If we're suffering a bit right now from spot shortages and labor tightness, it's only because the economy is growing so fast that it's hard for everyone to keep up. The Wall Street Journal writes today about our unprecedented economic rebound:

If we're suffering a bit right now from spot shortages and labor tightness, it's only because the economy is growing so fast that it's hard for everyone to keep up. The Wall Street Journal writes today about our unprecedented economic rebound:

New businesses are popping up at the fastest pace on record. The rate at which workers quit their jobs—a proxy for confidence in the labor market—matches the highest going back at least to 2000. American household debt-service burdens, as a share of after-tax income, are near their lowest levels since 1980, when records began. The Dow Jones Industrial Average is up nearly 18% from its pre-pandemic peak in February 2020. Home prices nationwide are nearly 14% higher since that time.

....“We’ve never had anything like it—a collapse and then a boom-like pickup,” said Allen Sinai, chief global economist and strategist at Decision Economics, Inc. “It is without historical parallel.”

Needless to say, this is all because Congress acted with a bigger and faster rescue package than ever in history—and the Fed cooperated during the entire downturn with loose monetary policy. Among other things, that makes the next couple of years a terrific experiment in monetary and fiscal policy. If we recover faster than ever, and do so without sparking an inflationary spiral, it will be a strong indication that our past responses to economic downturns have been routinely too timid. Stay tuned.

> If we recover faster than ever, and do so without sparking an inflationary spiral

then maybe the Dems can keep the Senate?

We can hope, also I hope for a bigger majority so we don't have business held up by one or two cantankerous senators.

Only if the GOP voters learn to love themselves. Until they do, they will keep eating whatever shit they are told to eat, and we will all sink together.

You're thinking we should use evidence-based policy. ROFL.

OMG Gas might be more than $3/gallon....it's a disaster!!!!

The Republicans will be heading to the fainting couch every time a price goes up.

Will it stick? We'll see....

As for the main point--yeah, erring on the side of stimulus is best. But the Republicans couldn't let that happen with Obama, else they'd never win again....

Gas prices?? Considering oil is a illusion of finance and vastly over produced now, there is no prices except set by financialist elitist. Destroy their ability to speculate, watch the price collapse.

Heh. $3 gasoline. I've heard of it. Around here though (SF Bay Area) we are on a trajectory to hit $5 a gallon (certainly for premium if nor regular unleaded). It might finally mean it made economic sense to buy the hybrid (plain, not plug-in) version of the Fusion back in 2013...

Housing market is already falling and real prices aren't far behind in terms of slowing then decline. But as I say, who cares. The housing bust of the 2000's was just a larger story of the prime lending.bubble of 83-07.

One of the fascinating parts of debt liquidation is the collapse of cosmopolitan immorality mirrored by starving peckers in rural areas. 1931-33 were a great time......Then the bourgeois interfered.....

Capacity was taken offline during the last year. Now that demand is back, supply will come back. With any luck, lots of low wage employers will shut down for lack of staff. This would be the best outcome from the pandemic: the closure of businesses relying on cheap labor.

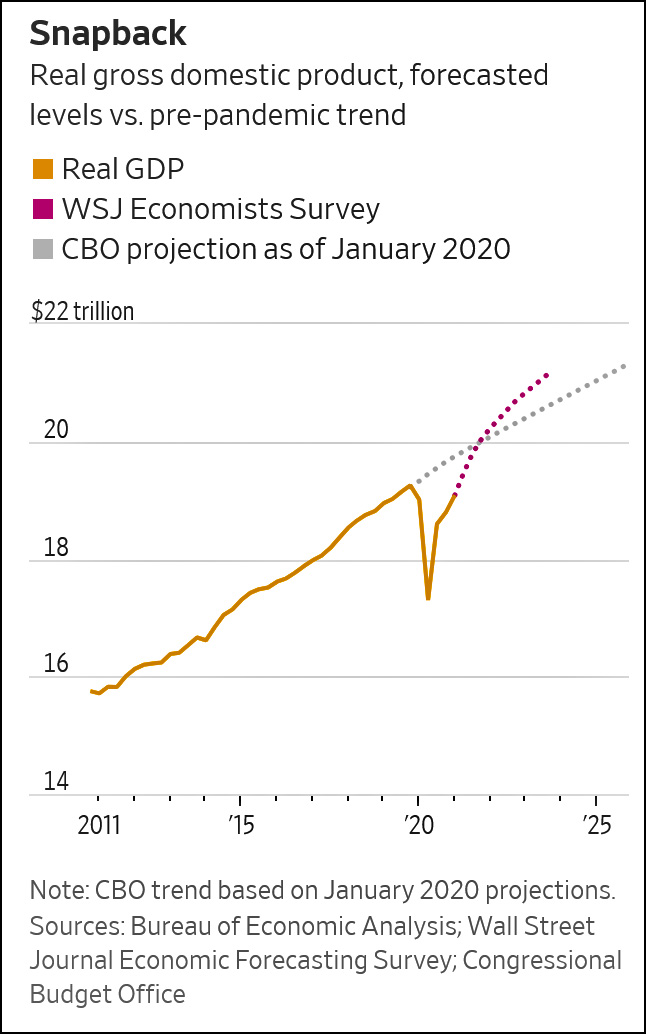

Yet the chart says we are not back to where we were (going to have been) before. Doesn’t that mean we should still have slack?

I agree with your assessment; yet I'm confounded that unemployment remains relatively high compared to pre-covid (6.1% vs 3.5%). I do not blame the FPUC, but there certainly seems to be a mismatch between a hot economy and a relatively large percentage who remain unemployed. Any thoughts on the cause/solution?

yet I'm confounded that unemployment remains relatively high compared to pre-covid (6.1% vs 3.5%).

Time lag. GDP shrank in 2020 as a whole. Economic growth in the US is accelerating, but the damage to the labor market won't be repaired over night. It took 5-6 years for the economy to reach reasonably full employment after the Great Recession.

It seems overwhelmingly likely that US employment numbers will look a lot healthier this time next year.

Based on trendline since real retail sales to full employment, it wasn't until 2018 reasonable full employment happened or 9 years. But looking at the difference between long term lost jobs 2009 vs 2021 shows the real difference.

Nooooo! We can’t have growth! Growth would mean some possibility of inflation!! And inflation might erode the static assets of the renter class by as much as several percent!! Inflation Monster coming to EEET US IN OUR BEDZ!!!

[strokes neatly-trimmed beard thoughtfully] Really, as anyone will tell you, at least at the better cocktail parties, it’s far better to ensure that millions upon millions of Americans continue to struggle hard and yet not escape poverty than it would be to risk... inflation. I mean where would it end? Affordable child care? Or medical care? For everyone?!? The horror...

Here's one of the standard quotes I trot out when thoughts about economic policy turn s to discussion about the overclass and what they think about current affairs. From Krugman:

"What struck me, looking at what Keynes wrote, were his remarks on interest rates and the return to capital: low rates of interest, he suggested,

'would mean the euthanasia of the rentier, and, consequently, the euthanasia of the cumulative oppressive power of the capitalist to exploit the scarcity-value of capital.'

Actually, for now at least profits remain high — but bond yields are very low.

What Keynes didn’t say, but now seems obvious, is that the rentiers are unlikely to accept their euthanasia gracefully. And therein, I’d argue, lies the ultimate explanation of the persistent clamor for monetary tightening despite weak economies and low inflation. I’ve described on a number of occasions how tight-money advocates are constantly shifting their arguments — it’s about inflation; no, it’s about sound market functioning; no, it’s about financial stability — but always with the same bottom line: rates must rise now now now.

Well, what I think we’re hearing is the sound of rentiers and those who, explicitly or implicitly, work for them, demanding their natural right to earn good returns even if the resource they control isn’t actually scarce anymore. They are not willing to go gently into their euthanasia."

IOW, this is all about being hagridden by people who are determined to protect their God-given right to a guaranteed percent return in perpetuity come Hell or high water.

Roaring '20's!!!

No thank you. I am more than willing to forgo another Roaring '20s in the name of avoiding a second round of the 1930s...

This is why the infrastructure bill may NOT be required to be as big as many DEMs want it to be. I get the need to replace/repair bridges and roads - those are maintained by the government

But internet access? The electric grid? Built by private businesses who made the CHOICE to not upgrade in the past. Now the government is supposed to provide the funding?

ANECDOTAL:

My grand daughter works PT in a restaurant. She was approached by 3 fast food store managers looking to hire her. Each promised over $15/hr with additional pay raises at the 90 day and 6 month mark. This was over the last 30 days.

I think the economy is just slightly over juiced but in a good way

The electric grid was not "built by private businesses" in any colloquial sense of the term. Even in fully deregulated electric power states, the grid is built and maintained by quasi monopolies heavily and often directly overseen by state and federal authorities. That's even before you get to things like the Tennessee Valley Authority or Bonneville Power Administration, which are actual government agencies.

Point being, if we want a better power grid (and we definitely need one--the societal benefits from transitioning to a flexible, responsive grid that can utilize fully-renewable generation are enormous but won't happen if we expect private entities to invest their capital now so that everybody is better off a decade or so in the future), federal investment is going to need to play a big role.

Point being, if we want a better power grid (and we definitely need one--the societal benefits from transitioning to a flexible, responsive grid...

Not only that, but, the growth acceleration effects of all this pent-up demand won't last forever. 30-40 years of running the economy to benefit the rentier class hasn't been great for most people. Let's try gunning for full employment over the long term for a change.

" Even in fully deregulated electric power states, the grid is built and maintained by quasi monopolies heavily and often directly overseen by state and federal authorities."

But who profits from them? I get the angle on the TVA and BPA but they serve multiple states

And yes, in the beginning rural areas were the LAST to get electrified - in fact we were building the Eisenhower Highway System WHILE we were electrifying most rural areas.

Many of our technological advances were made through government funded research which then were adapted by private businesses. Many of out advances in the military - radio, radar etc were again taken over by private businesses.

Yes regulatory agencies do oversee the grid but they do not profit off the grid - private companies do.

Why should the government FUND maintenance and improvements for these particular industries - because it's a NEED? The ONLY business guaranteed of government investment is the post office - which is required by the constitution.

Businesses are getting too used to socialism to correct problems that THEY should have corrected ON THEIR OWN prior to them becoming problems. Again - roads bridges yeah I can see the need they are maintained by the government on local state and federal level. I don't believe the federal government owns, maintains or installs internet capabilities to any community - although they should.

"But internet access? The electric grid? Built by private businesses ..."

Well, you can stop right there, pilgrim. The Internet was designed through government funding; the installagtion of the initial backbones, ditto. (They ran between major educational institutions and government labs.) Basically all work on the protocols that make it work was government funded or done by (generally government funded) volunteers. Finally, Big Telecomm hopped onto the band wagon when they saw dollar signs.

The 'Net is the electrical grid of the 2000s. Can't live without it. Had there been no 'Net, all of this "working from home", the Zoomy conferences, the "remote learning" would not have been possible. Yet lots and lots of families are still left out. Here in NM, in order to facilitate the Zoom lessons in K12 schools, the Albuquerque Public School system set up some of their school buses as wifi hot spots, so they could go to areas where few students had homes with 'Net access, and allow them to connect up. Perhaps needless to say, the school system also provided tablets for needy students.

Internet access is nearly as necessary as water these days. It's "infrastructure." Because of the sleazy, minimal-investment ramshackle edifice that "private industry" has built, which costs us Americans much more than people in the Civilized Nations pay, but is slower and has lower bandwidth, why shouldn't the federal government step in? Not like the states have stepped up enough.

Private businesses, who chose to let 90% of rural Americans do without electricity ...

https://livingnewdeal.org/glossary/rural-electrification-administration-rea-1935/

Take it one step further. Edison wanted New York to run on DC power not AC. AC of course won out thank goodness. But unless the government is RUNNING the system or REQUIRING certain standards then they should NOT be funding them through infrastructure bail outs.

Gasoline w/o tax breaks offered or subsidies would be $5/gal nationwide from what I have read. Is that the function of the federal government to keep prices artificially low so that more consumers spend more making the oil companies richer?

Is the government a guarantor of reliable electricity supply? Of internet access?

We all want these things - we want to believe we need these things but we sure don't have to have the government guarantee these things

By definition, if society as a whole decides something should be reliable, then government is guaranteeing reliability. Government is society as a whole making agreements to cooperate.

"Take it one step further. Edison wanted New York to run on DC power not AC. AC of course won out thank goodness."

Say what? No, for almost all practical purposes, DC is the better option, especially for power transmission. Compared to DC, AC requires a larger cross-section of conductor to transmit the same amount of power because of the skin effect. All other things being equal and for similar reasons DC can carry a higher voltage for the same transmission line; for DC peak and RMS voltages are the same, whereas AC peak voltage is ~1.4 (root two, to be precise) times RMS voltage. Also losses via reactance/radiative dissipation become significant when using AC to transmit power long distances (which is a vital consideration if there is ever going to be the distributed smart grid renewables are always on about). Not so with DC! And speaking to the latter point -- smart grids linking intermittent power sources over long distances -- you don't have to synchronize DC between regional grids the way you do with three-phase AC.

Of course, this is the 'all other things being equal' scenario; there are both safety and legacy costs to going with DC. But I don't have near the chops to casually comment on the relative costs. I just wanted to point out that your 'thank goodness' isn't automatically a given 🙂

"Private" electric grids is how you end up with people freezing to death in Texas. And how after a year of people depending on internet access for school and jobs is it not an infrastructure issue?

From my lay perspective, it seems like one of the lessons of the Obama stimulus package is that infrastructure spending can't be done quickly enough to really work as Keynesian anti-cyclical stimulus. The bureaucracy just takes too long to work through.

To me this would imply that there is relatively little risk of inflation resulting from an "overly big" infrastructure program. The major consideration should just be cost-benefit on any given project. Of course, reducing our crazy construction costs should be a big priority.

Didn't Obama coin the phrase 'shovel ready' back in the day? I'm sure there are plenty of plans already drawn up for stuff like bridge and road repair.

Have so Barry R to go with your breakfast beer!!

https://ritholtz.com/2021/06/the-great-reset/?fbclid=IwAR3kgxT1MIX6uZkTcnD0Y81OZcLaYSjRmTWUSC54oJyxGCbgHabOCqPRIEk

so = some

"the Fed cooperated during the entire downturn with loose monetary policy."

The Fed did make a lot of loans to support small business, but the main thing it did was back up financial markets and banks, as it did in 2008. There was only a momentary loss of confidence on the financial side, and the stock market has soared to heights only exceeded before the crash of 2000. There are many other signs of a bubble attitude, including in in this blog and the WSJ Economists Survey. Is this good or bad? It will be good until the next crash, which will happen sooner or later.

The pandemic has been a very special situation, and the next crash will be a more meaningful test of monetary and fiscal policy. What would be most useful is changes to the financial system - that is mainly regulation - which would prevent overextension and crashes in the first place. What has happened in the last year has certainly not been a test of the prevention system and there has been little effort to improve that system.

How did Randy Waldman put it?

"Their overwhelming priority is to protect the purchasing power of incumbent creditors. That’s it. That’s everything. All other considerations are secondary ... That is the overriding preference, in context of which observed behavior is rational.

ADP employment report for May: +978,000 employed.

Friday's BLS report is going to force GOP to flip-flop and make claims that the surging economy is more proof of an oncoming runaway inflation. Just watch.

They will make the argument that there is no need for the infrastructure from a stimulative sand point therefore no tax increases for it

They would be all for it if it were funded by debt - then they get to play debt is a job killer so we gotta cut entitlements again

> The Wall Street Journal writes today

I have as much confidence in what the WSJ writes as I do with what OAN writes.

The WSJ news pages are usually reliable; their editorial pages are crap

The WSJ news pages are usually reliable; their editorial pages are crap