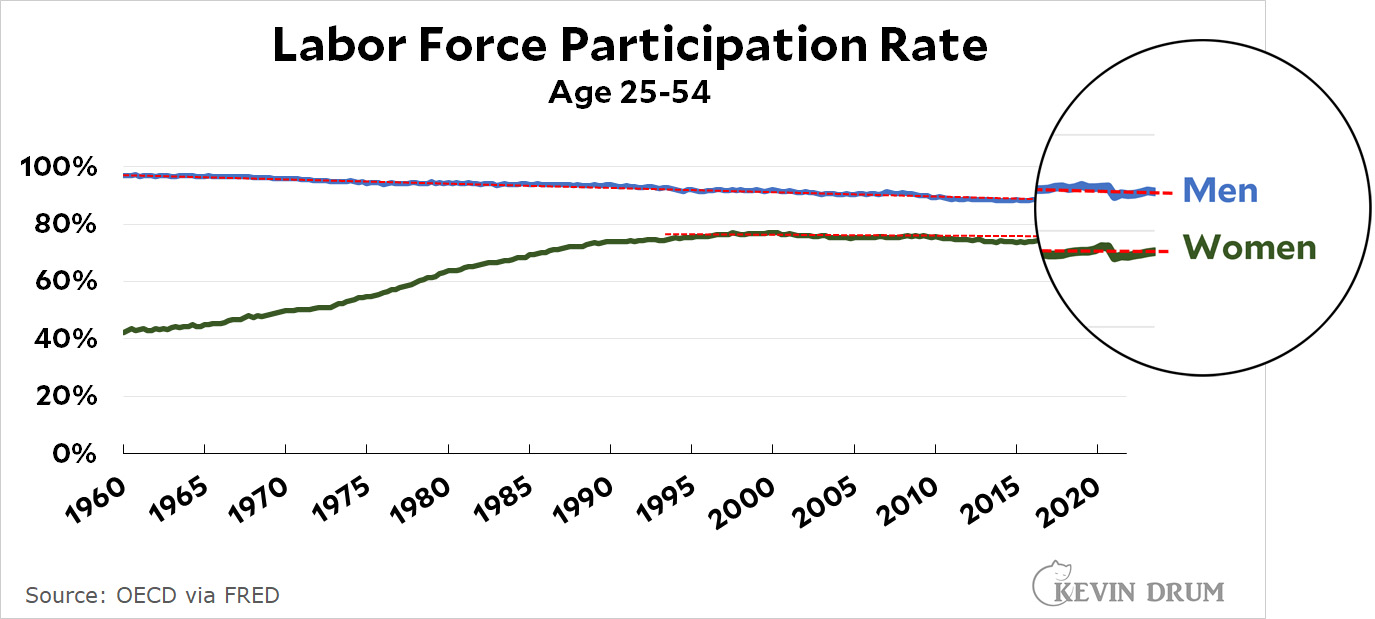

The Labor Force Participation Rate shows us the share of the population that works. The best measure is for ages 25-54, since that mostly eliminates the hassle of trying to adjust for people who are in school or retired. Here it is:

The trendline for men is drawn from 1960 through 2019 and then extended to the present. The trendline for women is drawn from 2000, when LFPR peaked, through 2019.

The trendline for men is drawn from 1960 through 2019 and then extended to the present. The trendline for women is drawn from 2000, when LFPR peaked, through 2019.

It's something of a mystery why these trends have gone steadily downward for 60 years (men) and 20 years (women), but they have. This is what the US labor market looks like. And right now, as you can see, the LFPR for both men and women is precisely on trend. There's no special reason to think it should increase.

It might, of course, though the usual way of bringing people off the sideline and into the workforce is higher pay, which we aren't seeing right now.

In other words, I continue to think that we're pretty close to full employment. The numbers might still go up by two or three million, which would be a small blip on the chart, or they might not. For all the complaining from employers about not being able to find workers, they can't be very serious about it since they aren't even willing to offer higher wages. That's the simplest way possible of getting more workers, after all.

With full employment, the need for additional government benefits is eliminated. The status quo is just fine.

They are definitely offering higher wages. One manufacturer in Ohio has boosted wages from 13.50 to start now to 18.50 to start, in 2 years. In 2018 it was 11.50.

Thanks for your anecdote of one employer in one state. Fuck off now troll.

Actually Kevin the CORRECT term is percentage of the population that wants to work.

I know of many born again Christian families in which the mother does not work nor does she want to work. They tend to be financially stable though lack of debt. You did include students, although the # of full-time students aged 24 is probably very small. Same for 54 year old retirees.

But with our population birth rates falling since 1965 (or thereabouts) the creation of millions of new jobs can be inflationary because we don't have enough warm bodies to fill those positions - and the republicans anti immigration views are adding to this problem. The biggest wage increases have been in service jobs. Locally our McDonalds are paying MINIMUM of 13.50/hr with pay in creases after 60 or 90 days. We have a $10.50. minimum wage here and just a scant 3 years ago fast food was paying $8 to $9/hr. We have bills in our state house to raise that to $15/hr in 2023 but our legislature is loathe to do this because their donors don't want it. NOR do they want immigrants. It's a lose-lose for them.

You won't find many immigrants operating container cranes at ports or getting their Class A truckers license either. Eventually the politicians MAY come to the realization that they may have been wrong about immigration in general.

The denominator = the entire adult non-institutionalized population within the specified age range, the numerator (‘participating’) = employed + unemployed-looking-for-work.

Unemployed and NOT looking for work is counted how?

THATs the key

They ARE part of the non-institutionalized population.

If you’re not looking for work, you’re not eligible for UI, and BLS considers you out of the labor force.

It's something of a mystery why these trends have gone steadily downward for 60 years (men) and 20 years (women)

I'd always thought it's because, for most people, work sucks, and one benefit of a more affluent society is a reduced need to work as one ages. The male/female differential might be the product of the gradual reduction in gender discrimination. As laws and societal attitudes changed, women were able to enjoy more meaningful participation in the paid employment market, and this dynamic delayed the aforementioned earlier retirement effect that was already reducing mail employment.

"male" employment

What's more puzzling to me is if we are at "full" employment, why are jobs going wanting? (Or maybe it's mostly local?) And you noted that wages are actually down a bit. Are there just better, newer jobs opening up that the low paid "burger flippers" taking? I also wonder if people working 2 or more jobs just to stay afloat is having an impact: maybe they are getting by with 1 ok job (that maybe is getting a salary bump to be less sucky?) and dropped the super sucky job that is now open?

What's more puzzling to me is if we are at "full" employment, why are jobs going wanting?

It's more difficult to fill job openings when everyone who wants a job has one (ie, full employment).

At no time during my life has the US had a shortage of labor. If it had, income for the bottom 90% of households would be much higher than it is now. From the early 1940s until the mid-1970s the bottom 90% of US households received about 60 to 65% of total personal income. This fluctuated with the state of the economy, but the trend line was positive. Anyone would have guessed that by now 65% would be the bottom 90%'s average share. Instead, the last numbers I saw said that only 49% of personal income went to the bottom 90%.

It's not like the 93rd percentile households are doing fabulous. The $3 Trillion that the bottom 90% are missing has mostly gone to the top 0.1%. Distribute the earnings the way they were in 1970 and the average household in the bottom 90% sees $30k/yr more income.

Another way to look at it: Dean Baker points out that the minimum wage used to track productivity growth, not inflation. Adjusted for inflation 1968's minimum wage would be $12.86/hr. Adjusted for productivity growth, it would be $24/hr.

An anecdote: Someone I know is an engineer. His son just got his first job as an engineer. Adjusted for inflation, their starting salaries are almost identical: no progress in 40 years.

So I agree with Kevin. Raise wages a lot. More people will find it worthwhile to work and businesses will have more incentive to increase productivity and get rid of useless jobs. By the way, it's not inflationary at all if the compensation at the top comes down to offset increases at the bottom. Before Reagan we kept top wages down by taxing the living daylights out of them. That's the way to fight inflation.

This would only be true if the labor ‘market’ really functioned as a market; it doesn’t, especially since the decline in private-sector union membership (which we can also blame in part on Reagan). Otherwise I agree with everything you say, especially that appropriately pricing labor encourages improved productivity. That is essential if we are to remain competitive in a global economy.

Even more so as the number of persons per household has also declined over time: https://www.statista.com/statistics/183648/average-size-of-households-in-the-us/ It’s not because more people are deciding to be homemakers for a working spouse. So how are people supporting themselves? Doubtful there that many more trust-fund kids. More black-market participants? Are ‘independent contractors’/gig workers counted as employed? People selling stuff on eBay? More unreported-cash-income freelance workers?

Also doubtful: significantly more people retiring or becoming disabled before age 54.

I know of many born again Christian families in which the mother does not work nor does she want to work. They tend to be financially stable through lack of debt.

Single income household, tithing to the church, more children than average, typical middle-class lifestyle desires despite their honest faith - picket fence house in a good safe neighborhood, big tv/entertainment center, fully loaded kitchen, Iphones, F-150 truck...

Somehow I doubt that they are any more financially stable than non-evangelicals; if anything I would think more on their CC's.

"since they aren't even willing to offer higher wages."

I think this hits the nail on the head: They know exactly what they need to do but they just can't bring themselves to do it. So they try complaining. Who knows maybe Joe Biden offers some tax money to make it happen? Worth a try.