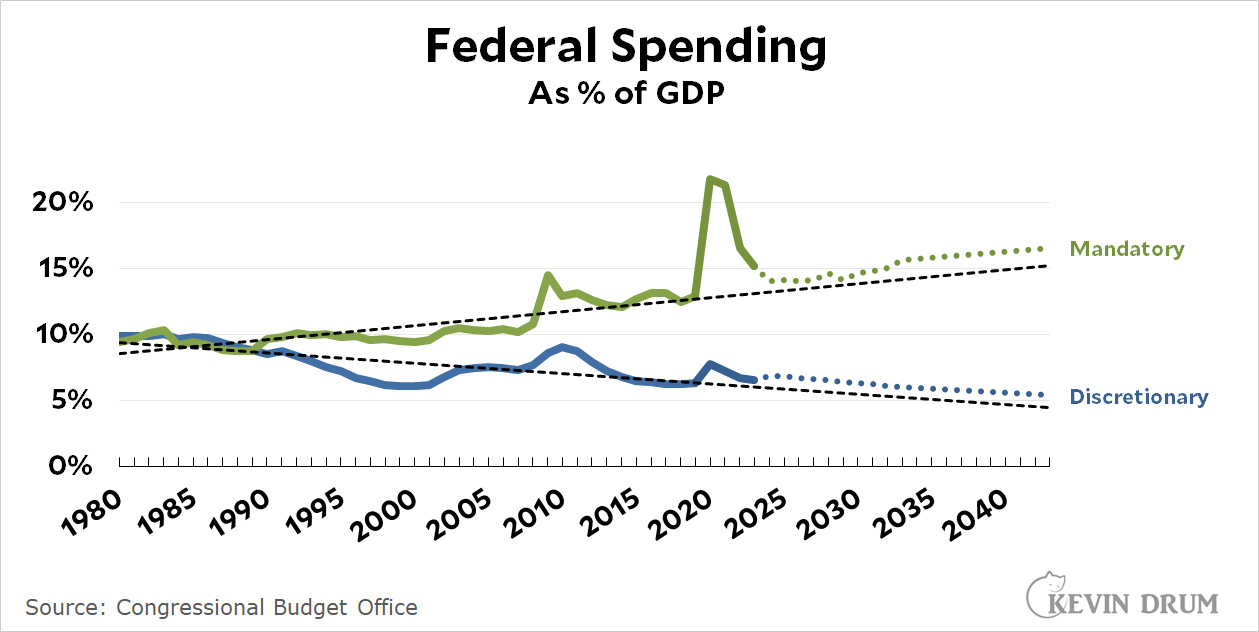

I happened to come across some whinging about federal spending earlier this morning and it prompted me to draw this chart:

This is all the spending we have control over. Mandatory spending is mostly Social Security and Medicare but contains a chunk of other stuff too. Discretionary spending is defense and domestic spending that's appropriated on a yearly basis.

This is all the spending we have control over. Mandatory spending is mostly Social Security and Medicare but contains a chunk of other stuff too. Discretionary spending is defense and domestic spending that's appropriated on a yearly basis.

Between 2019 and 2043, CBO projects that discretionary spending will decrease by 0.9% and mandatory spending will increase by 3.6%. That's a total increase of 2.7% of GDP.

This is nothing new. Despite all the kvetching from Freedom Caucus Republicans over discretionary spending, it's been going steadily down since 1980 and will keep going down. That's not a problem. Mandatory spending, by contrast, has been going up, but we've known all along that it will keep going up. Social Security will keep increasing as baby boomers retire, peaking in 2034 and then staying steady after that. Medicare will keep increasing through around 2050, partly because of baby boomer retirement and partly because medical costs grow faster than inflation.

In any case, this has been in the cards forever and there's nothing much to be done about it. Discretionary spending is already declining and both Social Security and Medicare are wildly popular—and in a democracy that means there's little chance of cutting them back. So if we want to stabilize deficits it means increasing taxes by about 2.7% of GDP—or maybe a little more if you want to reduce deficits. That's not really very much, and of course it would stabilize projected interest expenses too.

That's all it would cost us to fix our budgetary problems more or less forever. It's too bad Republicans refuse to allow it.

What does 2.7 percent of GDP convert to in tax rates? If we've been averaging about 20 percent GDP in Fed spending forever, aren't we talking about increasing everyone's taxes by 15 percent or more? And that's effective rates, so a lot more nominal.

Call me a delusional liberal but I'd like to think we could do and need to do good things with an increase in discretional spending over the next 50 years or so.

Well, the US GDP is ca. $23 trillion, so 2.7% of that would be....*sound of adding machine clacking away*....about $62 billion. Google tells me the IRS takes in about $5 trillion a year these days, so that means we would need to bring in about 12% more revenue going forward. It's estimated that the Trump tax cuts -- which largely benefited corporations and high-earning individuals -- will probably cost the government about $2.3 trillion over ten years. So just repealing those would go a long ways to getting us back on track.

This coming tax year is the first where Biden's 15% corporate AMT will be enforced for companies with earnings greater than $1 billion, so it will be interesting to see what effect that has. Corporate profits have been pretty sweet lately, so this might actually have a shot at reducing the deficit a bit.

ETA: with a little more googling, I found this interesting tidbit from the CRS: "The CAMT is projected to raise $222 billion over the next 10 years, an increase of 5.8% of corporate revenues, which is equivalent to the revenue that would be raised by increasing the regular 21% rate by slightly more than two percentage points".

Might want a new adding machine. 2.7% of $23 Trillion is $621 Billion, not $62 billion.

Doh! Just saw that myself a moment ago. Probably time to head home anyway.

Republicans won't allow it because they don't WANT to fix it. It's like the deficit, or like abortion was: they want it as something to complain about and use as a lever to get other things they want, eg tax cuts (the benefits of which go wildly disproportionately to the very wealthy) or cuts to social services (a perennial that keeps the racists juiced up). If this issue goes away, their lever goes away.

Don't look to Republicans to try to solve issues in good faith. They might have done in the past, but not today.

"It's too bad Republicans refuse to allow it."

Kevin I believe you are being disingenuous. When is the last Democratic President who promised raising taxes on folks who earn less than $400K per year?

Thus, its not like their is broad Democratic support with your idea either unless its a very targeted, exclusively hyper wealthy, tax raise.

But why would it be necessary to raise taxes on the little(r) guys, much less "promise" them that you're going to do it, when there are so many richer lodes to tap? Among others, rolling back the Defendant's big giveaway to the ultra wealthy (of which he's always claimed to be).

Salamander - my point, it seems the support for tax increases within the Democratic party is very limited to a very specific type of tax. ONLY IF the ultra wealthy pay, and not me (the 98% of tax payers), do most Democrats seemingly support a large tax increase for benefits they will enjoy.

The 99th percentile of income is very well off indeed but not ultra-wealthy -- middle-high six figures. And the federal income tax is very progressive: high-income people pay by far the largest share of it (which is not unreasonable, because other taxes, notably but not exclusively sales taxes and property taxes, hit lower-income taxpayers much harder as a percentage of income). So a tax increase on people making more than $400K (1) would still hit a large number of taxpayers and (2) wouldn't actually affect them that much, precisely because it would be spread out over a fairly large number and because they already pay a significant amount in taxes. And conversely, extending it to lower-income people would raise less income per person, so to make much difference to the 99th percentile, it would have to be increased significantly on those folks. As a political matter, the answer is obvious.

AND let's remember what McConnell and the Republicans engineered during TIFG's presidency. There was a HUGE giveaway to the very wealthy and corporations. This would just be clawing some of that back.

Don't forget payroll taxes. There's a cap on income taxed for social security, so it is regressive.

Kevin I believe you are being disingenuous. When is the last Democratic President who promised raising taxes on folks who earn less than $400K per year?

Kevin's not being remotely disingenuous. We could indeed raise most of the required 2.7% off the backs of high income earners. And, even if we can't raise all of the required funds from this income cohort—and even if it wouldn't be sound policy to exempt everyone earning less than $400k—at least Democrats are not ideologically opposed to increasing revenues to shore up the nation's finances. My point being, if Republicans weren't so blinkered on this issue, Democrats, having political cover, would likely be willing to adopt a more wholstic, realistic approach, and a compromise might be reached.

You can't compromise with anti-reality bomb-throwers.

There was a time when I would support increasing taxes to pay for all sorts of things liberals and progressives think are awesome. But now... such policies would also help republicans and, well, why would I want to do that?

How much of the national "income" comes in capital gains--so subject to lower taxes? With most of the income being funneled up, we need to tax the rich more. They'll still be making tons of money, just not quite as much as before. And going after various tax schemes and off shore accounts will catch money launderers and cut off funds going to cartels/gangs/terrorists--what's not to love?

According to David Stockman, exploding debt is a feature, not a bug. Indeed, it is the entire purpose of tax cuts.