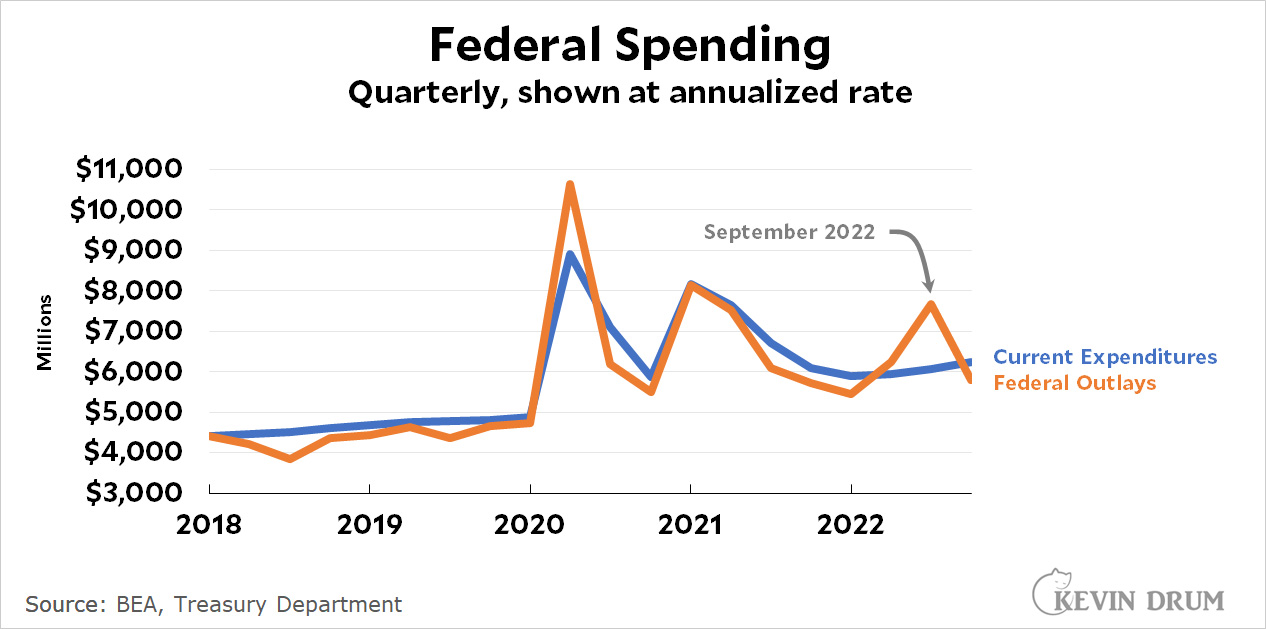

I suppose this is a longshot, but can anyone tell me the difference between federal expenditures and federal outlays? I wouldn't care too much except for this:

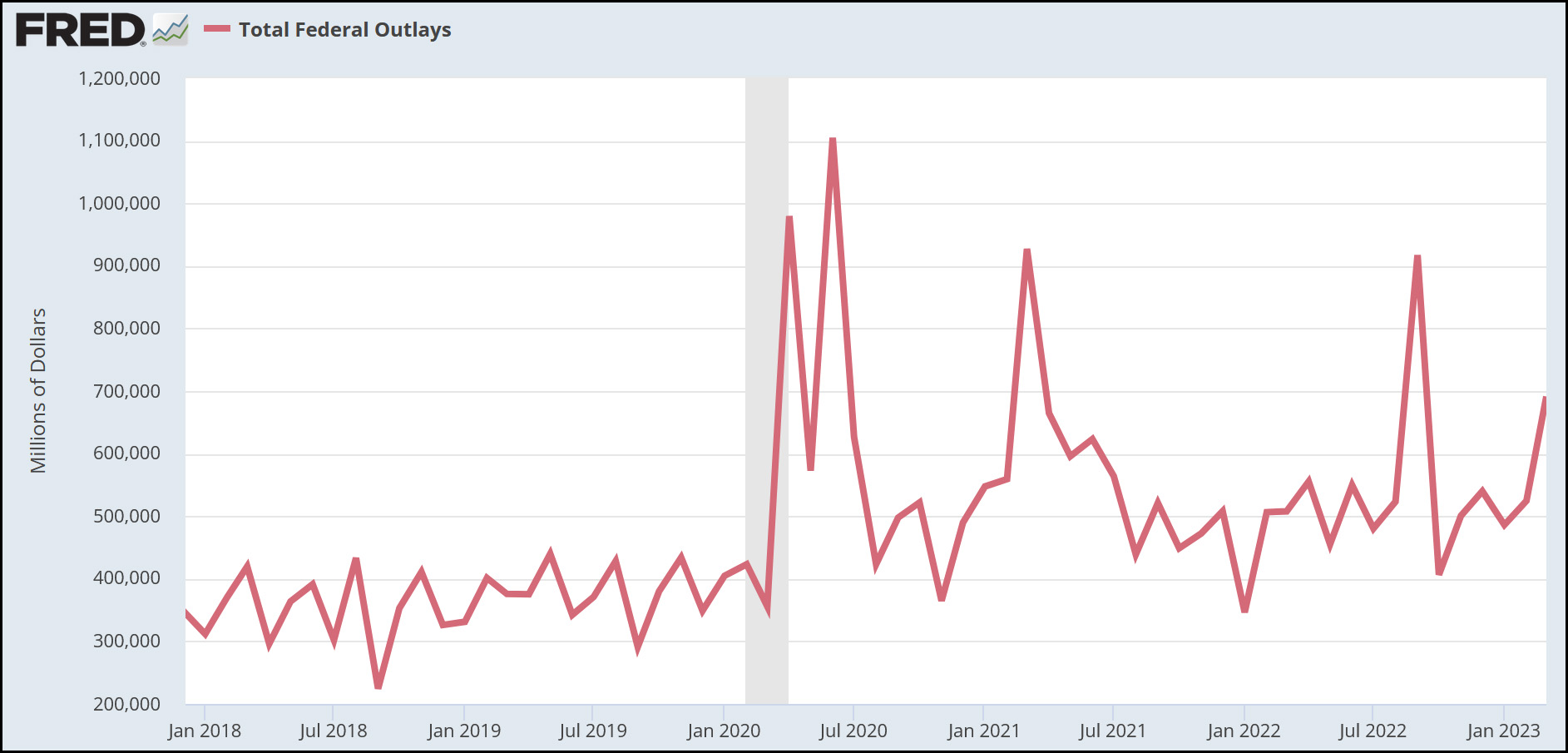

The two lines are generally the same, but outlays show a big spike in Q3 of 2022 while expenditures don't. This spike is specifically in September, as you can see in the monthly chart:

The two lines are generally the same, but outlays show a big spike in Q3 of 2022 while expenditures don't. This spike is specifically in September, as you can see in the monthly chart:

Are outlays the amount budgeted, while expenditures are what actually went out the door? No. According to the Treasury Monthly Statement, outlays represent the actual flow of money out of the Treasury.

Are outlays the amount budgeted, while expenditures are what actually went out the door? No. According to the Treasury Monthly Statement, outlays represent the actual flow of money out of the Treasury.

This is probably one of those things with an obvious answer that I will be embarrassed to learn I had missed. But what is it?

unspent monies from the FY 22?

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details

visit this article... https://createmaxwealth.blogspot.com

$99 per hour? Pffffft! CHICKENFEED! I make $28,443.81 EVERY HOUR OF EVERY DAY with the system I found at IAmACompleteSucker.com! Even when I'm sleeping! And I don't have to use zeroes in my sentences as a substitute for Os!

The budget report has an extra $400 billion for the Department of Education in September 2022. I think this was the student loan forgiveness that was blocked. It must have been counted in one data set and not the other.

Possibly outlays are net of any income, while expenditures are straight spend?

I was curious what ChatGPT would say. I asked:

"tell me the difference between federal expenditures and federal outlays?"

answer:

Federal expenditures and federal outlays are both terms used to describe the spending of the US federal government. However, there is a difference between these two concepts.

Federal expenditures refer to the total amount of money the federal government plans to spend in a given fiscal year. This includes all spending for programs, services, and other activities funded by the federal government.

On the other hand, federal outlays refer to the actual spending that occurs during a fiscal year. This includes all payments made by the federal government for goods and services, as well as transfer payments such as Social Security benefits, Medicare payments, and other entitlement programs.

In other words, federal expenditures are the planned or budgeted amount of money that the government intends to spend in a given fiscal year, while federal outlays are the actual amount of money that is spent during that fiscal year.

Does ChatGPT "think" it gets paid by the word? It takes four paragraphs to say what could be said in two sentences.

it's amazing that a few short months ago, people were flabbergasted by ChatGPT's abilities. now we're already critiquing minutiae of it's writing style.

Mine is hardly the first critique of ChatGPT's abilities. There are many. But "writing style" is important if the purpose of the bot is to communicate with humans.

One advantage ChatGPT should have over humans is the ability to take criticism and improve without being defensive about it.

TBH, real people do this too. They think it makes them look smart.

Which is probably how it made its way into ChatGPT.

ChatGPT *does* get paid by the word, doesn’t it?

Freaks me out a bit! What the world will be like 50 years from now is hard to get your head around.

The world will look much different in just 10 to 15 years. The long run may be very bright, but I think 2030 to 2050 will be a painful time prior to that. Free speech will end but that is only the start.

It miisght be the difference between obligations--the government committing to pay X dollars under a contract, etc--and expenditures--the government issuing the check.

In the sense that your conjecture relates to the difference between accrual accounting and cash accounting, I suspect that "obligations" are accrued as expenditures when they are incurred, while cash is only counted as an expense when it is actually forwarded to payees.

The ChatGPT answer could well be right. However, I also found this:

"The terms "budget outlays" and "outlays" mean, with respect to any fiscal year, expenditures and net lending of funds under budget authority during such year."

Since the provision distinguishes expenditures and lending, it may be that outlays are the sum of the two: what you spend and what you lend. (Net lending, of course, could be positive or negative.)

Source: https://uscode.house.gov/view.xhtml?req=(title:2%20section:622%20edition:prelim)

That sounds very plausible. Interestingly, either cash accounting or accrual accounting could deal with those two (spent and lent) and come up with similar differentials.

Expenditure = tracking of federal obligations (accrual basis)

Outlay = tracking of federal monies (cash basis)

It counts as an expenditure when the obligation is made and an outlay when the cash goes out.

BTW, federal outlays aren't seasonally adjusted while government expenditures are.

I know why outlays spike in September - end of fiscal year. Federal fiscal years begin October 1. Federal budget authorizes spending by fiscal year for most expenditures. If not used by end of the fiscal year, the agency loses the money - it just goes to the Treasury. So, a good manager will use that money and have it obligated by the end of the fiscal year. Ask any federal employee who has or does work in acquisitions - their busiest time of the year is August, to get the award done and money obligated by September 30. Note: It doesn't have to be paid by September 30, just obligated.

The short answer is that it's the end of the Fiscal Year for the US Government. Therefore, as others have noted, there are a variety of reasons that drive resolution of accounts to meet that date. These include bureaucratic use-or-lose incentives as well as natural project life cycle deadlines. Promises are made all year round, payments come due before 9/30.

But why the big delta in 2022 but not other years? (I was going to propose tax receipts timing, but the same objection applies to that.)

Student loan forgiveness. It was counted on one and not the other.

I should know this. But this has proven harder to define than I thought. From a federal budget perspective outlays and expenditures are one in the same. Its federal spending and that's how the comptroller of the U.S. looks at it anyway. But this graph is showing something different. I think the answer lies in separating federal spending from tax revenue losses due to tax provisions. According to the Congressional Research Service, there are three types tax expenditures: 1) exclusions, exemptions, and deductions; 2) preferential tax rates; and 3) refundable and non-refundable tax credits. So what the graph appears to show is a composition of the the national deficit split between outlays and tax expenditures. The Congressional Research Service has a report on the matter titled "Spending and Tax Expenditures: Distinctions and Major Programs"(Report No. R44530).