Yesterday it was shipping and mortgage rates. Today it's semiconductors:

The average contract prices for the two major types of memory, called DRAM and NAND flash, dropped by 15% and 28% respectively from the prior quarter during the July-to-September period, according to TrendForce, a Taiwan-based market researcher. Prices for both types of memory chips are expected to decline on a quarterly basis in the fourth quarter and all of next year, as excess inventory builds up, TrendForce estimates.

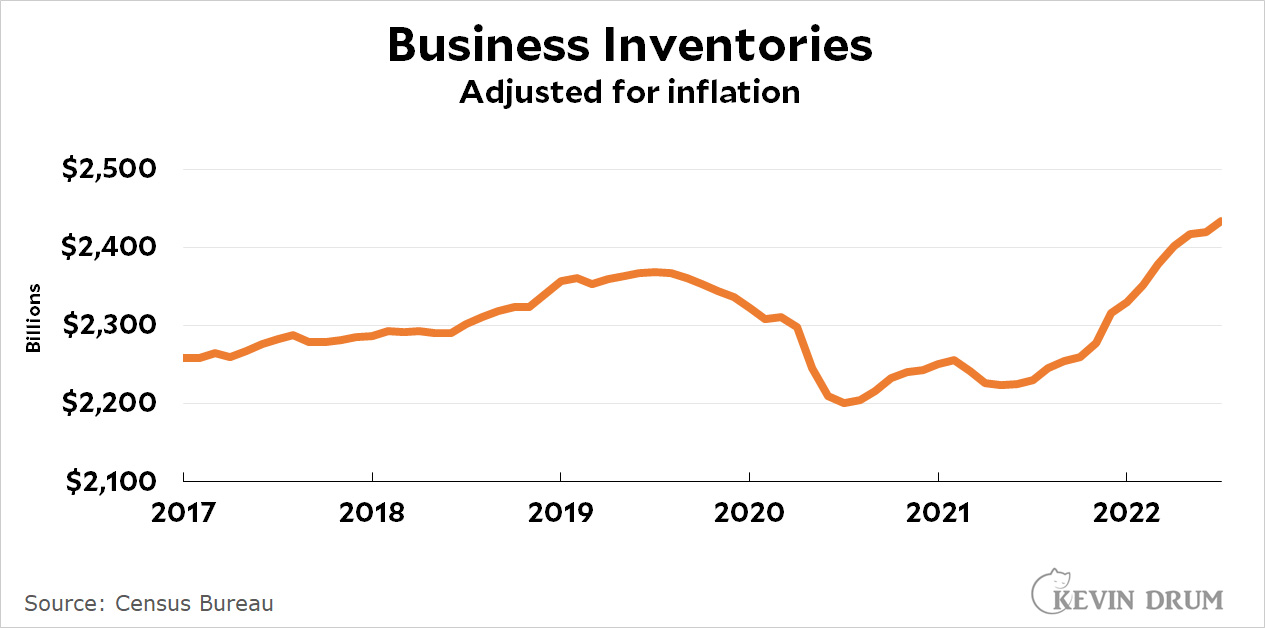

Prices are flattening or even dropping on lots of key commodities. And business inventories are getting swollen:

Real retail sales have been flat for more than a year and have been declining since May. I wouldn't say the economy is in terrible shape right now, but it sure doesn't seem like it's running hot. And it's running a little less hot with every passing month, weakening inflation naturally as it goes.

Real retail sales have been flat for more than a year and have been declining since May. I wouldn't say the economy is in terrible shape right now, but it sure doesn't seem like it's running hot. And it's running a little less hot with every passing month, weakening inflation naturally as it goes.

Hey! Jerome! You see this?

Still having a hard time affording food unfortunately.

Don't worry, the Fed raising rates will end the mega-drought out west.

You know, eventually Kevin will be right about inflation abating. But he's been wrong for so many months in a row, he's kind of lost credibility.

Fair enough. But Kevin's been overly optimistic for many months whereas many of the inflation hawks were wrong for over a decade. I saw Rick Santelli last week blabberiing on CNBC where he still has a job despite being wrong about almost everything for over a decade. And he's not alone, there's a long list of supposedly serious business folks who have been ready to squash incipient inflation year after year after year. If we'd listened to them for most of that time our economy would be much smaller and weaker. So Kevin's been wrong for the past 10 - 12 months. I think he's going to be right pretty soon .

Oh, Santelli. Yeah he has a lot to answer for. But he's too busy yelling about inflation and taxes to take questions. Is he supposed to have been a bond trader or something? Or is that his whole job, to stand on a trading floor and sound profoundly concerned for a few stand-ups every day?

Which had a greater negative effect? Claiming high inflation is looming when it doesn’t, or claiming high inflation is going away when it doesn’t?

Which has… not which had… grr.

If I'm not mistaken, inflation hysteria was a big part of anti-stimulus messaging through-out Obama's term. Hence a criminally slow recovery and trillions lost in unrealized GDP. On the other hand, team permanent has essentially no effective tools that team transitory hasn't already employed. The former is the damaging message, yes?

Claiming high inflation pretty clearly has caused greater harm to the well being of most Americans and the US economy in general.

Slowing the economy to create unemployment and reduce wages in order to avoid possible inflation is obviously harmful to everyone who relies on wages. This includes almost all working Americans and most children who will later enter into a smaller, poorer, lower wage economy.

Remember that the real concern of the Fed is wage growth. Wages are growing too fast and they intend to stop this 'dangerous' situation.

As the Fed has directly told us:

When assets are way up and the top 1% is raking it in, this is okay ...even though it is more expensive for all Americans to invest, buy a home, buy a business, this is all fine.

But when wages are increasing....we need to do something about that.

As have those warning of run away inflation and calling for a recession to stomp out the out of control inflation spiral that is always just a few months ahead. Unfortunately this group has a lot of sway with those directing policy for the US.

The issue is not who is an accurate prophet - nobody is. The main question is whether the Fed should be raising interest rates, possibly causing a recession and also international disruption if inflation is going to come down by itself. Kevin and also Krugman (NY Times) have been calling attention to how many actual components of inflation have been moderating. Kevin also points out (sometimes) that wages have not been increasing faster than prices - contrary to what you may read in business pages, low unemployment and rising wages are just not a major factor. But suppressing wages one way or another is a major objective of big (and small) business, which has great influence in the media and among some economists (some of whom are actually big businessmen themselves).

Some supposedly reputable economists have been predicting inflation for decades for various reasons, such as budget deficits, low unemployment and low interest rates, but they have always been wrong. Why would they have credibility this time? Certain things mostly related to the pandemic are causing inflation now, but most of them are temporary. There is always the possibility that oil and gas prices will cause high inflation - this is what caused inflation in the 70's, not uppity workers getting higher wages. Real wages declined severely at that time.

Hey, you know what else is dropping? Road spans from the Kerch Strait Bridge.

/S

That’s awesome!

Footage of China demolishing unused and abandoned high rises,

https://www.reddit.com/r/interestingasfuck/comments/xzrjhj/china_destroying_unfinished_and_abandoned/

Bought a box of Kraft Mac and cheese at the store yesterday. Used to be 99 cents. Now $1.50. Of course, the deal is 4 for $5. So I bought 4!

It's the little joys!

TPM had a note pointing out that gas prices are up in parts of the west, e.g. NV, recently due to refineries being off line due to accidents or "maintenance".

This is a great story for our times…

https://www.cnn.com/travel/article/amsterdam-schiphol-airport-chaos/index.html

Keep cutting flights. Cut them all!

Core inflation has been 6% for the entire calendar year. We know some of the externalities that caused inflation from a soft target of around 3% to double that. How economists lost their collective mind over a modicum of inflation is a sight to behold.

All this fuss over a little inflation (finally after 15 years of deflation). A fridge we bought 5 years ago cost $1,200 on sale. Now it costs $1,500 not on sale. That's about 4% inflation per year on this item (and like Drum says here about prices, major appliances' continue to fall). When this one or one just like it goes on sale around Thanksgiving, it'll probably bopp down to $1350 or so, so about 2% per year over the past five years. Just not that much.

(Oh, yeah. New one's got wifi so you can monitor the temperatures while you're away from home. Useless tech probably doesn't add anything to the cost of manufacture but really, who needs wifi on a refrigerator?)

Used to be the 4% rule. 4% inflation per year with 4% unemployment. They never announced it but at some point that became 2% inflation with 4% unemployment. Lots of ups and downs over the past fifty years since then; but it did change, that ratio, at some point along the way. My grandparents would be concerned. 'Whadaya mean only 2% inflation. That's ridiculous. My house in ten years is only gonna be worth $50,000? Nixon!'

Kamil Galeev on crypto-bros, and violent and non-violent entrepreneurs,

https://mobile.twitter.com/kamilkazani/status/1579124072390463488

Finally a reason to watch football,

https://twitter.com/i/status/1579226339764498432