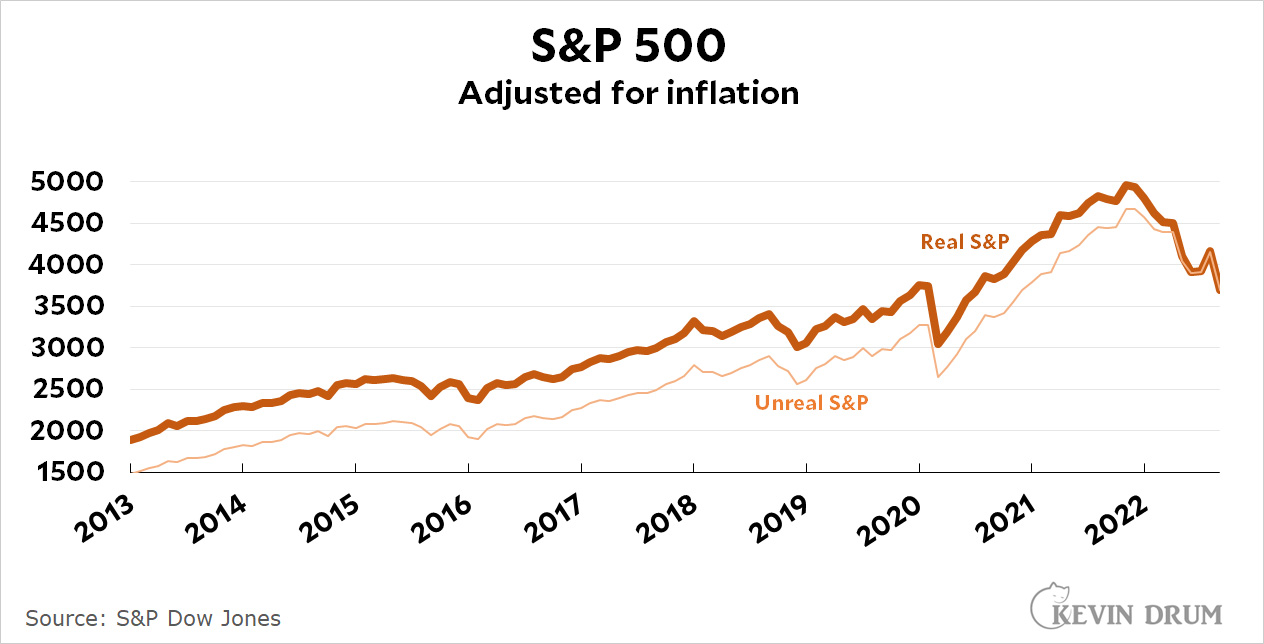

The Wall Street Journal tells us that the stock market is plummeting:

Dow Closes at a 2022 Low as Growth Fears Roil Markets

Wave of selling sweeps across the globe

But it's actually even worse than that. Here's something you don't usually see:

Adjusted for inflation, the market is down 25% from its peak, not just 20%.

It's a funny thing. In the bond market you can't avoid talk of inflation. The entire premise of the market is to get a return higher than inflation, and that's built into the entire structure of buying and selling.

But that's the premise of any investment, including stocks. And yet no one ever mentions inflation-adjusted stock prices. No one even compares the market indexes to the inflation rate—not often, anyway. Why is that?

In any case, even if you adjust for inflation the stock market has produced returns of 5% per year over the past five years. That's pretty good.¹ Hooray for long-term investing.

¹Assuming you put a bunch of money into the market five years ago, of course.

Are those SP500 prices adjusted for dividends?

If you're looking at the stock market as an investment (as opposed to just talking about stock prices in a vacuum), that's a critical consideration. If you're going to throw in an inflation adjustment then it's only fair to throw in a dividend adjustment to give the true rate of return.

As someone nearing retirement (late 50s) I’m getting a bit nervous. But I’m still working and just got a raise in a job change. Personally I hope tourism crashes again. That would be the best result. Of all the wasted effort and money… destroying everything in their path like a plague of insects or vermin.

https://www.theguardian.com/environment/2022/sep/11/tourism-utah-drought-zion-economy

“Fueled by the climate crisis and the overuse of dwindling water resources, the drought threatens the safety and sustainability of the spectacular sights; at the same time, tourists and the industries that cater to them contribute to an unfolding crisis in the cherished lands that brought them there.”

May all the people in the middle of nowhere where all the other local businesses have dried up and now are left either working tourism or for Walmart see their lives made worse off, all so the amoral monsters of the world like Justin can enjoy their retirements. (Cause of course if they were to move where jobs are more plentiful and they don’t need to rely on tourism, the Justins of the world would then fault them for contributing to water depletion & fossil fuel consumption in sunbelt states.)

Like +10!

Because, over the long run all you need to do is subtract the Fed inflation target rate from a (index) fund's average gain. Simple math that takes a few seconds.

And in the short-term, inflation is generally too small for speculators to notice in their profit/loss choices.

Well said.

Yeah, but 10% of that is pandemic bloat. By the 2013 trendline, the market should be 31500-32000. SP 3300-3700. Nas 11500-12000. I think people don't realize how over bloated this market was. Worst since 1987.

Growth fears are nothing you trade on. Poor class of rentiers we have.

Agree low interest rates take years to provide.

Low debt also.

Look at foreign exchange to see how the rich see the US as a choice.

If the Fed crashes the economy as planned, investment opportunities will dry up. People will have to buy stocks, and that will drive up the prices.

I started investing in the mid-1970s. Ever since the early 1980s, when consumer demand started its slow decline, the rule has been that recessions have been stock buying opportunities because of all that parked investment money.

It may be up from 5 years ago at a decent percentage--but damn, I lost a lot on my 401K's over the past few months!!!

Depending on setup, if you have mutual funds, there tends to be more churn during turmoil in the market--and therefore more "capital gains" and taxes, even if value is down in the short term (presuming your are not cashing out).

Auto production is ramping up as well. For the first time since January, all the big 8 had normal production with all clear for the rest of the year. Price cuts and incentives to buy are coming back by years end. Another hammer to inflation.

fyi: oil below $80/barrel....

CNN has it down to recession fears...

in general, market also reacting to news out of Russia. No matter how remote, any nuclear weapon or mishap in the war with Ukraine---then all bets are off.

Yes, Fed is overreacting--more or less determined to generate a recession just because....but market kinda knew that already...

It may generate a capex bubble instead. Corporate debt markets are just flush with cash as August showed. Aided by the strong dollar, the US is the place for domestic firms to invest. The foreign window is closed.

The WSJ says a wave of selling sweeps across the globe.

So where are the sellers putting their money? Wall Street: Money Never Sleeps

https://www.youtube.com/watch?v=sLAan2iZs_Y

For now, they'll put it into fixed income securities, but once the recession comes on, they'll have to put it back into the market rather than accept zero interest rates.

That would mean prices for fixed income securities would be soaring, no?

I'm not arguing, just trying to understand.

What do people here think of the Buffett Indicator? Market Value / GDP---It suggests Wall St. is still overvalued. It should also have inflation baked into the estimate.

The site dqydj (don't quit your day job) gives stock returns with and without dividends and adjusted or unadjusted for inflation, as you wish.

Perhaps Drum can engage his rather selective real rates mania also to interest rates, notably inflation adjustment for central bank benchmark rates.

Platitudes to live by: The factors that move the stock market are: fear and greed. And the stock market is not the economy.

The economy - like most things - is whatever the Republicans say it is that week. And when a Democrat is in the White House, the economy is always bad.

Instead of having all of your investments in one instrument, if you can get one real estate investment ball rolling and one mutual fund/stock investment ball rolling, you can just invest your "new" investment money into whichever is lowest. Essentially, it's looking like a great time to buy mutual funds as they're on sale, but real estate is still looking pricey.

This is the one place I think it's okay not to adjust for inflation, because an advantage of stocks is that they go up with inflation and bonds or money in a savings account don't (If every expense goes up X% and every sale goes up X%, then profits go up X%). Investment performance should be based on how much more money you're getting compared to keeping the money in cash, not how how many more things you can afford to buy.

The rule that stock prices go up in inflation was invalidated when the Fed started trying to fight inflation by raising interest rates. There was inflation anyway in the 70's, but stock prices went very low by the early 80's. That was actually a golden time for investors (who still had money), as both bond and stock prices rose for almost 20 years. Conversely the very high stock prices and low interest rates that prevailed until this year meant an unfavorable investment outlook. Now the Fed may be starting the whole cycle again.

But of course you always lose in inflation if you're holding cash or money in a no-interest account. Better to hold a money-market fund.

Real estate (land) also holds its value over the long run and can be a hedge against inflation, although obviously there are large ups and downs, thank largely to various aspects of Fed policy - regulation as well as interest rates.

" No one even compares the market indexes to the inflation rate—not often, anyway. Why is that?"

"No-one" is a big term. Quants and professionals absolutely care about this and take it into account, to the extent of worrying about sector-specific inflation.

So why doesn't the mass media talk about this? Well...

Could it possibly be that the role of the mass media is

(a) entertainment and

(b) political indoctrination (of whatever form, to whatever target audience)

rather than imparting actually important information?

Hmmm...

Fabulously written, imo.

Are you taking dividends into account?