From Ruy Teixeira, a longtime progressive scholar, on why he's gotten tired of the relentless identity politics among the left:

I’m just a social democrat, man. Trying to make the world a better place.

I don't know if Teixeira is right about conditions at the Center for American Progress, where he worked for the past couple of decades, but he has nothing good to say about it:

Like a lot of older and whiter veterans of liberal think-tanks and foundations, he also says he’s exhausted by the internal agita. “It’s just cloud cuckoo land,” he says. “The fact that nobody is willing to call bullshit, it just freaks me out.”

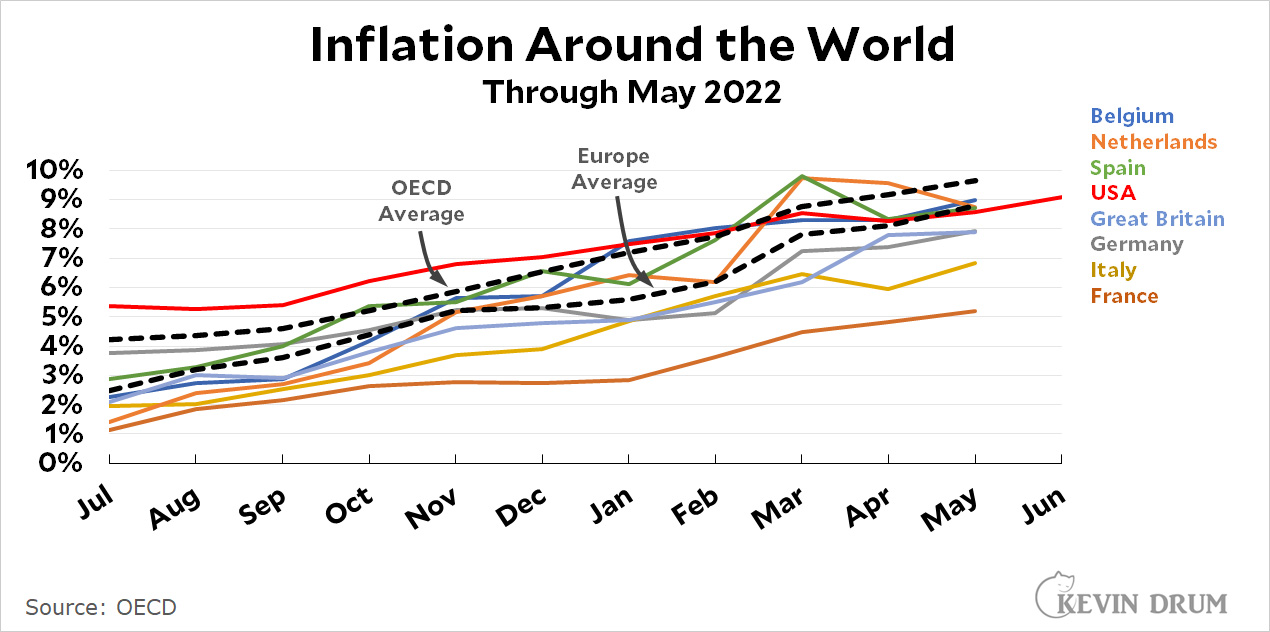

Since neoliberalism is now in such bad odor, how about if we all start up a new think tank that's called The Foundation for Social Democracy, or some such? We could have different groups dedicated to the Swedish model, the French model, the Japanese model, and so forth. Just sign up for the softball team of your choice.