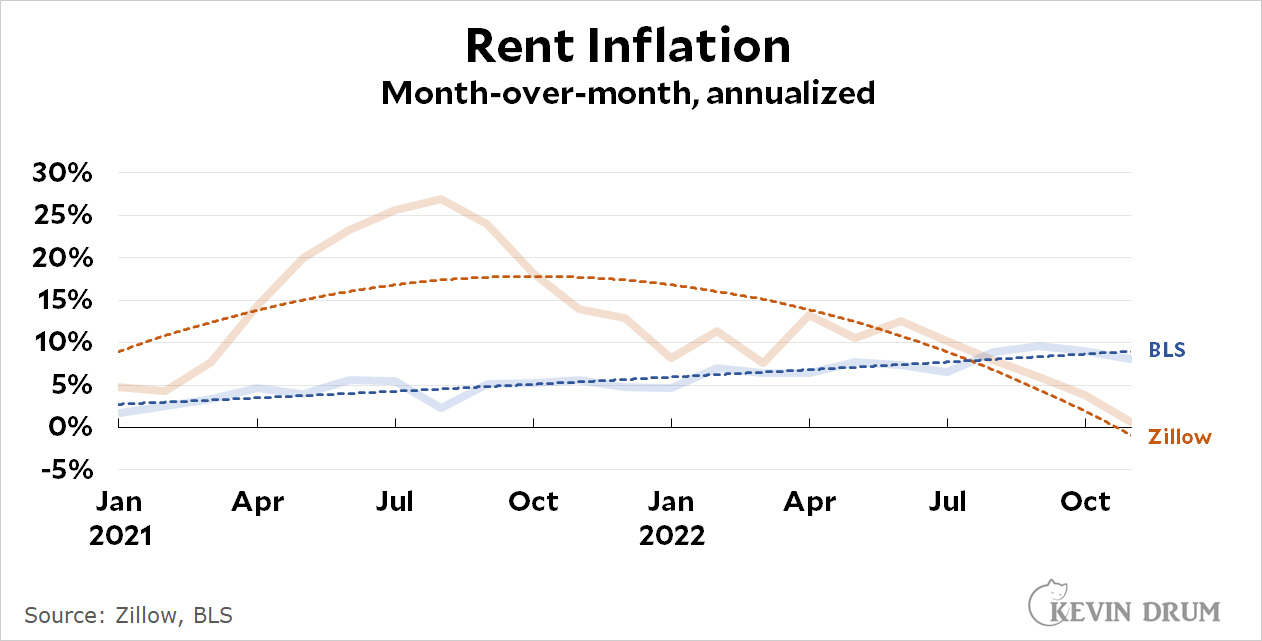

Earlier this morning I put up a chart showing what inflation looks like if you use a better estimate of rent than the one that BLS uses. I thought this could bear some explanation, so here are two estimates of rent inflation:

The official BLS estimate has continued to rise throughout 2022 even though everyone knows that rents have cooled off. This is because BLS uses a methodology that (a) combines new and existing rents and (b) is at least six months out of date because they conduct rent surveys only twice a year.

The official BLS estimate has continued to rise throughout 2022 even though everyone knows that rents have cooled off. This is because BLS uses a methodology that (a) combines new and existing rents and (b) is at least six months out of date because they conduct rent surveys only twice a year.

The Zillow index, by contrast, is a simple estimate of asking prices for new rentals over the past month. It shows that rent inflation peaked in mid-2021, fell for six months, and then started falling again in June. As of November, rent inflation was about zero.

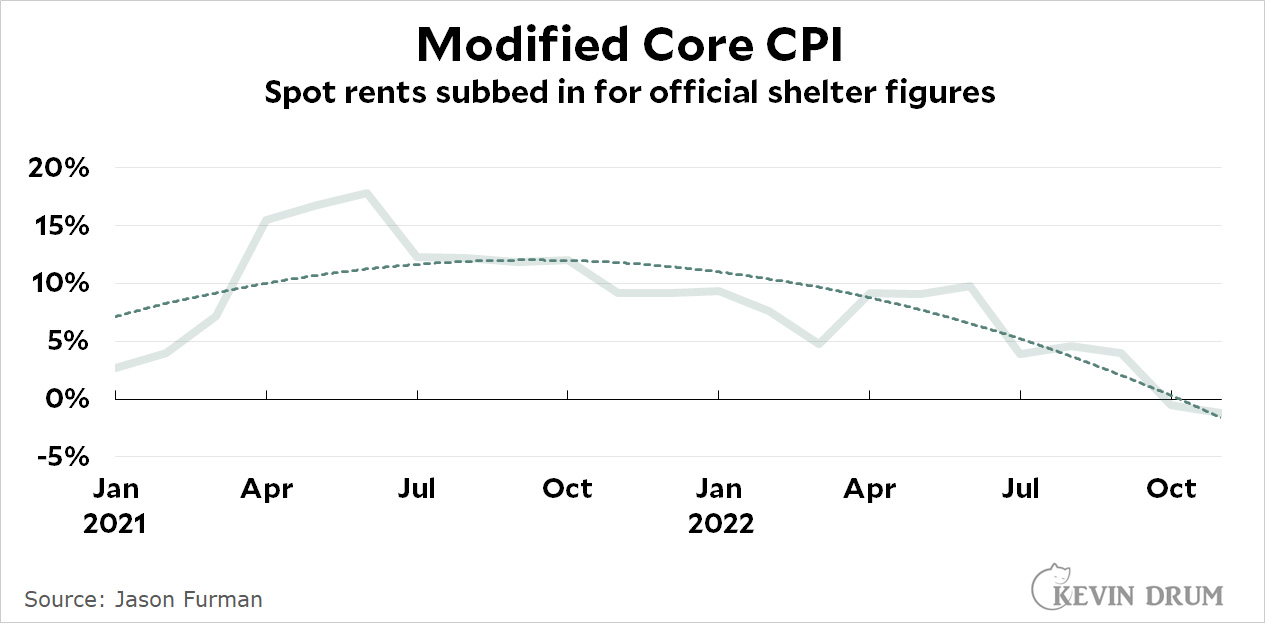

To account for this, Jason Furman has constructed a measure of core CPI that uses a more accurate index of current rents.¹ The idea behind this is to estimate core CPI with current figures, not old ones:

I'll confess that Furman's estimate strikes me as being suspiciously similar to those old right-wing efforts to "unskew" polls using all sorts of sketchy assumptions. In order to play fair and keep myself honest, I generally like to use the same measurements all the time even if they aren't perfect. Still, the rent figures in the inflation basket are widely known to be defective, and even the BLS is investigating ways to improve things. I suspect that Furman's numbers really are a better estimate of core inflation right now.

I'll confess that Furman's estimate strikes me as being suspiciously similar to those old right-wing efforts to "unskew" polls using all sorts of sketchy assumptions. In order to play fair and keep myself honest, I generally like to use the same measurements all the time even if they aren't perfect. Still, the rent figures in the inflation basket are widely known to be defective, and even the BLS is investigating ways to improve things. I suspect that Furman's numbers really are a better estimate of core inflation right now.

So that's the explanation. The core inflation figure you'll see in headlines is 6.0%. The core inflation figure if you measure monthly instead of yearly is 2.4%. The core inflation figure if you use better rent figures is -1.2%. Take your pick.

¹Furman uses both Zillow and Apartment List to construct his rent index, but the Apartment List numbers aren't seasonally adjusted and I don't know how to do seasonal adjustments. So I only showed the Zillow figures in the top chart.

I think Kevin has been on the right track in identifying the components that have really been driving inflation = and generally no longer are doing so - but the arbitrary curves can be annoying. If you don't have a mathematical model that dictates a curve, there is no justification for using it - they are not predictive. There is no known mathematical model for inflation, and the path of inflation has never followed any simple trend.

I’m currently generating over $35,100 a month thanks to one small internet job, therefore I really like your work! I am aware that with a beginning cdx05 capital of $28,800, you are cdx02 presently making a sizeable quantity of money online.

Just Check ———>>> https://propaymentweb01.blogspot.com/

I'm curious why we believe Zillow's rent estimates are accurate when their home valuation estimates do not seem to be.

https://money.com/zillow-zestimate-accuracy-flipping/

Somebody trying to predict inflation needs national average rent values or home prices. This is not the same as predicting the price of an individual home from the recent prices of others homes in the area, a more haphazard thing.

Kevin frequently uses 2nd order polynomials for his trend lines. They always look like an arch with the right side trending down, which suits his polemical needs.

There seem to be two different measurements, both useful, but in different ways. One measure is how much typical tenant household is paying in rent, and that should be a time weighted measure that assumes most people have leases that fix their rent for, typically, a year. The other measure is how much it would cost to set up a new household or how much it would cost to rent as opposed to buying.

If you are trying to understand purchasing power issues, the former measure seems more useful. There is a lag, sometimes of multiple years since landlords adjust rents more slowly when tenants renew, between a change in new rental rates and renter spending power.

If you are trying to understand the pressures on the housing market or new household formation, the latter measure seems more useful. The rent/buy and new household/stay in current household decisions are made at the margin, but once made the cost structure is locked in for a while.

Please stop trying to find a regression formula or metric or source in your bizarre attempt to deny inflation. It's so much like the screeds anti-vaxxers produce.

Today's post is probably your worst on this topic. This conclusion is insane:

The core inflation figure if you use better rent figures is -1.2%

KD: "The Zillow index, by contrast, is a simple estimate of asking prices for new rentals over the past month"

New rentals only. Not measuring rent prices for already-occupied units. Absurd.