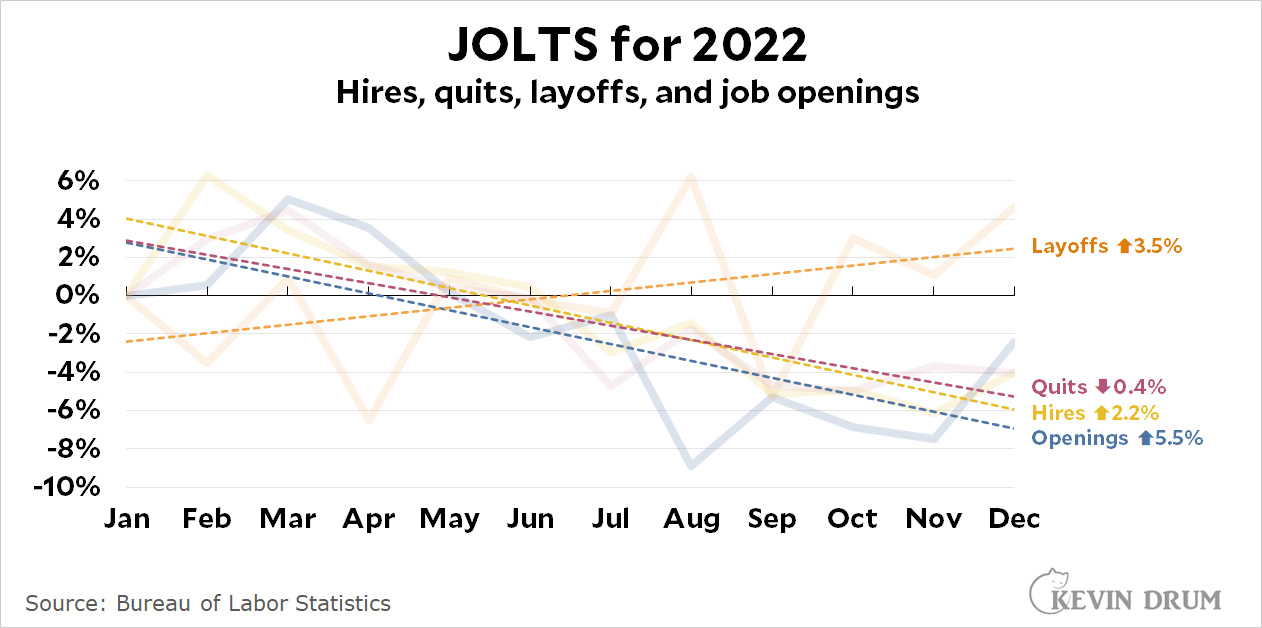

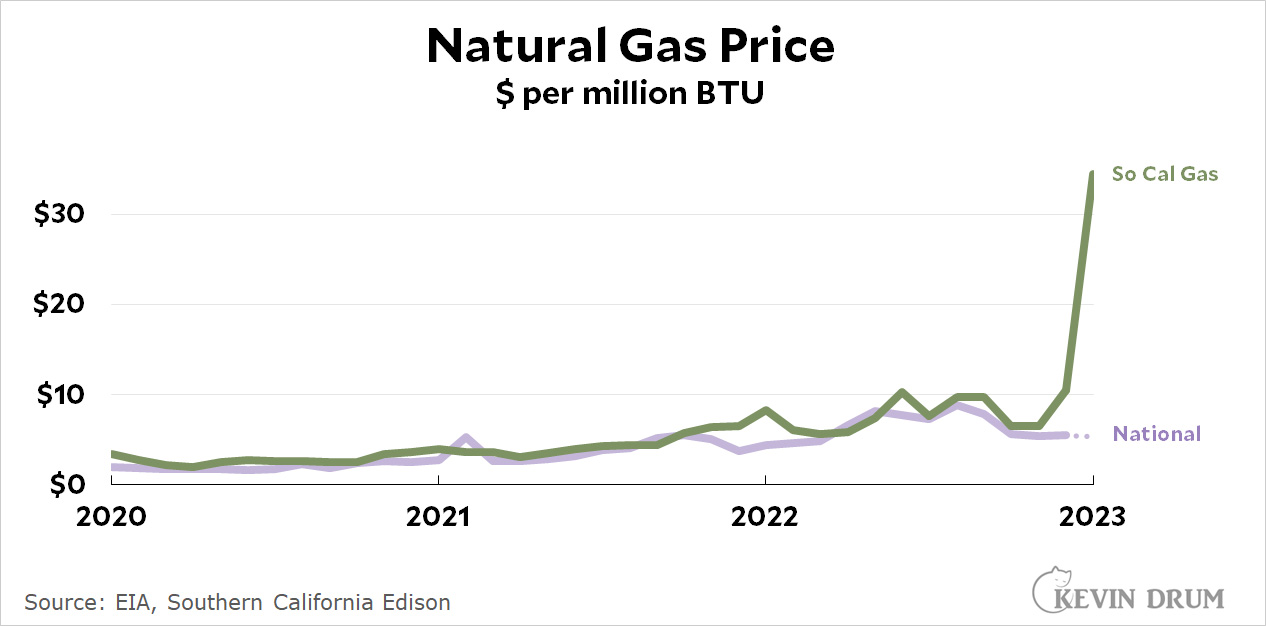

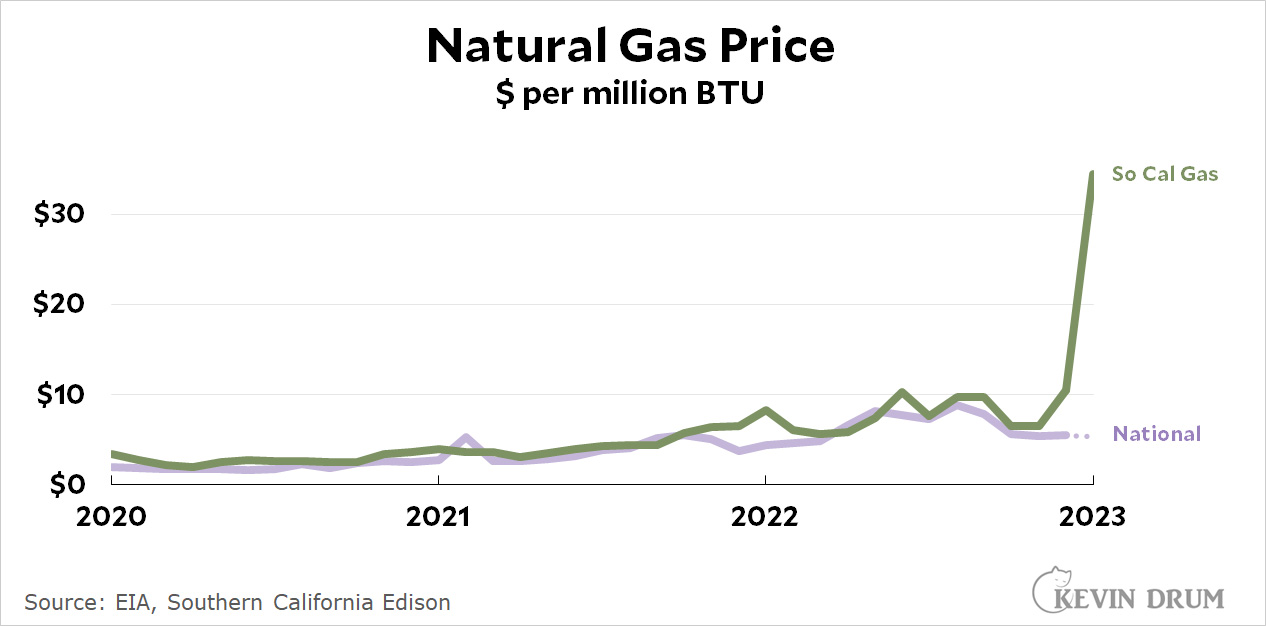

Two people in two days have told me that NextDoor is aflame with outrage about the price of natural gas. And that's hardly surprising: here in California gas bills for December ranged from double to triple the normal rate. People who normally have gas bills of $100 or so are reporting bills of $200-$500 depending on how much they use. Here's the chart I put up a few weeks ago:

This is an astonishing spike, and I spent some time today trying to figure out what caused it. The basic answer turns out to be simple: gas companies were predicting a warm, dry winter and instead got just the opposite. This has been one of our coldest winters of the past decade, and that drives up consumption and therefore prices.

This is an astonishing spike, and I spent some time today trying to figure out what caused it. The basic answer turns out to be simple: gas companies were predicting a warm, dry winter and instead got just the opposite. This has been one of our coldest winters of the past decade, and that drives up consumption and therefore prices.

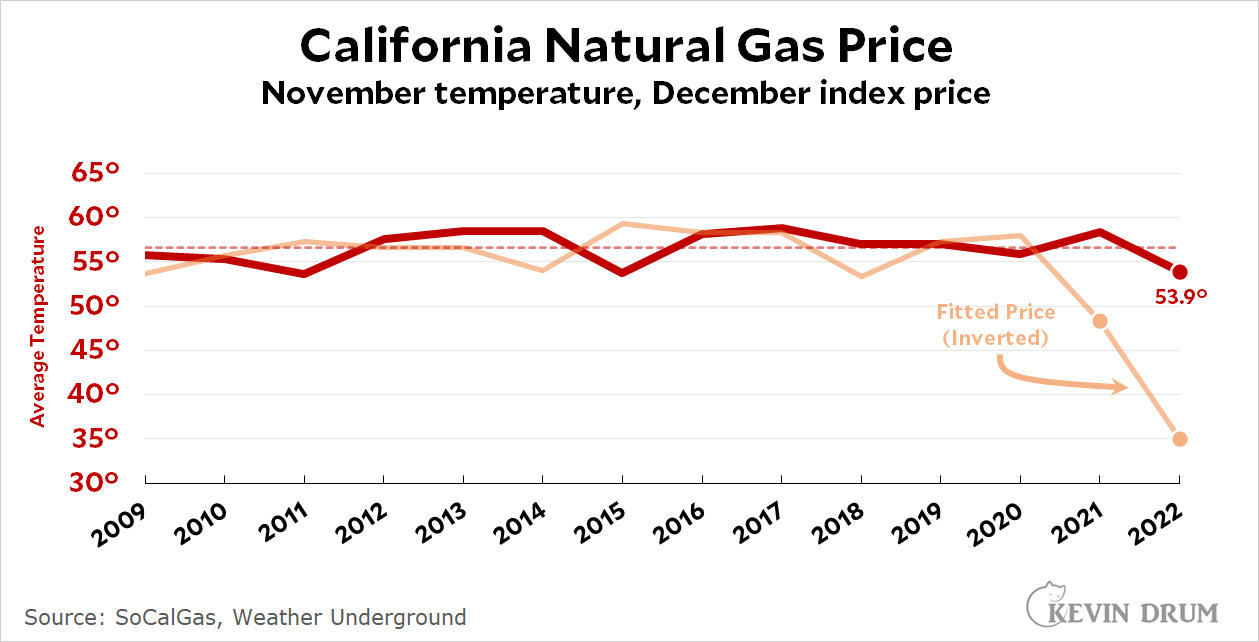

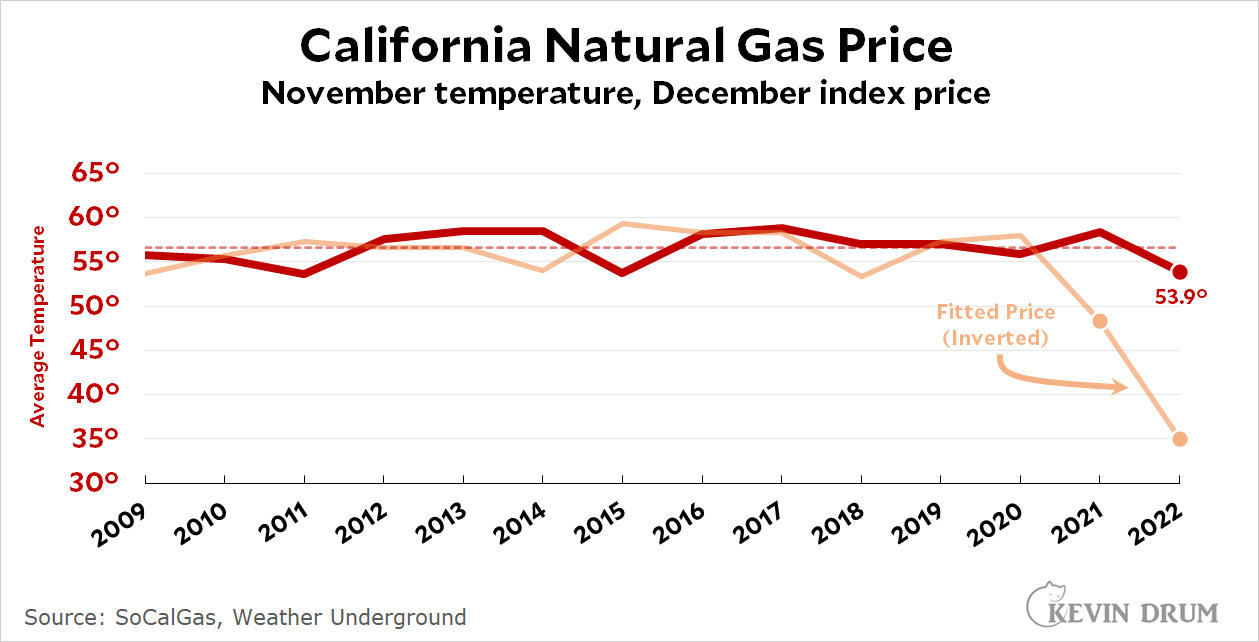

But that's not all. Here's a chart comparing temperature to gas prices in California:

The red line is the November temperature from 2009-22 (I used an average of Los Angeles and Sacramento). Lower temperatures mean higher prices, so I inverted the cost of gas and then scaled it to fit on the same chart. As you can see, price roughly follows temperature until 2021, when it suddenly diverged. Then in 2022 it diverged even more. What's going on?

The red line is the November temperature from 2009-22 (I used an average of Los Angeles and Sacramento). Lower temperatures mean higher prices, so I inverted the cost of gas and then scaled it to fit on the same chart. As you can see, price roughly follows temperature until 2021, when it suddenly diverged. Then in 2022 it diverged even more. What's going on?

Here's the way things work. Local utilities pay what's called an "index price for natural gas supplies:

There are dozens of liquidly traded, regional index points which represent the cost of gas delivered into different market areas....Weather conditions and available pipeline capacity often determine the volatility of an Index point. The monthly Index price is published the second business day of the month, after the decision of how much gas to flow has been determined.

Based on November temperatures, the index price for California started to soar. It was up 60% in December and then tripled in January. [But see the update at the bottom of the post.]

But why? We've had cold winters before, and the price of gas has increased only modestly. The answer is related to a seeming mystery: December prices were also well above average in 2021 even though winter was fairly warm that year. That doesn't make sense.

The problem was a pipeline from Texas that exploded in Coolidge, Arizona, earlier in the year and killed a person. The pipeline is operated by Kinder Morgan, and another one of their pipelines had exploded in Tucson in 2003. For this reason, the town of Coolidge was none too eager for the pipeline to reopen, and the NTSB was cautious too because they couldn't figure out what caused the explosion. This cut off one of California's sources of natural gas, which made it difficult to get enough supply during winter months.

In 2021 this caused a smallish upward blip in the index price. But in 2022, the pipeline outage combined with a cold winter to send prices skyrocketing. Kinder Morgan just recently applied for permission to reopen the pipeline, but the Pipeline and Hazardous Materials Safety Administration hasn't yet signed off on it. If all goes well, the pipeline will be back in service within a few months and this year's price spike won't happen again.

We hope.

POSTSCRIPT: But wait. Isn't it also true that we're exporting a lot of our natural gas to Europe this year? Isn't that contributing to lower supplies and higher prices here in the US?

Nope. Outside of the Pacific Coast natural gas prices are completely normal. In fact, an explosion at an LNG terminal in Quintana, Texas, cut off shipments of natural gas from Freeport and produced an enormous glut of natural gas. The glut is so big that prices of natural gas are negative down there: suppliers are willing to pay people to take gas off their hands because they don't have any place to store it anymore.

So we have a glut in Texas producing super low prices there, but no way to get that excess supply to California, where we need it. Welcome to modern life.

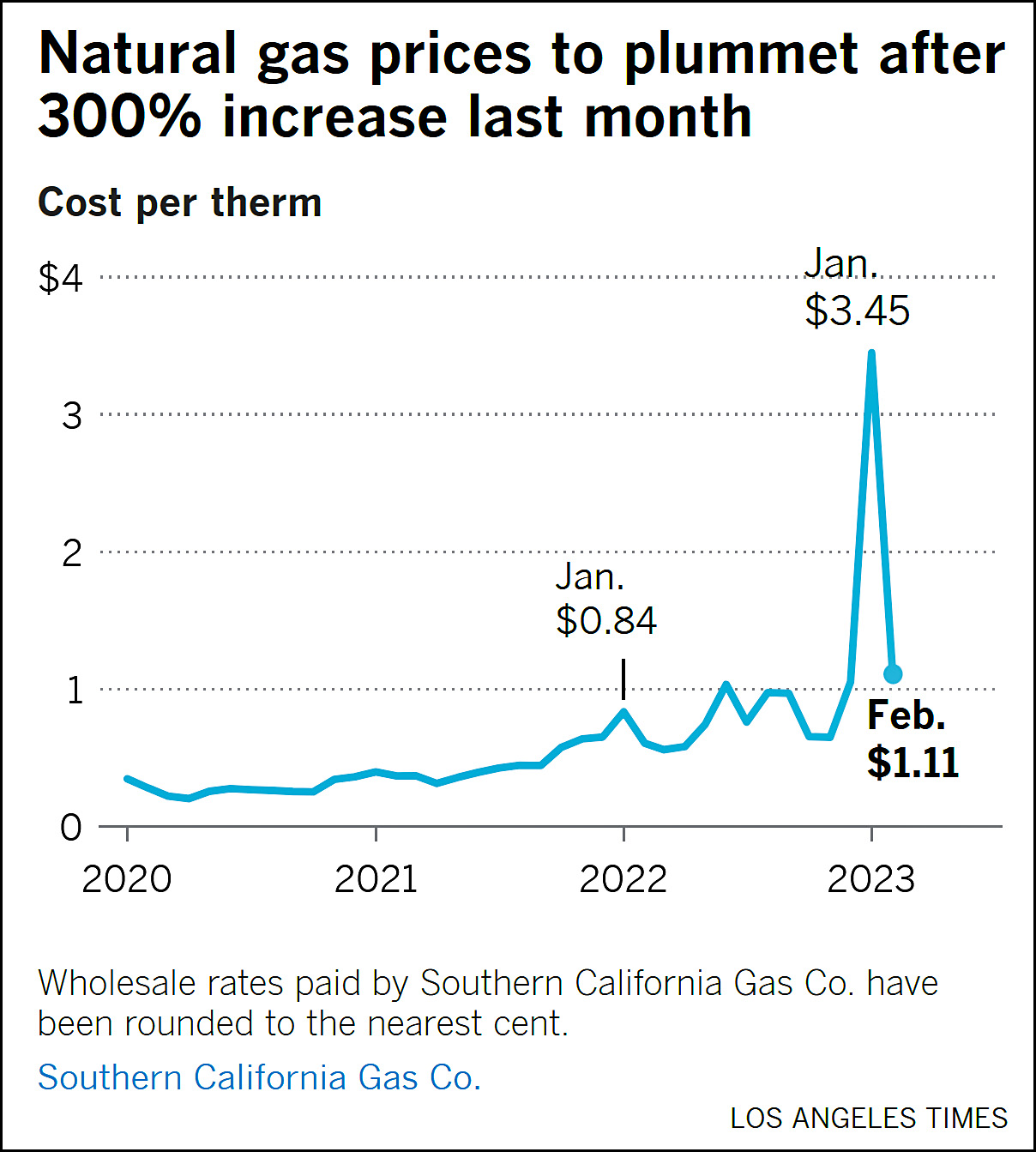

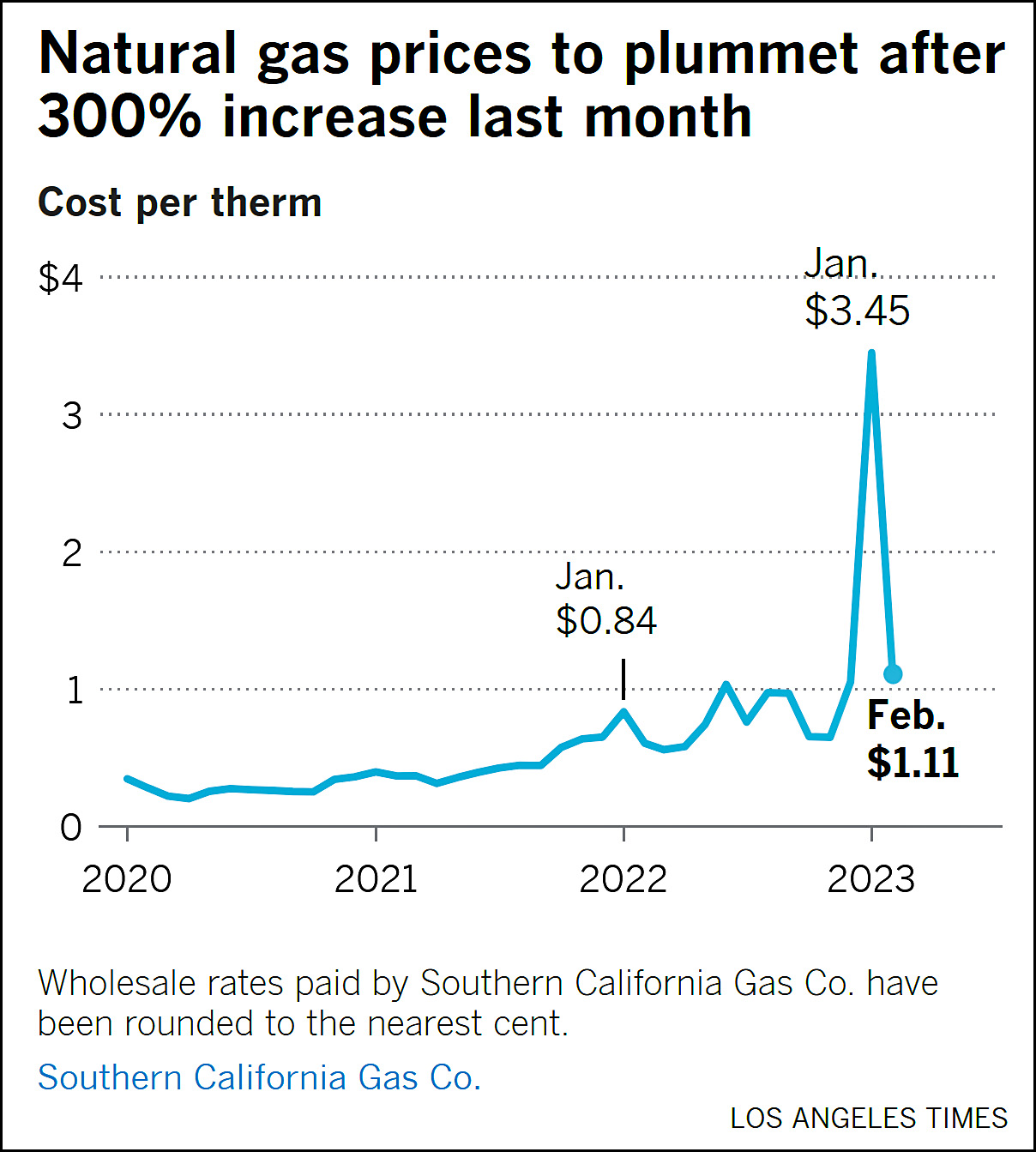

UPDATE: Good news! The LA Times reports that the index price for February has been published and the crisis is over:

That's still higher than normal, but it's not 3x higher than normal.

That's still higher than normal, but it's not 3x higher than normal.