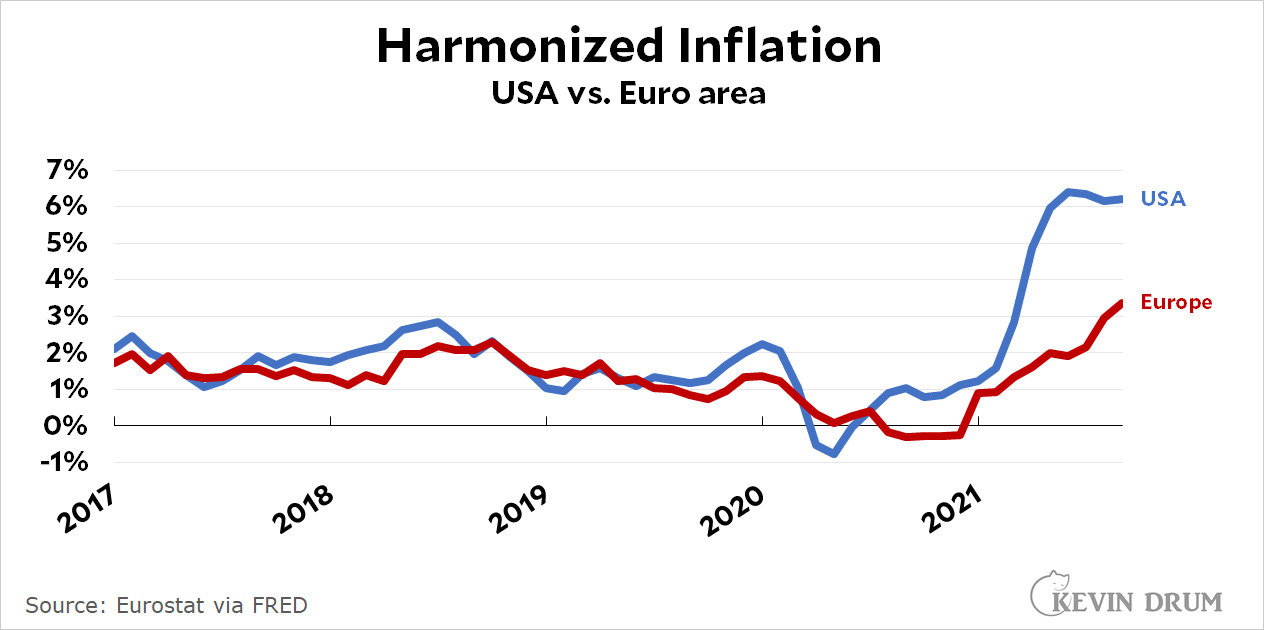

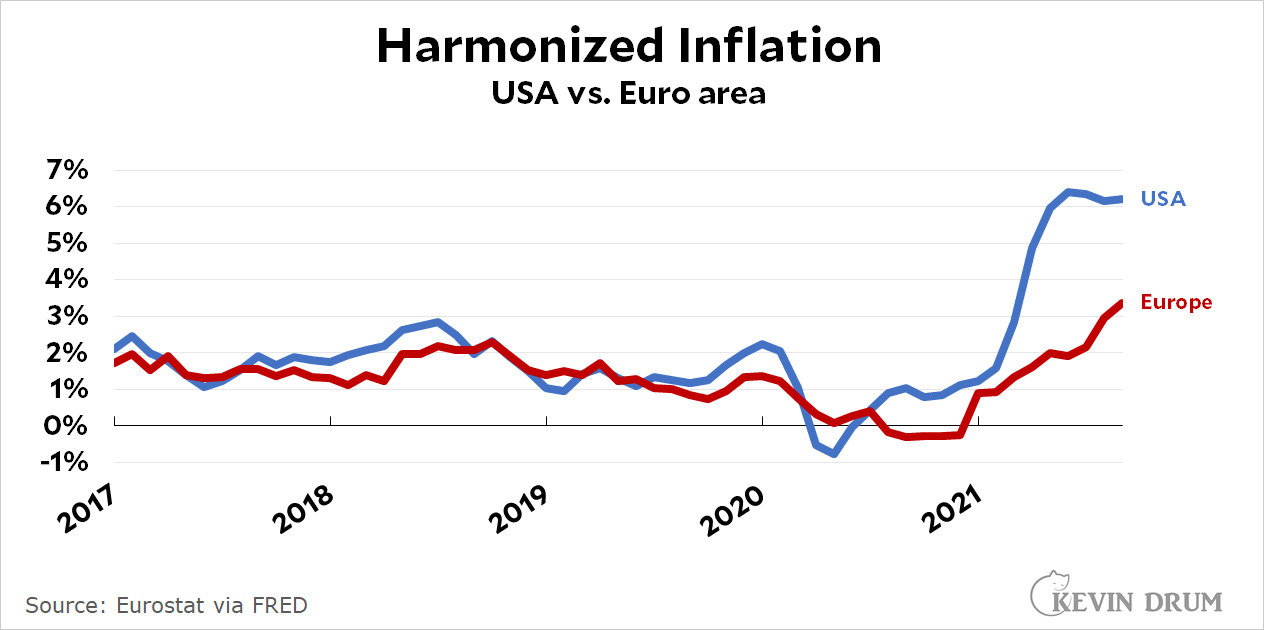

As long as we're on the subject of inflation, a reader emails to ask whether high inflation is a global problem or a purely American one. For starters, here is inflation in the US and Europe:

One thing to notice is that this is "harmonized" inflation. Every country has a slightly different way of calculating inflation, so Eurostat performs some statistical magic to bring them all into line and make them comparable. That's why the US figures look a little different than the ones you usually see. Eurostat thinks the US hit a 6% inflation rate back in May and has been pretty steady ever since. Euro-area inflation, by contrast, is still low but appears to be climbing.

One thing to notice is that this is "harmonized" inflation. Every country has a slightly different way of calculating inflation, so Eurostat performs some statistical magic to bring them all into line and make them comparable. That's why the US figures look a little different than the ones you usually see. Eurostat thinks the US hit a 6% inflation rate back in May and has been pretty steady ever since. Euro-area inflation, by contrast, is still low but appears to be climbing.

Take that for what it's worth. A few months from now things might look very different.

The main takeaway, however, is that in March US inflation started to pull away from Euro-area inflation. Why? Paul Krugman dedicated an entire column to this question and concluded that it was a mystery. And if it's a mystery to Krugman, who am I to have an opinion?

But let's throw caution to the wind and offer up the obvious answer: in the US we passed a $900 billion stimulus bill in December and then followed it up with a $1.9 trillion stimulus bill in March. That's a lot of money to dump into the economy, and seems plenty sufficient to touch off a round of inflation. European countries mostly didn't do this because they already have safety nets that take care of people during things like recessions and pandemics.

So that's my answer, anyway. It's also why I continue not to be too worried about high inflation. We pumped $2.8 trillion into the economy, and it's no surprise that it produced some inflation. However, that was a one-time event. Once that money works its way through the economy, inflation will fade away naturally.

That's just my two cents. Remember, though, I Am Not An Economist.¹

¹Not that economists seem to be doing any better on this question...

The volume of beef and pork produced follow each other almost perfectly. I can't think of any reason for them to be tied so closely together. What's going on?

The volume of beef and pork produced follow each other almost perfectly. I can't think of any reason for them to be tied so closely together. What's going on?