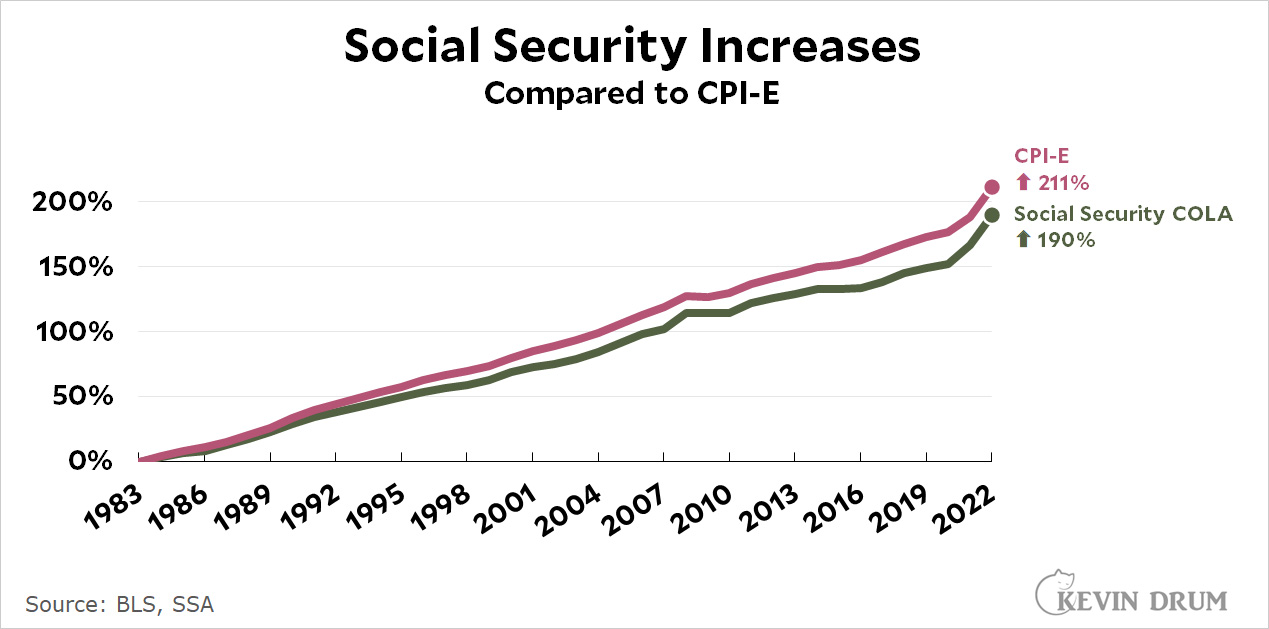

Social Security recipients are due for a whopping 8.7% increase in January, and since I'm currently a Social Security recipient that makes me very happy. But how has Social Security been doing over the years? The BLS tracks a research version of CPI called CPI-E (for elderly) that measures CPI specifically for the basket of goods and services mostly used by us old folks. Here's how Social Security payments compare to the rise in CPI-E:

Even with the big increases in recent years, senior citizens are still behind. A $1,000 monthly payment in 1983 should have gone up to $2,111 by now, but instead it's only up to $1,900. That's a shortfall of a couple hundred bucks.

Even with the big increases in recent years, senior citizens are still behind. A $1,000 monthly payment in 1983 should have gone up to $2,111 by now, but instead it's only up to $1,900. That's a shortfall of a couple hundred bucks.

Of course, this assumes you believe in CPI-E in the first place, which not everyone does. Even the BLS points out some potential problems rooted in the fact that CPI research is done on a sample of urban residents that might not match where seniors live. If, on average, they live in cheaper places, then their actual cost of living might be a bit lower than CPI-E suggests.

Since urban areas are generally the most expensive areas to live, I’m ok with leaving CPI as defined by urban residents’ costs. After all, one shouldn’t *have to* move away from everyone else one loves and hangs out with simply to be able to afford to live… living in a place where you have a support network is a key to living longer and having help when you experience medical problems.

I’m sure Social Security (and especially Medicare) could save a ton of money forcibly removing all old people to the cheapest states, but that wouldn’t be good for an allegedly “freedom-loving” society either.

Lots of old people do that anyway, voluntarily. For them, the benefit adjustments likely keep up with inflation, if delayed by a year or so.

Of course a person who began getting SS benefits in 1983 at the age of 65 would be 105 years old in 2023, so I don't think this impacts a whole lot of people. Getting an 8.7% increase is probably a whole lot better than what most jobs provide.

It still represents the economic strength of a 65 year old in 1988 versus today. It implies the 65 year old of today has a weaker economic position than their grandparents did in 1988.

Only if you live in a high-cost-of-living area. I would like to see a study about the average cost of living as endured by the elderly, as opposed to "urban residents". Given the natural urge to move to low cost of living areas, I expect the elderly don't suffer from inflation as much as the rest of us do.

It implies the 65 year old of today has a weaker economic position than their grandparents did in 1988.

I don't think that's the case. A person who turns 65 in 2022 and starts drawing a check would be getting more in real terms (all things equal, ie, same earnings percentile over working life) than one in 1983. The initial benefits calculation formula takes wage growth into consideration. It is the COLA that doesn't.

It just occurred to me that, for most people these days, it should be relatively easy to calculate a personal rate of inflation.

If you still use mostly cash, you'd still have a lot of work to do. But most people use payment mechanisms that result in the accounting being done "for free" (no effort on the spender's part). And (except for young folks and some rare cases) there's a long purchase history to extract trends from.

So it shouldn't be difficult at all to automatically construct a personal basket-of-goods and show price changes for your actual habitual purchases.

I think that information could be really interesting for a lot of things - regional variation (especially plotted against how competitive things like local grocers are), class/income variation... all sorts of neat ways to look at that.

State workers in Florida received their first COLA salary increase since Jeb Bush was governor. It was 2%.

Low cost states tend to be low service too. And if it's "low tax", expect really high fees for everything.

Move to rural setting--then poor cell coverage, high speed internet not really a thing there, and little, if any, public transit. And delivery services??? You've got mail.

Not necessarily. I had to move from the 'burbs to BFE Colorado for personal reasons. But I have 4G service that has blipped only once in the past 3 years (a construction crew cut their line by accident); DSL service that, and while not nearly as reliable as 4G still remains good 99% of the time. There is in-town public transit and food delivery, albeit only in-town. I live 5 miles outside the city limits, but there are still charities that help the elderly, including with food delivery (I volunteer for one of them).

And while my experience is admittedly anecdotal, I seriously doubt it's a one-off either. Rural America is not without resources these days, even if urban living is still more convenient.

I live 15 miles from the closest city, so we're pretty rural. But, we get 5G, and xfinity laid fiber optic cable in our development, so we are well connected. We don't have any chain drug stores or grocery stores. One signal in town. A couple of fast food places and three gas stations.

My experience is that living in the outer edge of civilization is more than doable . It's also peaceful and has a wonderful small town feel. Our social security, along with our pensions are enough to meet our needs.

I know people who live in a rural area a few miles away from a large land-grant university...and poor cell signal with expensive and relatively limited wired internet that costs a lot. I was hoping 5G (using the old TV bands) would help get signal to outlying areas--but that still has a way to go yet.

I shouldn't have been as sweeping with my statements, but these are things that need to be considered, along with access to health care, when moving.

👍👍👍

Let's see, based on five decades following politics in the United States, I'm gonna say that people who are getting the increase will say it's not enough & people who are not getting the increase will say it's too much.

A person who turned 65 in 1983 was born in 1918 well before SS was instituted.

They were also way before the baby boom of the 50s and early 60s.

Those folks tended to work till they died and ate far less processed foods than we do today. Now we retire earlier, eat far less healthy diets, and lead generally sedentary life styles and there are MANY MORE of us to boot.

Yet we are still living to a much higher age due to advances in medicine and health care which are counter acting our poor lifestyle choices.

According to statista those over 65 years of age will represent 22% of the entire population in 2050. Yet, in 2010 just a scant decade ago those over 65 accounted for just 13% of the population.