOTHING and can live comfortably for years with what I have. No one will seize my wealth because I failed to pay the mortgage or car payments because I don't have any. My CC's (of which I have 2) have zero balances on them - but I do use them.

I am glad to say my daughters are seeing the light now that the exuberance of their youth has worn off. They are working on getting out of debt, and quickly.

THAT FACT is what makes Fathers day tomorrow a good day for me. They are seeing what CAN be done if little steps are taken that lead to big changes in spending habits over time.

Happy Fathers day everyone

You mean 28% of cash based investor buying is gone. Now regularly s scheduled credit expansion will fill some of that gap.

I know it kinda feels like the Fed did shock therapy but are 3% interest rates really that awful? Seems like the whole country is addicted to the nonsensical 0 interest rate. Sorry but that stuff doesn’t last. We are starting to get to a normal growth trend line in the stock market and housing prices should moderate but not stop selling or buying. Pulling the punch bowl away should not crash economy.

You can call it "panic" if you wish but Fed also did what it did to reassure markets it is trying to control inflation and doing so in a dramatic way. Yet for all the caterwalling about it, at three percent we're a hell of a long way from 20 percent interest rates of late 70s and 80s and it make absolutely no sense to ever go that high again because so much of what is fueling inflation are things the Fed cannot control (war in Ukraine, Chinese COVID-19 lockdowns)

I agree completely with Kevin that the Fed's focus should be more employment than inflation and that an inflation rate of two percent is absurdly low. Between 4-5 percent annually would be ideal. For too long the economy has been deflated rather than inflated and that has to change otherwise the same rut of economic inequality in wages and different sectors of the economy and economic opportunity will continue.