The Wall Street Journal continues to write endlessly about inflation being right around the corner, and other news outlets are starting to join in. I suppose that's only natural since the headline inflation rate has been rising over the past few months.

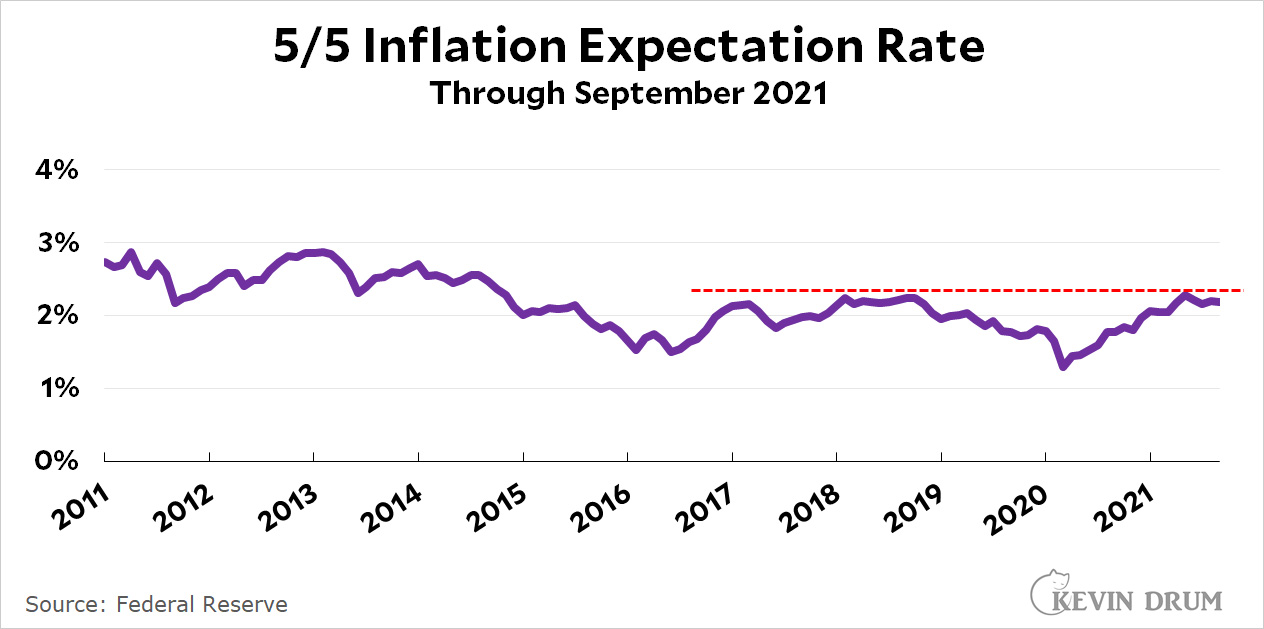

That said, inflationary expectations are . . . amazingly non-panicked. It's true that consumer expectations of inflation are up, but who cares? Consumer expectations are completely useless, as everyone who follows this stuff knows. On the other hand, here's our old friend the 5-year, 5-year forward inflation expectation rate:

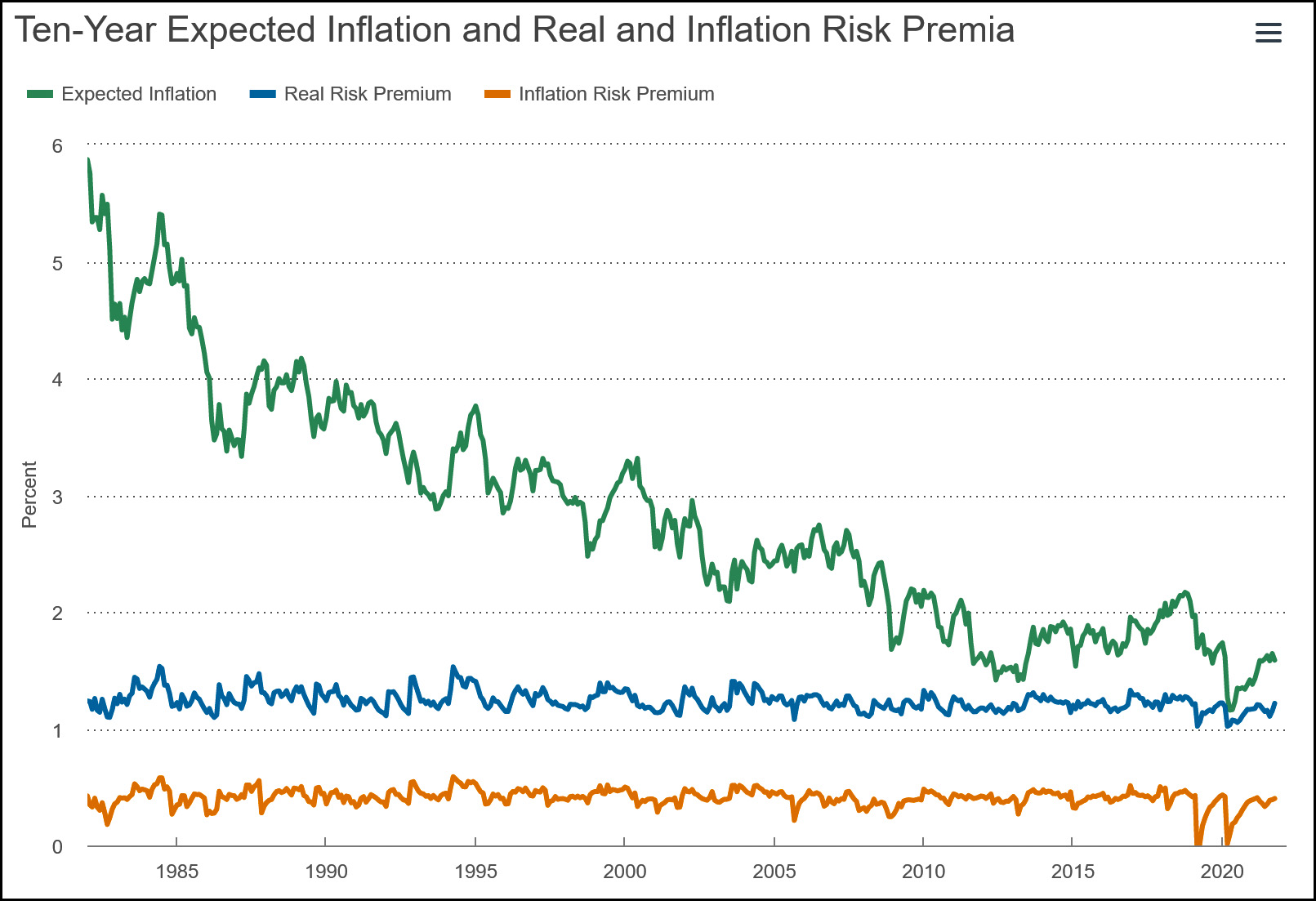

The 5/5 rate peaked in April, and despite rising headline inflation it's gone down since then. It currently sits at 2.20%, which is perfectly fine. And here's the Cleveland Fed's measure of 10-year inflation expectations:

The 10-year rate is currently sitting at 1.59% and hasn't changed since May. Meanwhile, TIPS securities maturing a year from now are selling for about 2% more than ordinary 1-year treasuries. TIPS are protected against inflation, which suggests that investors expect inflation to clock in around 2% or so over the next year.

I'm relatively agnostic about inflation right now. It's certainly true that we've pumped a tremendous amount of money into the economy over the past 18 months, and it's hardly ridiculous to think that might affect inflation. On the other hand, most of that money was simply replacing lost income from the pandemic. As I've mentioned before, I consider the stimulus spending of 2020-21 to be a fascinating test of Keynesian policy writ large, and I'll be as interested as anyone to see how it turns out.

Having said that, one thing I'm not agnostic about is good reporting. That means not just reporting headline inflation correctly, but showing inflationary expectations clearly if you write something claiming that everyone is freaking out about prices going up. The truth is that, at most, there's some mild fear of rising short-term inflation and absolutely none in the longer term. That may or may not turn out to be correct, but it's what the data tells us.