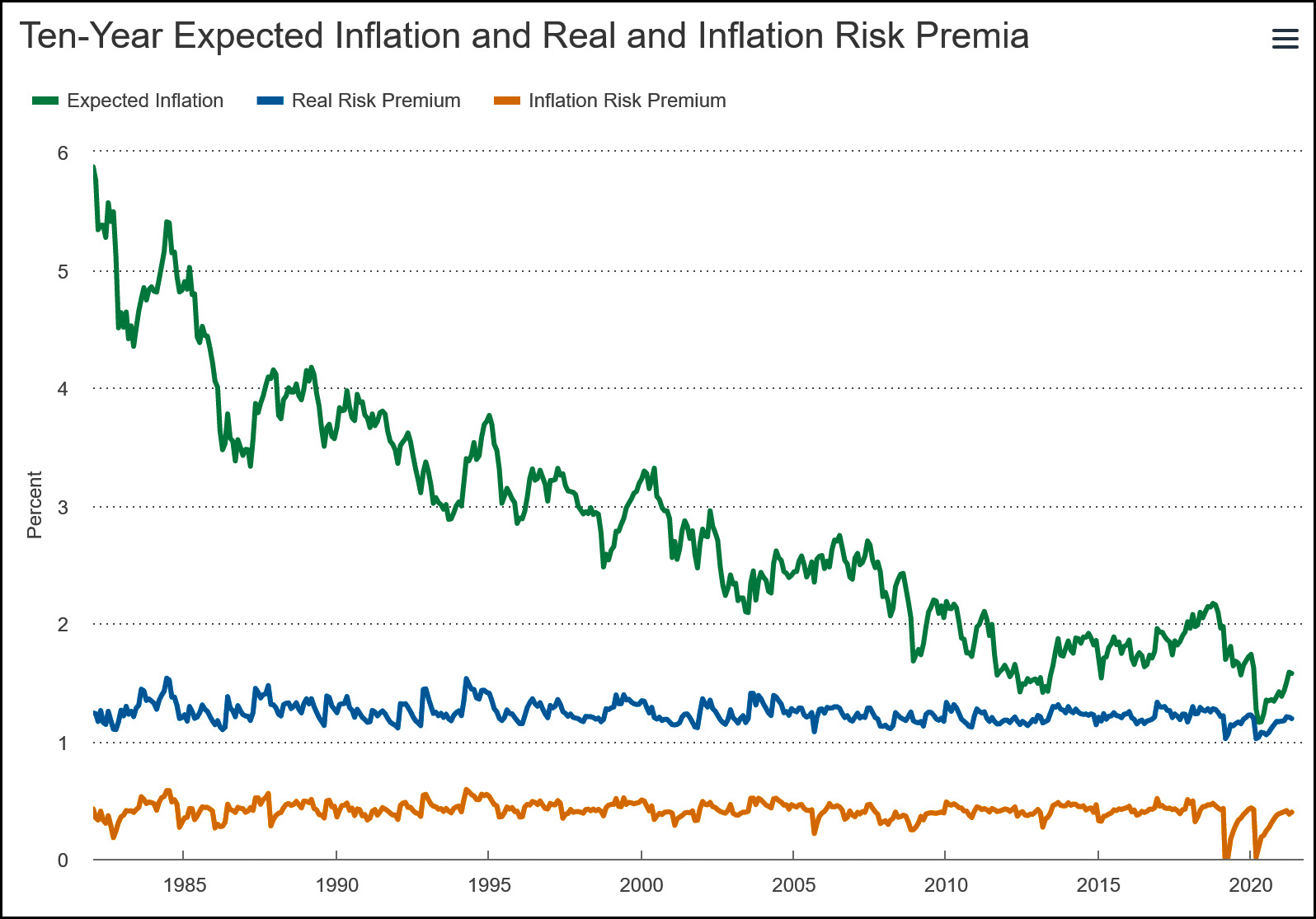

For those of you interested in a non-panicked look at inflation, the Cleveland Fed has been forecasting 10-year inflation expectations for the past forty years. Here's their entire time series:

These forecasts have been pretty accurate. Obviously there's a fair amount of noise in the data, and no forecast can account for recessions and pandemics ten years in the future, but generally speaking the Cleveland Fed forecasts are within about one percentage point of how things turn out ten years later. Right now they're forecasting future inflation at about 1.6%.

Other measures of inflation expectations, based on daily movements of Treasury rates, showed almost no movement today after the latest inflation figures were announced. Whatever the pundits are saying, the market doesn't seem to think today's figures meant much of anything at all. The 5/5 forward rate, for example, has been rising all year but dropped slightly today from 2.38% to 2.36%.

Bottom line: as with every other economic indicator, everyone should chill. Daily and monthly movements just don't mean anything, especially during a turbulent period like we're going through now. Over the next few months inflation will stabilize, the economy will grow, people will all get back to work, and everything will be fine.

Unfortunately, "everything is so expensive these days" is one of those comforting complaints lots of people use as a substitute for intelligent conversation. It will always have widespread endorsement unmoored from what prices are actually doing. But like unemployment, the political damage lies not so much in what has recently occurred as in what people expect to happen in the near future. If Republicans can succeed in their project to paint the Biden presidency as the start of Jimmy Carter ver.2, it will resonate with plenty of boomers who can remember the 1970s. Whether that will include any likely Democratic Party voters is a moot point.

Simply isn't going to work. The Carter era had a modern inflation adjusted peak of 8%......then a recession in 1980 to quell it. Again, when the July/August reopening works off and pandemic related shortages turn into oversupply, what then??? The U.S. Economy grew 4.2 between 1946-73. There has been no growth before or since that long at such a consistent rate since 1900. Us GDP will be back at 2%+ trend by summer. Unemployment is already declining quicker than the poor seasonal adjustments can even begin to show.

Try harder

James Earl Carter, Jr., wasn't even in office for the onset of petrol rationing.

But MAGA Haberman & Peter Baked Off His Ass never think to cite the Nixonian nadir or Ford failure when discussing the pitfalls of a presidency. Always the heartluster's heartache.

Funny how the US grew at that rate with very limited and ethnically balanced immigration. And that period, before 1973, was really before most of the Boomers were fully in the work force. Of course we had the Baby Boom during a that same period of tight immigration restriction, and put a man on the moon, and Apple and Microsoft were founded just after it ended. It's almost like mass immigration isn't necessary for economic growth and technological innovation, and actually hurts family formation and real wages.

Well yeah, there is a reason it was called the great boom. It occurred for a variety of reasons. GDP population growth was 2.7% in the 70's. In the 60's it was 2.4% in the 50's 1.9%. Major slowdown in growth covered up by increased population growth, which really began in 1941.

The Colonial Pipeline has already reopened.

The Panic! At the Citgo has ended.

Not quite hahaha, there's still a shortage of gas truck drivers to get the gas to the stations.

At least one news outlet sees it your way, Kevin. On my local NPR station, I heard "Marketplace" questioning the panic over the most recent inflation number. The host made the same analysis you did a couple of days ago, pointing out that the current month's number is comparing to the temporary downturn in March, 2020.

Marketplace did, but All Things Considered still breathlessly reported the high inflation number.

I imagine Reihan Salam & E.J. Dionne on All Things Friday will be tut-tutting the Biden-Harris dictatorship's shaky hand on the economy, too.

Well, Trump era inflation was 2.1-2% on avaerage between 2017-19. I bet 2020-21 is about the same if not a bit more on average.

But that was with a great economy and increasing wages at the bottom of the scale, do to some minor immigration restriction.

do -> due

Illegal immigration surged under Trump. There are no restrictions.

Inflation crazies are a comin'. Venezuela, cats, oh my? Hey, keep on plugging along. I enjoy your posts and wish you well. All, my best, Gary

America's second African president: Joebert Mubiden.

There certainly seems to be much inflation in the discussions of inflation.

You really should show all three of Cleveland Fed's charts on inflation expectations -- https://bityl.co/6p5U

So many people -- generally conservative and conservative-leaning folk -- point to the inflation monster right after *every* exogenous shock, presenting it as a sign of a black swan event.

I was just wondering if it would make sense (and how hard would it be) to chart the CPI basket cost vs median income.

The Cleveland Federal Reserve Bank sees inflation steady at a tick under two percent, but in this Lorain diner, they aren't so sure.

Actually, the US economy seems to be doing pretty well under its new communist overlords.

Again, what has caused very high inflation in sound economies is major events like wars and commodity shortages. Actually the oil shortage of the 70's which caused the inflation then was a fairly unique event. Another shortage could happen again because of events in the Middle East, but the impact would be much less. There are obviously some shortages now, but nothing like what happens in war when production is diverted to arms, or in the oil shortages of the 70's. Uppity workers have no power to force wage increases in the absence of war, and this was not the main cause of inflation of the 70's anyway.

So basically high inflation is not something that can be forecast by the Fed or anybody - if it happens it will be because of things that are outside the control of the Fed. It should always be kept in mind that the Fed did not prevent inflation in the 70's. The idea that the Fed can control inflation is a bizarre myth.

No, the forecasts are not accurate for 10 years in the future - they are several percent lower for 10 years ahead most of the time until around 2010. They are supposedly for the next 30 years and the idea that things can be predicted that far ahead is nonsense - economists can't predict one or two years in the future. There is also no evidence that markets can predict that far either - if they could there would be no crashes. Quotation of the this particular "forecast" proves nothing.

Exactly. Who predicted the 2008 financial crisis?

Aaaaaaand...ssSHAZAM! The market is up ~~ 400.

Inflation isn't real...and the Left's immigration policy preferences aren't causing wage depression.

https://newyork.cbslocal.com/2021/05/11/robbinsville-baps-hindu-temple-lawsuit-manual-labor-human-trafficking/

I think religious immigrants are a republican thing. Or you just have no idea what you're talking about.

The "rights" immigration policy has flooded the U.S. with illegals

Shouldn’t there be an “Actual Inflation” line along with the expected?