Here is the Wall Street Journal today:

Worker Pay and Benefits Grow at Record Pace, Pressuring Inflation

Compensation for American workers grew rapidly in the first quarter, as a tight labor market put more money in workers’ pockets while also keeping pressure on inflation.

Business and government employers spent 4.5% more on worker costs in the first quarter compared with the same period a year earlier, without adjusting for seasonality, the Labor Department said Friday. That marked the fastest increase in records dating to 2001, and the gain eclipsed 4.0% annual growth in the fourth quarter.

Compensation for workers also accelerated on a quarterly basis, rising a seasonally adjusted 1.4% in the first quarter compared with a 1.0% increase in the fourth quarter. The growth reflected strengthening wages, salaries and benefits.

I assume I'm not keeping you in too much suspense about the real story here? Hold onto your hats, here it is:

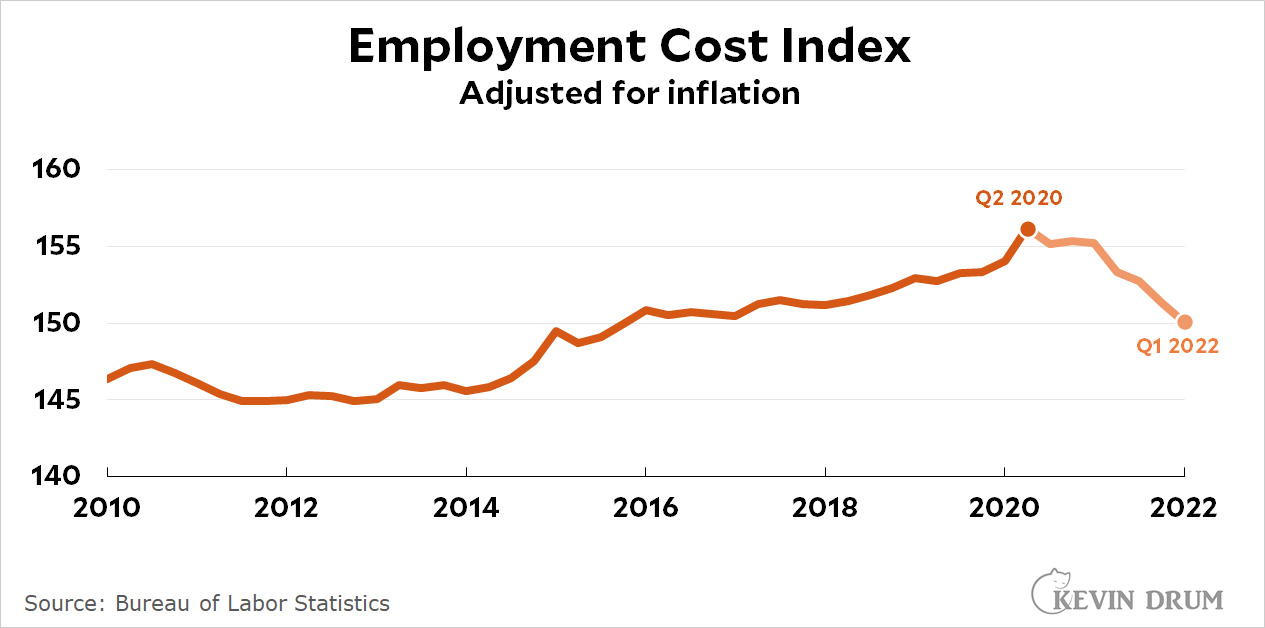

Yes, in one of the great surprises of economic reporting this century, the Journal has presented nominal numbers instead of taking a minute or two to adjust them for inflation. When you do that, you can see that ECI is down about 4% since mid-2020 and down 3-4% over the past 12 months.¹

Yes, in one of the great surprises of economic reporting this century, the Journal has presented nominal numbers instead of taking a minute or two to adjust them for inflation. When you do that, you can see that ECI is down about 4% since mid-2020 and down 3-4% over the past 12 months.¹

All of this is front and center in the BLS press release, so it's not hard to figure out. Right now, the real cost of employing someone—wages, benefits, Social Security, office space, etc.—is at about the same level it was at in 2016. In what way this is "keeping pressure on inflation" is a mystery to me.

¹The exact amount depends on which measure of inflation you favor, and I'm embarrassed to admit that I can't figure out which one BLS uses. I get -3.3% using ordinary old CPI; they get -3.7% using something else.

Also, what on earth do they mean by "employers spent 4.5% more on worker costs in the first quarter compared with the same period a year earlier, without adjusting for seasonality"? You don't "adjust for seasonality" when you're comparing data from the same season.

Th other thing is the top line amount they spent rather than per worker doesn't necessarily mean anything, like are sales up and the workforce grew by 4.5%?

The meaningful number is wages per employee, which as Kevin points out they lie about by not adjusting for inflation and even then its only the oh so scary, massive number 1.4%

Yeah. Also no mention of whether there's been any increase in productivity, which if so would mean there's no "pressure on inflation."

The WSJ publishes a dishonest article calculated to make the Biden Administration look bad? I'm shocked, shocked!

Slatepitch: Somehow this means we can't cancel student debt

Have you heard some of those people lately? More like

Biden's crap economy failure to lead means Elon Musk should become head of the Department of State, or else more Ukrainians will die.

The other thing is even if their number was adjusted for inflation, 1.4% Yikes the horror, soon workers might like be able to afford a slightly nicer car.

The 1.4% number was quarter to quarter comparison, seasonally adjusted--not adjusted for inflation...

right, it isn't even an increase in reality, my point was even if it was adjusted for inflation it wouldn't be a big deal, 1.4% they'll be living high on the hog and retired multi millionaires in like 100 years at that rate,

Kevin - they explain the inflation-adjustment in the supplemental materials. It's CPI-U, but 2005-based:

"Constant dollar ECI indexes are produced by adjusting the current dollar indexes (see Volume III of the ECI historical listings) by the Consumer Price Index for all Urban Consumers (CPI-U).... In order to do this adjustment, the CPI-U must be converted to the same index base period as the ECI, December 2005."

The supplemental pdf for constant-dollars is also worth checking out, to see beneath the aggregate to how poorly compensation has kept up in certain industries and types of worker. For example, scroll to the very end, and you'll see that as of March, non-union private sector workers are back to where they were prior to 2005. Union workers and State/Local government workers are doing much better, though knocked backed to 2015-era levels. These data also show how non-union private sector workers basically had no progress from 2005-2014, then a jump in 2015, then no progress after that.

https://www.bls.gov/web/eci/eci-constant-real-dollar.pdf

I'll just observe that the reporters, in classic WSJ fashion, collect some anecdata from a couple of employers who say they've had to raise wages a bunch, but don't actually speak to any, you know, workers who are like "yep, I'm really raking it in this year compared to a year or two ago. I went in, put the screws to my boss -- said 'I want two dollars an hour more or I'm outta here!' and, well, here I am! (*smiles, flashing new diamond tooth stud*)."

😉 Did you submit that article to The Onion yet?

Real wages actually fell at a very high rate during the 1975 and 1980 inflation spikes. Yet bizarrely economists and even bloggers continue to assume that there was a "wage-price" spiral that caused the inflation at that time.

Maybe. Was the government calculating inflation right or were they too high??? In 1978-79, almost assuredly.

Unions have been swept into dusty corners of the U.S, that’s one of the biggest win of your “1%” . As the union membership rate dropped, middle class share of income also fell and workers was turned into just another production factor one that is expendable (just check minimum wage)

… just as this article proves

It’s the American way but what this Swede , who used to run his own company and had employees don’t understand is why my Americans colleges don’t understand the simple fact that happy employees who feels secure in their employment is much more efficient

Laws on the rights of employees are extensive in Sweden just as in most European countries primarily due to unions

Believing less regulation is good for business is a misunderstanding

My well regulated Sweden is rated in pos 2 worldwide on “best country for business “ by unbiased international experts. Other top rated countries are also “well regulated “

USA ?

Position 17!

https://www.forbes.com/best-countries-for-business/list/

Or if you prefer this group of experts…Sweden is just in position 5 which is unusual in these,kind of indexes but…

The US of A is just in position 45 !

https://www.usnews.com/news/best-countries/rankings/open-for-business

This troll doesn’t need to ridicule USA , international experts and unbiased scientists are doing it my place but they are doing it much more efficiently

Have a nice day my friends

And you know who will desperately try to find some new articles on Sweden and Covid

In mid 2020 there were lots of people not working, and that was concentrated heavily among lower wage workers. With the job market once again booming, we have a more normal distribution of wages among workers. That absolutely does not excuse the WSJ from using nominal figures, but it does mean that we should keep a healthy skepticism in mind when comparing wages today with mid 2020 when the average was skewed higher by Covid lockdown job losses.

Which means this will shoot up later in the year. A large part is bls data missing small business creation and then coming back with it....in a lag. These wages are generally lower than others.

I think it's funny that you think a Murdoch-owned paper has enough credibility to be worthy of a take down.

It's skewed though. Even the rate of inflation is questionable. All government data hedonically adjusted is probably wrong. That is why you only have raw aggregates.

There is a point to looking at nominal data. If you believe that inflation is currently driven by transitory exogenous events, then, any macro changes to address a temporary inflation will have dire consequences on the back end of those changes.

If you think, as Larry Summers does, that inflation is a big threat, then go ahead and use real numbers to scream loud and wide that the Fed needs to curb inflation ASAP.

You have to pick a side, KD -- do you know what side you're on?