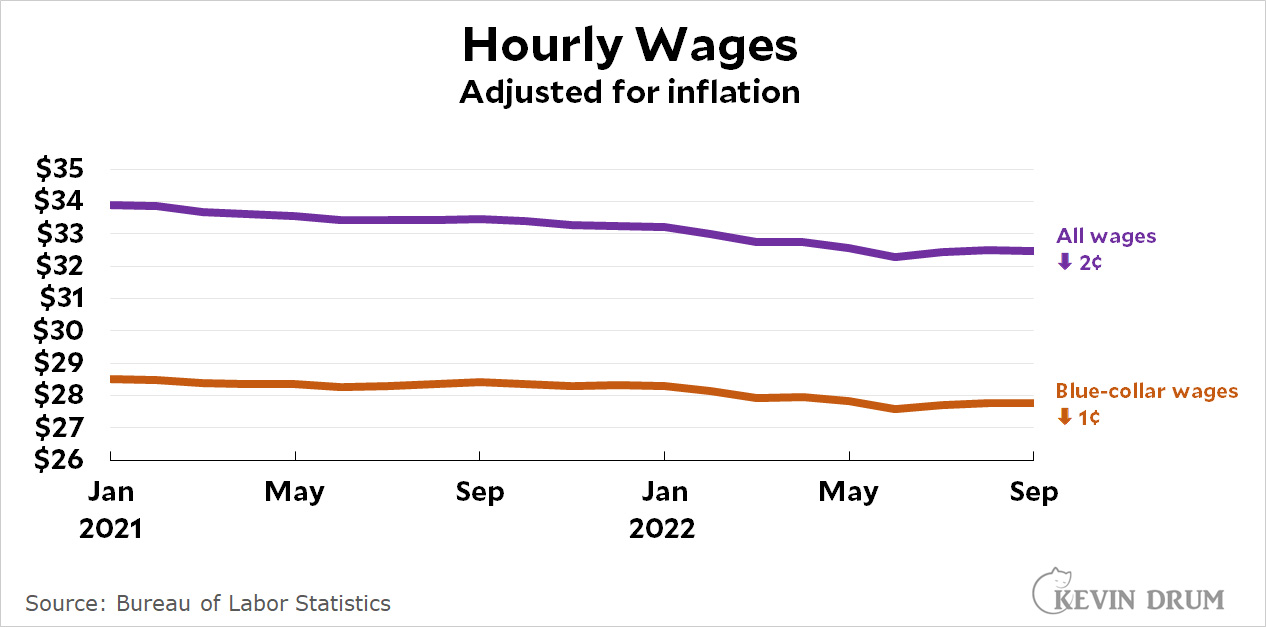

Even with inflation taking less of a bite than earlier in the year, real hourly wages declined yet again in September:

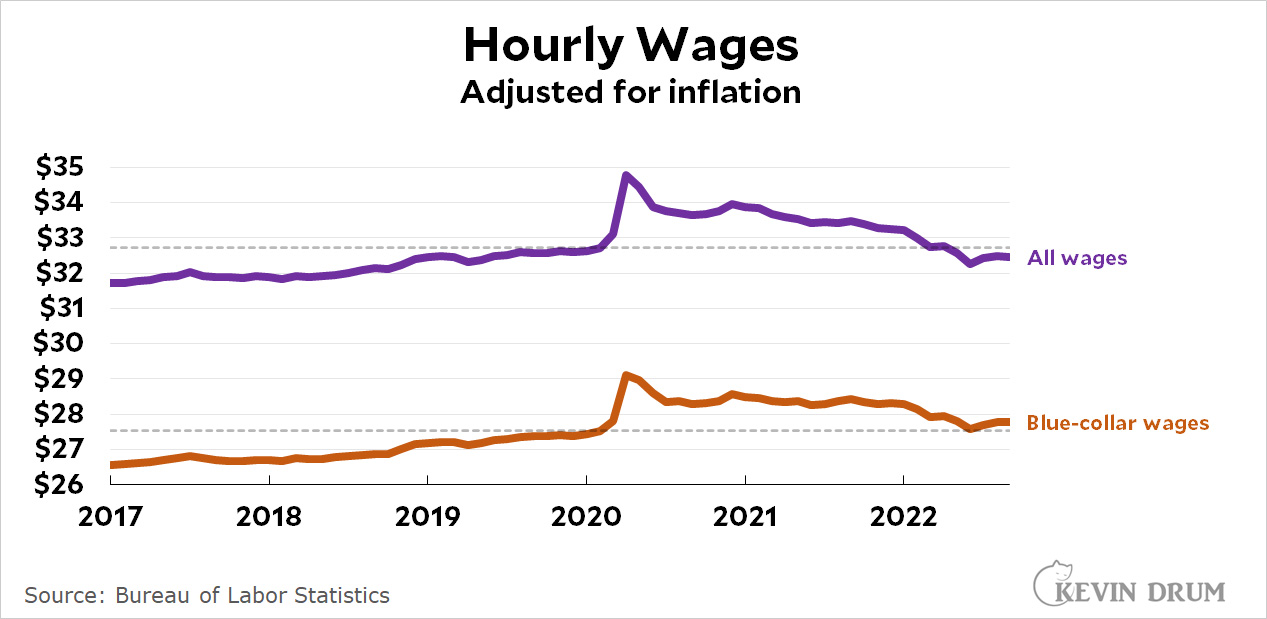

Since the beginning of 2021, hourly earnings are down $1.42. For blue-collar workers, hourly wages are down 73¢. Wages have now fully declined to their pre-pandemic level:

Since the beginning of 2021, hourly earnings are down $1.42. For blue-collar workers, hourly wages are down 73¢. Wages have now fully declined to their pre-pandemic level:

Wages are obviously not pushing up inflation. Nor do wages suggest that employers are really all that concerned about a lack of workers. So what the hell is going on?

Wages are obviously not pushing up inflation. Nor do wages suggest that employers are really all that concerned about a lack of workers. So what the hell is going on?

"So what the hell is going on?"

The Job Creators are reasserting their authority over the Peasants, er, Consumers.

This is correct. Win-win when you can jack profits and hide it by blaming a democratic administration.

They only get more profit if you buy their junk. Stop doing that.

Okay, so wages are down. Yet, amazingly, those poor, suffering old folks on "fixed incomes" (aka Social Security) are getting an 8.7% RAISE. Plus, they can't be fired. "Fixed"? Are they kidding?

NPR this morning had one of these unfortunates on to discuss the effects of our current inflation, and she was complaining that, as a result, she can't dine on fresh salmon every day now. Have pity!

Okay, time for another cup of coffee.

Generally when I get an increase in Social Security I use the increase to pay my higher Medicare cost that surely follows. Sort of a zero sum game.

not to mention the increases lag behind actual inflation...

Medicare premiums are going down next year. https://www.kiplinger.com/retirement/medicare-costs-to-go-down-in-2023

If you only have SS for your retirement you are in bad shape without inflation. The raise in SS payment will prevent you from falling even further behind so that you would have to cut back on your catfood consumption (whether it's salmon or mackerel).

But a lot of retired people depend at least in part on savings and the principal of savings has been taking a beating. Inflation reduces its value and the Fed interest-rate raises also additionally cut down on the value of bonds and other fixed-return investments. Of course stocks have also been falling. If you own a house or other real investment their value was increasing, but now prices seem to be headed down as mortgage rates rise. In general retired people are taking a beating.

Not incidentally this is a reason for expanding SS, payments from which are not directly dependent on investment income and keep up with inflation. Of course the income supporting SS, including wages and some bonds in the Trust Fund, also is also affected by inflation and Fed actions.

It must also be kept in mind that GDP grows faster than prices, at least over the long term. So people whose income is only keeping up with inflation, which applies not only to SS recipients but to all wage earners since 1973, are falling behind with respect to those whose income has kept up with or exceeded GDP growth - that is those at the top end of the income spectrum, mostly the 1%.

To put it another way, real GDP growth has mostly gone to the 1% at the expense of SS recipients and wage-earners.

Kevin is pointing out that real wages have been declining. Those on SS have not been getting a RAISE in terms of real income, they are just keeping up because of the CPI adjustment.

Granted. People on their so-called "fixed" income are getting COLAs. People earning a wage? Rarely.

Corporate profits and CEO pay/benefits/income are what's going on.

While there is broad variation by industry, ballpark, wages are about 30% of a corporation's cost. Thus, increases in other areas such as transport, raw materials, and financing can/likely are major drivers of inflation.

Companies can use real or perceived shortages as excuses to raise prices...so they raise prices.

The Russian invasion of Ukraine means higher energy and food prices.

The drought in the West also means higher food prices--and that's a long term issue too.

Bird flu affected egg prices--and may return (though not hearing about it much now).

"Supply chain" issues almost gone away--but not completely gone.

Investors competing with first time home buyers....

Biden's infrastructure bill will help--but the benefits won't show up for a while. In the mean time, Trump's tax cut for the wealthy still distorting our economy.

oops, meant this for the inflation post...oh well...

Bird flu is very much still with us!

"Blue-collar" is the wrong term for the average of "production and non-supervisory" workers. The most common job in America is retail salesperson, which at least used to be a kind of white-collar job, with not-bad pay. But the pay for retail and other service workers has fallen behind that of manufacturing and other true blue-collar workers (that is those more directly involved in production):

https://skeptometrics.org/BLS_B8_Min_Pov.png

I still have a job and I’ve stopped spending money. I’ll be fine. Go have your recession. I’m even back to working from home 3 plus days a week. Saving on gas too.

I assume your mom doesn’t charge you rent either for living in her basement.

Like +10!

Is Justin's last name "Time"? Inquiring minds want to know who is the bastard to blame for all the inventory problems.

It is bizarrely perverse and showing either fundamental lack of understanding or really stubborn motivated reasoning (à la Skewed Polls) to do an inflation adjusted graph of wages when inflation is reflected in nominal wages.

There is absolutely no econometric basis to draw an analysis that there is not wage inflation if there is not an increase in real wages (deflated). This is nonsense.

It is in fact a standard econometric observation that wage earners structurally tend to lose earning power (in real terms) in elevated inflation - that is indeed why inflaiton is so bloody politically toxic (and why it is fundamentally perverse for Democrats and Leftists to maunder on about the wealthy elite and inflation action as in fact it's wage earners that tend structurally to lose most ground in bouts of rapid inflation).

Real declines are bloody not indicators of inflation declines.

What is perverse is for economists and the Fed to keep saying that current low unemployment with supposed labor scarcity is a major driver of inflation and that wage raises must be kept down to prevent inflation. There are other obvious causes of inflation, most of which the Fed has no control over.

Your characterisations of the US Fed, aside from the tenditious nature, are a red herring of a response.

The perverse wrong headedness - in the realm of unskewed polls motivated reasoning - is using a Deflated analysis to say something about inflation with the utterly incorrect unstated assumption that it is only infationary if real wages are growing - that is wage rises run ahead of inflation. This is simply wrong. Utterly wrong.

The analysis on real wages does show the inflationary pain on wage earners and real economic impact to their buying power, but it says literally nothing about nominal wage impact on inflation - as it is stripped out. There is no intellectual foundation to doing a real wage analysis to comment on inflationary impact - wrong tool for the subject.

Drum either does not understand the subject or is so deeply and sadly bought into his desire / view of Transitory that like the increasing absurd trend lines he's distorting everything to "unskew" his data.

Nor do wages suggest that employers are really all that concerned about a lack of workers.

My guess is that employers see the inflation curve already bending downwards and don't want to put more money on the table right now for higher wages and salaries when they know things will probably settle down in the near future. Even moreso if they think the Fed is going to engineer a major recession to do it.

This may be a contributor currently, but the lack of response of wages to low unemployment is not new. Unemployment has often gone low since the 80's without causing great wage growth or inflation, contrary to the predictions of many economists. The NAIRU, the level of unemployment that was supposed to trigger inflation, was passed several times. It did not predict inflation this time either - inflation is currently caused by other things.

If the point of the post is "what effect are wages having on inflation, if any?"

I don't believe you can use inflation adjusted wages.

I mean, you easily get to the follow up question, which is on a macro level, how come everything doesn't just even out? I always figured that with a significant portion of the population in a situation where their income does not rise with inflation that's why its relevant.

Whether wages, on some sort of average, "keep up" with inflation is another issue.

Clearly, fixed income, does not keep up with inflation in any way, shape or form.

I always figured this can all be explained by "old people vote."

The frame at where acceptable profits accrue to Capital has almost been realized.

"What the hell is going on" is corporations harvesting their efforts to remove competition over the past four decades. There is at best a duopoly in most industries now, with many being completely dominated by one supplier and a few "also rans". While two whales might bump one another occasionally rushing to get the tastiest krill, they generally are quite satisfied with themselves and don't want the hassle and danger of a real competition.