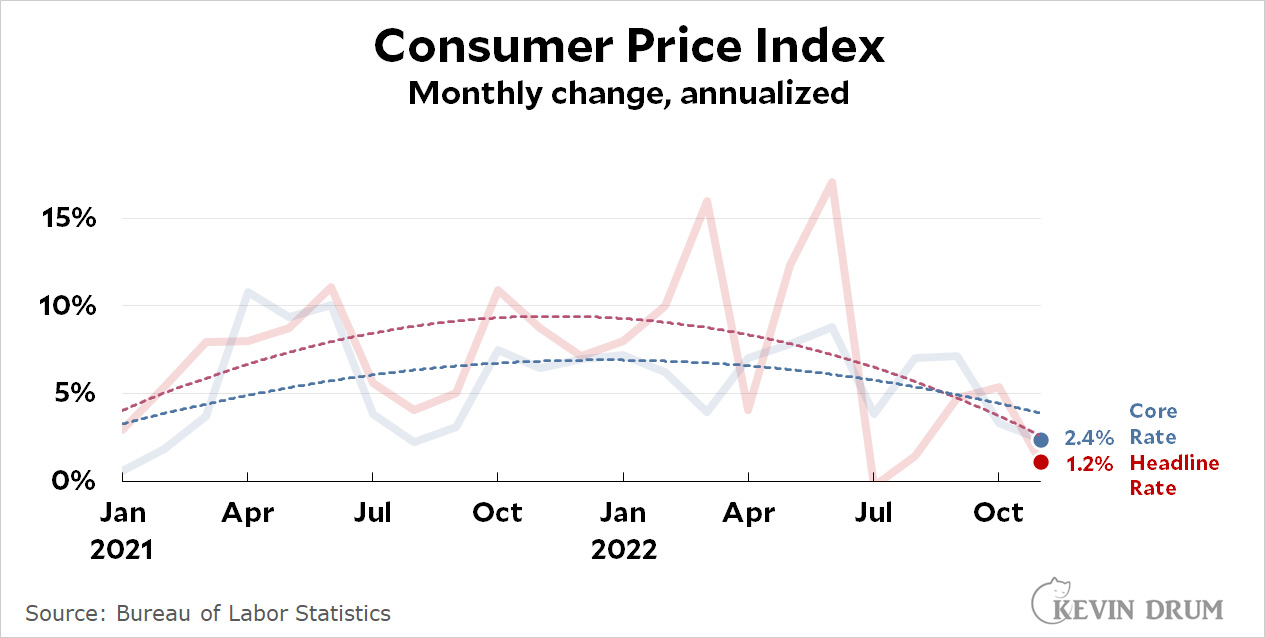

The BLS announced CPI figures for November today, and both the headline rate and the core rate declined substantially:

Shazam! The headline rate is below the Fed's target of 2% and the core rate is damn close. As always, I'm showing month-over-month rates that have been annualized. If you still insist on following the conventional year-over-year figures, they declined to 7.1% for the headline number and 6.0% for the core figure.

Shazam! The headline rate is below the Fed's target of 2% and the core rate is damn close. As always, I'm showing month-over-month rates that have been annualized. If you still insist on following the conventional year-over-year figures, they declined to 7.1% for the headline number and 6.0% for the core figure.

If you follow the trendline instead of the monthly figures—which is not a bad idea—inflation dropped to 2.8% for the headline rate and 4.0% for the core rate.

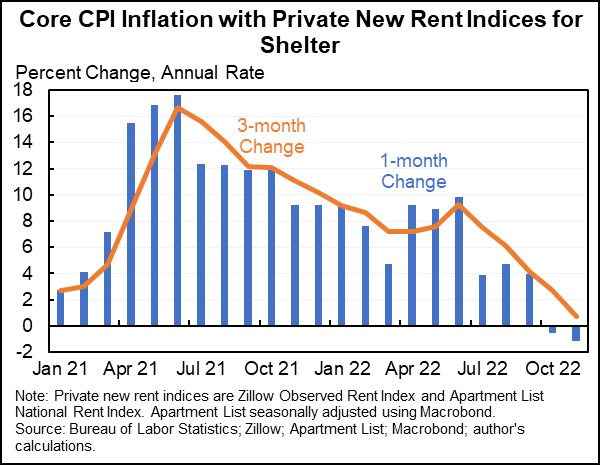

On an added note, shelter inflation rose 7.4%, a figure that's several months out of date. If instead we used more current figures for shelter, then the overall inflation number would be lower than the official figure. Here is Jason Furman's calculation of the core inflation rate if current spot rents are subbed in for the official figures:

Of course, in any given month some items will be flukily high—like shelter—and others will flukily low—like energy, used cars, and medical services in November. Some flukes will go down next month, but other flukes might go up. We'll just have to wait and see.

Of course, in any given month some items will be flukily high—like shelter—and others will flukily low—like energy, used cars, and medical services in November. Some flukes will go down next month, but other flukes might go up. We'll just have to wait and see.

STANDARD CAVEAT: The big newspapers all reported that inflation was "easing," which is the right take. But they underestimate just how much it's easing because reporters focus on headline inflation and on the useless annual figures. That's precisely the opposite of what they should do. The meaningful data is core inflation measured monthly, and in November it plummeted to 2.4% on an annualized basis. That's noisy data, so don't take it as gospel, but at the same time it's very good news. Core inflation measures the bedrock economy, and this month's figures say the economy is in pretty good shape.

A month-back my cousin's step-mum basically earnt $2,900 just sitting there twelve hours a week in their apartment and they're best friend's mother-in-law`s neighbour has been doing this for nine months and easily made more than $12,000 part-time from their laptop.

Apply the instructions on this site.. https://payathome.blogspot.com/

And before you realize it, we'll be right back at the ZLB.

So any chance this slows the rate increases?

PS: Please bring back Disqus before I get on board with this whole laptop at home thing I've been reading about here so often...

*upvotes in Disqus*

ie using Zillow, of which Kevin had this to say in the not too distant past (August)

https://jabberwocking.com/so-how-about-boomer-rents-vs-millennials/

Zillow's house flipping operation got into big trouble a while back. I read some speculation that it was caused by an incautious use of an AI algorithm to quickly determine what price to offer the current home owner. IIRC there might have been feedback from their "Zestimate" system (and possibly other similar systems like CoreLogic) - which tends to show a range of prices from low to (in some cases) unrealistically high. The Zillow offer system wound up overpaying significantly for a house acquisition, then the sales pricing system would inflate that even more.

And nobody wanted to buy at the doubly inflated house price.

Glad I'm not the only one who remembered this.

Kevin - for an extended period you have believed that inflation 'is not a real problem.' If you want a different perspective, perhaps listen to this podcast on the Ezra Klein show with Mohamed El-Erian (PIMCO)

https://podcasts.apple.com/us/podcast/the-ezra-klein-show/id1548604447?i=1000589571549

From stories I've seen, El-Erian does think that inflation of 3–4% will likely persist through 2023 and that the Fed should accept that and avoid further interest rate increases. That might not be what Kevin Drum expects, but it doesn't seem all that dark an outlook.

But eggs are still around 4x what they were a year ago.

Avian influenza has killed a very high percentage of laying hens. You don;t raise interest rates beccause natural disaster has limited supply. You lower interest rates to rebuild supply. (Note the same is true about just about all food prices, global warming has caused systemic global (china, western europe and western NA had record setting heatwaves that killed crops) crop failuers,

Let them throw cake?

The Bureau of Labor Statistics says a dozen eggs cost $3.72 this November, and they cost $1.72 in November 2021.

In Iowa I could get them for 89 cents a year ago, now they're $3.98.

Yeah, okay. My local price information source says eggs here in Illinois were between $1.50 and $2 a year ago, but when pressed, thought she remembered seeing an off-brand dozen for under a dollar at certain stores.

Local special conditions can always crop up and stick in the memory.

Luckily Walmart remembers everything.

On November 30, 2021 I bought 18 eggs for $1.80 and a gallon of milk for $1.59, but this appears to have been some kind of adjusted price where the real price is listed as $1.89 and $1.95.

More from my shopping history,

11 Feb 22 - a dozen eggs are 1.29, milk 1.95

9 Apr 22 - 18 eggs are 1.60

23 Apr 22 - milk 2.67

19 May 22 - 12 eggs are 1.96, milk 3.26

today - 12 eggs are 3.93, and a gallon of milk is 2.78

You know, it really depends on where you shop at. Trader Joe's is priced normally. Kroger's/Fred Meyer is slightly higher, and Safeway is out of the ballpark.

"and the core rate is damn close. " The resolution of these numbers limit the possibile values to 1.2% or 2.4%. So 2.4% is not just "damn clcose" to 2%, it is as close as mathematically possible, i.e. well within the measurement accuracy.

but employees, especially low wage employees are still getting raises. Factoring in actual current housing inflation instead of the delayed CPI method and workers are doing quite well.

sounds like we need higher interest rates to solve this problem.

If this was a football game, Team Transitory has a comfortable lead heading to the 4th QT. If the next report comes in at .3% or less I will call it a win and many people who have posted here (e.g. EarlofSpalding?) should report why they got it wrong. The answer of course is that the economy got hit by multiple temporary variables. Those variables are sufficiently removed from Fed action that the Fed rate increase are of reduced importance. You have a situation now that the rate increase exceeds the inflation rate and the whole effect of the Fed action is yet to be felt. The obvious course of action is not to raise rates tomorrow but that will not happen. So I would suggest, as a compromise, to raise the rate by 25 basis points to maintain

“credibility”. The one negative would be an overreaction by the markets which obviously the Fed does not like. And though I agree with that sentiment, the role of Fed intervention for such irrational expectation should be limited, after all the Fed cannot know the true value of stocks. I believe Crypto is a bigger threat to the economy and the Fed should be looking at that.

Wasn’t there a bit of evolution in the prognosticated duration?

a series of transitory events...

😉

Sigh. Looks like another win for Team Transitory, except, of course, the Federal Reserve will get its recession and stifle economic growth for another decade. The wealthy and powerful talk a good game about economic growth, but when you look at what they do rather than what they say, they loathe economic growth and the only thing that they loathe more is economic growth that provides benefits for people outside of their in group.

Good news on inflation--Fed won't hike rates (so much)--stock market jumps....

but wait....it's falling fast--there will be a recession...market falls....

but wait...

" . . . reporters focus on headline inflation and on the useless annual figures. That's precisely the opposite of what they should do."

But it's what they choose to do. The media think their function in society is to stick it to those "in power," which they currently consider to be the Democrats. Also, they hammered on the "skyrocketing" inflation throughout the election year in order to help keep the midterm elections would be as close as possible. It's a little embarrassing to admit you were tweaking the message so soon after the election.

Pingback: What’s up with rent inflation? – Kevin Drum

Nah, the used car price bubble has burst rather explosively, at least for the lower (older) end of the market. Prices that were driven higher in 2020-2021 have been cut in half for the kinds of economical and reliable daily drivers that are still road-worthy. I have one and regret not selling it in 2020-21 when I could've gotten 4K for it; today I can get 1.5 if I'm lucky.

So you're saying it is time for another interest rate hike.

All the reporting suggests the Fed will continue to hike. To me the only question is do they, perhaps, settle for basis 50 points instead of 75?