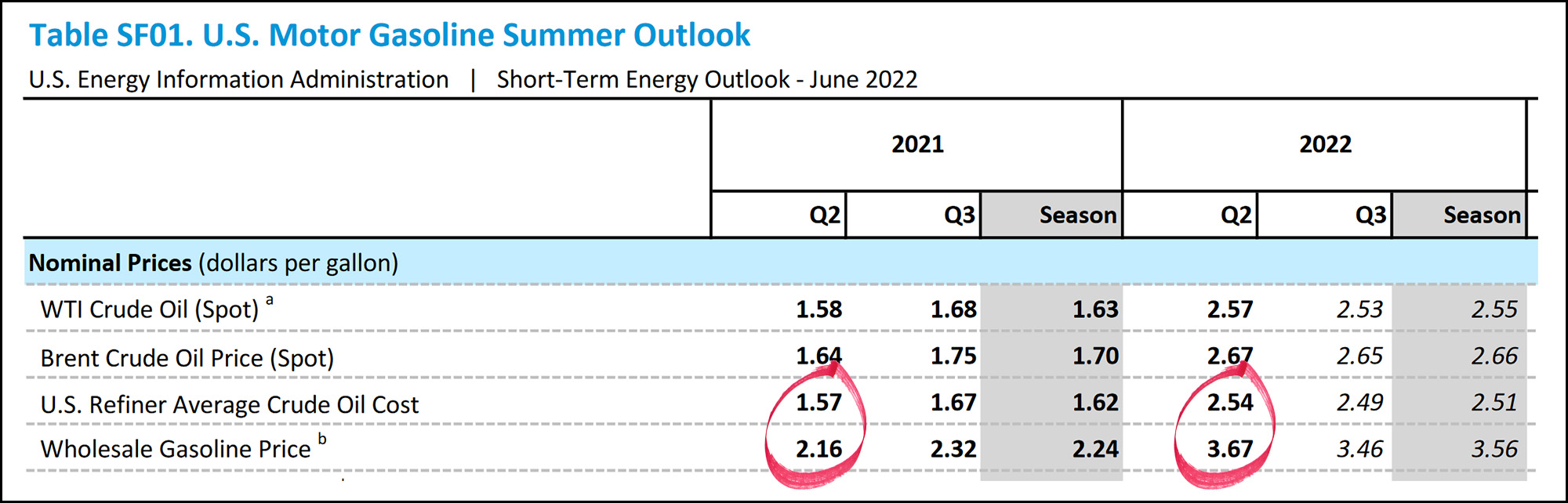

A friend of mine passed along the latest summer gasoline outlook from the Energy Information Administration:

In spring 2021, refineries sold gasoline for 59¢ more than their crude oil cost. In spring of this year, EIA projects that the difference is $1.13.

In spring 2021, refineries sold gasoline for 59¢ more than their crude oil cost. In spring of this year, EIA projects that the difference is $1.13.

That's an increase of 54¢. A few days ago I calculated that the price of gasoline was 61¢ higher than it "should" be based on its historical relationship to the price of oil. Those two numbers are suspiciously close, no?

No, not suspicious at all.

I say, they [those at the top] don't have to conspire, because they all think alike. The president of General Motors and the president of Chase Manhattan Bank really are not going to disagree much on anything, nor would the editor of the New York Times disagree with them. They all tend to think quite alike, otherwise they would not be in those jobs.

~Gore Vidal

+1

Let it be embedded in the collective memory of this blog that price gouging occurs. And let there not be amnesiac surprise the next time it becomes manifest.

Corporations gotta grift and gouge while the getting’s good.

Fraud.

I'll repeat a question from the other day - should this delta be expressed as an absolute number of cents per gallon, or as a fraction of the per-gallon price?

Yes, it needs to be return on investment, ROI, not the amount.

They're still making a killing, prices went up ca. 60%; return almost 100%.

Oil/gas is really subject to leading/following issues for pricing that make antitrust law, conspiracy against trade hard to prove.

Additionally, executives have this person, "Brandon", on whom all blame can be placed since most stenographers don't drill down past the surface news.

Why the refineries probably claim they're charging more: higher costs due to parts shortages, worker shortages, higher input costs for other gasoline components, switching over to summer formulations, yada, yada.

The real reason they're charging more: They can.

We'll see if this time around this actually results in the public buying fewer gas guzzling SUVs/ more EVs and cities and states investing in public transportation, or if it will all go down the memory hole in a year or so just like it did after the last bad gas price spike (ca. 2008-10). I think Big Oil is betting on the latter so they're really pushing the envelope on what they're charging this time around.

Skirelli Syndrome?

* Shkreli

This has actually been going on for a while. I remember a bogus (i.e. Republican) meltdown quite a while ago when Congress found out that a lot of Alaskan crude oil was being shipped to Japan. They held hearings and demanded to know why it wasn't being used in the US.

The oil company executives basically told them that there were no refineries in the US that could handle "heavy" (very long chain "thick" oil), sour (lot of sulfur) crudes. It would cost a hell of a lot money to upgrade them to be able to do that. Also - "go pound sand" cause we aren't going to invest in upgrades unless you give us a lot of money up front.

It was far cheaper for the oil companies to ship the oil to countries (like Japan) who HAD invested in refineries capable of handling Alaskan crude and were very happy to get a discount on that oil and re-direct light crude contracts to the US. Not long after that, US oil companies started spinning off their refineries - my brother in law was working for Conoco-Phillips when that happened to their refinery in Whatcom county in 2012.

The Canadian tar sand oil is FAR worse than Alaskan heavy crude - and it all gets exported AFAIK. The Canadians don't want to invest in new or upgraded refineries either.

Refiners don't really set the price. The price is set by auctions.

"They can."

Exactly this. As consumers, we have enjoyed a couple of decades of low inflation and an expectation that trend would continue. This constrained producers from jacking up retail prices.

Now, a few supply disruptions and a worker shortage has changed the conventional wisdom: the public expects prices to go up--providing an opportunity for producers to finally increase prices to gain more revenue.

Is it "gouging." OK, if someone wants to call it that. It's not surprising, though.

I have wondered if the global oil and gas industry is starting to price in future drops in demand. They look at coal and think....hmmm, that could be us in 5 years. Gotta make the money now.

The refineries are charging bigger margins because people will pay. They get away with it because there's a shortage of refinery capacity. Despite the shortage of refinery capacity, nobody has any plans to build refineries.

That's where "future drops in demand" come in. A refinery is amortized over thirty years or more. If it takes thirty years to pay for a refinery, but it is anticipated that demand is likely to drop to the point where that refinery will have to be closed in twenty years, then the refinery will not be built. My guess is that we've reached the point where no more oil refineries will be built; the existing refineries will just have to stagger on until they're no longer needed.

I deem this a good working hypothesis. Now how to test it ...

Our test involved buying our first EV in 2019. The results were so favorable to our budget that we upgraded a couple of months ago to a longer range EV.

Like +10!

My car is going on 8 years old. Its eventual replacement will be an EV. Preferably NOT a hybrid.

Nope, people aren't paying. Dumb shit post.

Your post implies that nobody is buying gasoline or diesel fuel They're buying, and paying, and complaining.

The obvious answer to the headline is because they can. The refiners have issued a letter recently pointing out the more specific answer is that export customers are biding that price for refined products. Biden could substantial and immediately reduce the price americans pay for gasoline by putting a 3% export tax on gasoline exports. Small enough that industry wouldn't be able to scream bloody murder but enough to modestly suppress foreign demand.

Note, since refining is an energy intenive process, the costs ae in fact linked to the price of oil. So you need to worki in percentages, not raw numes. In terms of percentages, gas in only 16 cents a gallon too high.

One could try to model the gas/oil markup based on market demand, commitment of national/regional markets to carbon reduction, age of industry assets, and plans to build new assets. I suspect many regions of the world are not seriously considering wholesale fossil fuel fleet conversion in the next 30 years. Perhaps they are seeing less of a markup?