Earlier today I asked if the 2018 bank deregulation bill had any effect on the collapse of Silicon Valley Bank. The consensus in comments was that deregulation allowed SVB to avoid Fed stress tests that might have uncovered its liquidity problems.

(As a brief aside, it's common to say that SVB bet on interest rates staying low and then took big losses when the Fed hiked interest rates. That's true as far as it goes, but SVB's bond portfolio was marked as Hold to Maturity, which means the losses never showed up on their books. In other words, the problem wasn't interest rates per se because SVB never intended to sell those bonds in the near term. The problem was that the bonds in this portfolio were illiquid because they couldn't be sold without recording a big loss all at once. This isn't an interest rate problem so much as a classic, time-honored liquidity problem.)

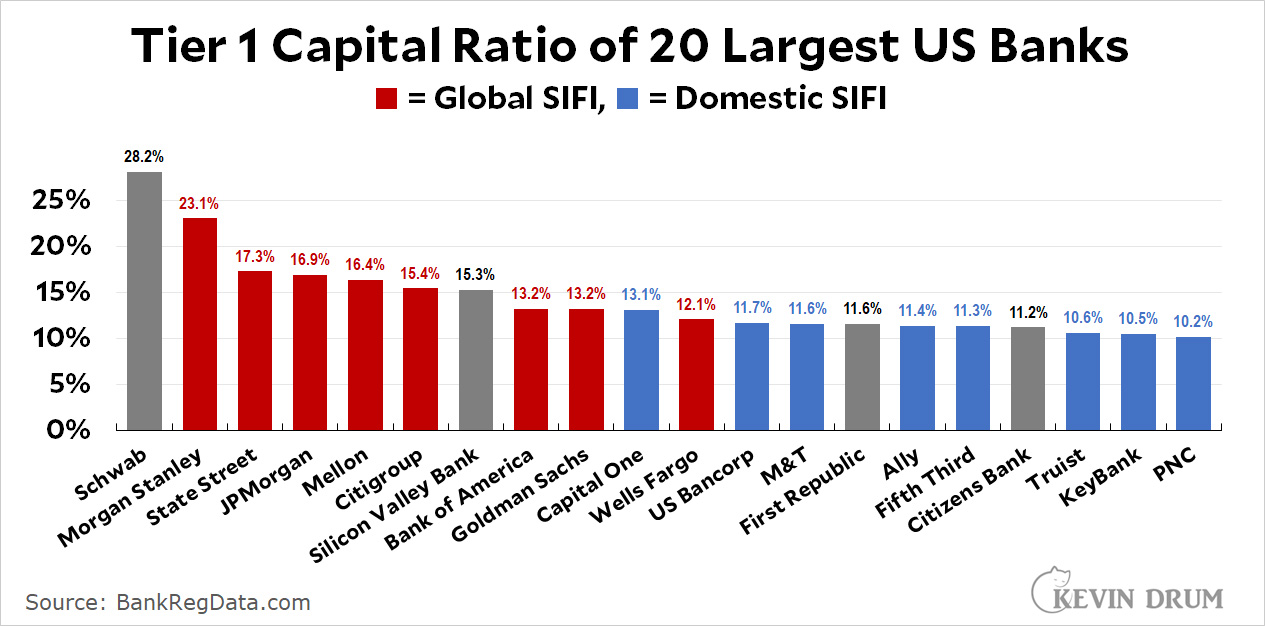

The question is whether this would have been flagged in a Fed stress test. For reference, here are the 20 biggest US banks sorted by Tier 1 capital ratio:

There are a couple of things to take away from this. First, SVB should have been designated a SIFI—a Systemically Important Financial Institution. It wasn't big enough to qualify as a global SIFI, but it was certainly big enough to qualify as a domestic SIFI.

There are a couple of things to take away from this. First, SVB should have been designated a SIFI—a Systemically Important Financial Institution. It wasn't big enough to qualify as a global SIFI, but it was certainly big enough to qualify as a domestic SIFI.

That said, its capital adequacy was excellent, higher than practically every domestic SIFI in the country—and higher than even the new capital ratios imposed on the three biggest US banks last year. Given that, would a liquidity stress test have demanded an even higher capital ratio? I have my doubts, and in any case SVB would have been given time to beef up its reserves.

None of this is meant to imply that SVB's management didn't make mistakes. Their unrecorded losses in long-dated bonds, along with the outflow of deposits caused by the tech crash, had been a widely recognized problem for at least a year. On the flip side, they really did have plenty of high-quality capital and plenty of cash available from selling other assets. They clearly recognized that the outflow of deposits was likely to last longer than they had thought, and they addressed this by (a) selling assets, (b) trying to sell shares, and (c) looking for a buyer. I don't have the banking chops to know if this was sufficiently prudent behavior, but certainly SVB would have been OK in the near term if it hadn't suffered a huge, almost instantaneous run coordinated over social media. The lesson, I guess, is that if you live by tech, you run the risk of dying by tech.

A liquidity stress test would have presumably highlighted the degree to which their deposit base, their lending base (same-same) were aligned on the low interest implicit bet.

Their need was not per se more capital - it was Different Capital - a profile of assets better matched to the potential liquidity risk given their (SVB) high sector concentration on both lending business and deposit sides - plus their extreme level of jumbo deposits which are well known to be high risk of moving on short notice (contra retail deposits, small company non-jumbo etc).

More capital then is not the need, different capital, more easily rapidly liquidated to match the liquidity risk profile of their very unusually elevated deposit base risk.

Note that the risks of this nature re SVB and its highly idiosyncratic profile - really very highly idiosyncratic profile - were noted as far back as 2021 (see Financial Times Alphaville: https://www.ft.com/content/9886dca2-b751-4573-ae2a-d4b4b390dded)

This said, however, yes, you are right, with a bit more time and had not a certain set of Randian VC bros not called for pulling deposits, SVB likely could have done a recap (for all that they should have started their process earlier [although human nature, no one likes drinking their medicine...] and the fact they went without a Chief Risk Officer during 2022 when risk was escalating .... not very good look for management

I love reading your analysis. Keep it up.

Yes. It seems well-informed and fair.

For context, while not in North America, I am in fact in related investment (my focus is renewable) and ten years ago I spent about ten years involved in central bank regulatory advisory and technical committees - right through 2008 and after, although unlike NeilWilson I was not a bank examiner. Not for USA land of course although then did learn from exposure the perverse complexity of US bank regulation with far too many competing regulators.

Remains your great unresolved weak point.

Frankly rather doing more on rules you all should seek to eliminate the duplicative / over-lapping regulators that exist on both federal and state levels. It leads to perverse outcomes, gives perverse incentives to regulatory arbitrage (particularly between the state and federal, there is no reason in the modern economy to continue to permit state level regulation bank and bank-feeding lenders).

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details

visit this article... https://createmaxwealth.blogspot.com

Maybe I'm being pedantic, but it's not the capital profile that was the problem. It was the asset profile.

It is an interest-rate problem. The raise in rates by the Fed is why the bonds "couldn't be sold without recording a big loss all at once".

Banks make the most money by lending at long term - that is really the function of most of them. They have to get a margin over the deposit rates and other rates they might pay.

This isn't exactly right. The HTM assets were principally agency-backed RMBS and CMBS. These are quite liquid - they could be sold without major liquidity issues if that's what management wanted to do. The real issue was the price SVB would receive if they sold the HTM assets - solvency issue.

Also I don't think the stress tests would have revealed something special. The fair value of the HTM positions is reported every quarter, even if the unrealized losses aren't recognized in income or regulatory capital.

The Regulators SHOULD have been following the unrealized loss in their investment portfolio on a minute by minute basis if there was a concern.

The Regulators had all of the investments on the computer and had the market value instantly available.

The loss that they recognized wasn't a surprise to the regulators. I guarantee it.

Point 1: The bank run KILLED SVB.

Point 2: See Point 1

That is the easy part.

WHY did the bank run start?

I am not sure what could have stopped it once it started.

Logic dictated for the last thousand years that if there were a rumor of a bank run then you needed to be close to the front of the line or you would lose everything.

So once the run started, there was NOTHING that could have been done to prevent it.

If today's rules were in place last week and SVB could have borrowed $50 billion more than it could have borrowed last week then they would have survived Friday and been shut down Friday night instead of during the day on Friday.

I believe they lost 30% of their deposits on Thursday and would have lost another 30% on Friday because anyone with a brain would have been screaming to tell people to get their money out of SVB by Friday. They could easily have lost $100 billion during the week.

This kind of reminds me of GameStop stock. Logic no longer applied. If you pushed the shorts hard enough they would have to give. In this case, you would be safeguarding your money by pulling it out of SVB while you were risking your money punishing the shorts.

Again, I am rambling too much. The government actions today make it a little easier to survive a run, not a lot, but a little easier.

The big thing appears to be that it makes it less likely that a bank run will develop because it sure appears that ALL deposits are fully insured.

So we probably will stop other reasonably healthy banks from failing.

FWIW, I went out and bought some regional bank stocks today. Not First Republic because I am clueless as to their real situation, but some of the banks that went down "ONLY" 20%-30% today.

If one looks at overall bank stocks, even the big systematics are down which is nonsensical - pure irrational panic - fear and fear of fear.

But for those not panicking, some opportunities.

When I started as a bank examiner in 1981, we had a fairly big bank that had a capital ratio of about 9% and had unrealized losses in their investment portfolio of about 12%. They had more unrealized losses in their loan portfolio but I didn't have access to the details needed to calculate the unrealized losses.

Foolish me went to my boss and said "When are we going to close the bank?"

Boss: "They never have to sell the bonds and can wait until they mature and get book value for them."

Neil: I know but when are we closing the bank.

Boss: They still have healthy capital

Neil: Let me try it another way. If I started a bank and bought the exact same assets they have and assumed the exact same liabilities they had then you would shut me down immediately because I would have negative capital.

Boss: That's right. We can't allow a bank to operate with negative capital.

This went on for a while.

The bank was merged out of existence within a year.

Regulators are A LOT better, SO MUCH BETTER than they were 40 years ago.

I also enjoy reading your analysis of what's going on. Thanks and keep it up.

So your boss was right and you still aren't willing to admit it!

Security Pacific National Bank?

Humans are humans in the end, no matter what.

Not sure I agree with all your conclusions. "Adequately capitalized if no one takes their money out" is not exactly the same as "adequately capitalized." But I think there are two questions that need to be addressed--hopefully by an ambitious Assistant US Attorney: 1) Was it a coincidence that the SVB CEO sold millions of dollars of his personally held stock right before the collapse, and 2) Why did a bunch of VCs get together on Slack and apparently try to engineer a run on the bank

No bank in existence has been or could be adequately capitalized if you define adequately as including "if no one takes their money out" if that includes losing 1/4 of your deposits in a single day.

I have been told by someone in the know that the stock sale was a regularly scheduled sale.

Surely a meaningful stress test would involve trying to predict what would happen in case the Fed started raising rates drastically. The Maestros are considered to have the mandate to do this at any time. Many supposed experts - and some of those who comment here - think that the Fed must start raising at the first sign of inflation, and somebody or other is always crying wolf about inflation for one reason or another.

So an adequate stress test must involve more than a simple capital ratio. If the actual tests don't do this then maybe the institutions which are subject to the test are also in danger of a similar crash.

Yes, there isn't a bank in existence that can survive a bank run.

One other hazy data point that might help flesh things out, FDIC was taking bids over the weekend to but SVB but been kinda quiet as to why it didn't happen. Bloomberg appears to be reporting that one bid came in but was rejected.

https://twitter.com/shansell/status/1635356176593608704

I'm guessing many banks are facing similar issues. SVB had a run up in assets, and now a draw down. Even without the run, they'd still be down almost half their assets by the end of the year and start ups burn through money and VC cash dries up. So any bank taking them on would need to be prepared to shell out, what, 100 billion to cover SVB withdrawals. Savings rate is dropping, so they'll need to cover their own net withdrawals.

I heard that the fed told all of the too big too fail banks that bids from them wouldn't be accepted. No one wants them getting bigger. And of course no one else had the size to absorb a SVB missing more than a quarter of its deposits.

“…certainly SVB would have been OK in the near term if it hadn't suffered a huge, almost instantaneous run coordinated over social media. The lesson, I guess, is that if you live by tech, you run the risk of dying by tech.”

That really is the best part of this otherwise unfortunate event. If only they would die. Metaphorically of course.

"The problem was that the bonds in this portfolio were illiquid because they couldn't be sold without recording a big loss all at once. This isn't an interest rate problem so much as a classic, time-honored liquidity problem."

The bonds are liquid. They could be sold at any time. That they would have been sold at a loss doesn't make them illiquid. The problem is that the loss of value due to rising interest rates makes the bank insolvent. Yes, they might have muddled through had there been no run on the bank, but they weren't so lucky. It was definitely a solvency rather than liquidity problem.

Except that if they hadn't had a liquidity problem, all of those bonds would have held to maturity and returned the expected profit and there would have been no solvency issue.. Until and Unless another shoe drops, It was a liquidity issue only.

I know nothing about this subject, but a question: could any bank survive if an email was sent out that said “hey all depositors, let’s go to our electronic banking site at 1:00 pm tomorrow and withdrew all our deposits.”?

Sure, if the bank has liquid assets of value sufficient to cover the withdrawals.

But no bank does if people follow the email.

"...The problem was that the bonds in this portfolio were illiquid because they couldn't be sold without recording a big loss all at once. This isn't an interest rate problem so much as a classic, time-honored liquidity problem.)"

I agree with the comments above that this was a solvency problem. The problem wasn't that there would have been an accounting loss. The problem was that the bonds weren't worth enough to cover the deposits.

No bank has sufficient ability to cover a loss of 25% of their deposits in a single day.

There is a story of a bank in Singapore that had a bus stop located just outside the front door. One day (maybe a bus was late) there was a long line of people waiting for the bus. Someone mistook that for people waiting to get into the bank to get their cash out. Word spread and pretty soon there was a real run on the bank. Needless to say the bank people were totally flummoxed as to why this was happening and it took some effort to calm the situation.

The point is that banking runs on trust. A bank is not like a piggy bank. It doesn’t just keep your money in the vault.

Maybe Powell can continue to raise rates and bankrupt all the banks. That will certainly stop inflation.

Sorry, dumb question: if the bank was basically in good shape, why didn’t the Fed lend it a bunch of money to handle depositors’ requests for cash? Isn’t that what the Fed is for?

"...if the bank was basically in good shape .."

The bank was insolvent.

A lot depends on the definition of insolvent that one uses. For most banks the rules are clear and history has supported them. Perhaps the big problem with this bank, as mentioned in the comments, was that their purpose and structure meant they had a relatively small number of depositors who held an inordinate amount of cash which could be withdrawn very quickly.

This wasn't an ordinary bank which had a lot of depositors with $1,000 each. It was one which had a few depositors with $10,000,000 each. The way of measuring solvency will apparently have to be modified to include this kind of circumstance.

For comparison, some people yesterday were talking about Schwab, but they have a very large customer base and most are not this large. That said, there are some firms which have large investors (speaking of investment funds) and one would have to do some calculations to see how "solvent" they are if many of their big-money investors moved money elsewhere suddenly.

Insolvent in the short term, right? Could the Fed have simply loaned the bank money to cover depositors until solvency returned?

Pingback: Silicon Valley Bank would have passed every test for liquidity – Kevin Drum

Pingback: Silicon Valley Bank was fine. It’s Silicon Valley that’s broken. – Kevin Drum