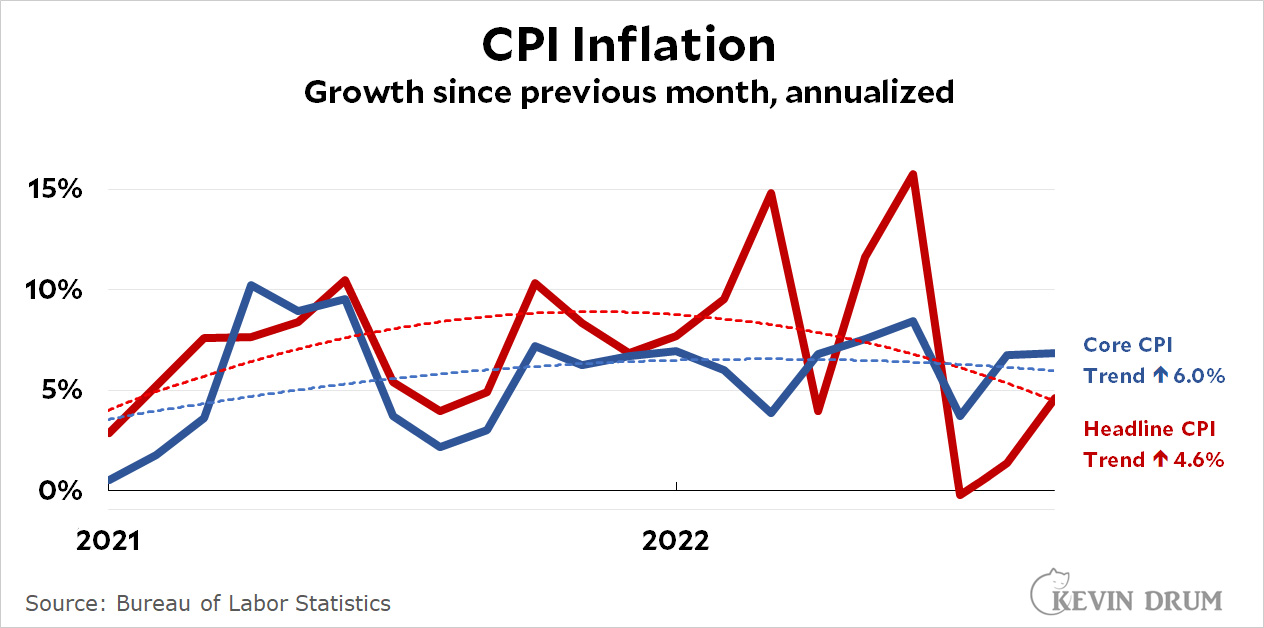

The BLS announced the CPI for September today, and the month-over-month figure was quite a bit higher than it was last month:

On a year-over-year basis, headline inflation came in at 8.2%, the same as last month. Core CPI rang in at 6.6%.

On a year-over-year basis, headline inflation came in at 8.2%, the same as last month. Core CPI rang in at 6.6%.

As always, though, the trendline is the thing to watch. The trend for headline inflation declined to 4.6% while the trend for core CPI was pretty much unchanged at 6.0%. That's only slightly lower than its peak trend rate of 6.5% in April.

Gasoline was down again in September, but food prices remained up about 10% on an annualized basis.

There's not much good news in this report. Core CPI in particular is only barely declining. I will be interested to see if PCE inflation shows the same thing. We'll find out in two weeks.

You’re gonna need a bigger trendline…

There is an unfortunate odour of skewed polls type reasoning. Disappointing.

Yeah.

I can't remember, was there a trendline drawn for us in February 2021? Wouldn't it have proved that inflation was going to remain stable at around 2%, in March 2021 and ensuing months?

Also announced today: https://www.nbcnews.com/news/amp/rcna51850

And voila, we are seeing (and not only in the USA, globally), a pattern generally although not perfectly of course reminiscent of the early 1970s pattern of entrenchment of inflation as 2nd/3rd order price increases start to pass through to final goods mfg and to consumer, continued energy pricing pressure on primary and on consumers. And the ungluing of stickier prices to contribute to new round of inflationary pressure as medium/long-term expectations are pushed upwards.

The 1970s inflationary episode had similar (multi-year) pattern of pausing/plateauing and then regain.

Fed et al contra Drum are not "panicking" but rather taking appropriate historical lessons on the danger of the self-reinforcing upwards cycle as similar to early-mid 1970s. And to avoid the errors of that period (notably pausing on inflation combat - in a fashion like Drum wants now - on bet of cooling and then seeing continued acceleration).

It is far better to tie this off now, a brief short-term pain to restabilise than to have a redo of the early-mid 1970s errors and risk generating a similar run (of course structural change in the economies will mean it will not be a rerun stricto sensu).

The Democrats should profit from such an approach, get pain over before Presidential, now and have rebound by the Presidential.

(and of course massive push to RE (including the badly needed permitting streamlining for not only RE projects but also distribution lines))

Core inflation is a laggard indicator, in about 3 months it will reflect the downward shift of food and energy prices. Basically, there is nothing surprising in the report, it is what one would expect based on what has happened the last few months. As long as oil stays around $90 barrel, core inflation will be under relative control (5-6% 3-6 months out until current Fed rates have more of an impact). A point to watch is the strength of the dollar, obviously it helps keep inflation lower than it would otherwise be but not as much as people think, the real question is what the strong dollar is doing to the world economy and whether it is driving it to a recession. It goes without saying that raising interest rates makes the dollar stronger.

Explains the Fed as well as anything,

https://twitter.com/gabriel_mathy/status/1580546061180887042