Writing about inflation, Paul Krugman says:

While interest rates have risen a lot this year, they haven’t yet had much effect on the real economy. Never mind claims that we’re in a recession; the reality is that unemployment is still near a historic low, and other measures, like the number of job vacancies, suggest that the economy in general and the labor market in particular are still running very hot. And we won’t get inflation down to an acceptable rate until things cool off.

Last year the Fed didn't take inflation seriously, so this year we have inflation. The lesson from this is that long and variable lags still exist.

This year the Fed is facing up to the high inflation it didn't stop last year, so it's raising interest rates. But inflation is still plugging along, so the Fed is panicking and considering even more interest rate hikes.

In other words, no lesson has been learned. There's no reason to expect that the interest rate hikes in March, May, June, and July should have already had an effect, and therefore no reason to keep panicking. Those interest rate hikes are working their way through the economy and will slow things down by the start of 2023.

This is doubly true since we already know that the housing market is slowing down, but because of delays in data collection this won't show up in the inflation figures until the end of the year.

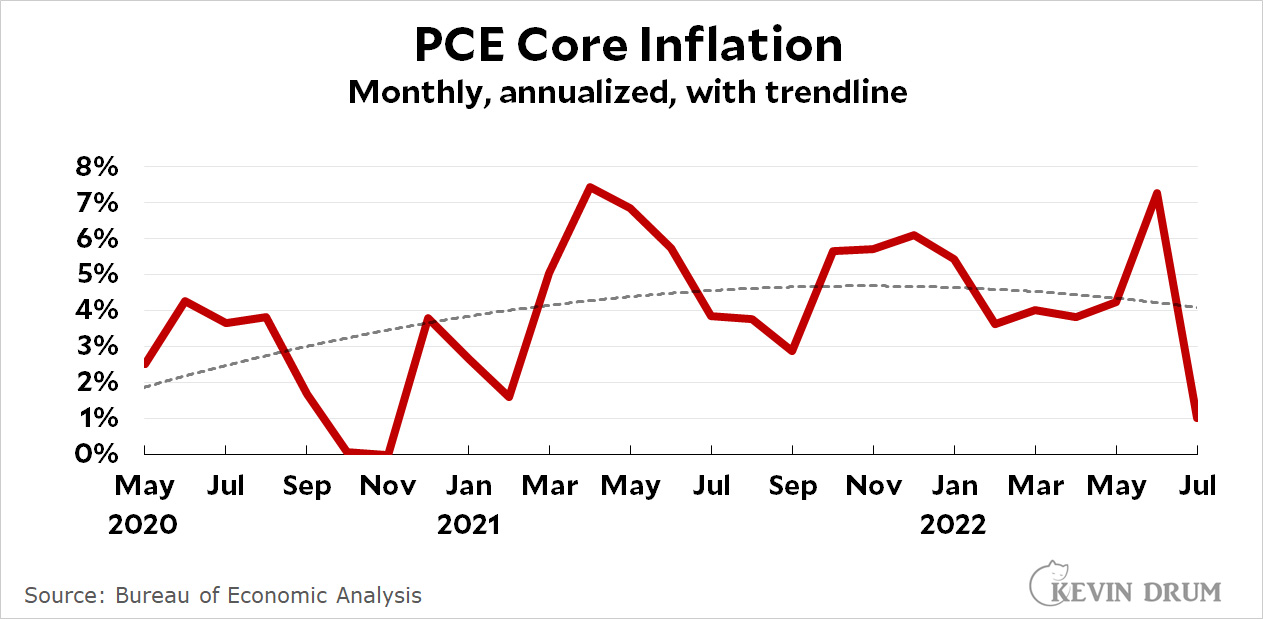

Core PCE is already down to about 4%. The interest rate hikes so far will probably knock off another percentage point, and housing has probably already shaved off a point that won't show up until December. Plus there are ongoing improvements in the supply chain that will also push inflation down. In other words, if we do nothing more we'll still probably get core PCE down to 2-3% by Christmas. Maybe lower. Who knows?

Core PCE is already down to about 4%. The interest rate hikes so far will probably knock off another percentage point, and housing has probably already shaved off a point that won't show up until December. Plus there are ongoing improvements in the supply chain that will also push inflation down. In other words, if we do nothing more we'll still probably get core PCE down to 2-3% by Christmas. Maybe lower. Who knows?

So my plea to the Fed is: don't keep doing the same thing over and over. Don't keep panicking because your actions aren't having an immediate effect. Don't keep leaking hot air out of your balloon because you can't see that the hot air you've already vented is already enough to eventually smash you into the ground.

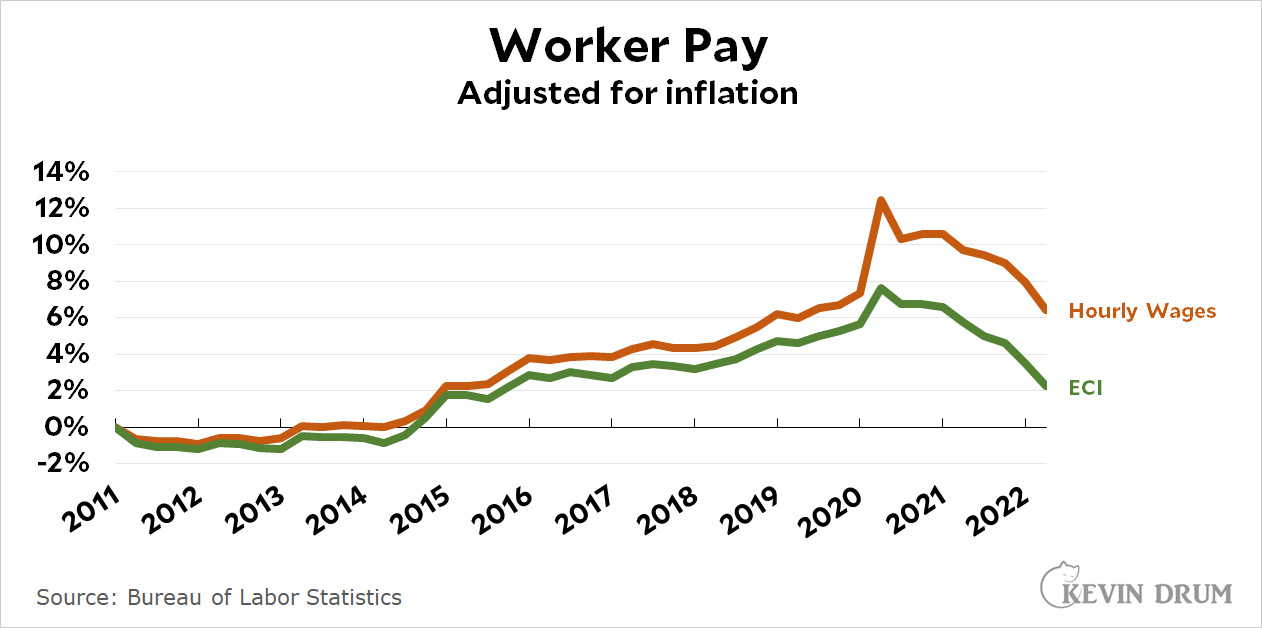

Instead, you should let us know what you think the underlying drivers of core inflation are. Stimulus spending? That's already long gone. Housing? It's declining already and is sure to decline some more. Supply chain problems? They're improving. A wage-price spiral? We sure haven't seen much evidence yet of wages skyrocketing. Bond market expectations? They're anchored.

So what is it? I'm open to being persuaded that I've missed something. Instead there's silence. Can't you at least pretend to take seriously all the workers you plan to throw out of jobs and explain why you're doing it?

And that goes for you too, Krugman. You say that both the labor market and the broad economy are running hot, but the data doesn't seem to back you up:

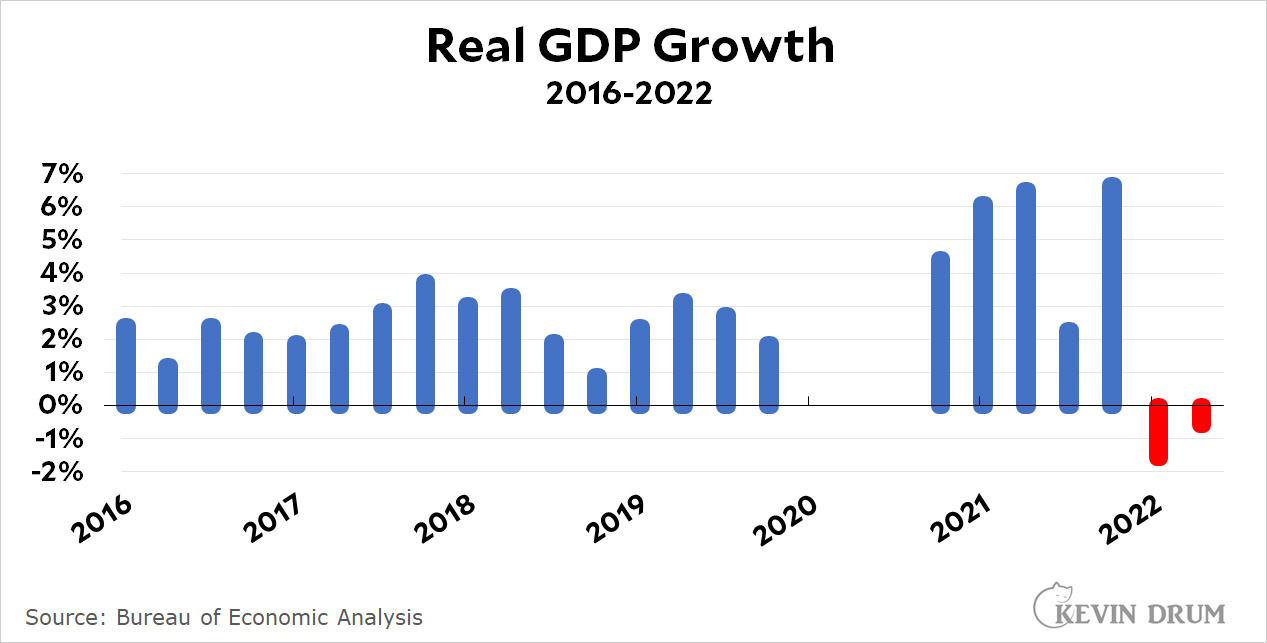

After adjusting for inflation, GDP growth has been negative since the start of 2022. Both ordinary wages and the Employee Compensation Index have been dropping steadily for the past two years. And this is supposed to be an overheated labor market?

After adjusting for inflation, GDP growth has been negative since the start of 2022. Both ordinary wages and the Employee Compensation Index have been dropping steadily for the past two years. And this is supposed to be an overheated labor market?

Talk to me. Tell me why I'm wrong. I'm listening.

I don't think the FED is panicking. They understood the situation well but you have an army of armchair economist and 24/7 talking heads that are have been demanding results NOW. The FED ignore them for a while, but the mood turned to "The Fed is Wrong, When will they learn... raise rate to 7% NOW...." . To calm down the mood, the Fed started to talk tough. So the mood became..Ahhh.. the adults are back at the Fed.... So were are we today... Inflation is topping, but no down yet which scare some, and at the same time fears of the Fed going to far are emerging. We are in that no man's land territory.

Kevin.. seems that the American consumer is less optimistic than thought.

Dining out is flat vs 2019 while well ahead in Canada, Mexico, Germany...

https://www.opentable.com/state-of-industry

Indeed, the Fed is not panicking, although Drum has been claiming that for a while (and it is very funny he managing in the opening paragraphs not to acknowledge he's been consistently wrong on the inflation trends since he

Inflationary pressures are a feed through from prior price rises, particularly as discrete price rises or sustained pricing on inputs (energy, other inputs which themselves begin to feed through their own pressures in a jumpy fashion, among which energy and wages). Unless and until there is a ful

Drum is in essence arguing in ignorance to make nearly identically the policy errors of the early 1970s of asserting pauses or trends indicate the battle is done, when in fact the collective pricing pressures are not abating.

This was in fact the pattern of the early 1970s - a stop and go cooling with reaccelrations as pricing pressures fed through various stages in the value chains on inputs for primary and intermediate goods and services, with Fed not taking sustained hammer and tongs action until after it got out of hand. And then it had to be bringing down the Volcker hammer.

It is far far better to address now, cut off the cycle, modest recession that will rebound.

Inflation is not topping it is plateauing, but within a full inputs value chain analysis of pricing pressures, it is not 'done' - and jumping to that is making again the errors of the early 1970s.

What is not clear to me is what the pricing pressures are that will continue

to drive inflation. Just to restate Kevin's points, stimulus spending seems to have already worked it's way through the system, housing prices are dropping (and rents will follow ?) , the supply chain bottlenecks are going away and wages don't appear to be driving anything. So other than the Russian war with Ukraine along with the economic sanctions that are being imposed as a reaction to the war, admittedly not trivial, what exactly are the pressing pressures that remain and will continue to keep inflation high ?

That's the demand pull inflation that is abating.

This rail agreement of 5% a year is much higher than the existing expectations.

The is the start of cost push inflation.

Workers are playing catchup and businesses will raise their prices to (maybe more than) cover higher labor costs.

Then workers will need more.

It's clear that there are no good models for inflation.

I would think that if Larry Summers had one, he would have shared it by now.

I am not an economist but it seems to me that predicting inflation is a bit of a mug's game. And when it comes to "curbing" inflation there aren't many tools. Years ago I had a friend - wonderful guy - who was a mechanic and he would sometimes joke that "when all else fails there's always the BFH" and he would produce a large black rubber mallet. The Fed raising rates comes to mind, only it's more like the little hammer the doctor uses on your knee to check your reflexes and the Fed just keeps whacking your knee until something happens. In short, imperfect understanding leads to imperfect responses. It's hard to tune a whole economy.

What is not clear to me is what the pricing pressures are that will continue to drive inflation.

Scarce workers. We're down several million workers from where we were 2019, due to usual reasons (deaths and retirements) but also due to long covid and (most importantly) a jarring drop in immigration inflows. Also, there's an elephant in the room: embedded expectations. I'm not suggesting this last bit is (nearly) as bad as it was in the late 1970s. But perhaps we've experienced some degree of this phenomenon?

I agree with Drum as it happens we don't need a "huge recession" but we may need a mild one. Or we may not; a simple cooling of the economy would be just fine if it works. But I hope the Fed continues to raise rates for a while yet. Maybe they can stand pat starting, say, in the spring, if it's clear the inflation beast has been slain. But we're definitely not there yet.

There is no jarring drop from immigration inflows. Most of this is retirement driven and indeed it's slowly reversing. You need a eye gouge. Maybe the pain will educate you.

To be clear, if raising rates more quickly now - along with the possible recession that followed - was necessary to prevent bigger problems down the road I would not be opposed. But just as the transitory team seem to have missed the past year's inflation the inflation hawks were preaching inflationary disaster just around the corner for a full decade after Obama's

spending in '09 . So how do we know which way we are headed now ?

& it finally happened in 2021.

The ARRA was just Obummer's version of James Earl Carter, Jr.'s, Community Reinvestment Act: an explicitly race-based handout to the undeserving that was also by design a slowrelease timebomb to explode when it would cause greatest pain to the working class.

The beatings will continue until morale improves!

Even better, we will judge morale using measurements taken many months before the beatings began!

This kind of Common sense approach will create a lot of economic harm and misery. The inflation boogeyman has a strong grip.

Lounsbury and all those who responded to L

Thank you.

ONE of the things that we have to be aware of is what some of you have touched on - labor scarcity

THIS is what separates the 70s from today. In 1970 we were looking at an explosion of available workers

The Boomers of the 50s were at or approaching working age AND we had 2.2M young men who had been drafted over the Vietnam war period who were returning to the civilian work force. Volker knew this and had to act quickly and decisively because they had to tame inflation -then re-HEAT the economy so they could absorb the huge influx of workers entering the work force.

Today the exact opposite is true. The boomers are leaving the work force. The difference is todays coming of age workers are better educated with more holding degrees of some kind. I think the comparisons to the early 70s might be a bit misguided.

No? Yes?

Boomers aren't leaving the workforce, they have left. Your out of date.

Shooter spittin' actual facts. Did he take his six Hurricane breakfast with a B12 shot chaser in his buttcheek (like in the best episode of Mad Men)?

The boomers (1945-58) are all going to be 65 by next year, so eligible for at least 80% SSRE allotment (hopefully, the yungest poorz among them can hold out til 67), & the boomerettes in Generation Jones are all late fifties, at least. (Fun Fact: while Kurt Cobain was decidedly Gen X (b. 1967), Courtney "Widow Cobain" Love was Gen Jones (b. 1964).)

It's dropping. Come back this winter idiot.

Not dining out may not be entirely because of inflation. My wife and I have stopped dining out because restaurants our completely understaffed. The last tew times we did go to a restaurant it was a complete shit show. And not just the local pizza shop, I mean higher end restaurants. Also, several of our old favorites never even reopened post-covid. And most people I've spoken to are saying the same thing.

I don't mind spending more to dine out, I am spending more to cook at home already.

Yeah, we've only done outside dining but as restaurants close it down, we're skipping them.

A lot of us are never going to eat in a restaurant again.

What we're mostly seeing now is inflation in the food sector and a few other places still trying to work out supply chain problems. Poultry producers have had to cull millions of birds to stop a bird flu outbreak. Ranchers have thinned their cattle herds because there's not enough water out West to raise them. Farmers in CA and AZ, where most of our vegetables come from have had to cut way back on planting because irrigation allocations are much reduced. And then there's the higher costs of trucking and transportation on top of that. And a shortage of labor due to immigration restrictions. Etc., etc. Unfortunately, I don't see any of those issues being worked out any time soon, especially the drought situation. I'm afraid high food prices are probably going to be around for quite a while.

While I don't think the Fed should panic, I do believe we are in for more rate increases. Further, I find elements of your augment not fully conceptionalized:

"Housing? It's declining already and is sure to decline some more." Likely true if you mean home prices but probably not true if you mean rental rates.

"A wage-price spiral? " true we have not seen 1970 wage increases. However, there is a lag. Ask anyone who is hiring today: are you offering wages that are meaningfully higher than two years ago.

"Supply chain problems?" it is true that logistical snags are improving. It is also true that trucking costs, shipping costs etc are up. Items such as increased transport cost will have to become embedded into prices.

"Bond market expectations?" I would say mostly true: however, equity market seems to be spooked by inflation.

real wages are below or at 2019 levels.

Middleoftheroaddem lives in a recursive loop of Van Halen's "Panama".

To see data that the economy is still hot look at initial weekly unemployment claims and the JOLTs data.

Unemployment claims have been flat since May when you adjust out the 2020 shadow.

It's probably a mistake to think that the Fed really understands all the factors that may be affecting inflation, or maybe even that they are seriously considering them. The basic dogma is simply the assumption that raising interest rates suppresses inflation, although astronomical raises in the 70's failed to suppress inflation, which came down only when oil price quit rising. Evidence which is inconsistent with this dogma is ignored. Also the Fed is susceptible to public opinion and political pressure. The Fed essentially dropped rates in 2019 at the behest of Trump, although there were no economic reasons to do so. All sorts of people would be yelling at the Fed if it doesn't do somethinganything about inflation.

Kevin at least looks at the individual factors, and I tend to agree with him that inflation will probably decline (not because of anything the Fed does or did). But the idea that you can predict things by drawing trend lines is absurd. Again, current inflation is due to several independent factors - there is no universal control of these things that would cause them to add up to a given straight line or curve. Or does he think that God is drawing these lines and regulating things accordingly?

The trend line supports the narrative therefore the trend line must be correct.

The trend lines don't predict the future, but they do show what has happened in the past. Understanding how the rate of inflation has changed over the last few months is useful information. Much of the general discourse regarding inflation doesn't appear to take into account what is actually happening with the rate of inflation.

One indication of how many supposed experts are out of touch is how they keep talking about how the tight labor market must be causing inflation. But real wages have just not been going up, as Kevin shows (again). So far wages have not been a major factor in inflation and there is no reason to think that they will be. Are workers going to miraculously regain the power to get raises that they lost many decades ago?

Deflation will cause real wages to surge. Labor market tightness is irrelevant.

I see claims of this sort being made. But, unemployment is low, job creation has been good, wages have indeed been rising (just not in all cases faster than inflation) and, critically, we've seen a major reduction in the inflow of immigrant workers relative to the pre-pandemic numbers as well as a nontrivial number of workers exiting the workforce (or reducing hours) because of long covid. We've also seen very large numbers of job vacancies (though one suspects this is beginning to recede).

So, I wonder if perhaps we have indeed seen both upwards pressure on wages due to workers shortages and a significant capacity on the part of firms to pass those higher labor costs onto consumers in the form of higher prices. This would still be a valid inflationary pressure even if the wage hikes in question trailed the overall rate of inflation.

In short, is there a law of economics that says only real wage and not nominal increases can contribute to inflation? I doubt it (I'm pretty sure we saw an erosion of real wages in the late 70s, for instance).

jasper

KD likes to point out the job creation numbers and says something along this line:

"We need 90K jobs per month just to keep up with population growth"

Has he EVER talked about what we needed in the 1970s and 80s to keep up with working age population growth?

It's not often you get a news story about inflation that doesn't mention the high inflation of the '70s, and many times invoking the name of Paul Volcker, the heroic Fed chair who tamed inflation once and for all by throwing millions of people out of work. Yay, Paul!

It's the only high inflation that people of a certain age have any memory of. But a longer look shows inflation then was really an exception to what generally happens.

Here's historical data on inflation from 1914 to today.

https://www.usinflationcalculator.com/inflation/historical-inflation-rates/

Most of the time high inflation is not a problem. When does high inflation occur? Generally, when the economy is making a major shift from one regime to another (peacetime to wartime, or vice versa). The exceptions are the oil crises of the '70s and today.

High-inflation periods:

a. WWI

b. Post-WWI

c. WWII (early years)

d. Post-WWII

e. Korea

f. Oil shock 1 (1973+)

g. Oil shock 2 (1978+)

h. Post-Covid Pandemic

Today we have an economy that's restarting after being shut down, with a host of supply/demand imbalances, a scenario that has more in common with a. thru e. than with the oil shocks. In the earlier examples, inflation runs hot (double digits, usually) for a period of about 2 1/2 years, then subsides. In the oil shocks, again inflation spikes for a couple of years, but then persists for years on end (so much for the idea that Volcker whipped inflation for good). Persistent inflation is a danger we want to avoid, but that's just not likely to happen.

Another scenario we want to avoid is what happened in 1921-22, when high inflation was followed by a couple of years of extraordinary deflation (-10.5%, -6.1%). The '20s then went on a tear for a few years, but we know what happened next.

We should expect that inflation numbers for months to come will be high, based on how the data is calculated and reported. So what is the Fed going to do? Are they going to keep hiking interest rates until inflation numbers improve? In that case, we may be headed for a depression. Or will the Fed get rates to about 4% and stop? I hope the latter, but I don't know it's clear.

And for all the talk about the "credibility" of the Fed, how can it have any credibility when its official target for inflation is 2%? It's an absurdity they need to ditch.

There was the guns and butter inflation of the late 60's that Nixon tried to end with wage and price controls.

About the Nixon wage and price controls, Wikipedia has "At the time, the U.S. also had an unemployment rate of 6.1% (August 1971) and an inflation rate of 5.84% (1971)."

This belongs between e & f.

KD’s economic analysis is spot on. The actions the Fed has taken need to work through the system and more importantly, more rate increases may crash the economy - does Fed really think that inflation can only be controlled by reducing economic activity and increasing immiseration? That would be some seriously wrong thinking.

Since 9/11 we've effectively had deflation for 20 years. The pandemic provided a shock that forced the end of it. So there's been some inflation over the past year or two. Finally. Still seems like a good thing getting some inflation back in the system. No one that had a long term fixed rate mortgage is paying any more now--and our homes purchased since the housing bubble of the mid-aughts are finally regaining appreciation that never happened from 2006 to 2020. Likewise, short term interest rates have been way too low all that time (mostly pegged at zero). Yellen wanted to raise rates while she was in as Fed chair and she was right but wasn't able to swing it. The Fed should have a standard target for these interest rates like they do for employment and inflation. Deviations from it would help average folks understand better what's really going on with their money. I'd guess that standard rate would be about 3% or 4%, the only question being when the Fed deviates above or below it how quickly Congress and the Fed can get back to it after events necessitate deviations. 0% short term interest rates sustain wealth inequality and are as bad for the economy long term as would be a rate above 4%.

Remember, it's not just the interest rate. The Fed has unwound (is unwinding?) the quantitative easing too.

Does it matter????? QE was a marketing gimmick.

…please don’t take my cheap money away.

Not so cheap. Just less buybacks. Real corporate spending is accelerating. Debt markets yawned in August.

Lets note rising rates and rising currency tend to create credit bubbles. Foreigners are shipping dollars back into the states pretty fast surging bank reserves for future use. Reducing holdings and causing the price to rise. Both the 80's and 00's debt bubbles came in the wake of that.

Makes me wonder if not the dollar would get too low killing the dollar standard, but too high, triggering depegs, killing the golden goose.

That's the opposite of what it does?

Nope. Not financial institutions. They aren't goods companies. A strong dollar is easy money for them. Repatriated dollars expanding credit. See, 99-05.

Lets also note economic data in the 2020 shadow is suspect. Looks like both 2021-22 1st/2nd quarter data will be revised up sharply.

This "shadow" won't be gone until 2024 from hedonics.

Labor is hot. Indicators:

Beveridge Curve -- https://bityl.co/ER5n

U/V -- https://bityl.co/ER5m

Unemployment Claims/Working age population -- https://bityl.co/ER54

Inflation is detached from labor and distorts commonly used indicators. This should tell you that it is exogenous.

https://www.cnn.com/2022/09/16/business/fedex-warning/index.html

FedEx warned that a global recession could be coming, as demand for packages around the world tumbles. Shares of FedEx (FDX) plunged 21% Friday — the biggest one-day drop in its history — after the company warned late Thursday that a slowing economy will cause it to fall $500 million short of its revenue target. The weakening global economy, particularly in Asia and Europe, has hurt FedEx’s express delivery business. The company said demand for packages weakened considerably in the final weeks of the quarter.

Well, this might be an indication that things are slowing. Stop buying junk you don’t need! This is the path to sustainability. Food, transportation, fuel, shelter, basic clothing. That’s it. Enough with this global economy spreading junk all over the world. Good luck.

...or maybe Amazon is sucking the air out of global logistics by way of its rapid expansion of its own global logistics?

Are UPS & DHL showing similar decline as the unionbusting plaything of the father of Atlanta Falcons coach Arthur Smith?

Note: that 21% was the amount FedEx's stock had been up for the year.

Kevin, your GDP growth chart isn't using the adjusted, complete numbers.

Labor has become demanding of better wages and working conditions. A huge recession will tame its market power discovered during the epidemic.

"So my plea to the Fed is: don't keep doing the same thing over and over" hoping it will turn out better this time ?