In the New York Times today, economist Glenn Hubbard says, "We Need to Do Hard but Necessary Things to Tackle Inflation." Uh oh, I thought. What horrible things is he proposing?

The Fed must begin tapering asset purchases more aggressively now. In recent weeks, Mr. Powell has signaled a willingness to double the pace of the taper to $30 billion a month — a move he should make in this week’s meeting of Fed officials.

....The Fed should also raise its benchmark federal funds rate in early 2022. This is a short-term interest rate at which banks borrow and lend reserve balances with one another. He should also be prepared to make further adjustments should macroeconomic conditions, including broader and longer-lasting inflation, demand it.

That's it? Reduce asset purchases—something the Fed is already likely to do—and raise interest rates by a quarter point or so a few months from now? If this is all Hubbard thinks we need to do, he must not think the current bout of inflation is very serious at all.

Larry Summers, bless his heart, at least puts his money where his mouth is. He thinks we've set off a permanent and dangerous increase in the inflation rate to 4% or so, and he recommends two or three sharp interest rate increases next year. That's a good deal more serious, though still hardly Paul Volcker territory.

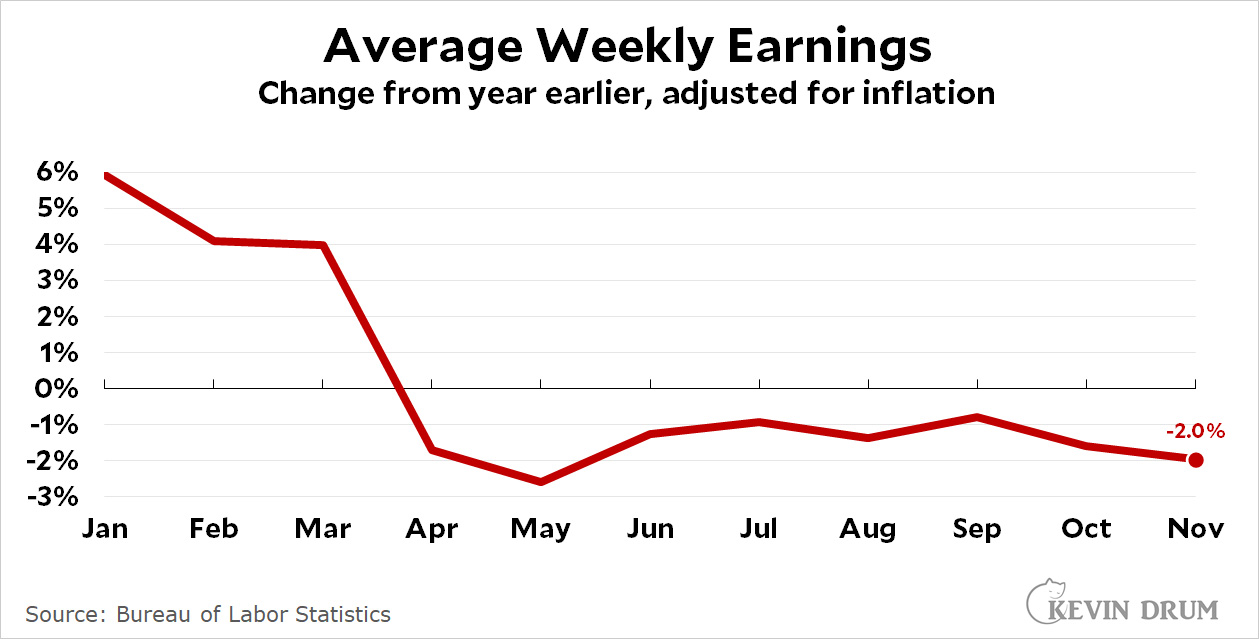

I'll confess I've never understood Summers's argument. I know it's trendy in left-wing circles to write off Summers as little better than a Republican-lite hack, but that's stupid. Summers is, and always has been, a mainstream liberal and a brilliant economist. You'll notice, for example, that Paul Krugman never writes him off. This is why I wish I understood his argument better. Summers says our current round of inflation was caused by the $1.9 trillion rescue package passed in March, and that part I get. But if that's the case, wouldn't the resulting inflation be transitory almost by definition? By now that money has all been spent, and wages clearly haven't spiraled out of control (Real earnings are down about 2% from a year ago.). So what's the mechanism for generating many years of inflation unless we stomp on the economy?

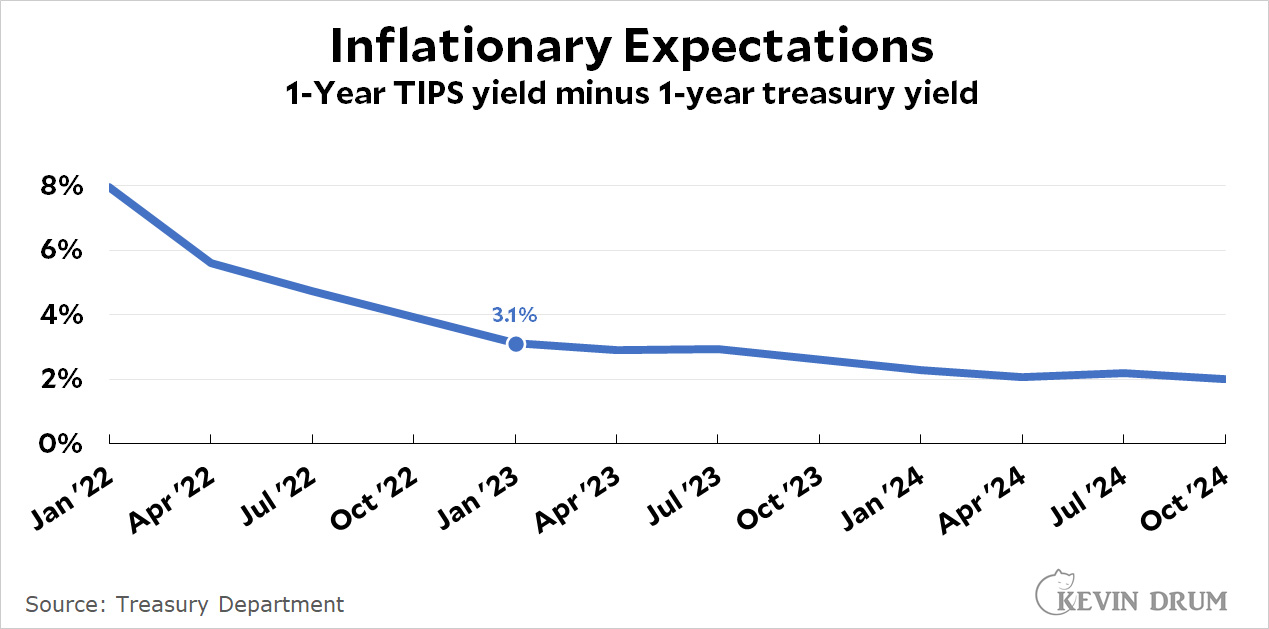

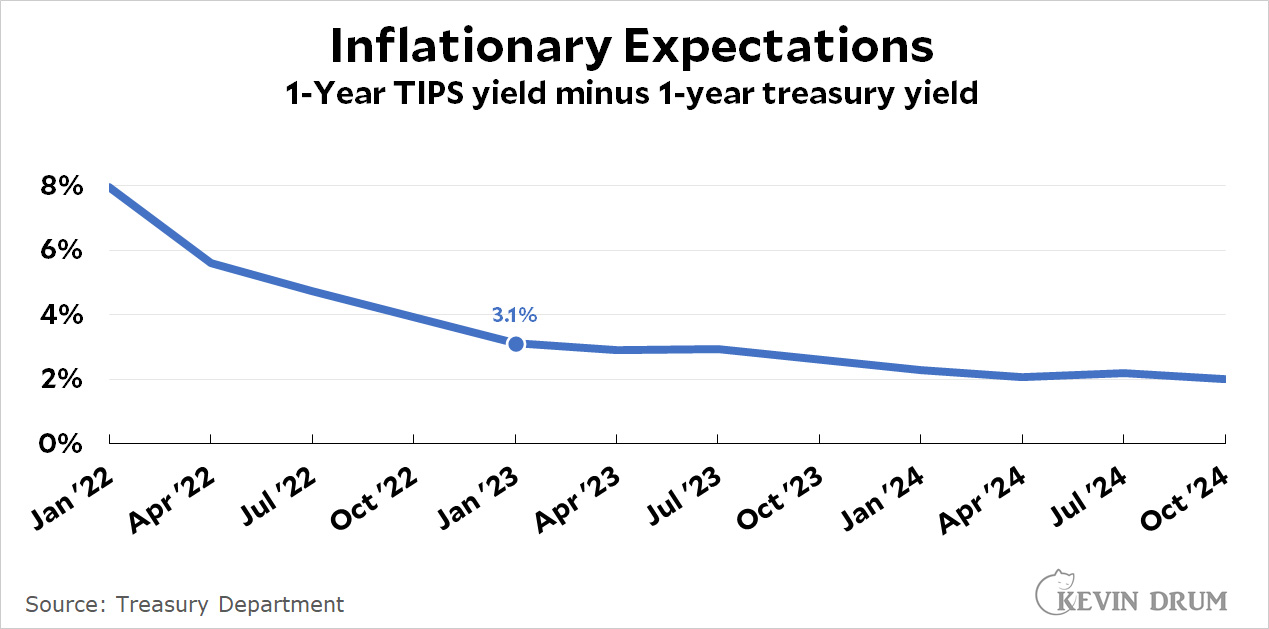

For what it's worth, here's the (very approximate) inflation rate predicted by current TIPS yields:

Don't take this super seriously, but it suggests that investors think inflation will be down to 3% by the end of next year and then keep dropping.

Don't take this super seriously, but it suggests that investors think inflation will be down to 3% by the end of next year and then keep dropping.

I dunno. Maybe there's more here that I don't understand. IANAE. But as savings get spent (which has already happened) and spending becomes normal (also already happened) and real wages continue to drop (also already happened) and investors are expecting that TIPS yields will be about 3% at the end of the year (also already happened) and supply chains get untangled (very likely to happen in the first half of next year)—

Given all that, what's the story for high inflation being permanent? Inquiring minds want to know.

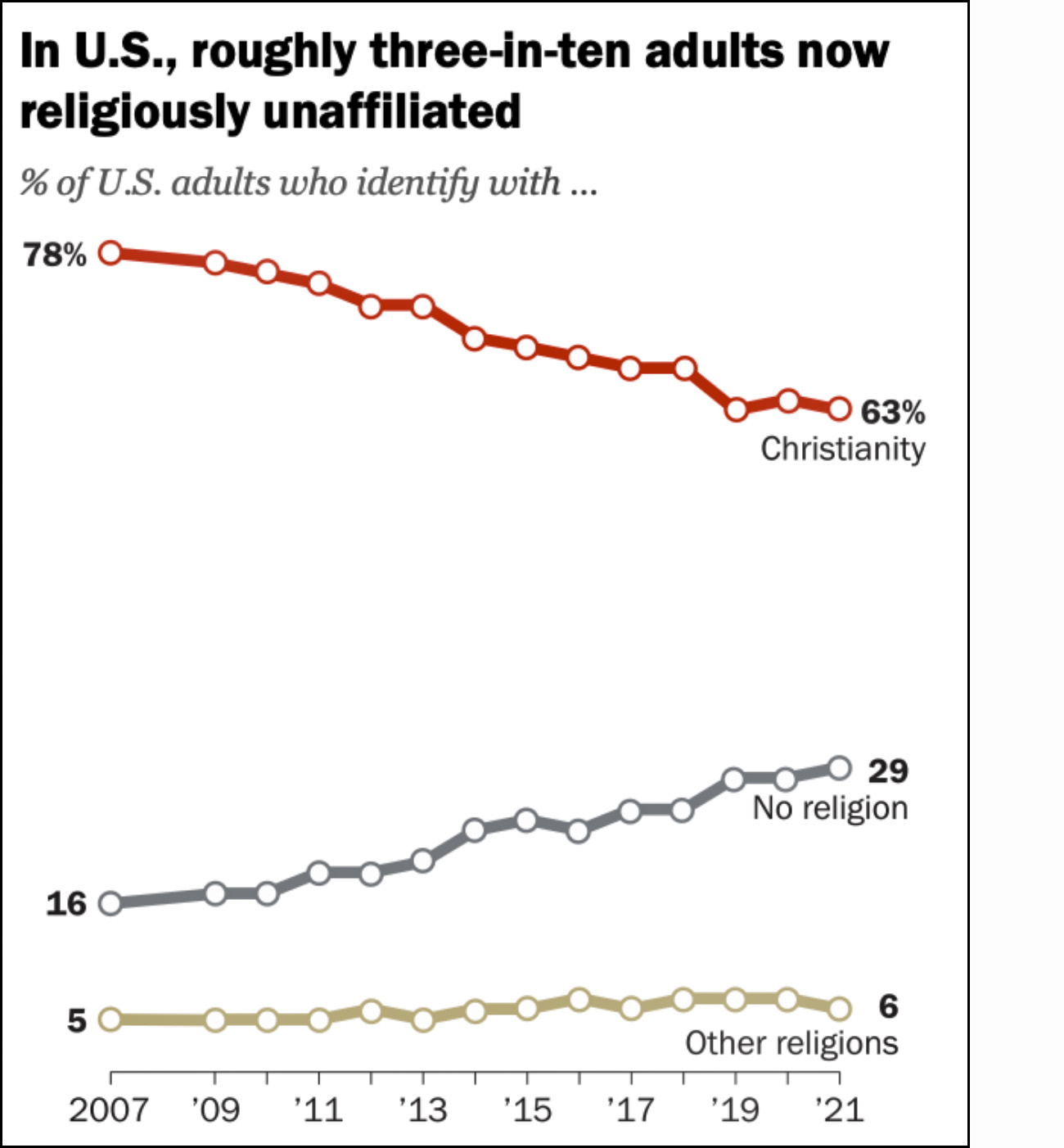

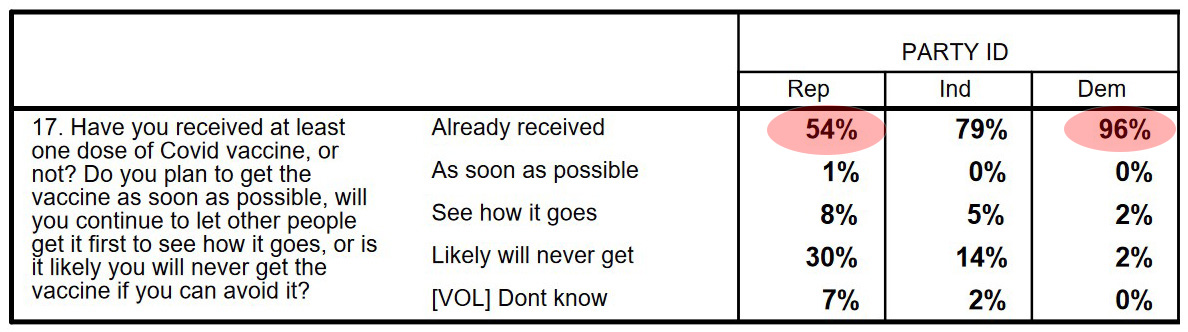

Forget everything else. Forget about whether the rollout of the vaccines was imperfect. Forget about Paxlovid. Forget about the CDC. This overwhelms everything else.

Forget everything else. Forget about whether the rollout of the vaccines was imperfect. Forget about Paxlovid. Forget about the CDC. This overwhelms everything else.