I don't mind saying that I'm a little confused about the collapse of Silicon Valley Bank. Here's some basic financial history:

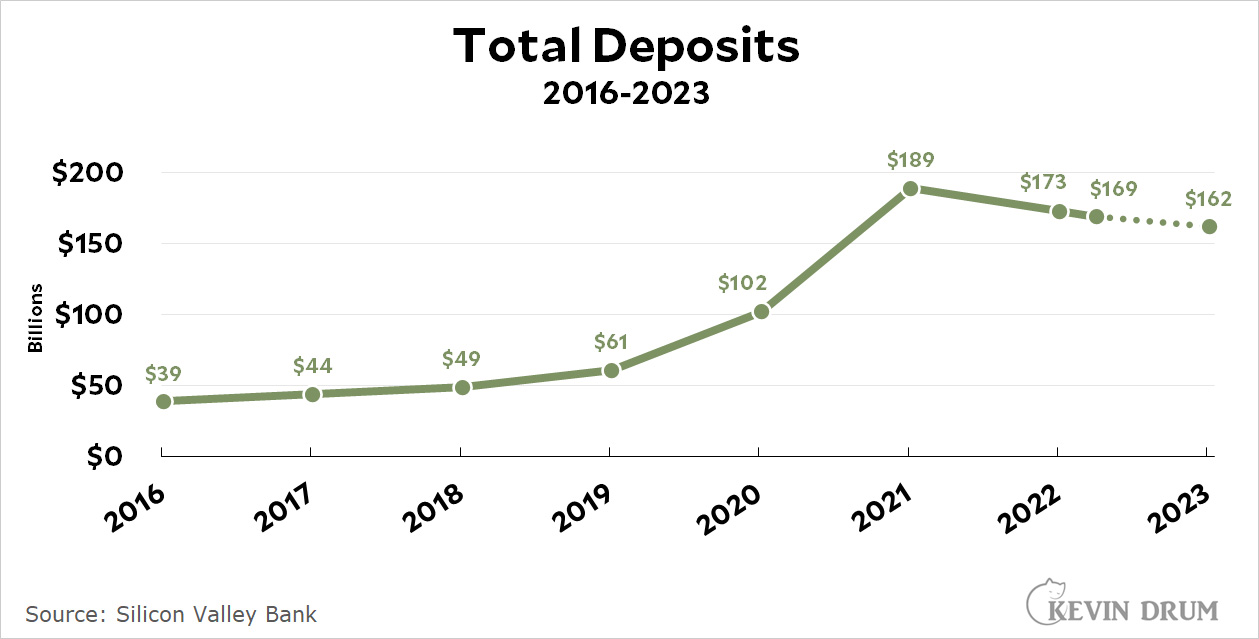

After a huge runup during the tech boom of 2020-21, deposits slowly fell back to earth in 2022, reaching $169 billion in February 2023.

After a huge runup during the tech boom of 2020-21, deposits slowly fell back to earth in 2022, reaching $169 billion in February 2023.

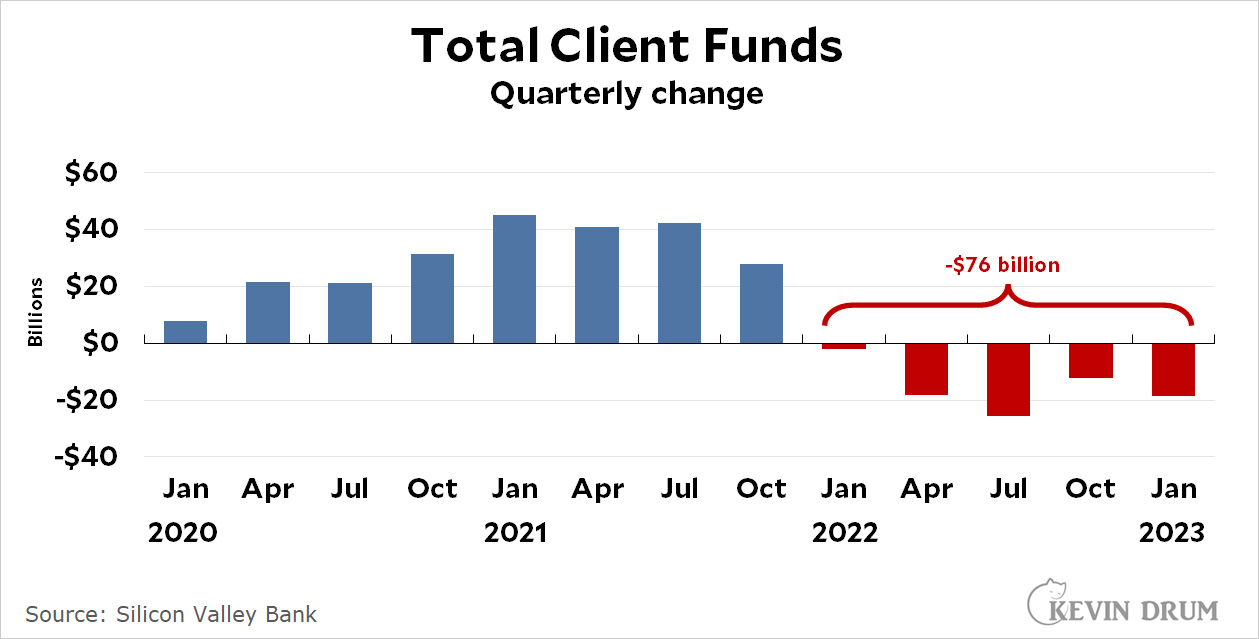

Since the start of 2022, SVB has seen withdrawals of $76 billion in client funds (through February of 2023).

SVB's stock performance skyrocketed during the deposit boom and then reverted to trend in 2022. Their stock price recovered a bit in January and then fell slightly in February.

All of this looks bad but not disastrous. In addition, SVB had $91 billion tied up in long-term bonds that had lost about $15 billion thanks to the Fed's recent surge in interest rates. However, those bonds were marked as Hold to Maturity, which means the loss didn't show up on SVB's accounts—and wouldn't for many years.¹

All of this was well known at the beginning of March. However, although the portfolio loss made people nervous, neither investors nor regulators seemed to be panicking. But then things started to roll downhill.

March 8: SVB releases a mid-quarter update stating that withdrawal activity had remained heavy and they had therefore sold $21 billion worth of their ATS holdings² at a loss of $2 billion. This provided them with $19 billion in cash and a paper loss that would impact earnings. At the same time they announced a small capital raise of about $2 billion.

March 9: Moody's downgrades SVB from A3 to Baa1. This is technically a small downgrade, but the change from A to B restricts the ability of many funds to hold SVB's stock. Shortly after this, Peter Thiel's VC fund, along with others, recommends that clients pull their money from SVB. This results in a $42 billion bank run.

March 10: SVB is closed by the FDIC and put into receivership.

The question is this: Was SVB management reckless in putting a huge amount of their reserves into a single basket (long-term government and mortgage bonds) that were technically safe but sensitive to interest rates, even while knowing that their deposit base was very homogeneous (tech startups) and therefore volatile?³

Or was this a reasonable decision that did poorly in the short term but didn't affect SVB's books and left them in fairly good health? If this is the case, the real problem was an insane bank run on Thursday of a size that no bank could survive.

But there's more. Even if SVB didn't make any big mistakes, did they screw up their mid-quarter review and end up spooking everyone? If so, what exactly did they do wrong? And why did they bother with the capital raise, which has a whiff of panic to it but wouldn't have produced enough money to really matter?

I remain up in the air about this. As near as I can tell, SVB was very well capitalized in general and there's no reason to think that stricter regulations would have changed anything. It seems as if there's something missing here that would help explain what really happened. I guess I'll just have to wait.

¹In fact, maybe never. The bonds will regain their value when the Fed eventually lowers interest rates, and if that happens before the redemption date of the bond then the bond portfolio will end up just fine.

²ATS = Available to Sell, which is just what it sounds like. Assets that are designated ATS are marked to market every quarter, so their gains and losses immediately affect the bank's balance sheet.

HTM = Hold to Maturity. The bank intends to hold these assets to maturity, so short-term changes in value don't affect the balance sheet. Gains or losses are recorded only when the bonds mature and are redeemed.

³For example: If the tech sector slumped—which it did—then flows of VC money into new startups would decline—which they did—and therefore fewer startups would have big chunks of cash to deposit into SVB—which also happened—and in addition, since VC funding had dried up, startups would need to withdraw money from SVB to make payroll and cover all their normal expenses.

If you're highly exposed to a single industry, you need to be prepared for a slump in that industry. It's not clear if SVB was.

I'll take a guess: Peter Thiel held a large short position in SVB.

"Several founders I spoke with mentioned they weren’t planning to pull their money out of SVB until Founders Fund, the venture-capital outfit controlled by Peter Thiel — of Gawker-killing, Palantir-founding, and Trump-endorsing fame — advised its portfolio companies to do so Thursday afternoon. It had a galvanizing effect: Think Elon Musk tweeting “Gamestonk!!” in January 2021. Various other prominent VC firms, including Union Square Ventures and Sequoia Capital, offered version of the same guidance."

https://nymag.com/intelligencer/2023/03/silicon-valley-banks-failure-felt-a-lot-like-gamestop-mania.html

Again, killing Gawker was a good thing.

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details

visit this article... https://createmaxwealth.blogspot.com

As some wag put it so well the other day: "This is the first bank run in history caused by Twitter."

The commentary in the Financial Times is useful.

Opinion Banks SVB’s collapse is not a harbinger of another 2008

ROBERT ARMSTRONG

"https://www.ft.com/content/0e1c671f-7998-4a55-a44e-edf07193616d

It is worth noting that as profiled in the FT, the bank came quite close to raising new capital, but noting that withdrawals significantly accelerated after Founders Fund recommended pulling deposits out. A bit of a prisoner's dilemma problem, a slightly different timeline might have seen an orderly capital raise

"Finally, SVB’s clients were creatures of low rates, too. When Fed policy was accommodative and the VC money was flowing, start-ups were confident and flush with cash. Higher rates and the tech sell-off has changed all that, leaving young companies jumpy and tight with their money. When Bloomberg reported on Thursday that Founders Fund, the prominent VC fund, was recommending its companies pull their money out of SVB, that may have sealed the bank’s fate."

Timing.

They probably made the major error in not getting ahead of the mid-quarter information

I'm sure management won't escape criticism because Job 1 should have been to keep the bank afloat and that didn't happen. Goes with the territory.

But a few other angles are worth discussion.

1. Role of the Fed. They failed to raise rates early and continue to hike now at an unprecedented rate. When doing stuff like that, something is bound to break. It's pretty to think this is an isolated incident. More likely, it's a sign some parts of the financial system are under extreme stress. Will the Fed modify its reckless target of 2% at all costs?

2. What impact did rolling back Dodd-Frank under Trump have? A lot, in this particular case, as I see it. Story about it here: https://www.nytimes.com/2018/03/06/opinion/democrats-trump-dodd-frank.html

3. Billionaire investor class hypocrisy. Libertarianism runs deep in SV. Interesting to see Thiel's role in the bank collapse. But don't expect the billionaires to be saying "tough luck, that's capitalism." Nope. Here's Bill Ackman demanding a government bailout. In 48 hours, no less!

https://twitter.com/BillAckman/status/1634564398919368704?s=20

HaHaHa. I love the VCs calling for bailouts now, when they're all otherwise geniuses. I'd bet there are a number of relatively small banks in a single industry that are susceptible to runs, but I have no idea which ones that is.

BTW, I wonder how many of the startups that are screwed now had been told by their VCs that they *had* to put their money in SVB?

It seems prudent to keep most of your money in T bills if you're going over the FDIC limit of $250K.

The 2% inflation target is not reckless, it is long-standing central banking 'standard' (coming out of New Zealand ironically). While many specialists would indeed support a modification broadly to 3 or 4, and there is much to say for that as this was broadly discussed in the Zero Bound Problem era (i.e. the past decade) on the finding that 2% was too low once it became the baseline rather than a target worked towards, engendering the perverse side effects we saw with QE etc, the Fed openly changing this objective now would be reckless and only have perverse side effects of likely causing more tightening pressure - versus for example a quiet recalibration as inflation cools and once down, allowing for 3 or 4 - politically wiser, easier and more likely to hold.

Any time there is a significant change parts of a system break - as Covid showed - so criticism of the Fed re rate raising is really nonsense, unless one has a statis economy there's always going to be moments of change, it's the system's capacity to mitigate breakage not eliminate breakage that counts.

But indeed the hypocrisy of the US libertarians is... well, what can one really say except it reveals the bankruptcy of libertarianism as a kind of inverted Bolshevik attitude to the economy rather than old-fashioned pragmatic liberalism.

Of course the CEO selling a few million dollars in shares within recent days does look a bit suspicious. But the answer to your headline is that SVB was both incompetent and unlucky. If your bank fails for any reason you are incompetent. You're in the business of taking people's money, in this case many billions of it, and charging them a little bit with the promise of keeping it safe for when they need it. In exchange, you get this huge pot of money you can invest in such a way that you get to make a nice profit. SVB failed at its fundamental job--keeping depositors' money safe.

No, they did not fail at keeping depositors money safe.

They failed due to a panic, bank run by self-same depositors. A liquidity crsis, the classic bank run.

Had not everyone started drawing, money was perfecty fine.

That's a failure of risk management. Your argument is the same as those who blame the flood for destroying their building, built to code and all regulations, but sited in a flood zone. It's also a failure of the businesses that had all their deposits in this one bank and can't meet payroll. I run a very small business. We split our deposits between several institutions and we could meet payroll for months from either one.

And I run a 300 million euro investment vehicle...

Yes SVB failed in its risk management, that is not however a failure of keeping depositors money safe in the sense on generally means for a lending institution - they were solvent and their loans and assets while illiquid were not going bad. A liquidity error, not an asset error.

Thanks for putting this together.

As you said, it was a classic bank run. But why? Unless the bank had run out of liquid assets, or would soon, then it was completely uncalled for. Investors might not be pleased with a few quarters of losses--but that's better than a collapse.

SVB catered to start ups, and apparently many of those were "sponsored" by Thiel's VC fund. I'm surprised they were not told to park some of their capital at other institutions. I read that a start up had billions all in that one institution. I consider that bad advice from their VC people.

It sounds like the vast majority of their assets were liquid, in that they could sell them, but were long term bonds, which meant that if sold, they'd be sold at a loss. And the size of the losses were so high that they actually were running out of money, and had fallen below the level where they could pay out their depositors.

Rule #1 for closing insolvent banks -- do it *now*, because things will only get worse. In this case, the more bonds they have to sell at a loss, the harder it will be to find someone to buy the bank.

Both incompetent and unlucky. Their customer base seems like part of the problem. But what do I care? Fuck those rich bitches! The federal reserve wanted to engineer a depression and so there are casualties. Chicken is expensive. Gasoline price jumped like 50 cents in the last week. It’s spring. Rich people on spring break driving. Poor people are suffering!

Meanwhile…. More casualties.

https://www.latimes.com/environment/newsletter/2023-03-09/white-drivers-are-polluting-the-air-breathed-by-l-a-s-people-of-color-boiling-point

“How white and affluent drivers are polluting the air breathed by L.A.’s people of color.”

Stay home, people.

Hilarious. Maybe it’s a good thing that California residents are being flooded out and having their economy wrecked. The last thing we need are more tech start ups.

Fuck off, concern troll.

I feel unsafe. If you knew where I lived, would you come here to kill me? I think you need some therapy.

https://youtube.com/watch?v=TjCmFREe_EE&feature=share

You seem unable to manage your anger issues.

No. Justin is justified. A lot of the damage to this country is being inflicted by rich white billionaires. In addition to bankrolling far right candidates for everything, the role of Peter Thiel in the Silicon Valley bank failure could well be very significant. From Josh Marshall in TPM today:

"A key accelerant of SVB’s collapse was Thiel’s guidance to all his invested companies to pull their deposits as the bank’s position became more dire."

I'm surprised that Kevin made no reference to this.

Why… thank you. Autism hates me because, I guess, I must have said something mean to them one time. Not sure I remember what it was.

Nothing you said, you're just an asshole, don't worry.

Autism is a war criminal. That’s what’s tormenting her. I’m Mr. Drum’s less polite voice. No daylight between us.

In other contexts we don't make a distinction between incompetent and unlucky. If you fail you fail, at least if you're not a wealthy bank investor or depositor. See the way we treat every college student who signs on to a big loan at the age of 18 without fully understanding the consequences. If we're going to have that policy maybe we should apply it consistently.

Oh, snap!

😉

Larry Summers: "What is absolutely imperative is that, however this gets resolved, [SVB] depositors be paid back, and paid back in full."

Also Larry Summers: “Student loan debt relief is spending that raises demand and increases inflation,” Summers said on Twitter. “It consumes resources that could be better used helping those who did not, for whatever reason, have the chance to attend college.”

Huh, imagine this!

Yeah. And paying SVB depositors back consumes resources that could be better used helping those who did not, for whatever reason, have more than $250k in the bank.

That certainly makes sense given that the converse is true as well, at least, the guys in the C-suites never attribute to luck what they can to competence. Neither confabulation makes sense, of course.

If SVB's scheme of borrowing short and lending long in the face of rising interest rates had actually worked they'd be slapping each other on the back and awarding themselves fat bonuses.

SVB did not have such a scheme at all - what got them into trouble was rather on an in-rush of jumbo corporate deposits they did expand lending in commensurate manner, but were buying fixed rate bonds.

See: https://www.ft.com/content/7cf4eb45-78b7-4e6e-b134-1f0b082ba203

"SVB caters to California’s tech industries, and has grown fast alongside those industries for years. But then, with the explosion of speculative financing in the coronavirus pandemic boom, deposits (dark blue line) rose super-duper fast. SVB’s core customers, tech start-ups, needed somewhere to put the money venture capitalists were shovelling at them. But SVB did not have the capacity, or possibly the inclination, to make loans (light blue line) at the rate the deposits were rolling in. So it invested the funds instead (pink line) — overwhelmingly in long-term, fixed-rate, government-backed debt securities.

This was not a good idea, because it gave SVB a double sensitivity to higher interest rates. On the asset side of the balance sheet, higher rates decrease the value of those long-term debt securities. On the liability side, higher rates mean less money shoved at tech, and as such, a lower supply of cheap deposit funding."

They bought fixed-rate bonds of long duration intending to hold them to maturity, then crossed their fingers hoping depositors wouldn't want their money back in the meantime. The depositors did in fact want their money back so SVB had to sell the bonds at a loss.

If their hope had panned out they'd be calling themselves geniuses. Of course since it didn't they're just "unlucky" and taxpayers should bail them out.

As you clearly do not understand either SVB or banking... the ideological knee-jerking is simply boring.

(the characterisations are to quote the scientists in response to irrelevant pseudo-science "not even wrong")

I'd like to hear from your former bank examiner reader on this, actually, and hope he can chime in.

A small quibble: doesn't "hold to maturity" mean that (barring government default) they should get the full face value returned? Hence there wouldn't be any loss on those; they'd just be illiquid if actually held. But also not earning much by way of returns until then, limiting the bank's income on these assets over quite a long period, the opposite of what it'd want.

One thing I saw about this situation is that the bank managers didn't really know what to do with the huge influx of deposits (effectively a tripling in 2 years, and at a time of economic stasis during covid) so they parked the money in long-term treasuries. Thus the need for raising capital or eating principal losses to cover the accelerating withdrawals. They were in the same boat as everybody else, essentially, not able to find a return on investable funds given zero interest rates and drastic economic slowdown.

But . . . I'm with Rattus Norvegicus on Peter Thiel. It's hard for me to see him passing up such a golden opportunity to take the bonanza short here. And ensuring the play by having his ventures pull their cash out.

I also think Joseph Harbin's questions are good ones; this was apparently one of the regional banks exempted from Dodd-Frank "stress testing."

To your first inquiry, it depends. 'Zero-coupon' bonds don't pay any interest over their lifetime; they pay face value when mature. For that reason, the long-term ones are priced at a deep discount at issue; the difference between the discounted price and face value set the interest rate for the life of the bond, if held to maturity. The discount in secondary markets fluctuates with current interest rates, so the effective interest rate for the purchaser closely tracks that for newly issued bonds. Coupon Treasury bonds pay periodic interest at a rate fixed at the time of sale (except for TIPS, Treasury Inflation-Protected Securities).

I'm guessing the long term bonds had the best yields at the time. Made sense as long as there wasn't going to be large net withdrawals from the bank.

As for Thiel--he might just be fin CYA mode. I'm guessing his VC firm may have recommended their startups keep all their money together in one place.

In Finance 101, you learn how volatile long term bonds are to changes in interest rates, and it is unlikely their customers can wait up to 30 years for SVB's Treasury Bond investments to mature and pay out par value. It would have been far safer to invest a portion of the $150B influx of deposits in a diversified portfolio of bank C&I syndicated loans, which are floating rate. The rest in T bills and Commercial Paper.

If they had over $200B in assets and $90B in T-Bonds, what did they invest the other $110B in? What does their loan portfolio look like? I would expect the uninsured depositors will take a sizeable haircut at the end of day, depending on the liquidity of the loan portfolio.

Apparently Roku has almost $500M in deposit at SVB, about 1/4 of their cash holdings.

SVB is insolvent, which means it is unable to meet its financial obligations as they come due. In this case, the problem arises with demand deposits, which are financial obligations that come due whenever the depositors demands their money. However, I have yet to see any indication that SVB is actually broke; it may be able to meet all its obligations given a little time.

As others have noted, something stopped bigger, better-capitalized banks from buying SVB, if its assets actually equaled or exceeded its liabilities.

It should be understood that SVB as a venture lender has a lending and risk profile that most standard commercial banks actively eschew. This is not just a regional bank, but a quite specialised sector bank in the end. Not the sort of business that the usual, and particularly highly regualted systematically important commercial bank, generally wants to take on.

SVB's general history indicates the niche can be effective (if one doesn't ignore the risks as seems to have happened in 2021-2022/3 period), but it is not something a typical commercial bank can easily get comfortable with.

The lack of a quick sale in an uncertain and declining tech-VC environment need not say SVB is fundamentally worse than it appears (maybe it is, but need not be on the fact set), but does need a specialist buyer.

Thanks, L, well explained.

Ironically, the Founders fund libertarian fools by making the call they did may have actually (through myopic short-termism rather typical in my opinion of American libertarianism) significantly impaired the whole affaire now (in a way it was not pre-collapse) due to the high degree of Cali VC interconnectedness.

I should say my comment was from a pre-collapse perspective for a buyer, relative to just getting a bigger commercial bank to buy.

As the Thiels of the world are unable to operate in at least a JP Morgan level of broader awareness of interest. The Funds individually in narrow and myopic self-interest calling for their investees to pull funds probably - unless their whinging and hypocritical calls for full bailout come through - harmed their own investees, whereas a federated capital rescue probably would have avoided significant damage - both to investees and to the ecosystem.

But the Bolshevik style ideological Ayn Randesque individualism seems to preclude.

This from Matt Levine at Bloomberg seems to the point:

"And so if you were the Bank of Startups, just like if you were the Bank of Crypto, it turned out that you had made a huge concentrated bet on interest rates. Your customers were flush with cash, so they gave you all that cash, but they didn’t need loans so you invested all that cash in longer-dated fixed-income securities, which lost value when rates went up. But also, when rates went up, your customers all got smoked, because it turned out that they were creatures of low interest rates, and in a higher-interest-rate environment they didn’t have money anymore. So they withdrew their deposits, so you had to sell those securities at a loss to pay them back. Now you have lost money and look financially shaky, so customers get spooked and withdraw more money, so you sell more securities, so you book more losses, oops oops oops."

https://www.bloomberg.com/opinion/articles/2023-03-10/startup-bank-had-a-startup-bank-run

That is, SVB's assets were heavily overweight in long-term securities, and its liabilities were massively overweight in uninsured demand deposits. One of the standard key points in risk management is to ensure a diversity of assets and liabilities, and it seems that SVB failed at this. Which indicates incompetence at least in this area.

Yes, the FT makes the same or similar point this AM.

They made a massive one-way liquidity bet on a non-diversified financing business with worse yet a non-diversified, highly correlated and highly mobile funding base.... AND they reacted too slowly when it was emerging that not only was the bet high-risk for the changing funding environment, but that their client base was starting to talk and they were entering into a prisoner's dilemma logic.

Notable the FT quotes a Hedge fund looking to short SVB from last year evoking publicly this run as an explicit risk given the profile of funding - while one should not jump at every hedge fund comment, nevertheless illustrates it was analytically available if one was looking at this bank closely.

The Financial Times (this being of course their subject matter par excellence) this AM has a useful profile of the end psychology of the run, which highlights again the not-so-hidden embedded risk of the bank with an extreme degree of sector lending concentration and funding - that is the source of their lending base being aligned with the sector, deposits from the VC backed tech sector which dominated - being not only the flightly and highly mobile corporate jumbo - above deposit insurance limits (contra sticky, not comparatively price sensitive retail deposits) but also a very limited and inter-connectec set of CFOs who talk to each other....

From: https://www.ft.com/content/b556badb-8e98-42fa-b88e-6e7e0ca758b8

"In early March, 40 chief financial officers from various technology groups gathered in the Utah ski resort of Deer Valley for an annual “snow summit” hosted by Silicon Valley Bank, a crucial financial institution for start-ups.

Barely a week later, on Thursday morning, several of the finance chiefs were exchanging frantic messages about whether they should continue to hold their cash in the bank.

A sale by SVB of $20bn of securities to mitigate a steep drop in deposits had focused investors’ attention on vulnerabilities in its balance sheet. They dumped its stock, wiping $10bn off its shares and crashing the market value of the bank — worth $44bn just 18 months earlier — to below $7bn.

“The prisoner’s dilemma was basically: I’m fine if they don’t draw their money, and they’re fine if I don’t draw mine,” said one of the CFOs, whose company had banked around $200mn with SVB. [....] “It turned out that one of the biggest risks to our business model was catering to a very tightly knit group of investors who exhibit herd-like mentalities,” said a senior executive at the bank. “I mean, doesn’t that sound like a bank run waiting to happen?”"

As I commented, the classic prisoner's dilemma, so long as there's no rush, SVB survives. However if one fears the other guy is moving, you have to rush to the exit....

Clearly Founder's Fund advice to investees / circle was a trigger - had the comments been in another direction, perhaps SVB might have pulled off a bridge capital raise to calm the waters.

The ex-executives interviewed on a placement change should be taken with grain of salt but at same time the description a a decision process has a consistency

"One person directly involved in the bank’s finances attributed the policy to a change of leadership within SVB’s key finance functions in 2017 [...].

The new financial leadership began to shift an ever greater percentage of excess cash into long-term fixed-rate bonds, a manoeuvre that would appease public shareholders by bolstering its overall profits, albeit only slightly.

But it appeared blind to the risk that cash pouring in was a symptom of low interest rates that could reverse if they rose. Central banks often increase rates to tamp overexuberance among investors, decisions that generally lead to a slowing of investment in speculative companies such as technology start-ups. SVB’s bond portfolio was exposed to rising rates and so too were its deposits.

“We had enough risk in the business model. You didn’t need risk in the asset/liability management profile,” said the former executive, referring to the bank’s ability to sell assets to meet its liquidity needs. “They missed that entirely.” [...] Ultimately, it committed a cardinal sin in finance. It absorbed enormous risks with only a modest potential pay-off in order to bolster short-term profits."

In effect they appeared to be making a one-way bet - that one can indeed call a degree of incompetence via blindness in risk-management terms most particularly when one takes into account the pecularities of a non-diversified deposit base highly aligned with its financing focus and with barely any sticky core deposits.

Also as the FT article highlights, the Timing Issue: had they recognised their risk exposure and gotten ahead of public reporting, in raising capital earlier, again maybe might have avoided... but betting heavily for small short-term boost given their overall risk profile, yes we can say that was incompetence.

So, question of the day for me is, what does the Fed do now? Pause it's tightening, at least this month?

This does not concern the Fed. It concerns the FDIC and no, the US central bank should not be riding to the rescue of the Venture Capital clique.

The strength of the US economy very much involves the Federal Reserve (indeed this is the law). The current situation may or may not provide the Fed with useful, actionable information about the state of the overall economy, and the impact on that economy of its multiple rounds of tightening (it's early days yet). And to state the obvious, if we have a liquidity crisis on our hands next week, that's bound to influence the central bank's decision-making with respect to its next move on monetary policy.

The failure of one idiosyncratic regional bank highly specialised in VC backed tech companies does not put in play the US economy

There is at this time no generalised liquidity crisis (unless some broad panic arrives, which while not rooted in fact and would be irrational, of course never to exclude) as most commercial banks do not have the highly idiosyncratic triple concentration of lending/financing, jumbo uninsured deposits from same sector, extreme acceleration of incoming deposits from same set of financed entities.

So to state the obvious, drawing superficial conclusions from an idiosyncratic bank whose profile is quite unique is not sensible.

Should irrational panic spread to other regional lenders, that can be of concern but other California regional lenders have vastly more diversified deposit bases, and ones with much more core deposits which not only are sticky are insured

Essentially identical observations are made at FT's unhedged newsletter: https://www.ft.com/content/7cf4eb45-78b7-4e6e-b134-1f0b082ba203 relative to the extreme idiosyncratic nature of SVB profile in funding as well as lending and assets- as most commercial lenders profile ends up benefitting from rate decompression so long as not too fast nor tipping into major recession

and also that there is resididual risks from a spread of irrational fear of bank runs that then generate the very bank runs.

I think there's good reason to think SVB is different than other banks and there's not a strong reason to worry about a general liquidity crisis.

But the financial system, like all systems, function in good part because people have faith in the system. If a large number of depositors begin pulling their assets out of a bank, that bank will soon be in trouble.

It concerns me that people like Thiel and Bill Ackman are predicting bank runs. There's a good probability that they are trying to profit off the situation, but whether warranted or not, their calls can become self-fulfilling prophecies. Like it or not, there are players working against a more stable system. Chaos is advantageous for some, as we've seen from our politics.

I don't know the balance sheet of Signature Bank, but if I had (uninsured) money there I'd probably pull it as fast as I could because I've seen it mentioned many times as the next bank to fall.

I'm not sure what the government or the Fed ought to do about SVB. Maybe something, maybe not. It probably depends on what happens next.

Well yes the irrational contagion effect is a genuine concern, and one that will lead the regulators to make some extra efforts, although it is not merely "a good reason to think"- it is quite clear from data their profile was rather eccentrically different.

The failure perhaps will be useful in drawing attention for regulators to the rate transition risks and careful steps to backstop against panics.

For Thiel et al - indeed they can not be trusted to act or speak even in a rational 'fellow VCs' interest, but only the most narrow and myopic Randian concept of self-interest (one can see a stark difference with the wider peer set who issued letters in support to rebooting SVB (of potential utility in an orderly restructuring and relaunch on acquisition of SVB by a specialist buyer for example).

Flip your Footnote #3 a bit: Was SVB management reckless for maintaining a lack of diversity in both their assets and deposits, so that downturns could hit both sides of the books at the same time?

SVB is a miniature model of how 2008's crash happened: financial stability should be measured against localized issues as well general downturns. SVB's deposit-side was well-protected against the failure of any given start-up or series of start-ups but not against a general downturn in the tech start-up sector. Its asset-side was well-protected against short-term threats but lacked short-term liquid assets needed to shore up against interest rate increases IF it also required a short-term cash infusion. As a result, when deposits slipped and interest rate increases squeezed the asset side of things, SVB needed cash and had to make financial moves that spooked investors.

That Peter Thiel was involved is troublesome and his reaction was self-fulfilling prophecy (which he might have known), but not central to the story. That SVB was well-capitalized overall is important to know and a reason that Dodd-Frank require stress testing of particular scenarios rather than general downturns. However, it is also important to remember that SVB was a leading lobbyist for overturning and limiting such stress testing and for loosening caps on reserve requirements for "small" banks as well.

Did someone say diversity?

Here's a novel explanation of the SVB failure. Guess which likely presidential contender said it.

“I mean, this bank, they’re so concerned with DEI and politics and all kinds of stuff. I think that really diverted from them focusing on their core mission.”

Clearly, the woke agenda has gotten out of hand. It's causing banks to fail now.

.... extreme unseriousness, but the US Republicans have become a photonegative of Bolsheviks.

It doesn't sound to me like a general contagion that will spread to other banks, but I found it interesting that a small local bank where my business keeps significant funds saw fit to send emails last night proclaiming their fiscal health. I don't ever recall them doing that before in reaction to any news story.

More than 90 percent of SVB’s deposits were uninsured, meaning that most of their depositors were exposed to losses in the event of a failure. For the banking industry as a whole, about 58 percent of deposits are fully insured, and at your typical community bank, the percentage is much higher. Depositors with balances of less than $250,000 have no incentive to withdraw their deposits when a bank gets in trouble. The large share of SVB’s deposits that were exposed to loss, plus the homogeneity of their depositors, made the bank run vastly more likely once signs of weakness surfaced.

97%... a stunning number...

Even more - the concentration of the source of the deposits - not even a broad or diversified corporate deposit base but one heavily exposed to their focus sector. Risk on risk.

Pingback: Silicon Valley Bank was fine. It’s Silicon Valley that’s broken. – Kevin Drum