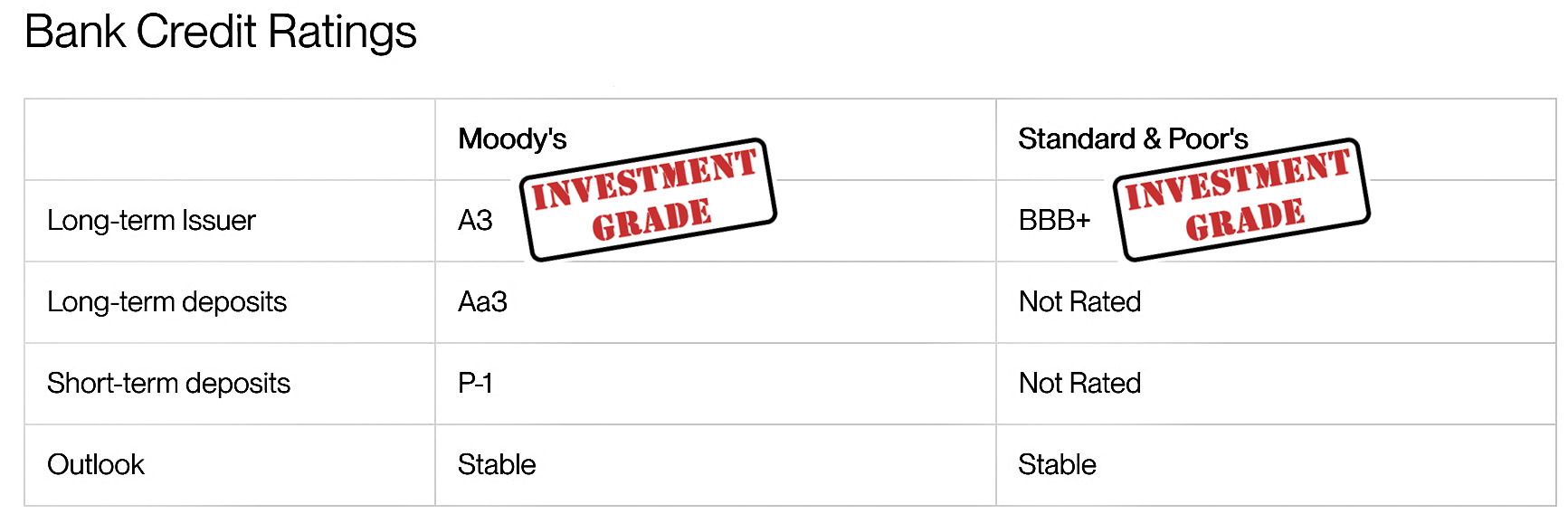

Was Silicon Valley Bank in good shape before it was put out of business by a bank run? As of Tuesday, March 7, here's what the rating agencies said about them:

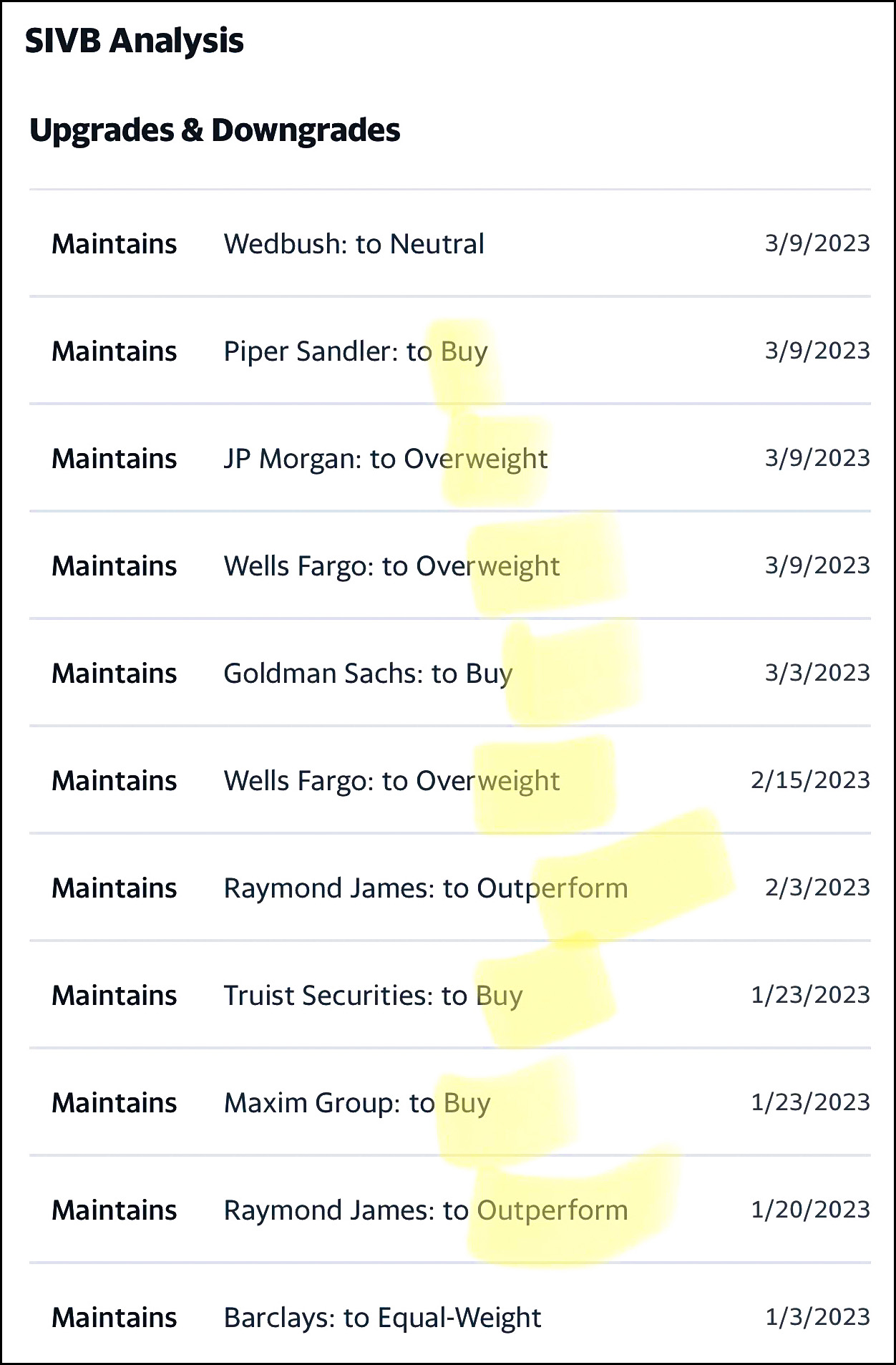

These ratings hadn't changed in over a year. Here's what the major stock analysts had to say:

These ratings hadn't changed in over a year. Here's what the major stock analysts had to say:

Buy! Overweight! Outperform! The analysts who followed SVB and were intimately familiar with its balance sheet remained enthusiastic until literally the very last minute.

Buy! Overweight! Outperform! The analysts who followed SVB and were intimately familiar with its balance sheet remained enthusiastic until literally the very last minute.

I'd also show you what the regulators said, but there's nothing to show. Like the rating agencies and the analysts, they saw no problems.

Even on Wednesday, March 8, after SVB had issued its mid-quarter review, nothing happened. Moody's downgraded them slightly to Baa1, which is still solidly investment grade, and that was about it. None of the pros who understood SVB best had anything bad to say about them.

By close of business the next day there was nothing left but ashes.

Thanks a bunch for the sleuthing, Kevin, this is great!

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details visit

this article... https://createmaxwealth.blogspot.com

That annoying Keynes chap:

sentiment, and now you are seeing in the market an irrational wave of fear hitting otherwise adequate banks, fear which ironically starts to generate the very problem the fearful are afraid of in a vicious self-fulfilling cycle.

Nice catch, Kevin. And it points to the heart of why I find the bailout scolds so unconvincing: even professional investment analysts didn't see the trouble on the very eve of a bank run. But we expect every firm with bank deposits to be able to spot trouble at their bank before it arrives and get their money out? The reality is society doesn't view depositing cash in a bank as "investing"—it views it as a service. I don't know what the answer is. If we don't radically raise FDIC coverage and/or eliminate the cap we'll likely see a steady migration of deposits to the largest money center banks. Maybe that's a good thing?

Instead of

This isnt evidence that the bailout scolds are wrong....this is instead reminder number 1 million that rating agencies and individual stock analysis dont provide much (any?) value.

And we absolutely should expect banks to be fully aware of how risky it is to invest significant amounts of deposits in long term bonds when rates are very low. This is the most obvious way to put a bank at risk of failure and certainly the bank was aware of the risk even if its debateable how likely a future huge rate increase was from a 2021 perspective.

This isnt evidence that the bailout scolds are wrong.

I'd say it is indeed such evidence, to the extent that a big part of their argument usually flows from the contention that sophisticated players are capable of assessing the risk of where they park their operating funds. But if fancy Wall Street analysts didn't know better, and even the government didn't know better, then corporate finances guys working for real estate developers and software houses are supposed to know better?

I'm not suggesting a more open-ended commitment to raising deposit insurance caps (or indeed eliminating them, as appears to be the case) shouldn't be accompanied by tweaks to regulations. What we learn from this episode should indeed be applied in the form of updated rules! But make no mistake, the "deep pockets can protect themselves" line of reasoning appears increasingly vacuous. And to the extent it still has merit, we plainly aren't prepared to follow it given the risk of contagion.

I understand your point, but it doesnt follow from the evidence provided and doesnt really make any sense at all.

Youve shown that rating agencies and Wall Street analysts dont provide any value...but weve always known that. The business model for both doesnt require them to provide good analysis.

But where your argument falls off the track in insisting that large depsositors should also have no interest in understanding where they put uninsured deposits and how no interest in whether or not they will lose their assets.

The logic that large depositors should not pay attention because credit rating agencies and buy side 'analysts' dont need to pay attention in order to get paid just doesnt make sense.

Those demanding bailouts will certainly claim that they couldnt have known...and as long as they always get bailouts, there will never be a reason to know.

So when mortgage rates are at record lows (as they were) and people are flocking to buy houses or refinance, banks should refuse them? The problem with SVB, aside from the way that the Fed has license to raise rates and disrupt all sorts of things when inflation threatens, is that so much of their deposits were uninsured. The neighborhood bank (if there are any left) has small deposits which are covered by insurance, so there is no reason for depositors to panic and start a run.

If the stress tests which are applied to the bigger banks wouldn't have detected this particular combination - and what Kevin has in this post suggests that they wouldn't - then the specific change in 2018 isn't responsible. It was just a matter of lack of foresight all around. But this lack of foresight has to be addressed with appropriate regulations - the plungers can't be trusted to protect themselves. And if they are always bailed out they don't even have to protect themselves.

Every firm with bank deposits absolutely should be cognizant of possible trouble at their bank. That's how the system is supposed to work. Of course it's unrealistic to expect every individual with <$250k to pore over their bank's financial statements, which is why we have deposit insurance. But big depositors absolutely should be aware when a bank is in trouble and either not deposit their money there or withdraw it if they have some there. Otherwise you have a situation where banking is the only field in which quality doesn't matter. If you're going to do that just nationalize all of it rather than giving bad bank management a pass every time.

More importantly though, companies with millions in cash should be investing it, not parking it.

No, the individuals concerned at not going to have the required awareness - they never have had. The problem has to be addressed by supposedly wiser people making regulations. There were some such wiser people in the New Deal, but over time the regulations were weakened. Dodd-Frank regulations were also weakened, although that specific change may not be the problem with SVB.

Big depositors absolutely should have the awareness. If you're a CFO for a company with millions in cash you're just lazy if you stick it in just any bank and hope for the best.

Anyone who disagrees is welcome to lobby for raising the deposit insurance limit. But keeping the limit and just ignoring it as soon as someone screams about how scary the current situation is is just untenable and an insult to the rule of law.

And the Trump years should have warned us that there aren't and never will be "wiser people" making and enforcing regulations.

I see it as another step on the long march to having the FDIC operate on a retail basis and eliminate the banking industry as we know it. We'd still have venture capital firms, but they'd be for those with sufficient assets and tolerance for risk. Everyone else would get the same standard deal and probably use the same government app just as they use government issued cash now.

Some countries, like China and India, are already moving in this direction. It has serious privacy issues, but the government, and especially a representative government, is much better at building and respecting data firewalls than any private organization.

I could watch *The Big Short* again, or I could just read the financial news in the US on any given day. It's the same story, over and over and over and over.

The whole stock market has become a giant Ponzi scheme. In fact, it's so giant it's "too big to fail", so the Federal Government will run the money presses as long as needed to keep the paper pyramid from falling over. This is how we got to $30 Trillion in national debt.

Actually, we got $30T in government debt with all those tax cuts over the years, that and the Fed explicitly targeting economic growth for destruction.

Even on Wednesday, March 8, after SVB had issued its mid-quarter review, nothing happened. Moody's downgraded them slightly to Baa1, which is still solidly investment grade, and that was about it.

The Moody's downgrade was no small matter. It was the thing that led to the collapse.

Announcing the sale of shares was a mistake. As somebody said after the fact, you make that kind of announcement after the sale, not before. Otherwise, you may spook the markets or invite bad behavior (e.g., spreading rumors of a bank run).

BTW The bank run happened quickly but was massive. That's in part a function of having a few very large depositors, I suppose.

Peter Thiel withdrawing huge amounts and telling others to do the same was a major factor.

Funny that. I think a lot of Americans’ mental image of a bank run is Mom and Pop mobbing George Bailey to get their little nest eggs out. Thanks to FDIC, Mom and Pop can sleep soundly; it was the big boys who panicked. You know, the ‘smartest guys in the room’. Not ‘old-fashioned’ at all.

Agreed: particularly if you are an Institution whose client base is very concentrated, very interconnected both business wise and socially (and as one can see if rather too overweight to a certain fraction who have lapped up Randian thinking).

A more diversified client base, and/or one less deeply interconnected might have modestly changed timing.

Useful European perspective comment in FT Alphaville (https://www.ft.com/content/7e7fdddb-724c-42fd-98ee-5d7248d53334) from 2008 veteran with obs from own lessons

"First, go big. Really big. Bazooka-big. Raise a lot more equity than you need and a lot more equity than regulators tell you to raise. Don’t just fill in the capital hole.

Second, the stock offering has to be underwritten. Hard-underwritten. Or already subscribed-for. Investors must assess the equity offering on the basis of a repaired balance sheet. They must know you don’t actually need them.

On both counts — especially the second count — the offering of SVB stock failed. Maybe it was a lost cause anyway, but the stock offering had no chance."

While acknowledging as he does hindsight is 20/20 the critique on the sizing (implicetely the timing one could allow as well) seems to correspond with other aspects where SVB management seem to have been trying to baby-walk their way around their crisis

Nobody talks about how wrong the ratings agencies were now and in 2008.

Pingback: Silicon Valley Bank was fine. It’s Silicon Valley that’s broken. – Kevin Drum